Advanced Jet Type is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The modernization and replacement of aging military aircraft fleets represents a primary driver for the global military training aircraft market. Many nations operate trainer aircraft that are decades old, lacking the advanced avionics and digital systems required to adequately prepare pilots for modern combat platforms. This compels investments in new generation trainers capable of simulating complex operational environments. For instance, according to Hindustan Aeronautics Limited, March 1, 2023, the Indian Ministry of Defence contracted with HAL for the procurement of 70 HTT-40 Basic Trainer Aircraft for the Indian Air Force at over ₹6,800 crore, directly addressing the replacement of outdated basic training assets. This continuous upgrade cycle ensures training infrastructure evolves with frontline aircraft technology.Key Market Challenges

A primary impediment to the expansion of the Global Military Training Aircraft Market is the substantial procurement costs associated with advanced training systems. Modern military training aircraft incorporate sophisticated avionics, complex simulation capabilities, and high-performance specifications, driving up their unit price significantly. This financial burden poses a direct challenge for many nations, particularly those operating with constrained defense budgets, as allocating extensive capital towards these specialized assets can necessitate trade-offs with other critical defense expenditures.Key Market Trends

The Global Military Training Aircraft Market is significantly influenced by the expanded integration of artificial intelligence (AI) and adaptive learning systems. These systems deliver personalized and dynamic training experiences by analyzing individual pilot performance and adjusting scenarios in real-time, thereby optimizing skill development and reducing overall training timelines.According to the European Defence Agency (EDA), in 2023, the agency managed approximately 94 cooperative ad-hoc projects and programmes, including capability development, training, and research and technology, with an estimated value in the range of €664 million, reflecting broad investment in advanced defense solutions that encompass AI applications in training. In a notable development, Saab, in collaboration with Helsing, successfully completed initial flight tests in May-June 2025 integrating an AI agent, 'Centaur,' into a Gripen E fighter jet, with the AI trained on the equivalent of 1.2 million flight hours of Beyond Visual Range (BVR) combat training.

Key Market Players Profiled:

- Boeing

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- Pilatus

- Embraer

- KAI

- Aero Vodochody

- Diamond

- Textron

Report Scope:

In this report, the Global Military Training Aircraft Market has been segmented into the following categories:By Type:

- Basic Jet

- Intermediate Jet

- Advanced Jet

By Seat Type:

- Single

- Twin

By Application Type:

- Armed

- Unarmed

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Military Training Aircraft Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Military Training Aircraft market report include:- Boeing

- Lockheed Martin

- Northrop Grumman

- BAE Systems

- Pilatus

- Embraer

- KAI

- Aero Vodochody

- Diamond

- Textron

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

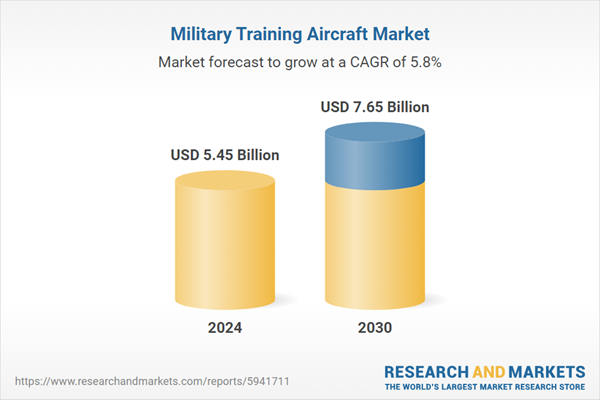

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 5.45 Billion |

| Forecasted Market Value ( USD | $ 7.65 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |