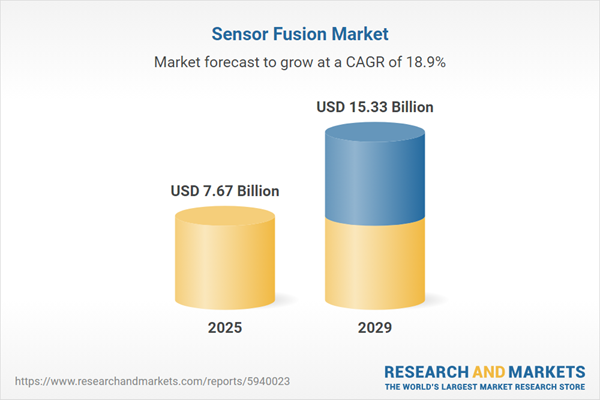

The sensor fusion market size is expected to see rapid growth in the next few years. It will grow to $15.33 billion in 2029 at a compound annual growth rate (CAGR) of 18.9%. The growth in the forecast period can be attributed to IoT and smart cities initiatives, consumer electronics evolution, medical imaging and healthcare, energy efficiency concerns, wearable health tech expansion, and cloud-based sensor fusion services. Major trends in the forecast period include AI and machine learning integration, robotics advancements, augmented reality (AR) and virtual reality (VR) applications, and environmentally sustainable solutions.

The growing adoption of electric vehicles is expected to drive the growth of the sensor fusion market in the future. An electric vehicle is powered by an electric motor that draws energy from a battery, which is charged externally. Sensor fusion is crucial for the functionality, safety, energy efficiency, and autonomous capabilities of electric vehicles, making it a vital component in the evolving automotive sector. For example, in July 2023, the International Energy Agency, a France-based intergovernmental organization, reported that sales of electric vehicles reached 10 million in 2022, with an anticipated increase to 14 million in 2023. Therefore, the rising penetration of electric vehicles is propelling the growth of the sensor fusion market.

The increasing adoption of 5G technology is expected to propel the growth of the sensor fusion market. 5G, the fifth generation of wireless technology, offers faster data speeds, lower latency, and enhanced connectivity for various devices and applications. Sensor fusion is integral to 5G technology, amalgamating data from multiple sensors to improve accuracy, efficiency, and real-time responsiveness across diverse applications, from autonomous vehicles to smart cities. According to a June 2022 report by Ericsson, it is projected that there will be 4.4 billion 5G subscriptions, representing approximately 48% of the global mobile subscription base by the end of 2027. Hence, the rising adoption of 5G technology is a significant driver for the sensor fusion market.

Technological advancements emerge as a prominent trend gaining traction in the sensor fusion market. Key companies in this sector are leveraging advanced technologies to maintain their market positions. In November 2022, STMicroelectronics, a Switzerland-based semiconductor manufacturer, introduced the LSM6DSV16X, an advanced 6-axis inertial measurement unit (IMU) that incorporates artificial intelligence (AI), adaptive self-configuration (ASC), and technology for superior power optimization through sensor fusion low power (SFLP). This IMU facilitates rapid and potent edge processing with reduced energy consumption, making it ideal for applications such as advanced 3D phone mapping and context awareness on laptops and tablets.

Major companies in the sensor fusion market are also focusing on cutting-edge solutions such as perception technology to meet the growing demand for enhanced data accuracy and real-time insights. Perception technology involves the integration of sensors and AI to interpret and understand complex data from the environment. In July 2023, TIER IV Inc., a Japan-based software company, launched the Sensor Fusion Development Kit, streamlining the creation of autonomous driving systems and related applications using advanced perception technology. The kit integrates high-quality automotive sensors, including HDR cameras and 3D LiDARs, with robust computing systems, simplifying sensor fusion development.

In April 2022, CARIAD, a Germany-based automotive software company, acquired the automotive division of Intenta GmbH for an undisclosed amount. This acquisition aims to enhance CARIAD's capabilities in sensor data fusion, thereby accelerating the development of assisted and automated driving features for the Volkswagen Group. Intenta GmbH, also based in Germany, specializes in sensor data fusion technology for the automotive industry.

Major companies operating in the sensor fusion market include Qualcomm Technologies Inc., Broadcom Inc., NVIDIA Corporation, Asahi Kasei Microdevices Corporation, Texas Instrument Incorporated, Aptiv PLC, STMicroelectronics N.V, Infineon Technologies AG, NXP Semiconductor N.V, Amphenol Corporation, Analog Devices Inc., Renesas Electronics Corporation, Microchip Technology Inc., Trimble Inc., InvenSense Inc., MEMSIC Semiconductor Co. Ltd., CEVA Inc., First Sensor AG, Bosch Sensortec GmbH, LeddarTech Inc., Kionix Inc., Fullpower Technologies, QuickLogic Corporation, NIRA Dynamics, Kitware Inc., Innoviz Technologies, PNI Sensor Corporation, Hillcrest Laboratories Inc., Baselabs GmbH.

Asia-Pacific was the largest region in the sensor fusion market in 2024, and is expected to be the fastest-growing region in the forecast period. The regions covered in the sensor fusion market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the sensor fusion market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Sensor fusion involves the amalgamation of input gathered from diverse sensors to reduce the level of uncertainty inherent in automated machine navigation or task execution. Its role is crucial in compensating for imprecisions or gaps in knowledge pertaining to specific environmental factors.

The primary categories of sensor fusion encompass radar sensors, image sensors, inertial measurement units (IMUs), temperature sensors, and others. Radar sensors function as conversion tools, translating microwave echo signals into electrical signals. Sensor fusion enhances radar sensors by incorporating data from various sensors such as cameras or lidar, thereby improving the accuracy of object detection and tracking. This enhancement contributes to more dependable situational awareness across diverse applications. Sensor fusion technologies include micro-electric mechanical systems (MEMS), non-micro-electric mechanical systems (MEMS), and others applied in smartphones, tablets, TV remotes, cameras, video games, and more. End users of sensor fusion technology span across consumer electronics, automotive, home automation, medical, military, and industrial sectors.

The sensor fusion research report is one of a series of new reports that provides sensor fusion market statistics, including the sensor fusion industry's global market size, regional shares, competitors with a sensor fusion market share, detailed sensor fusion market segments, market trends and opportunities, and any further data you may need to thrive in the sensor fusion industry. This sensor fusion market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The sensor fusion market consists of revenues earned by entities by providing sensor fusion services such as sensor data fusion, and sensor fusion software. The market value includes the value of related goods sold by the service provider or included within the service offering. The sensor fusion market also includes sales of AI-enabled sensor fusion kits and sensor fusion and tracking toolboxes, which are used in providing sensor fusion services. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Sensor Fusion Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on sensor fusion market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for sensor fusion? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The sensor fusion market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Radar Sensor; Image Sensor; Inertial Measurement Unit (IMU); Temperature Sensor; Other Types2) By Technology: Micro-Electronic Mechanical Systems (MEMS); Non-Micro-Electronic Mechanical Systems (MEMS); Other Technologies

3) By Application: Smartphones; Tablets; TV Remote; Camera; Video Games; Other Applications

4) By End User: Consumers Electronics; Automotive; Home Automation; Medical; Military; Industrial

Subsegments:

1) By Radar Sensor: Automotive Radar Sensors; Airborne Radar Sensors; Ground-Based Radar Sensors2) By Image Sensor: CCD (Charge-Coupled Device) Sensors; CMOS (Complementary Metal-Oxide-Semiconductor) Sensors; Infrared Sensors

3) By Inertial Measurement Unit (IMU): Gyroscopes; Accelerometers; Magnetometers

4) By Temperature Sensor: Thermocouples; Thermistors; Infrared Temperature Sensors

5) By Other Types: Proximity Sensors; Pressure Sensors; Ultrasonic Sensors; Humidity Sensors

Key Companies Mentioned: Qualcomm Technologies Inc.; Broadcom Inc.; NVIDIA Corporation; Asahi Kasei Microdevices Corporation; Texas Instrument Incorporated

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

- Qualcomm Technologies Inc.

- Broadcom Inc.

- NVIDIA Corporation

- Asahi Kasei Microdevices Corporation

- Texas Instrument Incorporated

- Aptiv PLC

- STMicroelectronics N.V

- Infineon Technologies AG

- NXP Semiconductor N.V

- Amphenol Corporation

- Analog Devices Inc.

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Trimble Inc.

- InvenSense Inc.

- MEMSIC Semiconductor Co. Ltd.

- CEVA Inc.

- First Sensor AG

- Bosch Sensortec GmbH

- LeddarTech Inc.

- Kionix Inc.

- Fullpower Technologies

- QuickLogic Corporation

- NIRA Dynamics

- Kitware Inc.

- Innoviz Technologies

- PNI Sensor Corporation

- Hillcrest Laboratories Inc.

- Baselabs GmbH

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | February 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 7.67 Billion |

| Forecasted Market Value ( USD | $ 15.33 Billion |

| Compound Annual Growth Rate | 18.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |