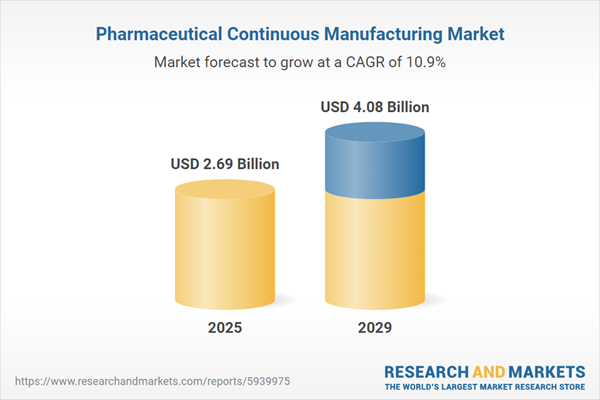

The pharmaceutical continuous manufacturing market size is expected to see rapid growth in the next few years. It will grow to $4.08 billion in 2029 at a compound annual growth rate (CAGR) of 10.9%. The growth in the forecast period can be attributed to increasing generic drug production, biopharmaceutical manufacturing, personalized medicine manufacturing, focus on patient-centric approaches. Major trends in the forecast period include adoption of continuous manufacturing, integration of process analytical technology, use of advanced automation and robotics, strategic collaborations and partnerships, digitalization and connectivity.

The forecast of 10.9% growth over the next five years reflects a modest reduction of 0.2% from the previous estimate for this market. This reduction is primarily due to the impact of tariffs between the US and other countries. Tariff barriers are expected to hamper the U.S. by increasing the cost of continuous flow reactors and real-time monitoring systems sourced from Sweden and the Netherlands, thereby slowing advanced manufacturing adoption and raising operational costs. The effect will also be felt more widely due to reciprocal tariffs and the negative effect on the global economy and trade due to increased trade tensions and restrictions.

The increasing prevalence of various chronic ailments is projected to drive the growth of the pharmaceutical continuous manufacturing market in the future. Chronic ailments are generally defined as conditions that last for a year or more, require ongoing medical treatment, and disrupt daily activities. Continuous manufacturing processes allow pharmaceutical companies to optimize medication production, leading to greater efficiency and reduced costs. This approach also facilitates wider access to essential medications, which is particularly critical for managing chronic conditions that necessitate long-term treatment. For example, in April 2022, a report from the National Association of Chronic Disease Directors (NACDD), a US-based non-profit organization focused on chronic disease programs, indicated that nearly 60% of adult Americans have at least one chronic disease, and about 40% have multiple chronic conditions (MCC). This situation is anticipated to cost the US economy $2 trillion annually, or $8,600 per person by 2030. Consequently, the growing prevalence of chronic ailments is expected to drive the pharmaceutical continuous manufacturing market.

The rise in industrial automation is anticipated to drive the growth of the pharmaceutical continuous manufacturing market in the future. Industrial automation involves using control systems, such as computers or robots, to manage various processes and machinery within an industry, replacing or supplementing human intervention. This automation facilitates pharmaceutical continuous manufacturing by providing monitoring and real-time feedback control in continuous manufacturing processes, helping to reduce human error and maintain consistent product quality. For instance, in September 2023, the World Robotics report published by the International Federation of Robotics, a Germany-based professional non-profit organization, revealed that there were 553,052 industrial robot installations in factories globally, representing a 5% year-on-year growth rate in 2022. Thus, the increase in industrial automation is propelling the growth of the pharmaceutical continuous manufacturing market.

Technological innovations are emerging as a prominent trend in the pharmaceutical continuous manufacturing market, with major companies actively developing new products to maintain their market positions. One notable example is the introduction of the USP Advanced Manufacturing Technology Lab by The United States Pharmacopeia (USP) in December 2022. This initiative includes the launch of R&D analytical solutions aimed at assisting drug manufacturers in adopting advanced manufacturing technologies, such as pharmaceutical continuous manufacturing (PCM). The goal is to enhance geographic diversity in pharmaceutical manufacturing, thereby bolstering the resilience of the medicine supply chain. The lab services provided by USP facilitate the characterization of materials and the development and qualification of methods to ensure the quality of PCM-based medications.

Major companies in the pharmaceutical continuous manufacturing market are focusing on the development of advanced equipment, such as continuous manufacturing lines, to gain a competitive edge. For instance, WuXi STA, a China-based contract research development, and manufacturing organization (CRDMO), launched a Continuous Manufacturing (CM) line for oral solids in January 2023. This CM line, compliant with global cGMP regulations, introduces advancements in oral drug development by incorporating continuous direct compression equipment for various processes, including dispensing, blending, lubrication, tablet compression, and coating. Process Analytical Technology (PAT) is integrated into the system to monitor blending uniformity in real-time, ensuring high product quality.

In January 2023, Cambrex Corporation, a US-based contract development manufacturing organization (CDMO) for pharmaceuticals, acquired Snapdragon Chemistry Inc. This acquisition strengthened Cambrex's expertise in active pharmaceutical ingredient (API) process development in continuous flow manufacturing. Snapdragon Chemistry Inc., a US-based company specializing in API batch and continuous flow process development, was integrated to complement Cambrex's recent investments in endless flow process development capabilities. These initiatives collectively showcase the industry's commitment to leveraging technological innovations for advancements in pharmaceutical continuous manufacturing.

Major companies operating in the pharmaceutical continuous manufacturing market include Pfizer Inc., Robert Bosch GmbH, Siemens AG, Novartis AG, Thermo Fisher Scientific Inc., GlaxoSmithKline Plc., Eli Lilly and Company, Corning Inc., Vertex Pharmaceuticals, Lonza Group Ltd., GEA Group AG, Catalent Inc., Mettler Toledo, Patheon, Cytiva, Samsung Biologics Co.Ltd., WuXi Biologics, Syntegon Technology GmbH, Coperion GmbH, Hosokawa Micron Group, FUJIFILM Diosynth Biotechnologies, Leistritz AG, Glatt GmbH, Freund-Vector Corp., SK biotek Co. Ltd., Gericke AG, GEBRÜDER LÖDIGE MASCHINENBAU GmbH, Munson Machinery Company Inc., L.B. Bohle Maschinen und Verfahren GmbH, KORSCH AG, Chemtrix BV.

Western Europe was the largest region in the pharmaceutical continuous manufacturing market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the pharmaceutical continuous manufacturing market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the pharmaceutical continuous manufacturing market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Note that the outlook for this market is being affected by rapid changes in trade relations and tariffs globally. The report will be updated prior to delivery to reflect the latest status, including revised forecasts and quantified impact analysis. The report’s Recommendations and Conclusions sections will be updated to give strategies for entities dealing with the fast-moving international environment.

The sudden escalation of U.S. tariffs and the resulting trade tensions in spring 2025 are having a significant impact on the pharmaceutical sector. Companies are grappling with higher costs on imported active pharmaceutical ingredients (APIs), glass vials, and laboratory equipment - many of which have limited alternative sources. Generic drug manufacturers, already operating with minimal profit margins, are particularly affected, with some scaling back production of low-margin medications. Biotech firms are also experiencing delays in clinical trials due to shortages of specialized reagents linked to tariffs. In response, the industry is shifting API production to regions like India and Europe, building up inventory reserves, and advocating for tariff exemptions on essential medicines.

The pharmaceutical continuous manufacturing market research report is one of a series of new reports that provides pharmaceutical continuous manufacturing market statistics, including pharmaceutical continuous manufacturing industry global market size, regional shares, competitors with a pharmaceutical continuous manufacturing market share, detailed pharmaceutical continuous manufacturing market segments, market trends, and opportunities, and any further data you may need to thrive in the pharmaceutical continuous manufacturing industry. This pharmaceutical continuous manufacturing market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

Pharmaceutical continuous manufacturing (PCM) is a streamlined process that involves the production of pharmaceutical goods from initiation to completion on a single, uninterrupted production line. This innovative approach is particularly utilized for manufacturing active pharmaceutical components through continuous flow chemical transformations and multistep syntheses, allowing for extended operational durations and potentially mitigating medicine shortages.

The primary categories of pharmaceutical continuous manufacturing products include integrated continuous systems, controls and software, and semi-continuous systems. The Integrated Continuous System (ICS) represents a comprehensive method for producing pharmaceutical items seamlessly on a continuous production line. These systems find application in the manufacturing of both large molecule and small molecule therapeutics, playing a vital role in producing solid formulations, liquids, and semi-solid formulations. ICS is deployed in various applications, including final drug product manufacturing and active pharmaceutical ingredient (API) manufacturing. This technology is adopted by diverse end-users such as pharmaceutical companies, contract manufacturing organizations, and other relevant entities in the pharmaceutical industry.

The pharmaceutical continuous manufacturing market consists of revenues earned by entities by providing manufacturing services such as mixing, granulation, coating, and tablet compression. The market value includes the value of related goods sold by the service provider or included within the service offering. The pharmaceutical continuous manufacturing market also includes sales of organic PCM and inorganic PCM techniques. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 1-3 business days.

Table of Contents

Executive Summary

Pharmaceutical Continuous Manufacturing Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on pharmaceutical continuous manufacturing market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as geopolitical conflicts, trade policies and tariffs, post-pandemic supply chain realignment, inflation and interest rate fluctuations, and evolving regulatory landscapes.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for pharmaceutical continuous manufacturing? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward, including technological disruption, regulatory shifts, and changing consumer preferences? The pharmaceutical continuous manufacturing market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include: the technological advancements such as AI and automation, Russia-Ukraine war, trade tariffs (government-imposed import/export duties), elevated inflation and interest rates.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Integrated Continuous System; Control and Software; Semi-Continuous System2) By Therapeutics Type: Large Molecule; Small Molecule

3) By Formulation: Solid Formation; Liquid and Semi-Solid Formation

4) By Application: Final Drug Product Manufacturing; Active Pharmaceutical Ingredient (API) Manufacturing

5) By End-Users: Pharmaceutical Companies; Contract Manufacturing Organization; Other End-Users

Subsegments:

1) By Integrated Continuous System: Continuous Mixer Systems; Continuous Granulation Systems; Continuous Tablet Press Systems; Continuous Coating Systems2) By Control and Software: Process Analytical Technology (PAT) Tools; Manufacturing Execution Systems (MES); Control Software for Automation; Data Management and Visualization Software

3) By Semi-Continuous System: Batch-to-Continuous Transition Systems; Hybrid Systems; Semi-Continuous Granulation and Drying Systems

Companies Mentioned: Pfizer Inc.; Robert Bosch GmbH; Siemens AG; Novartis AG; Thermo Fisher Scientific Inc.; GlaxoSmithKline Plc.; Eli Lilly and Company; Corning Inc.; Vertex Pharmaceuticals; Lonza Group Ltd.; GEA Group AG; Catalent Inc.; Mettler Toledo; Patheon; Cytiva; Samsung Biologics Co.Ltd.; WuXi Biologics; Syntegon Technology GmbH; Coperion GmbH; Hosokawa Micron Group; FUJIFILM Diosynth Biotechnologies; Leistritz AG; Glatt GmbH; Freund-Vector Corp.; SK biotek Co. Ltd.; Gericke AG; GEBRÜDER LÖDIGE MASCHINENBAU GmbH; Munson Machinery Company Inc.; L.B. Bohle Maschinen und Verfahren GmbH; KORSCH AG; Chemtrix BV

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

The companies featured in this Pharmaceutical Continuous Manufacturing market report include:- Pfizer Inc.

- Robert Bosch GmbH

- Siemens AG

- Novartis AG

- Thermo Fisher Scientific Inc.

- GlaxoSmithKline Plc.

- Eli Lilly and Company

- Corning Inc.

- Vertex Pharmaceuticals

- Lonza Group Ltd.

- GEA Group AG

- Catalent Inc.

- Mettler Toledo

- Patheon

- Cytiva

- Samsung Biologics Co.Ltd.

- WuXi Biologics

- Syntegon Technology GmbH

- Coperion GmbH

- Hosokawa Micron Group

- FUJIFILM Diosynth Biotechnologies

- Leistritz AG

- Glatt GmbH

- Freund-Vector Corp.

- SK biotek Co. Ltd.

- Gericke AG

- GEBRÜDER LÖDIGE MASCHINENBAU GmbH

- Munson Machinery Company Inc.

- L.B. Bohle Maschinen und Verfahren GmbH

- KORSCH AG

- Chemtrix BV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 250 |

| Published | September 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 2.69 Billion |

| Forecasted Market Value ( USD | $ 4.08 Billion |

| Compound Annual Growth Rate | 10.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 32 |