Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

In the wake of global health concerns, infection control has become a top priority for healthcare facilities. Nonwoven disposables are essential tools in minimizing the spread of infections. Items such as surgical gowns, face masks, and drapes are made from nonwoven materials, providing an effective barrier against contaminants and pathogens. Nonwoven disposables are easy to use, lightweight, and require no laundering or sterilization. They are ideal for single-use applications, reducing the risk of cross-contamination and saving time for healthcare professionals. The aging global population is driving demand for medical services and products. Nonwoven disposables find extensive use in geriatric care, including adult incontinence products, wound dressings, and bed linens. Increasing environmental awareness has led to the development of eco-friendly nonwoven materials made from biodegradable or recyclable fibers. These sustainable options are gaining popularity, aligning with the healthcare industry's push towards more environmentally responsible practices.

Key Market Drivers

Surge in Surgical Procedures is Driving the Global Medical Nonwoven Disposables Market

In recent years, the global healthcare industry has witnessed a significant surge in surgical procedures. This increase is not only driven by the rising burden of chronic diseases but also by advancements in medical technology, making surgeries safer and more accessible. The surge in surgical procedures has led to a corresponding boost in the demand for medical nonwoven disposables. These disposable products play a crucial role in ensuring the safety and hygiene of both healthcare workers and patients during surgical interventions.Medical nonwoven disposables encompass a wide range of products designed for single-use applications in healthcare settings. They are typically made from synthetic fibers, such as polypropylene or polyethylene, and are engineered to be durable, lightweight, and highly resistant to fluids and pathogens. These disposables include surgical gowns, drapes, masks, caps, and shoe covers, among others. The global medical nonwoven disposables market has experienced substantial growth, and this growth is primarily attributed to the increase in surgical procedures worldwide. Several factors are contributing to this surge in surgical interventions, which, in turn, are driving the demand for medical nonwoven disposables.

As the global population continues to age, there is a corresponding increase in the prevalence of chronic diseases and age-related health issues. Many of these conditions require surgical intervention for diagnosis and treatment. Advances in medical technology have made surgical procedures safer and more precise. Minimally invasive surgery, robotic surgery, and innovative surgical instruments have expanded the scope of surgeries that can be performed, increasing patient access and surgeon proficiency. An increase in healthcare awareness, access to medical information, and a growing middle-class population in emerging economies have contributed to a greater willingness to undergo surgeries as a means of improving health and quality of life. Beyond essential surgeries, there is a growing demand for elective procedures such as cosmetic surgery and joint replacements. These procedures are often chosen by individuals looking to enhance their appearance or mobility. The globalization of healthcare services has led to medical tourism, with patients traveling to countries known for offering high-quality surgical procedures at a lower cost. This trend has further driven the demand for surgical interventions.

Increasing Healthcare Expenditure is Driving the Global Medical Nonwoven Disposables Market

The global medical nonwoven disposables market is experiencing remarkable growth, and one of the key drivers behind this expansion is the increasing healthcare expenditure worldwide. As healthcare systems grapple with rising demands and the need for cost-effective solutions, medical nonwoven disposables have emerged as a crucial component in providing quality patient care.In recent years, healthcare expenditure has been on the rise across the globe. This trend can be attributed to several factors, including population growth, aging demographics, the increasing prevalence of chronic diseases, and advancements in medical technology. As countries seek to improve their healthcare infrastructure and services, the allocation of resources and funds to healthcare has become a priority. This increased investment in healthcare infrastructure and services has a direct impact on the demand for medical nonwoven disposables. These disposables, including surgical gowns, drapes, masks, caps, and wound care products, are essential in maintaining a high standard of patient care, preventing cross-contamination, and ensuring the safety of both healthcare workers and patients. The growing healthcare expenditure allows for the procurement and utilization of quality medical nonwoven disposables, further contributing to the growth of the market.

One of the primary concerns in healthcare settings is infection control. Medical nonwoven disposables play a pivotal role in preventing the spread of infections by providing a barrier between healthcare workers, patients, and potentially contaminated surfaces. This is particularly important in surgical procedures, where any breach in infection control can have dire consequences. While medical nonwoven disposables are single-use items, their cost-efficiency cannot be understated. Reusable textiles require extensive laundering, which involves water, energy, and chemical usage. Medical nonwoven disposables reduce the environmental impact and costs associated with maintaining and sterilizing reusable materials. Patients benefit from the comfort and convenience provided by medical nonwoven disposables. Soft and breathable materials make them more comfortable for patients to wear, while healthcare workers appreciate the ease of use and disposability of these products. The increasing focus on sustainability and environmentally friendly practices has led to innovations in the materials used for medical nonwoven disposables. Biodegradable and eco-friendly options are now available, aligning with the growing global commitment to reduce the carbon footprint.

Key Market Challenges

Regulatory Compliance

One of the foremost challenges in the medical nonwoven disposables industry is the ever-evolving regulatory landscape. Governments and regulatory bodies worldwide impose stringent requirements on product safety and quality, necessitating continuous adherence to changing standards. Meeting these requirements often involves substantial investments in research, development, and compliance measures. For manufacturers, navigating this complex regulatory environment can be a daunting task and may hinder product innovation and market entry.Price Volatility of Raw Materials

The production of nonwoven disposable medical products relies heavily on raw materials like polypropylene, polyethylene, and polyester. The prices of these materials are subject to fluctuations influenced by factors like oil prices, supply chain disruptions, and geopolitical events. Such volatility can have a significant impact on the manufacturing costs and profitability of companies in the industry, potentially leading to price increases that affect healthcare providers and patients.Environmental Concerns

The medical nonwoven disposables market is grappling with growing environmental concerns related to product disposal. Single-use medical products often end up in landfills, contributing to plastic waste and environmental pollution. As global awareness of sustainability and environmental issues increases, manufacturers are under pressure to develop eco-friendly alternatives and reduce the environmental footprint of their products. Finding sustainable solutions while maintaining product performance and affordability remains a significant challenge.Competitive Market

The global market for medical nonwoven disposables is highly competitive, with numerous manufacturers vying for market share. This competition drives innovation and quality but can also lead to pricing pressures and reduced profit margins. Differentiation and product quality are essential for success in this crowded market, which poses challenges for both established companies and newcomers.Technological Advancements

Advancements in medical technology, such as robotic surgeries and minimally invasive procedures, are changing the landscape of healthcare. These advancements often require specialized medical nonwoven disposables that can adapt to new requirements. Manufacturers must invest in research and development to stay abreast of evolving healthcare technologies and provide products that meet the changing needs of the industry. This requires significant financial resources and expertise.Supply Chain Disruptions

Global events, such as the COVID-19 pandemic, have underscored the fragility of global supply chains. Disruptions in the supply chain can lead to shortages of essential medical nonwoven disposables, affecting healthcare services and patient care. Manufacturers must invest in resilient supply chains, diversify sourcing, and develop contingency plans to mitigate the impact of unforeseen disruptions.Key Market Trends

Technological Advancements

The healthcare industry has witnessed significant technological advancements over the years, revolutionizing patient care and medical practices. Among the innovations, medical nonwoven disposables have emerged as a critical component in healthcare settings, addressing hygiene, infection control, and patient comfort. The global medical nonwoven disposables market is on an upward trajectory, primarily due to the relentless pace of technological advancements.Technological advancements have led to the development of advanced nonwoven materials, which are more efficient and effective. Innovations in materials have allowed for increased strength, durability, and breathability, making these disposables more reliable and comfortable for patients. Infection control is a primary concern in healthcare settings. Technological progress has led to the creation of antimicrobial nonwoven materials that actively inhibit the growth of pathogens. This innovation has been crucial in reducing the risk of healthcare-associated infections, which have been a major challenge in the industry. The production of medical nonwoven disposables has benefited from automation and robotics. This not only ensures consistent quality but also allows for higher production volumes, meeting the increasing demand in the healthcare sector. Technological advancements have also addressed environmental concerns. Sustainable nonwoven materials, made from recycled or biodegradable sources, have gained traction, aligning with the global push for eco-friendly practices in healthcare.

The rising technological advancements in medical nonwoven disposables have far-reaching implications for the healthcare sector. Enhanced materials and technology-driven disposables contribute to better patient outcomes by reducing the risk of infections and providing greater comfort during treatment. Although disposable products require an initial investment, they can save healthcare facilities money in the long run by reducing the need for sterilization, laundry, and maintenance of reusable items. Technologically advanced nonwoven disposables help healthcare institutions adhere to stringent infection control guidelines and regulatory requirements. The development of sustainable nonwoven materials aligns with the growing awareness of environmental responsibility, making healthcare facilities more eco-friendly. The continued growth of the medical nonwoven disposables market creates opportunities for companies to innovate and expand their product offerings, further benefiting the healthcare industry.

Segmental Insights

Product Insights

Based on the category of product, Medical Supplies emerged as the dominant player in the global market for Medical Nonwoven Disposables in 2023. The global medical nonwoven disposables market is shaped by a variety of product types that cater to the diverse needs of healthcare professionals and patients. Surgical drapes and gowns, face masks, wound dressings, incontinence products, and nonwoven surgical face masks are some of the product types that are dominating this dynamic market. As the healthcare industry continues to evolve and emphasize infection control, hygiene, and patient comfort, the demand for these nonwoven disposables is expected to remain strong, driving further innovation and growth in the sector.End-use Insights

The Hospitals & Clinics segment is projected to experience rapid growth during the forecast period. Hospitals and clinics serve a high volume of patients on a daily basis. This translates into a constant need for disposable medical products, such as gowns, drapes, bed linens, and wound dressings. The consistent demand from these healthcare settings drives the growth of the global market. Surgical procedures require a wide array of nonwoven disposables, including surgical gowns, drapes, and masks. Hospitals perform a significant number of surgeries, ranging from routine procedures to complex operations. The requirement for sterile, single-use items in these settings is substantial.Regional Insights

North America emerged as the dominant player in the global Medical Nonwoven Disposables market in 2023, holding the largest market share in terms of value. One of the primary reasons for North America's dominance in the medical nonwoven disposables market is its substantial healthcare expenditure. The United States and Canada consistently allocate significant resources to healthcare, which has led to the development of state-of-the-art medical facilities and a high demand for medical nonwoven disposables. The United States, in particular, has the largest healthcare expenditure globally, with a healthcare system that emphasizes patient safety and infection control. This emphasis on safety has driven the adoption of medical nonwoven disposables, thereby propelling the market's growth.North America has been at the forefront of technological advancements in the medical nonwoven disposables sector. Manufacturers in the region invest heavily in research and development to create innovative products that are both effective and cost-efficient. These advancements lead to the development of disposable products with superior barrier properties, comfort, and breathability, further increasing their adoption by healthcare facilities.

Report Scope:

In this report, the Global Medical Nonwoven Disposables Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Medical Nonwoven Disposables Market, By Product:

- Hygiene products

- Medical Supplies

Medical Nonwoven Disposables Market, By End-use:

- Hospitals & Clinics

- Ambulatory Care Centers

- Others

Medical Nonwoven Disposables Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Medical Nonwoven Disposables Market.Available Customizations:

Global Medical Nonwoven Disposables market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Domtar Corporation

- Medtronic plc.

- Mölnlycke Health Care AB

- First Quality Enterprises, Inc.

- Svenska Cellulosa Aktiebolaget SCA

- Medline Industries, LP

- Unicharm Corporation

- Freudenberg Performance Materials

- Georgia-Pacific

- MRK Healthcare Pvt. Ltd.

- Polymer Group, Inc.

- Asahi Kasei Corporation

- Cypress Medical Products LLC

- Abena A/S

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | February 2024 |

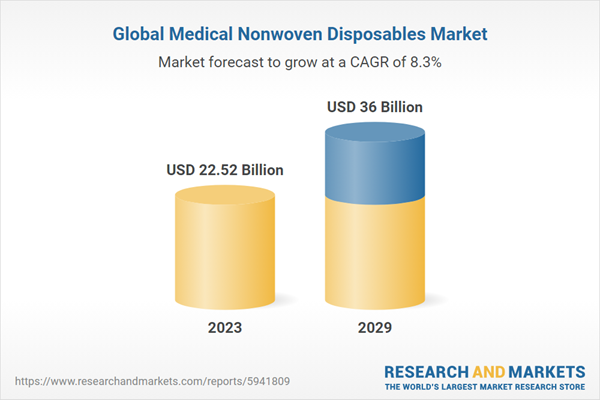

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 22.52 Billion |

| Forecasted Market Value ( USD | $ 36 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |