Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Bone densitometry provides valuable information for assessing fracture risk and guiding treatment decisions in patients with osteopenia or osteoporosis. It helps healthcare providers determine the appropriate course of action, including lifestyle modifications, dietary supplements, pharmacological treatments, and fracture prevention strategies. Bone densitometry is used to monitor changes in bone density over time and assess treatment response in patients undergoing osteoporosis management interventions. Regular bone density testing allows healthcare providers to track bone health status, adjust treatment regimens as needed, and optimize patient outcomes.

As the global population ages, there is a higher prevalence of osteoporosis and other bone-related conditions. The aging demographic creates a substantial demand for bone density testing to assess fracture risk and guide treatment decisions, thereby driving market growth. Advances in bone densitometry technology have led to the development of more accurate, efficient, and user-friendly devices. Modern bone densitometers offer precise measurements of bone mineral density and assess fracture risk with high sensitivity and specificity, enhancing the accuracy of diagnosis and treatment monitoring.

There is increasing awareness of the importance of bone health and early detection of osteoporosis. Healthcare organizations, advocacy groups, and government agencies promote bone health awareness and implement screening programs to identify individuals at risk. These initiatives drive the adoption of bone densitometry as a primary tool for diagnosing osteoporosis and assessing fracture risk. Ongoing research efforts focus on the development of innovative technologies and diagnostic techniques for assessing bone health. Research initiatives drive product innovation, improve diagnostic accuracy, and expand the capabilities of bone densitometers, stimulating market growth and adoption.

Key Market Drivers

Technological Advancements

Dual-energy X-ray Absorptiometry (DXA) remains the gold standard for bone density measurement. Modern DXA systems utilize low-dose X-rays to assess bone mineral density (BMD) at specific anatomical sites, typically the spine, hip, and forearm. DXA machines have become more compact, faster, and more user-friendly over time. In addition to central DXA, peripheral bone densitometry devices have been developed to assess bone density in peripheral skeletal sites such as the heel, wrist, and finger. These devices offer portability and convenience, making them suitable for point-of-care testing and screening programs.Quantitative Ultrasound (QUS) technology utilizes ultrasound waves to measure bone density and assess bone quality. QUS devices are portable, radiation-free, and relatively inexpensive compared to DXA systems. While not as widely used as DXA, QUS provides an alternative method for assessing bone health, particularly in resource-limited settings. Some advanced bone densitometers incorporate three-dimensional imaging techniques, such as quantitative computed tomography (QCT), to assess bone density and structure with greater detail and precision. QCT provides volumetric bone density measurements and enables the evaluation of trabecular and cortical bone compartments.

Software algorithms and data processing techniques have improved the accuracy and reliability of bone density measurements. Advanced software features allow for automated analysis, quality control, and interpretation of bone densitometry results, reducing user variability and enhancing diagnostic consistency. AI-driven algorithms are increasingly being integrated into bone densitometry systems to improve diagnostic accuracy and streamline workflow. AI algorithms can analyze large datasets, identify patterns, and assist radiologists and clinicians in interpreting bone densitometry images and identifying abnormalities. Modern bone densitometers feature enhanced connectivity capabilities, allowing for seamless integration with electronic health record (EHR) systems and picture archiving and communication systems (PACS). This facilitates efficient data management, storage, and retrieval, enhancing workflow efficiency and patient care coordination. Manufacturers are focused on improving patient comfort and experience during bone density testing. Design improvements, such as open-architecture scanners and ergonomic patient positioning systems, help reduce anxiety and discomfort for patients undergoing bone densitometry exams. This factor will help in the development of the Global Bone Densitometer Market.

Growing Awareness and Screening Programs

Awareness campaigns and educational initiatives raise public awareness about the importance of bone health and the risks associated with osteoporosis and other bone-related conditions. As individuals become more informed about the impact of bone density on overall health and quality of life, there is a greater demand for screening and diagnostic services to assess bone health. Growing awareness prompts individuals, particularly those at higher risk of osteoporosis, to seek early detection and preventive measures. Screening programs encourage individuals to undergo bone density testing to assess their risk of fractures and osteoporosis-related complications.Early detection allows for timely intervention strategies to prevent bone loss, reduce fracture risk, and preserve bone health. Healthcare organizations and government agencies implement targeted screening initiatives aimed at identifying individuals at high risk of osteoporosis and fractures. These initiatives often target specific demographics, such as postmenopausal women, older adults, and individuals with certain medical conditions or risk factors. Screening programs may offer bone density testing as part of routine health assessments or community-based outreach efforts. Clinical practice guidelines recommend bone density testing for certain age groups, particularly postmenopausal women and older adults, to assess fracture risk and guide treatment decisions. Growing awareness of these guidelines among healthcare providers and patients increases the demand for bone densitometry services as a standard component of preventive healthcare.

Public health campaigns and advocacy efforts raise awareness about osteoporosis prevention, risk factors, and available screening options. These campaigns aim to empower individuals to take proactive steps to protect their bone health and encourage healthcare providers to incorporate bone density screening into routine clinical practice. Increasing awareness of bone health and osteoporosis leads to greater demand for screening services, prompting healthcare facilities to expand access to bone densitometry services.

Improved access to screening services, including the availability of bone densitometers in primary care settings, clinics, and imaging centers, facilitates early detection and intervention for individuals at risk of osteoporosis. Media coverage and health education programs contribute to raising awareness about osteoporosis and the importance of bone density screening. Educational materials, public service announcements, and media campaigns disseminate information about osteoporosis risk factors, symptoms, and available screening modalities, prompting individuals to seek bone density testing as part of their preventive healthcare routine. This factor will pace up the demand of the Global Bone Densitometer Market.

Increase in the Aging Population

Osteoporosis, a common bone disorder characterized by decreased bone density and increased fracture risk, is more prevalent among older adults. As the population ages, there is a higher incidence of osteoporosis and related bone disorders, driving the need for bone density testing to assess fracture risk and guide treatment decisions. Older adults are at greater risk of fractures due to age-related bone loss and decreased bone strength. Preventive healthcare strategies aim to identify individuals at risk of fractures through bone density testing and implement interventions to prevent fractures and preserve bone health. Bone densitometers play a crucial role in fracture prevention and management by providing accurate measurements of bone mineral density and assessing fracture risk in older adults. Bone densitometry allows for the early detection of bone loss and osteoporosis in older adults before fractures occur. Early intervention strategies, including lifestyle modifications, nutritional supplementation, and pharmacological treatments, can help slow the progression of bone loss and reduce fracture risk in older individuals.Bone densitometry is used to monitor changes in bone density and assess treatment response over time in older adults receiving osteoporosis management interventions. Regular bone density testing allows healthcare providers to track changes in bone health, adjust treatment regimens as needed, and prevent fractures in older adults at risk of osteoporosis-related complications. Healthcare policies and clinical practice guidelines recommend bone density testing for older adults, particularly postmenopausal women and men over the age of 50, to assess fracture risk and guide osteoporosis management. Reimbursement policies support bone density testing as part of preventive healthcare services for older adults, ensuring access to screening services for individuals at risk of osteoporosis and fractures. Public health initiatives raise awareness about osteoporosis prevention, fracture risk reduction, and the importance of bone density testing among older adults and healthcare providers. Educational campaigns promote healthy aging practices, lifestyle modifications, and preventive healthcare measures to preserve bone health and reduce the burden of osteoporosis-related fractures in the aging population. This factor will accelerate the demand of the Global Bone Densitometer Market.

Key Market Challenges

Interpretation of Results and Clinical Decision-Making

Interpreting bone densitometry results requires specialized knowledge and expertise. Bone density measurements are influenced by various factors, including age, gender, ethnicity, body composition, and underlying medical conditions. Healthcare providers need to consider these factors and interpret bone densitometry results in the context of each patient's individual risk factors and clinical history. Bone densitometry results are used to stratify patients into different risk categories based on their fracture risk and likelihood of developing osteoporosis-related complications. Determining the appropriate risk threshold for initiating preventive treatments and interventions can be challenging, as fracture risk assessment involves multiple clinical factors beyond bone mineral density measurements. Clinical practice guidelines for osteoporosis diagnosis and management may vary among different professional organizations and healthcare systems.Variability in guideline recommendations can lead to inconsistencies in clinical decision-making and interpretation of bone densitometry results, particularly regarding treatment thresholds, follow-up intervals, and recommended interventions. Interpreting bone densitometry results requires integration with the patient's clinical context, including medical history, risk factors, comorbidities, and treatment preferences. Healthcare providers must consider the broader clinical picture when interpreting bone density measurements and making treatment decisions to ensure individualized care and optimal patient outcomes. Communicating bone densitometry results and treatment recommendations to patients in a clear and understandable manner is essential for promoting patient engagement and adherence to treatment plans. Healthcare providers need to effectively communicate the implications of bone density testing and empower patients to make informed decisions about their bone health and fracture risk reduction strategies.

Cost Constraints

Reimbursement policies for bone densitometry testing vary widely among different countries, regions, and healthcare systems. Variability in reimbursement rates, coverage criteria, coding guidelines, and documentation requirements can create administrative complexities and financial uncertainties for healthcare providers and facilities. In some cases, reimbursement rates for bone densitometry testing may not adequately cover the costs associated with equipment acquisition, maintenance, and operational expenses. Inadequate reimbursement rates can result in financial losses for healthcare providers and facilities, particularly in settings with high overhead costs and limited patient volume. Coding and billing for bone densitometry services involve complex procedures and documentation requirements, including accurate coding of procedures, modifiers, and diagnosis codes.Incorrect coding or documentation errors can result in claim denials, delayed reimbursements, and revenue loss for healthcare providers. Some payers may require prior authorization for bone densitometry testing, which can delay patient access to diagnostic services and create administrative burdens for healthcare providers. Prior authorization requirements may involve additional paperwork, documentation, and approval processes, leading to inefficiencies and delays in patient care delivery. Reimbursement policies may impose coverage limitations, frequency restrictions, and eligibility criteria for bone densitometry testing, which can impact patient access to diagnostic services. Coverage restrictions may limit the number of tests covered per year, restrict testing to certain patient populations, or require clinical justification for testing based on specific indications or risk factors.

Key Market Trends

Market Expansion in Emerging Economies

Emerging economies are experiencing rapid economic growth and increasing healthcare expenditures. With rising incomes and improved healthcare infrastructure, emerging economies are investing in advanced medical technologies, including bone densitometers, to meet the growing healthcare needs of their populations. Global manufacturers of bone densitometers are forming partnerships and collaborations with local distributors, healthcare providers, and government agencies to expand their presence and market share in emerging economies. These partnerships enable manufacturers to leverage local expertise, distribution networks, and market insights to penetrate new markets and reach underserved populations.Urbanization, sedentary lifestyles, dietary changes, and other lifestyle factors contribute to the increasing burden of chronic diseases, including osteoporosis, in emerging economies. Healthcare systems in these regions are prioritizing preventive healthcare measures, early detection, and management of chronic conditions, creating opportunities for market expansion in the bone densitometer segment. Emerging economies are investing in expanding and modernizing healthcare infrastructure, including hospitals, clinics, and diagnostic centers. The availability of advanced medical facilities and equipment, such as bone densitometers, improves access to diagnostic services and enhances patient care delivery in underserved areas.

Segmental Insights

Type Insights

The Axial Bone Densitometers segment is projected to experience significant dominance in the Global Bone Densitometer Market during the forecast period. As the global population ages, there is a higher prevalence of osteoporosis and other bone-related conditions. Axial bone densitometers, which measure bone mineral density in the spine and hips, are essential tools for diagnosing osteoporosis and assessing fracture risk in older adults. There is a growing awareness of the importance of bone health and early detection of osteoporosis. Healthcare organizations and governments worldwide are implementing screening programs and guidelines that recommend bone density testing for certain age groups, particularly postmenopausal women, and older adults.Axial bone densitometers have undergone significant technological advancements, leading to improved accuracy, precision, and efficiency in bone density measurements. These advancements include enhanced imaging capabilities, faster scanning times, and software innovations that provide more detailed assessments of bone health. Emerging economies are witnessing rapid expansion and modernization of healthcare infrastructure, leading to increased accessibility to diagnostic services such as bone densitometry. As healthcare systems invest in advanced medical equipment, including axial bone densitometers, the market for these devices experiences growth. There is a growing emphasis on preventive medicine and proactive management of chronic conditions such as osteoporosis. Axial bone densitometry plays a crucial role in identifying individuals at risk of fractures and guiding interventions to prevent bone loss and improve overall bone health.

Application Insights

The Osteoporosis and Osteopenia Diagnosis segment is projected to experience rapid growth in the Global Bone Densitometer Market during the forecast period. The global population is aging, leading to an increased prevalence of osteoporosis and osteopenia, especially among older adults. Osteoporosis is a common bone disorder characterized by decreased bone density and increased risk of fractures, while osteopenia refers to low bone mass, which can progress to osteoporosis. As the elderly population grows, there is a greater demand for bone density testing to assess fracture risk and guide treatment decisions. There is a growing awareness of the importance of early detection and management of osteoporosis and osteopenia. Healthcare organizations, advocacy groups, and government agencies are promoting bone health awareness and implementing screening initiatives to identify individuals at risk.Bone densitometry, including Dual-energy X-ray Absorptiometry (DXA) scans, is a primary tool for diagnosing osteoporosis and osteopenia. Emerging economies are investing in healthcare infrastructure development, including the procurement of advanced diagnostic equipment such as bone densitometers. As healthcare facilities expand and modernize, there is an increasing availability of bone densitometry services, driving market growth in regions with previously limited access to diagnostic resources. There is a shift towards preventive healthcare practices aimed at reducing the burden of chronic diseases, including osteoporosis. Early detection of bone loss through routine bone density screening allows for timely intervention strategies, such as lifestyle modifications, dietary supplements, and pharmacological treatments, to prevent fractures and preserve bone health.

Regional Insights

North America emerged as the dominant region in the Global Bone Densitometer Market in 2023. North America boasts advanced healthcare infrastructure, including well-equipped hospitals, clinics, and diagnostic centers. This infrastructure facilitates widespread access to bone densitometry testing and contributes to the region's leadership in the market. Osteoporosis and related bone diseases are prevalent in North America, particularly among aging populations. The awareness of bone health issues and the need for early detection and management are higher in this region, driving demand for bone densitometry screening and diagnostic services. North America is at the forefront of technological innovation in healthcare, including the development and adoption of advanced diagnostic equipment such as bone densitometers. The region benefits from a robust research and development ecosystem, fostering continuous improvement and innovation in bone health assessment technologies.Report Scope:

In this report, the Global Bone Densitometer Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Bone Densitometer Market, By Type:

- Axial Bone Densitometers

- Peripheral Bone Densitometers

Bone Densitometer Market, By Application:

- Osteoporosis and Osteopenia Diagnosis

- Cystic Fibrosis Diagnosis

- Body Composition Measurement

- Rheumatoid Arthritis Diagnosis

- Others

Bone Densitometer Market, By End User:

- Hospital

- Specialty Clinics

- Diagnostics and Imaging Centers

- Others

Bone Densitometer Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Bone Densitometer Market.Available Customizations:

Global Bone Densitometer Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Eurotec Group Ltd

- GE Healthcare Technologies, Inc.

- Hologic Inc.

- Medilink Incorporation

- Osteometer MediTech A/S

- OsteoSys Corp

- Scanflex Healthcare AB

- Swissray International Inc.

- Trivitron Healthcare Pvt. Ltd

- Xingaoyi Medical Equipment Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | May 2024 |

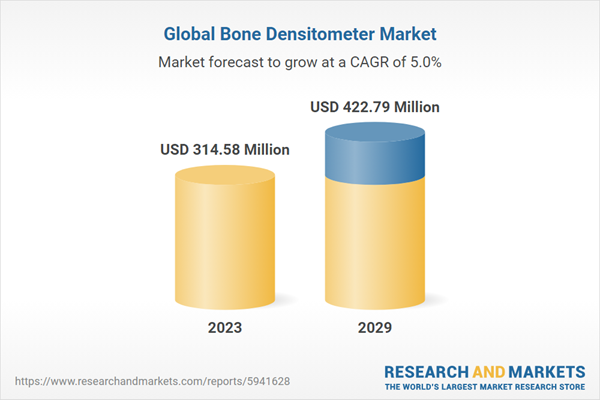

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 314.58 Million |

| Forecasted Market Value ( USD | $ 417.69 Million |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |