Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Nevertheless, the market faces a major obstacle due to the substantial capital expenditure required for sophisticated instrumentation. The significant financial outlay needed to purchase and sustain complex machinery frequently curbs adoption rates within smaller research laboratories and academic institutions with limited budgets. This economic hurdle presents a concrete risk to the steady growth of the market and constrains the availability of high-performance spectrometry solutions in developing areas.

Market Drivers

The robust growth of the pharmaceutical and biotechnology industries acts as a major driver for the spectrometry market, underscored by the essential requirement for exact molecular analysis in drug discovery and development. Spectrometry methods, especially mass spectrometry, are vital for metabolomics, proteomics, and verifying the purity of active pharmaceutical ingredients during production. As corporations ramp up their initiatives to create innovative biologics and personalized treatments, investment in sophisticated analytical instrumentation has risen to sustain these intricate research processes. For example, a March 2025 report by Fierce Biotech on top pharma R&D budgets notes that AstraZeneca raised its research and development spending by 24% to bolster its pipeline, illustrating the aggressive expenditure trends promoting the use of high-performance analytical instruments.Furthermore, an increase in government funding for life sciences research is actively stimulating market growth by improving financial access to advanced equipment for academic and public entities. Initiatives backed by the state are increasingly focusing on healthcare innovation and sustainable manufacturing, generating significant chances for instrument suppliers to utilize their technologies in funded projects. According to a November 2025 press release from the UK Government regarding the 'Sustainable Medicines Manufacturing Innovation Programme', over £74 million in joint funding was granted to support advanced life sciences projects. This financial backing supports broader market growth, as evidenced by major industry players; Shimadzu Corporation reported in May 2025 that its Analytical & Measuring Instruments segment reached net sales of 347.9 billion yen for the fiscal year ended March 31, 2025, a 2.9% year-on-year rise attributed to these strong demand drivers.

Market Challenges

The substantial capital expenditure necessitated by advanced instrumentation acts as a major hurdle to the expansion of the Global Spectrometry Market. The considerable financial investment required to acquire high-performance spectrometers, along with continuous expenses for maintenance, facility infrastructure, and specialized operator training, establishes a clear barrier to entry for numerous prospective users. This financial pressure is especially severe for smaller research laboratories and academic institutions with restricted budgets, often compelling them to prolong the use of older equipment rather than investing in modern technologies.As reported by the Japan Analytical Instruments Manufacturers' Association in 2025, the production value of analytical instruments intended for process use amounted to roughly 6.8 billion yen for the 2024 fiscal year, marking a 5.3 percent decline from the prior year. This reduction in a vital industrial sector emphasizes the negative influence of budgetary limitations on purchasing choices. When capital funds are limited, industries tend to favor critical operational costs over the upgrading of analytical infrastructure, which consequently impedes the uptake of contemporary spectrometry solutions and hinders overall market growth in cost-conscious sectors.

Market Trends

The incorporation of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is significantly transforming the spectrometry landscape by automating intricate data interpretation and enhancing instrument efficiency. Manufacturers are increasingly integrating intelligent software into analytical platforms to reduce human error, forecast maintenance requirements, and hasten the recognition of unidentified compounds in high-throughput settings. This technological fusion is directly contributing to financial gains for major industry participants who focus on smart instrumentation; Shimadzu Corporation reported in November 2025 that its Analytical & Measuring Instruments segment attained net sales of 168.1 billion yen for the six months ended September 30, 2025, reflecting a 4.7% year-on-year rise partly due to the active launch of new products employing AI and robotics.Simultaneously, the demand for hybrid spectrometry systems is rising as laboratories seek improved analytical powers to address complex biological and chemical challenges. These sophisticated setups merge various mass analysis methods, such as quadrupole and time-of-flight technologies, into a unified platform to provide enhanced resolution, speed, and sensitivity for proteomic and metabolomic research. The market is observing the introduction of next-generation instruments engineered to notably shorten experimental durations while upholding high data accuracy for detailed molecular profiling. For instance, Thermo Fisher Scientific announced in a June 2025 press release regarding the launch of next-generation mass spectrometers at ASMS 2025 that the new Orbitrap Astral Zoom mass spectrometer offers 35% faster scanning speeds and 40% greater throughput, establishing a new performance standard in life sciences research.

Key Players Profiled in the Spectrometry Market

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Waters Corporation

- Shimadzu Corporation

- Bruker Corporation

- JEOL Ltd.

- Teledyne Technologies Inc.

- Endress+Hauser AG

- MKS Instruments, Inc.

Report Scope

In this report, the Global Spectrometry Market has been segmented into the following categories:Spectrometry Market, by Type:

- Molecular Spectrometry

- Mass Spectrometry (MS)

- Atomic Spectrometry

Spectrometry Market, by Product:

- Instrument

- Consumables

- Services

Spectrometry Market, by Application:

- Proteomics

- Metabolomics

- Pharmaceutical Analysis

- Forensic Analysis

- Others

Spectrometry Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Spectrometry Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Spectrometry market report include:- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Agilent Technologies, Inc.

- Waters Corporation

- Shimadzu Corporation

- Bruker Corporation

- JEOL Ltd.

- Teledyne Technologies Inc.

- Endress+Hauser AG

- MKS Instruments, Inc

Table Information

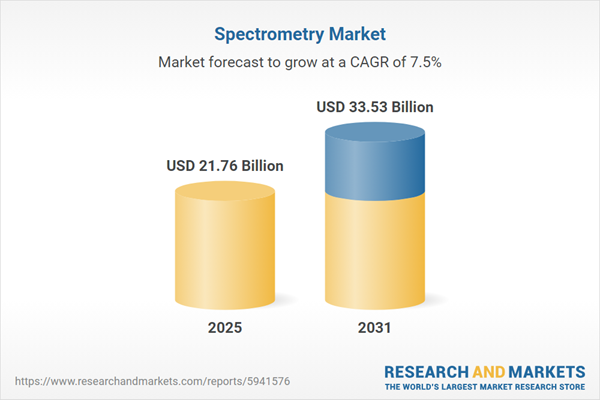

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 21.76 Billion |

| Forecasted Market Value ( USD | $ 33.53 Billion |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |