Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The connected manufacturing market refers to the evolving landscape where industrial processes integrate advanced digital technologies to create a cohesive and interconnected ecosystem. At its core, connected manufacturing involves the seamless interlinking of machines, devices, sensors, and systems within a manufacturing environment, fostering real-time communication and data exchange. This integration enables enhanced visibility, control, and optimization of various production processes, ultimately leading to increased efficiency, productivity, and adaptability.

Key components of the connected manufacturing market include the Internet of Things (IoT), data analytics, artificial intelligence (AI), and advanced communication technologies. These elements work in tandem to create smart factories and production systems that can autonomously monitor, analyze, and respond to changing conditions. The overarching goal is to create a more agile and responsive manufacturing ecosystem, capable of meeting the demands of modern industry through data-driven decision-making and seamless collaboration between machines and human operators. As the global manufacturing sector embraces digital transformation, the connected manufacturing market continues to evolve, driving innovation, efficiency gains, and a paradigm shift in traditional industrial practices.

Key Market Drivers

Industry 4.0 and Digital Transformation

In recent years, the global connected manufacturing market has been significantly driven by the adoption of Industry 4.0 principles and the broader digital transformation sweeping across industries. Industry 4.0 represents a new era of smart manufacturing, characterized by the integration of digital technologies, data exchange, and advanced automation in various manufacturing processes. The seamless connectivity of machines, sensors, and other devices enables real-time data exchange and decision-making, optimizing overall operational efficiency. As industries worldwide recognize the potential for increased productivity and cost savings through digitalization, the demand for connected manufacturing solutions continues to grow.One key aspect of Industry 4.0 is the implementation of the Internet of Things (IoT) devices and sensors, creating a network of interconnected devices that can communicate and share data. This connectivity allows for better monitoring and control of manufacturing processes, predictive maintenance, and improved overall equipment effectiveness. The ongoing evolution of Industry 4.0 is expected to further drive the global connected manufacturing market, as businesses seek to gain a competitive edge by leveraging cutting-edge technologies.

Rising Demand for Smart Factories

The increasing demand for smart factories is another critical driver propelling the growth of the global connected manufacturing market. Smart factories leverage advanced technologies like IoT, artificial intelligence, and robotics to create more efficient, flexible, and responsive manufacturing environments. These facilities enable seamless communication and collaboration between machines, systems, and humans, fostering a highly connected and intelligent manufacturing ecosystem.Smart factories offer several advantages, including enhanced production efficiency, reduced downtime, improved quality control, and the ability to quickly adapt to changing market demands. The integration of data analytics and machine learning further enhances decision-making processes, enabling manufacturers to optimize their operations and make data-driven strategic decisions. As industries worldwide recognize the transformative potential of smart factories, the demand for connected manufacturing solutions is expected to witness substantial growth.

Globalization and Supply Chain Optimization

The globalization of markets and the increasing complexity of supply chains have driven the need for connected manufacturing solutions. In today's interconnected world, manufacturers often operate in a global landscape, with suppliers, production facilities, and customers dispersed across different regions. Connected manufacturing technologies facilitate real-time communication and collaboration, allowing companies to optimize their supply chains, reduce lead times, and enhance overall supply chain visibility.By leveraging connected manufacturing solutions, companies can achieve better coordination and synchronization throughout their supply chains. This is particularly crucial in industries with just-in-time manufacturing processes, where any disruption can have a cascading effect on production schedules. The ability to monitor and manage the entire supply chain in real time enhances agility and resilience, enabling manufacturers to respond swiftly to changing market dynamics and customer demands.

Emphasis on Energy Efficiency and Sustainability

The increasing focus on sustainability and energy efficiency has emerged as a significant driver for the global connected manufacturing market. As environmental concerns continue to gain prominence, manufacturers are under pressure to reduce their carbon footprint and adopt more sustainable practices. Connected manufacturing technologies play a crucial role in achieving these objectives by optimizing energy usage, reducing waste, and enhancing overall resource efficiency.Through the implementation of IoT-enabled sensors and monitoring systems, manufacturers can track and analyze energy consumption in real time. This data-driven approach allows for the identification of areas where energy efficiency improvements can be made, leading to cost savings and a reduced environmental impact. Additionally, connected manufacturing solutions enable better management of waste and emissions, aligning with the growing emphasis on corporate social responsibility and sustainable business practices.

Advancements in Communication Technologies

The continuous advancements in communication technologies, including 5G networks, have significantly contributed to the expansion of the global connected manufacturing market. The success of connected manufacturing relies heavily on fast, reliable, and low-latency communication networks that can support the seamless exchange of data between devices and systems. The deployment of 5G networks, with their high data transfer speeds and low latency, provides a robust foundation for the widespread adoption of connected manufacturing solutions.With faster and more reliable connectivity, manufacturers can implement real-time monitoring, control, and analysis of their processes. This not only enhances operational efficiency but also opens up new possibilities for applications such as remote operation, augmented reality (AR), and virtual reality (VR) in manufacturing. The integration of these technologies into connected manufacturing further contributes to the market's growth by providing innovative solutions for improving productivity and collaboration.

Regulatory Initiatives and Standards Compliance

The global connected manufacturing market is also driven by regulatory initiatives and the increasing emphasis on standards compliance. Governments and regulatory bodies worldwide are recognizing the potential benefits of connected manufacturing in terms of productivity, quality, and sustainability. Consequently, they are introducing regulations and standards to promote the adoption of these technologies across various industries.Compliance with industry standards not only ensures the interoperability of connected manufacturing solutions but also instills confidence in manufacturers regarding the security and reliability of these technologies. Regulatory frameworks often encourage the implementation of best practices in cybersecurity, data privacy, and overall system reliability. As businesses strive to meet these standards to enhance their competitiveness and ensure smooth operations, the global connected manufacturing market is poised to experience sustained growth.

In conclusion, the global connected manufacturing market is being propelled by a convergence of factors, including the widespread adoption of Industry 4.0, the rise of smart factories, globalization, sustainability goals, advancements in communication technologies, and regulatory initiatives. As these drivers continue to shape the manufacturing landscape, businesses that embrace connected manufacturing solutions are likely to gain a competitive edge in terms of efficiency, flexibility, and overall operational excellence.

Government Policies are Likely to Propel the Market

Industry 4.0 Adoption Incentives

Governments worldwide are increasingly recognizing the transformative potential of Industry 4.0 in driving economic growth, innovation, and competitiveness. To encourage businesses to adopt connected manufacturing technologies and embrace the principles of Industry 4.0, governments are implementing a range of incentives and support programs.One common policy approach involves providing financial incentives, such as tax credits or grants, to companies investing in connected manufacturing solutions. These incentives aim to alleviate the initial financial burden associated with the adoption of new technologies, making it more appealing for businesses, especially small and medium enterprises (SMEs), to modernize their manufacturing processes.

Additionally, governments may offer subsidies for workforce training programs focused on developing the skills required for operating and maintaining connected manufacturing systems. By investing in the education and upskilling of the workforce, governments aim to ensure a smooth transition to Industry 4.0 and enhance the overall competitiveness of their manufacturing sectors on the global stage.

Cybersecurity and Data Privacy Regulations

As the global connected manufacturing market expands, governments are increasingly prioritizing the development and enforcement of robust cybersecurity and data privacy regulations. Connected manufacturing systems rely heavily on the seamless flow of data between devices, sensors, and control systems. Ensuring the security and privacy of this data is paramount to prevent cyber threats and safeguard sensitive information.Government policies in this domain often include the establishment of cybersecurity standards and frameworks that businesses must adhere to when implementing connected manufacturing technologies. These standards cover aspects such as data encryption, access controls, and regular security audits. Additionally, governments may mandate the reporting of cybersecurity incidents to enhance overall transparency and response capabilities.

Data privacy regulations, aligned with international standards such as the General Data Protection Regulation (GDPR), are also crucial components of government policies related to connected manufacturing. These regulations govern the collection, storage, and processing of personal and sensitive data, providing individuals with greater control over their information. Adherence to these policies not only fosters trust among consumers but also contributes to the global harmonization of data protection practices.

Research and Development Funding

To foster innovation and maintain a competitive edge in the global connected manufacturing market, governments are actively promoting research and development (R&D) initiatives. Government policies often include substantial funding allocations for R&D projects focused on advancing technologies related to connected manufacturing, such as the Internet of Things (IoT), artificial intelligence (AI), and advanced robotics.By providing financial support for collaborative R&D projects involving academia, research institutions, and private enterprises, governments aim to accelerate the development and commercialization of cutting-edge technologies. These initiatives contribute not only to the growth of individual businesses but also to the overall advancement of the connected manufacturing ecosystem.

Government-backed R&D funding may also target specific industries or sectors where connected manufacturing technologies have the potential to bring about significant improvements. For instance, there might be a focus on healthcare, aerospace, or automotive manufacturing, aligning with broader economic and strategic goals outlined by the government.

Standardization and Interoperability Guidelines

Interoperability is a critical aspect of the connected manufacturing landscape, ensuring that different devices and systems can seamlessly communicate and work together. To address this, governments are actively involved in the development of standardization and interoperability guidelines that create a common framework for connected manufacturing technologies.Government policies in this realm often involve collaboration with industry stakeholders, standards organizations, and international bodies to establish common protocols and standards. These guidelines not only enhance the compatibility of diverse manufacturing systems but also facilitate a more open and competitive market environment.

By promoting interoperability, governments aim to prevent vendor lock-in and encourage healthy competition among technology providers. This approach fosters innovation and allows manufacturers to choose solutions that best meet their specific needs, ultimately driving the overall growth and maturity of the connected manufacturing market.

Environmental Sustainability Initiatives

Governments worldwide are increasingly incorporating environmental sustainability into their policies, and connected manufacturing is no exception. Recognizing the potential of connected technologies to optimize resource usage and reduce environmental impact, governments are implementing initiatives that align with broader sustainability goals.One key aspect of these policies involves providing incentives for manufacturers to adopt connected manufacturing solutions that enhance energy efficiency and reduce waste. Governments may offer tax breaks, grants, or other financial incentives to companies implementing technologies such as IoT-enabled sensors for real-time energy monitoring and predictive maintenance.

Additionally, environmental sustainability policies related to connected manufacturing may include the establishment of regulatory frameworks that encourage the reduction of carbon emissions and the implementation of circular economy practices. By promoting sustainable manufacturing processes, governments aim to address both environmental concerns and the growing demand for eco-friendly products.

International Collaboration and Trade Agreements

Given the global nature of manufacturing and the interconnected supply chains, governments recognize the importance of international collaboration to foster the growth of the connected manufacturing market. Government policies often involve active participation in international forums, collaborative research initiatives, and the negotiation of trade agreements that facilitate the cross-border flow of connected manufacturing technologies.Through bilateral and multilateral agreements, governments seek to create a conducive environment for the exchange of ideas, technologies, and best practices. Harmonizing regulatory frameworks, reducing trade barriers, and promoting a level playing field for businesses are common objectives in these agreements.

Furthermore, governments may engage in joint research and development projects with other countries to address common challenges and promote the global advancement of connected manufacturing. By fostering international collaboration, governments aim to create a more interconnected and resilient global manufacturing ecosystem, benefiting both individual nations and the overall growth of the connected manufacturing market.

Key Market Challenges

Security and Privacy Concerns in Connected Manufacturing

The rapid expansion of the global connected manufacturing market brings with it a host of security and privacy challenges that demand careful consideration and strategic solutions. As manufacturing processes become increasingly interconnected through the deployment of Internet of Things (IoT) devices, sensors, and advanced communication technologies, the vulnerabilities to cyber threats and unauthorized access rise significantly.One of the primary concerns in connected manufacturing is the potential for cyberattacks targeting critical infrastructure, disrupting production processes, and compromising sensitive data. Malicious actors may exploit vulnerabilities in connected devices or network infrastructure, leading to production downtime, loss of intellectual property, and even safety hazards. The consequences of such attacks extend beyond financial losses to include damage to reputation, legal ramifications, and potential harm to employees.

To address these security challenges, it is essential for manufacturers and governments to collaboratively develop and implement robust cybersecurity measures. This involves adopting encryption protocols, secure authentication mechanisms, and continuous monitoring of network traffic for unusual activities. Governments can play a crucial role in establishing and enforcing cybersecurity standards across industries, ensuring that manufacturers adhere to best practices in safeguarding their connected systems.

Data privacy is another critical aspect of security concerns in connected manufacturing. As vast amounts of data are generated and exchanged in real-time, protecting sensitive information becomes paramount. Government policies must address the collection, storage, and sharing of data to safeguard the privacy rights of individuals and prevent the misuse of personal information.

Moreover, the interconnected nature of the global supply chain introduces complexities in managing data privacy across borders. Governments need to collaborate on establishing international frameworks for data protection, ensuring a consistent approach that fosters trust among manufacturers and consumers alike. Adherence to regulatory standards, such as the General Data Protection Regulation (GDPR), becomes crucial in maintaining the integrity and privacy of data in the connected manufacturing landscape.

Balancing the need for connectivity and data sharing with the imperative to secure critical systems and protect sensitive information is an ongoing challenge in the global connected manufacturing market. Government policies must evolve in tandem with technological advancements to address these security and privacy concerns comprehensively, fostering a secure and resilient connected manufacturing ecosystem.

Integration and Interoperability Issues Across Systems

While the vision of a seamlessly connected manufacturing ecosystem holds immense promise, the practical implementation poses significant challenges related to integration and interoperability. Manufacturers often operate diverse sets of machinery, systems, and software, each with its own proprietary protocols and communication standards. Achieving seamless connectivity and data exchange among these disparate components is a complex task that requires careful planning and investment.One of the primary challenges in connected manufacturing is the legacy infrastructure that many manufacturers still rely on. Upgrading existing machinery and systems to be compatible with modern IoT technologies can be a costly and time-consuming process. The lack of standardization across the industry exacerbates this challenge, making it difficult for manufacturers to integrate new technologies without substantial modifications to their existing infrastructure.

Interoperability issues also arise when dealing with different vendors and suppliers in the supply chain. Each may employ different communication protocols and data formats, leading to inefficiencies and communication breakdowns. This lack of standardization hampers the seamless flow of information across the entire value chain, affecting production planning, inventory management, and overall operational efficiency.

To address these challenges, governments and industry stakeholders must collaborate on the development and adoption of common standards for connected manufacturing. Establishing industry-wide protocols for communication, data exchange, and interoperability can significantly ease the integration process and promote a more cohesive ecosystem. Governments can incentivize the adoption of standardized solutions through policies that encourage adherence to industry norms and best practices.

Furthermore, investment in research and development initiatives focused on interoperability solutions is crucial. Governments can allocate funds for projects that aim to create open-source frameworks, middleware, or communication protocols that facilitate seamless integration across diverse manufacturing systems. By fostering a standardized and interoperable environment, governments play a pivotal role in overcoming the integration challenges that often hinder the full realization of the potential benefits of connected manufacturing.

Segmental Insights

Organization Insights

The SMSs segment held the largest Market share in 2023. Many technology providers offer scalable solutions suitable for SMEs, allowing them to implement connected manufacturing technologies gradually based on their specific needs and budget constraints.SMEs are often more agile and flexible in adapting to new technologies. Connected manufacturing solutions can be customized to fit the specific workflows and requirements of smaller-scale operations.

Some connected manufacturing technologies are designed to be cost-effective, making them more accessible to SMEs with limited budgets. Cloud-based solutions and pay-as-you-go models can reduce upfront costs.

SMEs may see the adoption of connected manufacturing technologies as a way to gain a competitive edge, improve efficiency, and meet customer demands, especially in industries where technological innovation is a key differentiator.

Various governments and industry associations promote Industry 4.0 initiatives that aim to encourage digital transformation across all scales of manufacturing. These initiatives may provide incentives or support programs that benefit SMEs.

Application Insights

The operation optimization segment held the largest Market share in 2023. Operation Optimization focuses on improving overall operational efficiency, which is a critical goal for manufacturers seeking to enhance productivity and reduce operational costs.Connected manufacturing solutions provide real-time visibility into production processes, enabling manufacturers to monitor key metrics and make data-driven decisions swiftly. This capability is central to optimizing operations on the fly.

By optimizing operations, manufacturers can identify and address inefficiencies, leading to cost reductions. Efficient resource utilization, including manpower, raw materials, and equipment, contributes to improved profitability.

Manufacturers adopting connected technologies for Operation Optimization gain a competitive edge by responding more effectively to market demands, reducing time-to-market, and adapting quickly to changing production requirements.

Operation Optimization aligns with the principles of continuous improvement, allowing manufacturers to adapt and refine processes based on real-time data insights. This adaptability is crucial in dynamic manufacturing environments.

Operation Optimization can be tailored to address specific industry challenges and requirements. Different manufacturing sectors may prioritize this application to address their unique operational pain points.

Regional Insights

North America held the largest market share in the Global Connected Manufacturing Market in 2023.North America, particularly the United States, hosts a plethora of leading technology companies, research institutions, and startups at the forefront of innovation in connected manufacturing technologies. These entities pioneer cutting-edge solutions for industrial Internet of Things (IIoT), machine-to-machine (M2M) communication, data analytics, and automation, all integral to modern manufacturing systems. With a robust and diverse manufacturing base spanning automotive, aerospace, electronics, pharmaceuticals, and consumer goods sectors, North American industries are early adopters of connected manufacturing technologies. These advancements aim to bolster operational efficiency, cost reduction, and product quality enhancement. Aligned with the principles of Industry 4.0, North American manufacturers are embracing digital integration, automation, and data-driven decision-making in their production processes.

Connected manufacturing solutions offer real-time monitoring, predictive maintenance, and optimization capabilities, in line with Industry 4.0 objectives. Benefitting from advanced information technology (IT) infrastructure, including high-speed internet connectivity, cloud computing services, and robust data analytics capabilities, North America provides a solid foundation for deploying connected manufacturing systems. This infrastructure enables leveraging real-time data insights for driving process improvements and fostering innovation. The region boasts a skilled workforce adept in manufacturing, engineering, IT, and data science. Manufacturers prioritize investments in training and upskilling employees to effectively operate and manage connected manufacturing technologies, ensuring their successful implementation and utilization. North America upholds stringent regulations and standards to guarantee safety, security, and compliance in manufacturing operations.

Regulatory frameworks encourage the adoption of connected manufacturing technologies by outlining guidelines for data privacy, cybersecurity, and interoperability, fostering a conducive environment for market growth. Collaboration between North American manufacturers and technology vendors, system integrators, and research organizations is commonplace. These partnerships facilitate the integration of disparate technologies, customization of solutions, and knowledge sharing to address specific industry challenges and requirements. With a diverse customer base comprising large enterprises and small-to-medium-sized businesses (SMBs) across various industries, North American manufacturers cater to specific pain points such as production inefficiencies, quality control issues, and supply chain visibility. This drives demand for innovative connected manufacturing solutions in the market.

Report Scope:

In this report, the Global Connected Manufacturing Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Connected Manufacturing Market, By Organization:

- SMSs

- Large Enterprises

Connected Manufacturing Market, By Application:

- Operation Optimization

- Real-Time Tracking

- Predictive Maintenance

Connected Manufacturing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Connected Manufacturing Market.Available Customizations:

Global Connected Manufacturing Market report with the given Market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Siemens AG

- General Electric Company (GE)

- Rockwell Automation, Inc.

- Honeywell International Inc.

- ABB Ltd.

- Schneider Electric SE

- Bosch Group

- Mitsubishi Electric Corporation

- Fanuc Corporation

- Hitachi, Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | February 2024 |

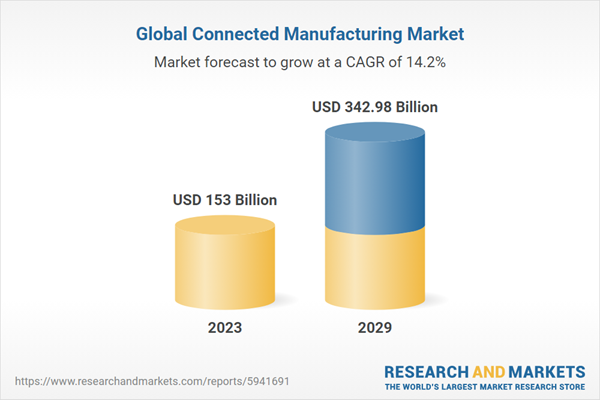

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 153 Billion |

| Forecasted Market Value ( USD | $ 342.98 Billion |

| Compound Annual Growth Rate | 14.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |