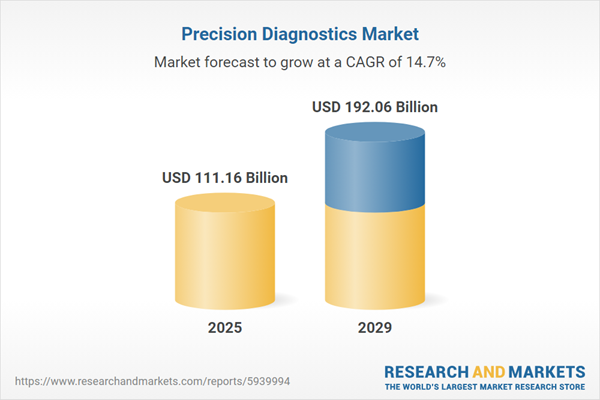

The precision diagnostics market size is expected to see rapid growth in the next few years. It will grow to $192.06 billion in 2029 at a compound annual growth rate (CAGR) of 14.7%. The growth in the forecast period can be attributed to expansion of liquid biopsy applications, integration of artificial intelligence (AI), growing demand for companion diagnostics, expansion of point-of-care testing, population health management initiatives. Major trends in the forecast period include technological innovations in sequencing, advancements in multi-omics technologies, rise of digital pathology, real-world evidence integration, collaborations in research and development.

The precision diagnostics market is poised for growth, driven by the increasing prevalence of chronic diseases. Chronic diseases, lasting three months or more and potentially worsening over time, prompt a growing demand for precise diagnostic solutions. Precision diagnostics play a crucial role in managing healthcare models for patients with chronic conditions, offering accurate disease diagnosis. For instance, data from the National Library of Medicine in January 2023 indicates that the number of individuals aged 50 and older in the US with at least one chronic condition is projected to reach 142.66 million by 2050, emphasizing the role of precision diagnostics in addressing the rising prevalence of chronic diseases.

An additional factor contributing to the growth of the precision diagnostics market is the increased spending on healthcare. Greater healthcare spending allocates substantial resources to advanced diagnostic solutions, fostering the development and widespread adoption of precision diagnostics. This aligns with the industry's commitment to delivering personalized and effective healthcare solutions. According to the 2021-2030 National Health Expenditure (NHE) report from the Centers for Medicare & Medicaid Services in March 2022, national health spending is expected to grow by 5.1% annually between 2021 and 2030, reaching nearly $6.8 trillion. The projected growth in healthcare spending, with annual increases in Medicare and Medicaid spending, is a key driver of the precision diagnostics market.

Leading companies in the precision diagnostics market are concentrating on innovative therapies, including the introduction of AI-driven video analysis tools that enhance patient engagement and facilitate the understanding of complex medical data, empowering individuals to take control of their health. An AI-driven video analysis tool utilizes artificial intelligence to analyze video content, simplifying intricate information such as health reports by highlighting essential parameters and providing clear insights for better comprehension and informed decision-making. For example, in August 2024, Healthians, an India-based diagnostic firm, launched an industry-first AI-driven video analysis tool designed to simplify complex medical data by emphasizing key health parameters and explaining their relevance, effectively guiding users through their health reports. This groundbreaking feature allows users to receive personalized insights within 15-30 minutes after completing a brief questionnaire on the Healthians app, thereby enhancing their capacity to make informed health decisions.

Major players in the precision diagnostics market are embracing a strategic partnership approach to provide personalized and precision-focused healthcare. Strategic partnerships involve companies leveraging each other's strengths and resources to achieve mutual benefits and success. For instance, in September 2023, Owkin, a France-based AI biotech company, partnered with Tribun Health, a provider of computational pathology solutions based in France, to improve the development and global deployment of AI-driven diagnostic and research solutions for pathology departments and pharmaceutical companies. By integrating Owkin's advanced AI diagnostics into Tribun Health's CaloPix platform, this collaboration aims to streamline pathology data workflows and enhance diagnostic accuracy, ultimately accelerating personalized treatment options for patients.

In February 2022, SQI Diagnostics Inc., a Canada-based precision medicine company, acquired Precision Biomonitoring Inc. for $6,825,000. This acquisition aims to expand SQI's human diagnostic business portfolio by incorporating Precision Biomonitoring's TripleLock molecular diagnostic testing technology. Precision Biomonitoring Inc., a Canada-based biotechnology and research company, specializes in providing precision diagnostic services, including DNA-based surveillance and detection.

Major companies operating in the precision diagnostics market include Pfizer Inc., F. Hoffmann-La Roche Ltd., Bayer AG, Novartis AG, Abbott Laboratories, Danaher Corporation, Amgen Inc., Koninklijke Philips N.V., Becton Dickinson and Company (BD), Thermo Fisher Scientific Inc., Quest Diagnostics Inc., Siemens Healthineers AG, Agilent Technologies Inc., PerkinElmer Inc., Beckman Coulter Inc., Charles River Laboratories International Inc., Sysmex America Inc., Waters Corporation, Bio-Rad Laboratories Inc., Bruker Corporation, Qiagen N.V., Bio-Techne Corporation, Illumina Inc., Lantheus Medical Imaging Inc., Luminex Corporation, BioFire Diagnostics LLC, Genomic Health Inc., Swiss Precision Diagnostics GmbH, Bluebird Bio Inc.

North America was the largest region in the precision diagnostics market in 2024. Asia Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the precision diagnostics market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the precision diagnostics market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Precision diagnostics is a subset of precision medicine, focusing on utilizing individual data, including genetic, environmental, and lifestyle information, to enhance the prevention, diagnosis, and treatment of illnesses in healthcare. It involves providing detailed genetic information about a patient's clinical history to aid in the treatment process.

The primary types of precision diagnostics include genetic tests, esoteric tests, and others. Genetic tests involve laboratory examinations aimed at identifying differences in an individual's DNA, such as alterations in chromosomes, genes, or gene expression within their cells or tissues. Various technologies are employed, including next-generation sequencing (NGS), polymerase chain reaction (PCR), in situ hybridization (ISH), mass spectrometry, immunohistochemistry (IHC), and others. These technologies find applications in various fields such as oncology, infectious diseases, cardiovascular health, neurology, genetic disorders, and others. Precision diagnostics are utilized by hospitals and clinics, diagnostic laboratories, research institutes, pharmaceutical and biotechnology companies, among others.

The precision diagnostics market research report is one of a series of new reports that provides precision diagnostics market statistics, including precision diagnostics industry global market size, regional shares, competitors with a precision diagnostics market share, detailed precision diagnostics market segments, market trends, and opportunities, and any further data you may need to thrive in the precision diagnostics industry. This precision diagnostics market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The precision diagnostics market consists of revenues earned by entities by providing precision imaging, molecular imaging, on-device X-ray AI algorithms, and automated MR workflow. The market value includes the value of related goods sold by the service provider or included within the service offering. The precision diagnostics market also includes sales of medical diagnostic kits, rapid test kits, instruments and analyzers, and diagnostic equipment which are used in precision diagnostics services. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Precision Diagnostics Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on precision diagnostics market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for precision diagnostics? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The precision diagnostics market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Genetic Tests; Esoteric tests; Other Types2) By Technology: Next Generation Sequencing (NGS); Polymerase Chain Reaction (PCR); in Situ Hybridization (ISH); Mass Spectrometry; Immunohistochemistry (IHC); Other Technologies

3) By Application: Oncology; Infectious Diseases; Cardiovascular; Neurology; Genetic Disorders; Other Applications

4) By End-User: Hospitals and Clinics; Diagnostic Laboratories; Research Institutes; Pharmaceutical and Biotechnology Companies; Other End-Users

Subsegments:

1) By Genetic Tests: Next-Generation Sequencing (NGS); Polymerase Chain Reaction (PCR) Tests; Whole Exome Sequencing (WES); Single Nucleotide Polymorphism (SNP) Testing2) By Esoteric Tests: Proteomics; Metabolomics; Specialized Infectious Disease Testing; Rare Disease Testing

3) By Other Types: Biomarker Testing; Liquid Biopsies; Companion Diagnostics; Pharmacogenomic Testing

Key Companies Mentioned: Pfizer Inc.; F. Hoffmann-La Roche Ltd.; Bayer AG; Novartis AG; Abbott Laboratories

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Pfizer Inc.

- F. Hoffmann-La Roche Ltd.

- Bayer AG

- Novartis AG

- Abbott Laboratories

- Danaher Corporation

- Amgen Inc.

- Koninklijke Philips N.V.

- Becton Dickinson and Company (BD)

- Thermo Fisher Scientific Inc.

- Quest Diagnostics Inc.

- Siemens Healthineers AG

- Agilent Technologies Inc.

- PerkinElmer Inc.

- Beckman Coulter Inc.

- Charles River Laboratories International Inc.

- Sysmex America Inc.

- Waters Corporation

- Bio-Rad Laboratories Inc.

- Bruker Corporation

- Qiagen N.V.

- Bio-Techne Corporation

- Illumina Inc.

- Lantheus Medical Imaging Inc.

- Luminex Corporation

- BioFire Diagnostics LLC

- Genomic Health Inc.

- Swiss Precision Diagnostics GmbH

- Bluebird Bio Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 111.16 Billion |

| Forecasted Market Value ( USD | $ 192.06 Billion |

| Compound Annual Growth Rate | 14.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |