Orthodontic Products: Introduction

Orthodontics is a branch of dentistry that deals with correct positioning of teeth and jaws. It also helps in enhancing oral health and overall dental health. Orthodontic products include braces, clear aligners, palate expanders and retainers. Advancements in digital technology have revolutionized orthodontics, with 3D imaging and CAD/CAM technologies facilitating more precise treatment planning and implementation. As orthodontics continues to evolve, it offers increasingly effective and aesthetically pleasing solutions to a wide array of dental issues.Global Orthodontic Products Market Analysis

The introduction of digital and artificial intelligence enabled tools has revolutionized the orthodontics products market value. In February 2023, Owandy Radiology Inc., a global dental radiology hardware and imaging software manufacturer, unveiled its AI-powered Ceph analysis orthodontic software. It enables numerous features like fully automatic cephalometric tracing, radiograph analysis and image superimposition, visual growth projections, along with treatment plan simulations. With the help of such new-age tools, the diagnosing and treatment process for healthcare professionals can become more accurate and rapid.In April 2023, a United States based company, Grin, also launched an entirely new product line, integrated with a new software. The AI records app, which allowed the patients to take high quality scans of both intraoral as well as extraoral parts was a key highlight of the product line. Moreover, it facilitated in practice communication between the practice members to discuss, annotate, and manage cases in time.

The increasing popularity of clear aligners is also contributing to orthodontic products market growth. This can be accredited to the aesthetic appearance of clear aligners which makes it more desirable than the traditional wired braces. The market is fueled by new innovations like Slate Dental's electric flosser. The device combines floss with 12,000 sonic vibrations that help remove plaque and bacteria from the orthodontic brackets. The emergence of such devices indicates market expansion in the forecast period.

Global Orthodontic Products Market Segmentation

Orthodontic Products Market Report and Forecast 2025-2034 offers a detailed analysis of the market based on the following segments:Market Breakup by Product

- Fixed

- Dental Braces

- Molar Bands

- Molar Wires

- Others

- Removable

- Aligners

- Retainers

- Others

Market Breakup by Patient

- Adults

- Children

Market Breakup by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Global Orthodontic Products Market Overview

With increased emphasis on improving the facial features and maintaining oral health, North America, particularly United States, has dominated the orthodontic products market share during the historical period. The market size can be attributed to the presence of impactful healthcare companies that ran several campaigns to attract the right audience. In March 2023, 3M launched a campaign called ‘Colors that make you smile' to specifically attract the generation Z patients. The campaign intended to provide orthodontists with pre-prepared marketing tools like downloadable social media toolkit and paid media templates to help them reach the target audience.The Asia Pacific market is expanding at a steady rate owing to an increase in the disposable income of the population pertaining to the area. Countries like South Korea hold a significant market for aesthetic treatments and has been experiencing considerable share of medical tourism as well. Moreover, the overall healthcare infrastructure of South-East Asian countries is improving, which is expected to affect the market positively in upcoming years.

Europe is also experiencing high orthodontic products market demand, driven by facilities like virtual orthodontic checkups. With a robust medical infrastructure that can integrate modern technologies like artificial intelligence and machine learning, there has been a significant upswing in patient volume. Furthermore, the existence of numerous treatments like 3D imaging and digital wires, printing resins, smaller more comfortable braces, nickel and copper-titanium wires, and robotic wire bending, and CAD/CAM technology has also attracted significant number of patients.

Global Orthodontic Products Market: Competitor Landscape

The key features of the market report include patent analysis, grants analysis, clinical trials analysis, funding and investment analysis, partnerships, and collaborations analysis by the leading key players. The major companies in the market are as follows:- 3M Company

- American Orthodontics

- Align Technology, Inc.

- Dentaurum GmbH & Co. KG

- Envista Holdings Corporation

- G&H Orthodontics, Inc. (Altaris Capital Partners, LLC)

- Dentsply Sirona Inc.

- Great Lakes Dental Technology

- Henry Schein, Inc.

- Ultradent Products

- DB Orthodontics

- Angelalign Technology, Inc.

- Aditek Orthodontics

- Rocky Mountain Orthodontics, Inc.

- TP Orthodontics, Inc.

This product will be delivered within 3-5 business days.

Table of Contents

Companies Mentioned

- 3M Company

- American Orthodontics

- Align Technology, Inc.

- Dentaurum GmbH & Co. KG

- Envista Holdings Corporation

- G&H Orthodontics, Inc. (Altaris Capital Partners, LLC)

- Dentsply Sirona Inc.

- Great Lakes Dental Technology

- Henry Schein, Inc.

- Ultradent Products

- DB Orthodontics

- Angelalign Technology, Inc.

- Aditek Orthodontics

- Rocky Mountain Orthodontics, Inc.

- TP Orthodontics, Inc.

Table Information

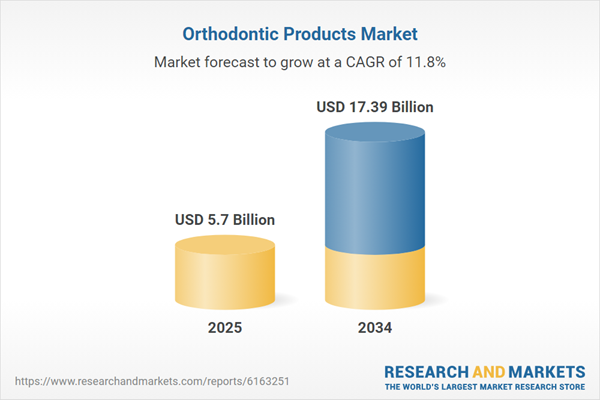

| Report Attribute | Details |

|---|---|

| No. of Pages | 350 |

| Published | July 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.7 Billion |

| Forecasted Market Value ( USD | $ 17.39 Billion |

| Compound Annual Growth Rate | 11.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 15 |