Speak directly to the analyst to clarify any post sales queries you may have.

MARKET TRENDS & OPPORTUNITIES

Booming Demand for Luxury Bathrooms

The increasing demand for luxury bathrooms has significantly impacted the plumbing parts market. Several factors have contributed to this surge in demand. The hospitality industry, particularly luxury hotels, has been investing heavily in upgrading bathrooms to provide guests with a more lavish and comfortable experience. For instance, in 2022, the Spanish luxury hotel sector witnessed a substantial increase in investments, with approximately USD 1.458 billion poured into five-star establishments. This surge in investment has directly contributed to a notable uptick in demand for high-quality plumbing parts within the market. These luxurious accommodations aim to maintain and enhance their opulent amenities, so the demand for top-tier bathroom plumbing components has risen significantly. This trend reflects the industry's commitment to offering guests a superior and seamless experience, fueling the demand for luxury bathroom plumbing parts in the market.Increasing Government Investment in Infrastructure

Increasing government investment in infrastructure can significantly impact the demand for plumbing parts in the market. When governments allocate more funds towards infrastructure projects such as building roads, bridges, schools, and public facilities, it leads to a surge in construction activities. These construction projects often require extensive water supply, sewage, and drainage plumbing systems. Further, as construction projects expand, there is a higher need for plumbing components such as pipes, fittings, valves, faucets, and other related products. Plumbers and contractors involved in these infrastructure developments will require an increased supply of plumbing materials to complete their projects efficiently and according to regulatory standards. This surge in demand can stimulate the plumbing industry, increasing production, job opportunities, and revenue for plumbing manufacturers and suppliers and supporting the plumbing parts market growth. For instance, the Indian government's budget allocation of USD 9.6 billion for providing housing facilities under the Pradhan Mantri Awas Yojana in 2023-2024 is expected to significantly boost the demand for plumbing parts in the market.INDUSTRY RESTRAINTS

Lack of Skilled Labour

The shortage of skilled labor in the plumbing industry can significantly impact the demand for plumbing parts. Skilled plumbers are essential for installing, maintaining, and repairing plumbing systems in residential, commercial, and industrial buildings. A shortage of professional plumbers can delay construction and renovation projects. Builders and property owners may have to put their projects on hold or slow down the construction process due to a lack of plumbing expertise. This delay can directly impact the demand for plumbing parts, as fewer parts will be needed during project construction.SEGMENTATION INSIGHTS

INSIGHTS BY PRODUCT

The global plumbing parts market by product is segmented into pipes & tubes, valves, fittings, and manifolds. The pipes and tubes hold the most dominant share of the global market in 2023 and are expected to witness the highest CAGR in the product segment. The demand for pipes and tubes is increasing due to several factors, including government initiatives, emerging markets, technological advancements & others. Furthermore, the valves segment accounted for the second-highest share in the product segment. The construction of new pipelines or the expansion of existing ones generates a substantial demand for various types of valves, including gate valves, ball valves, check valves, and control valves. These valves are pivotal in controlling the flow of liquids and gases within the pipelines. This increased demand in the market is a direct result of the expanding infrastructure in various industries.Segmentation by Product

- Pipes & Tubes

- Valves

- Fittings

- Manifolds

INSIGHTS BY END-USER

The residential end-user segment dominated the global plumbing parts market in 2023. The higher segmental share can be attributed to the rise in the global base of housing units and the growing demand for plumbing parts across various regions. Rising urbanization and growing per capita income have driven demand for architectural projects for building and construction. Further, the surge in housing construction within the U.S. has pronounced an impact on the market for plumbing parts in residential settings. This increase in demand can be attributed to several key factors, each of which underscores the integral role that plumbing components play in the construction and maintenance of residential properties. Also, renovating and maintaining existing residential structures, often occurring in tandem with new construction, contribute significantly to the heightened demand for plumbing parts.Segmentation by End-users

- Residential

- Non- Residential

INSIGHTS BY APPLICATIONS

The global plumbing parts market by applications is segmented into faucets, sinks, toilets & others, showerheads, and bathtubs. The application segment has been dominated by faucet plumbing parts, accounting for more than 37% of the market share. The demand for plumbing parts, specifically faucets, is rising. This increase can be attributed to home renovation projects, growing construction activities, and a focus on water efficiency. As a result, manufacturers and retailers are experiencing a surge in the need for faucets and related plumbing parts to meet consumer demands. Moreover, the sinks, toilets, & other segments have the highest CAGR during the forecast period. With a surge in home renovations and new construction projects, there is a growing need for plumbing fixtures like toilets and sinks. Homeowners and developers seek modern, efficient, and aesthetically pleasing options. Consumers increasingly value the design and aesthetics of their bathrooms and kitchens. This drives the demand for stylish and modern sinks and toilets.Segmentation by Applications

- Faucets

- Sinks, Toilets & Other

- Showerhead

- Bathtubs

GEOGRAPHICAL ANALYSIS

The APAC region accounted for the highest share of the global plumbing parts market, valued at over USD 24 billion in 2023. The demand for plumbing parts surged in APAC due to government investments in infrastructure, increasing construction activities, and rapid urbanization. Within APAC, China and India are the significant contributors to the revenue of plumbing parts, driven by a rise in hotel construction and a growing population. Moreover, Europe is the second-largest revenue contributor in the global plumbing parts market. This is attributed to a rising demand for renovation, increasing construction of houses, and positive economic growth within the region. In the Middle East and Africa, the demand for plumbing parts is fueled by increasing construction in the hospitality sector and healthcare. Moreover, Latin America is witnessing the highest CAGR in the global plumbing parts market during the forecast period. Residential permits and the rising disposable income of the population drive the demand for plumbing parts in this region.Segmentation by Geography

- APAC

- Europe

- North America

- Middle East & Africa

- Latin America

COMPETITIVE LANDSCAPE

The global plumbing parts market is highly competitive, with many vendors. Rapid technological improvements adversely impact market vendors as consumers expect continuous innovations and product upgrades. The vendors are encouraged to adopt and improve their unique value to achieve a strong market presence. Some major players dominating the global plumbing parts market include the Central States Industrial, Finolex Industries Limited, McWane, and many others. Currently, the global plumbing parts market is dominated by vendors that have an international presence. Many international players are expected to expand their reach worldwide during the forecast period, especially in the fast-developing countries of the APAC region and Latin America, to enhance their market share. Lately, vendors of plumbing parts have undertaken significant R&D activities to have a strong market position and keep up with the latest trends.Recent Developments in the Global Plumbing Parts Market

- Uponor: In 2023, the company announced the production OF PEX pipe based on 100% chemically recycled raw material. Through this, the company diversifies its product portfolio and increases the volume of recycled materials in the market.

- Reliance Worldwide Corporation: In September 2023, the company announced a partnership with Galvin Engineering, aiming to create Lead Safe CliniMix Healthcare Thermostatic Mixing Valves (TMV) for the Australian plumbing industry. Through this collaboration, the company seeks to enhance its presence in the Australian market and expand its local manufacturing operations within the region.

- NUPI INDUSTRIE ITALIANE: In 2023, the company introduced 63mm electrofusion and spigot tees with incorporated adaptors, reducing assembly height and the need for multiple welds, improving efficiency. With this, the company aims to gain a competitive advantage in the plumbing parts market and increase its sales.

Key Company Profiles

- Central States Industrial

- Finolex Industries Limited

- McWane

- Morris Group

- Mueller Industries

- NUPI INDUSTRIE ITALIANE S.p.A.

- Reliance Worldwide Corporation

- Turnkey Industrial Pipe & Supply Inc

- Uponor

Other Prominent Vendors

- Prince Pipes and Fittings

- Masco Corporation

- Charlotte Pipe and Foundry

- TOTO

- CERA

- Hansgrohe Group

- Jaquar

- Kohler

- Ideal Standard

- Westlake Pipe & Fittings

- Elkay Manufacturing Company

- Guangdong Huayi Plumbing Fittings

- Jacuzzi

- Globe Union Industrial

- Roca Sanitario

- Proflo

- Geberit AG

- Moen

- Novanative

- Multipipe

- Flair-It

- Giacomini

- VNE Corporation

- Zhejiang Valogin Technology

- Viega

- Caleffi

- HotTubOutpost

- Tech Tubes & Fittings

- Tigre USA

KEY QUESTIONS ANSWERED

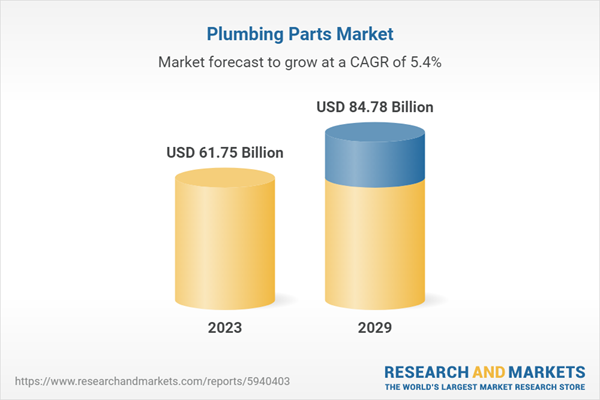

1. How big is the plumbing parts market?2. What is the growth rate of the global plumbing parts market?

3. Which region dominates the global plumbing parts market share?

4. What are the significant trends in the plumbing parts market?

5. Who are the key players in the global plumbing parts market?

Table of Contents

Companies Mentioned

- Central States Industrial

- Finolex Industries Limited

- McWane

- Morris Group

- Mueller Industries

- NUPI INDUSTRIE ITALIANE S.p.A.

- Reliance Worldwide Corporation

- Turnkey Industrial Pipe & Supply Inc

- Uponor

- Prince Pipes and Fittings

- Masco Corporation

- Charlotte Pipe and Foundry

- TOTO

- CERA

- Hansgrohe Group

- Jaquar

- Kohler

- Ideal Standard

- Westlake Pipe & Fittings

- Elkay Manufacturing Company

- Guangdong Huayi Plumbing Fittings

- Jacuzzi

- Globe Union Industrial

- Roca Sanitario

- Proflo

- Geberit AG

- Moen

- Novanative

- Multipipe

- Flair-It

- Giacomini

- VNE Corporation

- Zhejiang Valogin Technology

- Viega

- Caleffi

- HotTubOutpost

- Tech Tubes & Fittings

- Tigre USA

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 296 |

| Published | February 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 61.75 Billion |

| Forecasted Market Value ( USD | $ 84.78 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 38 |