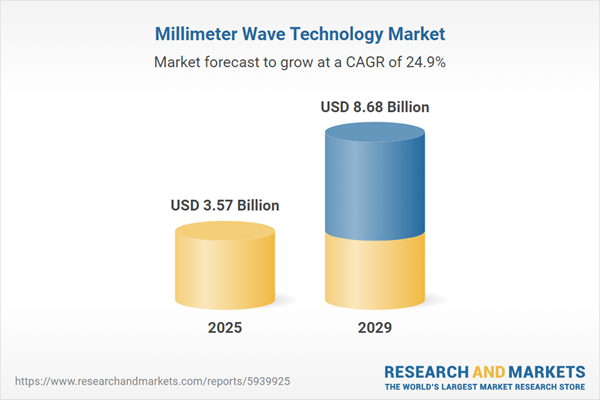

The millimeter wave technology market size is expected to see exponential growth in the next few years. It will grow to $8.68 billion in 2029 at a compound annual growth rate (CAGR) of 24.9%. The growth in the forecast period can be attributed to increased bandwidth requirements, environmental sensing and weather monitoring, energy efficiency solutions, IoT connectivity, smart cities initiatives, industrial automation, and rapid urbanization. Major trends in the forecast period include advancements in 5g technology, integration with AI, technological advancements in silicon photonics, and integration with machine learning.

The increasing adoption of autonomous vehicles is projected to stimulate the growth of the millimeter wave technology market in the coming years. Autonomous vehicles are those capable of operating and navigating without human intervention. They utilize a combination of advanced sensors, cameras, radar, lidar, and artificial intelligence algorithms to perceive their surroundings, make decisions, and control their movements. Millimeter wave technology facilitates real-time communication for autonomous vehicles, enabling them to exchange large volumes of data and make informed decisions. For example, in 2023, the International Energy Agency (IEA), a France-based autonomous intergovernmental organization, reported that electric car sales exceeded 10 million in 2022, representing 14% of all new car sales, up from around 9% in 2021. Thus, the rise in autonomous vehicle adoption is driving the expansion of the millimeter wave technology market.

The expanding adoption of the Internet of Things (IoT) is expected to contribute to the growth of the millimeter wave technology market. IoT, a networked system of interconnected computing devices and machinery, utilizes millimeter wave technology for high-speed data transfer and increased bandwidth. This technology enables efficient communication by transmitting large amounts of data at very high frequencies. A report by Ericsson, a Sweden-based telecommunications company, indicates a global IoT connection growth from 13.2 billion connections in 2022 to an expected 34.7 billion connections by 2028, driving the demand for millimeter wave technology.

The millimeter wave technology market is witnessing a notable trend of technological advancements, with major companies actively embracing new technologies to maintain and strengthen their market positions. An example of this trend is seen in the recent introduction by SMK Electronics Corporation, a US-based manufacturing company, of Milweb Millimeter Wave Sensor Technology and Solution in January 2023. This innovative sensor technology employs proprietary algorithms to identify objects, surfaces, and terrain, even measuring an individual's heart rate and respiration at close range. Its applications span across diverse industries, including home automation, automotive manufacturing, healthcare, and safety products. Milweb Millimeter Wave Sensor Technology enables the integration of intelligent technologies, enhancing manufacturers' capabilities to offer products with advanced safety features and functionalities. Its versatility in applications such as health monitoring, security systems, room occupancy detection, and vehicle alert systems opens up new possibilities for improved functionality and safety in various environments.

Major players in the millimeter wave technology industry are adopting strategic partnership approaches to drive innovation and expand market reach, particularly in the realms of high-speed data transmission and 5G technology implementation. For instance, in May 2023, the partnership between ZTE Corporation, a Finland-based provider of information and communication technology solutions, and Advanced Info Service Public Company Limited (AIS), a Thailand-based mobile network operator. This collaboration aims to introduce a new-generation ultra-large-bandwidth millimeter-wave AAU, distinguished as the world's first to support 1.2 GHz bandwidth and above, with a maximum bandwidth of 1.6 GHz.

In June 2022, Quantic Electronics, a US-based electronic components manufacturing company, acquired Microwave Dynamics, a provider of microwave and millimeter-wave components. This acquisition has fortified Quantic Electronics' oscillator portfolio and expanded its capabilities in high-precision microwave and millimeter-wave components, enhancing its ability to address the intricate design challenges in aerospace, defense, and industrial markets.

Major companies operating in the millimeter wave technology market include Huawei Technologies Co. Ltd., Lockheed Martin Corporation, Denso Corporation, QUALCOMM Inc., Mitsubishi Electric Corporation, Fujitsu Limited, Ericsson, NEC Corporation, L3Harris Technologies Inc., Toyoda Gosei Co. Ltd., Keysight Technologies Inc., Smiths Interconnect, Aviat Networks Inc., Mistral Solutions Pvt. Ltd., Vayyar Imaging Ltd., Siklu Communications Ltd., REMEC Broadband Wireless Networks LLC, Radio Gigabit Inc., Eravant, Sivers Semiconductors AB, Farran Technology Ltd., LightPointe Communications Inc., Millimeter Wave Products Inc., Blu Wireless Technology Limited, Vubiq Networks Inc., E-Band Communications LLC, Hubei YJT Technology Co Ltd., BridgeComm Inc., Movandi Corporation, Wireless Excellence Limited.

North America was the largest region in the millimeter wave technology market in 2024. Europe is expected to be the fastest-growing region in the forecast period. The regions covered in the millimeter wave technology market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the millimeter wave technology market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Millimeter wave technology serves as a cutting-edge wireless communication solution, facilitating rapid data transfer and supporting high-bandwidth applications. This technology harnesses electromagnetic waves within the millimeter-wave frequency range for applications such as radar and satellite communication.

The key components of millimeter wave technology include antennas and transceiver components, frequency sources, communication and networking components, imaging components, RF and radio components, sensors and controls, interface components, power and battery components, and others. Antennas and transceiver components play a pivotal role, functioning as devices that both transmit and receive electromagnetic waves within a single unit. The product categories encompass scanning systems, radar and satellite communication systems, telecommunication equipment, and more, featuring license types such as light licensed frequency millimeter wave, unlicensed frequency millimeter wave, and fully licensed frequency millimeter wave. Frequencies ranging from 24 GHz to 57 GHz, 58 GHz to 86 GHz, and 87 GHz to 300 GHz find applications across diverse sectors, including telecommunications, military and defense, automotive and transport, healthcare, electronics and semiconductor, and security.

The millimeter wave technology market research report is one of a series of new reports that provides millimeter wave technology market statistics, including millimeter wave technology industry global market size, regional shares, competitors with a millimeter wave technology market share, detailed millimeter wave technology market segments, market trends and opportunities, and any further data you may need to thrive in the millimeter wave technology industry. This millimeter wave technology market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The millimeter wave technology market consists of revenues earned by entities by providing radio astronomy, remote sensing, security screening, and telecommunications services. The market value includes the value of related goods sold by the service provider or included within the service offering. The millimeter wave technology market also includes sales of e-band, V-band, Microwave, and Wi-Fi equipment which are used in providing services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Millimeter Wave Technology Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on millimeter wave technology market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for millimeter wave technology? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The millimeter wave technology market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Component: Antennas and Transceiver Components; Frequency Sources and Related Components; Communication and Networking Components; Imaging Components; RF and Radio Components; Sensors and Controls; Interface Components; Power and Battery Components; Other Components;2) By Product: Scanning Systems; Radar and Satellite Communication Systems; Telecommunication Equipment; Other Products;

3) By License Type: Light Licensed Frequency Millimeter Wave; Unlicensed Frequency Millimeter Wave; Fully Licensed Frequency Millimeter Wave

4) By Frequency: 24 GHz To 57 GHz; 58 GHz To 86 GHz; 87 GHz To 300 GHz

5) By End-Use: Telecommunications; Military and Defense; Automotive and Transport; Healthcare; Electronics and Semiconductor; Security

Subsegments:

1) By Antennas and Transceiver Components: Antenna Arrays; Transmitter Modules; Receiver Modules; Integrated Circuits2) By Frequency Sources and Related Components: Oscillators; Frequency Synthesizers; Signal Generators; Mixers

3) By Communication and Networking Components: Modulators; Demodulators; Routers; Switches

4) By Imaging Components: Millimeter Wave Cameras; Sensors; Imaging Software

5) By RF and Radio Components: Amplifiers; Filters; Waveguides

6) By Sensors and Controls: Proximity Sensors; Motion Sensors; Control Units

7) By Interface Components: Connectors; Adapters; Cables

8) By Power and Battery Components: Power Amplifiers; Battery Management Systems; Energy Harvesting Modules

9) By Other Components: Heat Sinks; Enclosures; Miscellaneous Accessories

Key Companies Mentioned: Huawei Technologies Co. Ltd.; Lockheed Martin Corporation; Denso Corporation; QUALCOMM Inc.; Mitsubishi Electric Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Huawei Technologies Co. Ltd.

- Lockheed Martin Corporation

- Denso Corporation

- QUALCOMM Inc.

- Mitsubishi Electric Corporation

- Fujitsu Limited

- Ericsson

- NEC Corporation

- L3Harris Technologies Inc.

- Toyoda Gosei Co. Ltd.

- Keysight Technologies Inc.

- Smiths Interconnect

- Aviat Networks Inc.

- Mistral Solutions Pvt. Ltd.

- Vayyar Imaging Ltd.

- Siklu Communications Ltd.

- REMEC Broadband Wireless Networks LLC

- Radio Gigabit Inc.

- Eravant

- Sivers Semiconductors AB

- Farran Technology Ltd.

- LightPointe Communications Inc.

- Millimeter Wave Products Inc.

- Blu Wireless Technology Limited

- Vubiq Networks Inc.

- E-Band Communications LLC

- Hubei YJT Technology Co Ltd.

- BridgeComm Inc.

- Movandi Corporation

- Wireless Excellence Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.57 Billion |

| Forecasted Market Value ( USD | $ 8.68 Billion |

| Compound Annual Growth Rate | 24.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 30 |