Furniture serves different needs in different environments-office furniture is designed for workspaces, outdoor furniture is built for durability against weather conditions, and residential furniture focuses on comfort and style. According to the publisher, the design and arrangement of furniture can greatly influence the functionality and ambiance of a space. Currently, furniture is widely available across India in various styles and designs, from classic and ornate to modern and minimalist, to suit the needs of individuals.

With a market size of USD 237.21 billion in 2023, the furniture market in Asia Pacific holds the largest market share. India, which has the second largest furniture industry in Asia Pacific, is also becoming one of the most preferred locations for multinational companies.

Currently, the Indian furniture market is primarily driven by the growing middle class population with higher disposable incomes. This demographic shift has led to an increased demand for space-efficient and stylish furniture, especially in urban areas where modern living spaces are prevalent. The rapid expansion of real estate, especially in the residential and commercial sectors, continues to drive demand for various types of furniture, including home, office and outdoor furniture.

Moreover, the proliferation of e-commerce platforms has played a significant role in accelerating the adoption of furniture products by offering a diverse range at competitive prices. In addition, customization has emerged as a key growth driver as consumers prioritize personalized, functional, and design-oriented furniture solutions.

Another major factor contributing to the market growth is the increasing emphasis on sustainability and eco-friendly practices, which is driving the demand for furniture made from renewable or recycled materials. Government initiatives such as the 'Make in India' campaign have also encouraged domestic manufacturing, improving the availability of quality furniture at affordable prices, thereby fostering market expansion.

According to the publisher, the Indian furniture market size will reach $23.9 billion in 2023 and is expected to reach $59.4 billion by 2033, growing at a compound annual growth rate (CAGR) of 9.3% during 2024-2033.

India is a very small global player when it comes to furniture, the export value of furniture in 2023 is only nearly US$ 3.5 billion, accounting for only 1.5 percent of global furniture exports. However, with future improvements in India's infrastructure and dividends from its demographics, India is expected to become the new center of furniture manufacturing, gradually replacing China's market position.

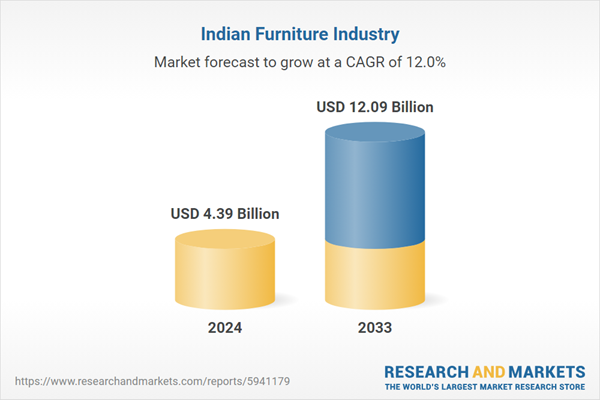

The publisher forecasts that the export value of India's furniture will continue to grow at a CAGR of 11.9% from 2024 to 2033, reaching US$ 12.09 billion in 2033.

Topics covered:

- India Furniture Industry Overview

- The economic and policy environment of India's furniture industry

- India Furniture Industry Market Size, 2024-2033

- Analysis of the main India furniture production enterprises

- Key drivers and market opportunities for India's furniture industry

- What are the key drivers, challenges and opportunities for India's furniture industry during the forecast period 2024-2033?

- Which companies are the key players in the India furniture industry market and what are their competitive advantages?

- What is the expected revenue of India furniture industry market during the forecast period 2024-2033?

- What are the strategies adopted by the key players in the market to increase their market share in the industry?

- Which segment of the India furniture industry market is expected to dominate the market by 2032?

- What are the main negative factors facing the furniture industry in India?

Table of Contents

Companies Mentioned

- IKEA

- WoodenStreet

- HomeTown

- Godrej Interio

- Durian

- Nilkamal

- Natuzzi

- Stanley

- Savya Home

- Bluwud

- HTL

Methodology

Background research defines the range of products and industries, which proposes the key points of the research. Proper classification will help clients understand the industry and products in the report.

Secondhand material research is a necessary way to push the project into fast progress. The analyst always chooses the data source carefully. Most secondhand data they quote is sourced from an authority in a specific industry or public data source from governments, industrial associations, etc. For some new or niche fields, they also "double-check" data sources and logics before they show them to clients.

Primary research is the key to solve questions, which largely influence the research outputs. The analyst may use methods like mathematics, logical reasoning, scenario thinking, to confirm key data and make the data credible.

The data model is an important analysis method. Calculating through data models with different factors weights can guarantee the outputs objective.

The analyst optimizes the following methods and steps in executing research projects and also forms many special information gathering and processing methods.

1. Analyze the life cycle of the industry to understand the development phase and space.

2. Grasp the key indexes evaluating the market to position clients in the market and formulate development plans

3. Economic, political, social and cultural factors

4. Competitors like a mirror that reflects the overall market and also market differences.

5. Inside and outside the industry, upstream and downstream of the industry chain, show inner competitions

6. Proper estimation of the future is good guidance for strategic planning.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 60 |

| Published | February 2024 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 4.39 Billion |

| Forecasted Market Value ( USD | $ 12.09 Billion |

| Compound Annual Growth Rate | 12.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 11 |