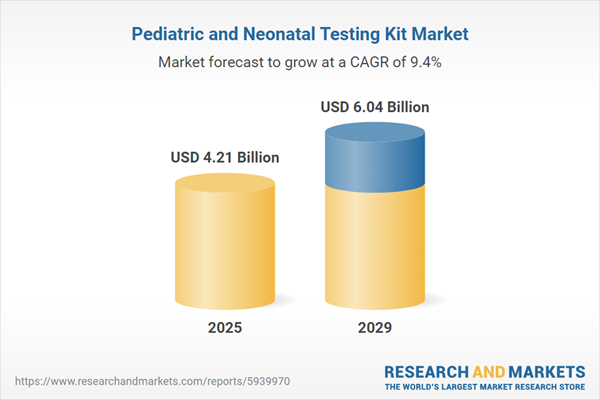

The pediatric and neonatal testing kit market size is expected to see strong growth in the next few years. It will grow to $6.04 billion in 2029 at a compound annual growth rate (CAGR) of 9.4%. The growth in the forecast period can be attributed to a rise in demand for non-invasive testing methods, expansion of point-of-care testing in pediatrics, increasing investments in neonatal and pediatric research, and adoption of digital health solutions. Major trends in the forecast period include the development of rapid and accurate testing kits, implementation of next-generation sequencing in pediatric diagnostics, expansion of newborn screening programs, increasing focus on metabolic testing in neonates, and integration of artificial intelligence in diagnostic tools.

The pediatric and neonatal testing kit market is poised for growth due to the rising prevalence of congenital disorders in newborns. These disorders, occurring during fetal development or present at birth, underscore the importance of pediatric and neonatal screening. Early detection of congenital disabilities through such screening enables healthcare professionals to initiate prompt treatment. In February 2023, the World Health Organization (WHO) reported that approximately 240,000 babies worldwide die within the first 28 days of birth due to congenital disorders annually, with an additional 170,000 deaths occurring between the ages of 1 month to 5 years. The European Commission noted in December 2022 that anomalies were prevalent in 253.38 per 10,000 births in 2020, with 58.22 instances of termination of pregnancy for congenital anomalies (TOPFA). This emphasizes the significant impact of congenital disorders on infant mortality and underscores the need for pediatric and neonatal testing kits.

The growing neonatal and pediatric population is fueling the expansion of the pediatric and neonatal testing kit market. Neonates refer to newborns, typically from birth to 28 days old, while pediatric patients include children and infants aged 21 or younger at the time of diagnosis or treatment. The pediatric and neonatal testing kit market is essential for meeting the specific healthcare needs of this increasing population. For example, in September 2024, the Australian Institute of Health and Welfare, a government agency in Australia, reported that in 2022, there were 297,725 births to 293,435 mothers, with male infants accounting for 51% of the total and females for 49%, resulting in a male-to-female ratio of 105.4 males for every 100 females. Therefore, the rising neonatal and pediatric population is driving growth in the pediatric and neonatal testing kits market.

The emergence of novel screening tests is a significant trend gaining traction in the pediatric and neonatal testing kits market. Leading companies are concentrating on developing innovative screening kits, including mass screening tests, to maintain their competitive edge. For example, in May 2024, Shimadzu Techno-Research, Inc., a Japan-based contract analysis company, introduced a new service for conducting PCR testing aimed at improving newborn mass screening. This service tests for serious rare diseases such as Severe Combined Immunodeficiency (SCID), B-cell Deficiency (BCD), and Spinal Muscular Atrophy (SMA). Its goal is to identify these conditions shortly after birth, enabling timely intervention and treatment to enhance health outcomes for newborns. Currently, the service is available in 40 of Japan's 47 prefectures, with plans to expand testing to all newborns through public funding. By collaborating with hospitals and delivery facilities, STR aims to enhance the health and welfare of newborns across Japan.

Major players in the pediatric and neonatal testing kits market are actively engaging in strategic collaborations to fortify their market positions. Collaborations, such as the one between Baebies, Inc., a US-based medical device company, and Medical Horizons s.r.l, an Italy-based medical device supplier, exemplify efforts to advance precision medicines for chronic kidney diseases. This collaboration, initiated in May 2022, aims to discover and develop innovative products facilitating early disease detection and comprehensive diagnosis. The expansion of digital microfluidics technology into new global markets is a strategic focus, offering opportunities to screen more infants and improve overall patient outcomes.

In April 2022, Innara Health, a U.S.-based neonatal medical device company, joined forces with Cardinal Health. This partnership aims to enhance neonatal feeding development by redesigning Innara's FDA-cleared NTrainer System into a more compact and user-friendly device that integrates smoothly into NICU feeding protocols. The initiative seeks to improve feeding outcomes for preterm infants and reduce their hospital stays. Cardinal Health is a U.S.-based healthcare company that produces pediatric testing kits.

Major companies operating in the pediatric and neonatal testing kit market include F. Hoffmann-La Roche AG, Thermo Fisher Scientific Inc., Abbott Laboratories, Medtronic Plc, Siemens Healthineers, GE Healthcare GmbH, Eurofins Scientific SE, Trivitron Healthcare Pvt Ltd., Hologic Inc., PerkinElmer Inc., Quidel Corporation, Bio-Rad Laboratories Inc., QIAGEN NV, Natus Medical Incorporated, BioFire Diagnostics LLC, Luminex Corporation, Meridian Bioscience Inc., MP Biomedicals LLC, ELITech Group SAS, Baebies Inc., Labsystems Diagnostics Oy, Advacare Pharma LLP, Beckman Coulter Inc., JETA Molecular BV, EpigenTek Group Inc., ZenTech SA, Hangzhou Testsea Biotechnology Co. Ltd.

North America was the largest region in the pediatric and neonatal testing kit market in 2024. The regions covered in the pediatric and neonatal testing kit market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pediatric and neonatal testing kit market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

A pediatric and neonatal testing kit encompasses a compilation of specialized medical devices, instruments, and tools meticulously crafted for the evaluation and diagnosis of infants, newborns, and children. These kits serve as indispensable resources for healthcare professionals, including pediatricians, neonatologists, nurses, and other medical personnel, facilitating the precise diagnosis, monitoring, and treatment of pediatric patients.

Key test types featured in pediatric and neonatal testing kits include dried blood spot, hearing screening, critical congenital heart defect (CCHD), among others. The dried blood spot (DBS) test, a diagnostic technique, entails the collection of a small blood volume from individuals, allowing it to dry on a specialized filter paper. The product offerings include assay kits, reagents, and instruments employing various cutting-edge technologies such as tandem mass spectrometry, pulse oximetry, enzyme-based assays, DNA-based assays, electrophoresis, and more. These advanced testing solutions cater to a diverse range of end users, including hospitals, diagnostic centers, maternity facilities, specialty clinics, and other healthcare institutions.

The pediatric and neonatal testing kit market research report is one of a series of new reports that provides pediatric and neonatal testing kit market statistics, including pediatric and neonatal testing kit industry global market size, regional shares, competitors with a pediatric and neonatal testing kit market share, detailed pediatric and neonatal testing kit market segments, market trends and opportunities, and any further data you may need to thrive in the pediatric and neonatal testing kit industry. This pediatric and neonatal testing kit market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The pediatric and neonatal testing kit market consists of sales of maternal blood screening, ultrasound tests, amniocentesis, and glucose screening. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Pediatric and Neonatal Testing Kit Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pediatric and neonatal testing kit market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pediatric and neonatal testing kit? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The pediatric and neonatal testing kit market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Test Type: Dried Blood Spot; Hearing Screening; Critical Congenital Heart Defect (CCHD); Other Test Types2) By Product: Assay Kits and Reagents; Instruments

3) By Technology: Tandem Mass Spectrometry; Pulse Oximetry; Enzyme-Based Assays; DNA Based Assays; Electrophoresis; Others Technologies

4) By End User: Hospitals; Diagnostic Centers; Maternity and Specialty Clinics; Other End Users

Subsegments:

1) By Dried Blood Spot: Newborn Screening Panels; Genetic Testing; Infectious Disease Screening2) By Hearing Screening: Automated Auditory Brainstem Response (ABR) Tests; Otoacoustic Emissions (OAE) Tests; Portable Hearing Screening Devices

3) By Critical Congenital Heart Defect (CCHD): Pulse Oximetry Screening Kits; Echocardiography Screening Tools; Clinical Assessment Protocols

4) By Other Test Types: Blood Gas Analysis Kits; Urine Testing Kits; Infectious Disease Testing; Point-of-Care Testing Devices

Key Companies Mentioned: F. Hoffmann-La Roche AG; Thermo Fisher Scientific Inc.; Abbott Laboratories; Medtronic Plc; Siemens Healthineers

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- F. Hoffmann-La Roche AG

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Medtronic Plc

- Siemens Healthineers

- GE Healthcare GmbH

- Eurofins Scientific SE

- Trivitron Healthcare Pvt Ltd.

- Hologic Inc.

- PerkinElmer Inc.

- Quidel Corporation

- Bio-Rad Laboratories Inc.

- QIAGEN NV

- Natus Medical Incorporated

- BioFire Diagnostics LLC

- Luminex Corporation

- Meridian Bioscience Inc.

- MP Biomedicals LLC

- ELITech Group SAS

- Baebies Inc.

- Labsystems Diagnostics Oy

- Advacare Pharma LLP

- Beckman Coulter Inc.

- JETA Molecular BV

- EpigenTek Group Inc.

- ZenTech SA

- Hangzhou Testsea Biotechnology Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 4.21 Billion |

| Forecasted Market Value ( USD | $ 6.04 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 27 |