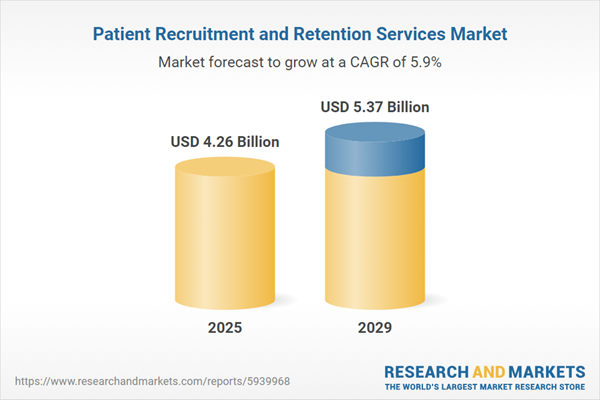

The patient recruitment and retention services market size is expected to see strong growth in the next few years. It will grow to $5.37 billion in 2029 at a compound annual growth rate (CAGR) of 5.9%. The growth in the forecast period can be attributed to a growing focus on diversity in clinical trials, increased outsourcing of patient recruitment services, expansion of precision medicine trials, advances in data analytics for recruitment, and emphasis on real-world evidence in trials. Major trends in the forecast period include the integration of social media in patient recruitment, the development of patient engagement platforms, the rise in virtual and decentralized trial approaches, the implementation of predictive analytics in recruitment strategies, and the customization of patient-centric trial designs.

The increase in the number of clinical trials is propelling the growth of the patient recruitment and retention services market. Clinical trials involve research studies that investigate new procedures and medications, assessing their impact on health outcomes. Patient recruitment and retention services are essential for identifying and enrolling eligible participants, thereby facilitating the development of clinical trials. Consequently, as the number of clinical trials rises, so does the demand for these services. For instance, in November 2023, the Association of the British Pharmaceutical Industry, a UK-based trade association, reported a slight increase of 4.3% in the total number of industry-sponsored clinical trials launched in the UK, from 394 trials in 2021 to 411 in 2022. Therefore, the growth in clinical trials is driving the patient recruitment and retention services market.

The significant factor contributing to market growth is the surge in funding for clinical research. Clinical research funding, involving financial support for scientific studies related to understanding, diagnosing, treating, or preventing medical conditions, plays a crucial role in advancing medical knowledge. The portion allocated to patient recruitment and retention services is utilized to enhance processes for identifying and retaining participants in clinical trials. Notably, data from the National Institutes of Health reveals an increase in support for new and renewed extramural grants in Fiscal Year 2022, reaching a total of 58,368, representing a 2.8% rise compared to the previous year. The success rate for new Research Project Grants (RPGs) also increased by 1.6 percentage points, from 19.1% in 2021 to 20.7% in 2022. This substantial funding growth underscores the positive impact on the patient recruitment and retention services market.

Technological advancements have emerged as a prominent trend in the patient recruitment and retention services market, with major companies strategically introducing advanced products to fortify their market positions. An example of this trend is evident in the actions of Aloha Health Network, a US-based artificial intelligence platform. In March 2023, the company launched an augmented AI/ML platform designed to expedite patient recruitment in pharmaceutical clinical trials. This innovative service leverages cutting-edge natural language processing (NLP) algorithms to identify and pre-screen potential clinical trial volunteers using a diverse range of structured and unstructured data points, including electronic medical records and medical histories.

Companies at the forefront of the patient recruitment and retention services market are concentrating on developing groundbreaking solutions, emphasizing a patient-first approach. Patient-first service, a philosophy in healthcare and related services, prioritizes the well-being, needs, and experiences of the patient. Illustrating this approach, Innovative Trials, a UK-based global patient recruitment service provider, introduced the Navigator Service in October 2023. This patient-centric service is designed to expedite the development of therapies by assisting sponsors and sites. The service has demonstrated success in multiple pilot projects within the United States, showcasing its effectiveness in improving the recruitment process and enhancing patient engagement.

In March 2022, M and B Sciences Inc., a US-based clinical research organization, made a strategic move by acquiring Clara Health for an undisclosed amount. This acquisition serves to reinforce M and B Sciences' innovative patient recruitment and retention technology platform. Clara Health, a US-based patient recruitment and retention technology company, brings valuable expertise and technology to complement and strengthen the capabilities of M and B Sciences in this evolving market landscape.

Major companies operating in the patient recruitment and retention services market include IQVIA Holdings Inc, ICON PLC, Veradigm Inc., Medpace Holdings Inc., Worldwide Clinical Trials Inc., Bioclinica Inc., Altasciences, BMC Group, Evolution Research Group (ERG), Science37, Veristat LLC, Elligo Health Research Inc., CROee Inc., MMG (Matthews Media Group), Linical Co. Ltd, Global AES, Bright Pharmaceutical Services Inc., Clinrol, Antidote Technologies Inc., Ignite Data Solutions, BBK Worldwide LLC, Integrated Clinical Trial Services (ICTS) Inc., Syneos Health Inc., 3H Medi Solution Co. Ltd., Fidelis Research Ltd., S4 Research Pvt. Ltd, Clinical Accelerator Ltd., Polaris BioPharma Consulting Ltd, CSSi Lifesciences.

North America was the largest region in the patient recruitment and retention services market in 2024. Asia-Pacific is expected to be the fastest-growing region in the patient recruitment and retention services market report during the forecast period. The regions covered in the patient recruitment and retention services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the patient recruitment and retention services market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Patient recruitment and retention services play a crucial role in clinical trials, facilitating the identification and enrollment of eligible participants through strategic methods and ensuring their continued participation throughout the drug development cycle.

The key steps in patient recruitment and retention services involve pre-screening and screening. Pre-screening involves verifying a candidate's historical information to assess their eligibility. Clinical trials progress through distinct phases, namely Phases I, II, III, and IV, addressing diverse therapeutic areas such as cardiovascular diseases, oncological disorders, infectious diseases, central nervous system disorders, respiratory disorders, hematological disorders, among others. These services are essential for the effective completion of clinical trials and contribute to the overall success of the drug development process.

The patient recruitment and retention services market research report is one of a series of new reports that provides patient recruitment and retention services market statistics, including patient recruitment and retention services industry global market size, regional shares, competitors with a patient recruitment and retention services market share, detailed patient recruitment and retention services market segments, market trends and opportunities, and any further data you may need to thrive in the patient recruitment and retention services industry. This patient recruitment and retention services market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The patient recruitment and retention services market include revenues earned by entities by providing services such as patient identification, data management, site support and training. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Patient Recruitment and Retention Services Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on patient recruitment and retention services market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for patient recruitment and retention services? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The patient recruitment and retention services market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Patient Recruitment Steps: Pre-screening; Screening2) By Trial Phases: Phases I; Phases II; Phases III; Phases IV

3) By Therapeutic Areas: Cardiovascular Diseases; Oncological Disorders; Infectious Diseases; Central Nervous System Disorders; Respiratory Disorders; Hematological Disorders; Other Disorders

Subsegments:

1) By Pre-screening: Patient Identification; Initial Outreach and Engagement; Eligibility Questionnaire; Patient Database Review; Digital and Media Campaigns for Recruitment2) By Screening: In-Depth Eligibility Assessment; Medical History Review; Diagnostic Testing (if required); Informed Consent Process; Clinical Trial Enrollment Confirmation

Key Companies Mentioned: IQVIA Holdings Inc; ICON PLC; Veradigm Inc.; Medpace Holdings Inc.; Worldwide Clinical Trials Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- IQVIA Holdings Inc

- ICON PLC

- Veradigm Inc.

- Medpace Holdings Inc.

- Worldwide Clinical Trials Inc.

- Bioclinica Inc.

- Altasciences

- BMC Group

- Evolution Research Group (ERG)

- Science37

- Veristat LLC

- Elligo Health Research Inc.

- CROee Inc.

- MMG (Matthews Media Group)

- Linical Co. Ltd

- Global AES

- Bright Pharmaceutical Services Inc.

- Clinrol

- Antidote Technologies Inc.

- Ignite Data Solutions

- BBK Worldwide LLC

- Integrated Clinical Trial Services (ICTS) Inc.

- Syneos Health Inc.

- 3H Medi Solution Co. Ltd.

- Fidelis Research Ltd.

- S4 Research Pvt. Ltd

- Clinical Accelerator Ltd.

- Polaris BioPharma Consulting Ltd

- CSSi Lifesciences

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.26 Billion |

| Forecasted Market Value ( USD | $ 5.37 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |