1. Research Methodology

1.1. Study Objectives

1.2. Study Scope

1.3. Research Assumptions

1.4. Research Framework

2. Introduction

2.1. Market Definition

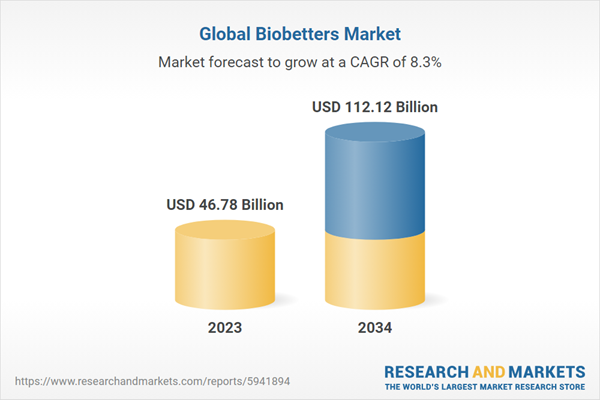

2.2. Global Biobetters Market Overview

4. Market Environment Analysis

4.1. Porter’s 5 Forces Analysis

4.2. PESTEL Analysis

4.3. SWOT Analysis

5. Market Dynamics

5.1. Drivers Analysis

5.2. Restraints Analysis

5.3. Opportunities Analysis

5.4. Threats Analysis

5.5. Trend Analysis

7. Biobetters Market: Drug Class Estimates & Trend Analysis

7.1. Drug Class Segment Opportunity Analysis

7.2. Erythropoietin biobetters

7.2.1. Erythropoietin biobetters Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.3. Insulin biobetters

7.3.1. Insulin biobetters Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.4. G-CSF biobetters

7.4.1. G-CSF biobetters Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.5. Interferon biobetters

7.5.1. Interferon biobetters Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.6. Monoclonal antibodies biobetters

7.6.1. Monoclonal antibodies biobetters Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.7. Anti-hemophilic factors

7.7.1. Anti-hemophilic factors Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

7.8. Other biobetters

7.8.1. Other biobetters Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8. Biobetters Market: Disease Indication Estimates & Trend Analysis

8.1. Disease Indication Segment Opportunity Analysis

8.2. Diabetes

8.2.1. Diabetes Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.3. Cancer

8.3.1. Cancer Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.4. Renal disease

8.4.1. Renal Disease Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.5. Neurodegenerative diseases

8.5.1. Neurodegenerative Diseases Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.6. Genetic disorders

8.6.1. Genetic disorders Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

8.7. Others

8.7.1. Others Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

9. Biobetters Market: Route of Administration Estimates & Trend Analysis

9.1. Route of Administration Segment Opportunity Analysis

9.2. Subcutaneous

9.2.1. Subcutaneous Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

9.3. Intravenous

9.3.1. Intravenous Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

9.4. Others

9.4.1. Others Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

10. Biobetters Market: Distribution Channel Estimates & Trend Analysis

10.1. Distribution Channel Segment Opportunity Analysis

10.2. Hospital Pharmacies

10.2.1. Hospital Pharmacies Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

10.3. Retail Pharmacies

10.3.1. Retail Pharmacies Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

10.4. Online Pharmacies

10.4.1. Online Pharmacies Market Analysis & Forecast, 2023-2034 (Revenue, USD Bn)

11. Regional Market Analysis

11.1. Regional Market Opportunity Analysis

12. North America Biobetters Market

12.1. North America Biobetters Market

12.1.1. North America Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.1.2. North America Biobetters Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

12.1.3. North America Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

12.1.4. North America Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

12.1.5. North America Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

12.1.6. North America Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.2. U.S. Global Biobetters Market

12.2.1. U.S. Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.2.2. U.S. Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

12.2.3. U.S. Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

12.2.4. U.S. Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

12.2.5. U.S. Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

12.3. Canada Global Biobetters Market

12.3.1. Canada Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

12.3.2. Canada Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

12.3.3. Canada Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

12.3.4. Canada Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

12.3.5. Canada Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13. Europe Global Biobetters Market

13.1. Europe Global Biobetters Market

13.1.1. Europe Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.1.2. Europe Biobetters Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

13.1.3. Europe Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

13.1.4. Europe Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

13.1.5. Europe Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

13.1.6. Europe Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.2. Germany Global Biobetters Market

13.2.1. Germany Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.2.2. Germany Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

13.2.3. Germany Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

13.2.4. Germany Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

13.2.5. Germany Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.3. UK Global Biobetters Market

13.3.1. UK Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.3.2. UK Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

13.3.3. UK Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

13.3.4. UK Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

13.3.5. UK Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.4. France Global Biobetters Market

13.4.1. France Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.4.2. France Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

13.4.3. France Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

13.4.4. France Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

13.4.5. France Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.5. Spain Global Biobetters Market

13.5.1. Spain Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.5.2. Spain Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

13.5.3. Spain Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

13.5.4. Spain Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

13.5.5. Spain Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.6. Italy Global Biobetters Market

13.6.1. Italy Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.6.2. Italy Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

13.6.3. Italy Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

13.6.4. Italy Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

13.6.5. Italy Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

13.7. Rest of Europe Global Biobetters Market

13.7.1. Rest of Europe Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

13.7.2. Rest of Europe Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

13.7.3. Rest of Europe Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

13.7.4. Rest of Europe Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

13.7.5. Rest of Europe Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14. Asia Pacific Global Biobetters Market

14.1. Asia Pacific Global Biobetters Market

14.1.1. Asia Pacific Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.1.2. Asia Pacific Biobetters Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

14.1.3. Asia Pacific Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

14.1.4. Asia Pacific Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

14.1.5. Asia Pacific Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

14.1.6. Asia Pacific Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.2. Japan Global Biobetters Market

14.2.1. Japan Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.2.2. Japan Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

14.2.3. Japan Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

14.2.4. Japan Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

14.2.5. Japan Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.3. China Global Biobetters Market

14.3.1. China Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.3.2. China Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

14.3.3. China Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

14.3.4. China Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

14.3.5. China Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.4. India Global Biobetters Market

14.4.1. India Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.4.2. India Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

14.4.3. India Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

14.4.4. India Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

14.4.5. India Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.5. South Korea Global Biobetters Market

14.5.1. South Korea Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.5.2. South Korea Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

14.5.3. South Korea Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

14.5.4. South Korea Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

14.5.5. South Korea Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.6. Australia Global Biobetters Market

14.6.1. Australia Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.6.2. Australia Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

14.6.3. Australia Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

14.6.4. Australia Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

14.6.5. Australia Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

14.7. Rest of Asia Pacific Global Biobetters Market

14.7.1. Rest of Asia Pacific Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

14.7.2. Rest of Asia Pacific Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

14.7.3. Rest of Asia Pacific Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

14.7.4. Rest of Asia Pacific Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

14.7.5. Rest of Asia Pacific Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15. Latin America Global Biobetters Market

15.1. Latin America Global Biobetters Market

15.1.1. Latin America Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.1.2. Latin America Biobetters Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

15.1.3. Latin America Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

15.1.4. Latin America Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

15.1.5. Latin America Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

15.1.6. Latin America Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15.2. Brazil Global Biobetters Market

15.2.1. Brazil Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.2.2. Brazil Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

15.2.3. Brazil Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

15.2.4. Brazil Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

15.2.5. Brazil Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15.3. Mexico Global Biobetters Market

15.3.1. Mexico Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.3.2. Mexico Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

15.3.3. Mexico Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

15.3.4. Mexico Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

15.3.5. Mexico Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15.4. Argentina Global Biobetters Market

15.4.1. Argentina Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.4.2. Argentina Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

15.4.3. Argentina Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

15.4.4. Argentina Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

15.4.5. Argentina Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

15.5. Rest of Latin America Global Biobetters Market

15.5.1. Rest of Latin America Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

15.5.2. Rest of Latin America Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

15.5.3. Rest of Latin America Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

15.5.4. Rest of Latin America Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

15.5.5. Rest of Latin America Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

16. MEA Global Biobetters Market

16.1. MEA Global Biobetters Market

16.1.1. MEA Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

16.1.2. MEA Biobetters Market Size and Forecast, By Country, 2023-2034 (Revenue USD Bn)

16.1.3. MEA Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

16.1.4. MEA Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

16.1.5. MEA Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

16.1.6. MEA Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

16.2. GCC Global Biobetters Market

16.2.1. GCC Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

16.2.2. GCC Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

16.2.3. GCC Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

16.2.4. GCC Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

16.2.5. GCC Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

16.3. South Africa Global Biobetters Market

16.3.1. South Africa Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

16.3.2. South Africa Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

16.3.3. South Africa Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

16.3.4. South Africa Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

16.3.5. South Africa Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

16.4. Rest of MEA Global Biobetters Market

16.4.1. Rest of MEA Biobetters Market Size and Forecast, 2023-2034 (Revenue USD Bn)

16.4.2. Rest of MEA Biobetters Market Size and Forecast, By Drug Class, 2023-2034 (Revenue USD Bn)

16.4.3. Rest of MEA Biobetters Market Size and Forecast, By Disease Indication, 2023-2034 (Revenue USD Bn)

16.4.4. Rest of MEA Biobetters Market Size and Forecast, By Route of Administration, 2023-2034 (Revenue USD Bn)

16.4.5. Rest of MEA Biobetters Market Size and Forecast, By Distribution Channel, 2023-2034 (Revenue USD Bn)

17. Competitor Analysis

17.1. Company Market Share Analysis, 2023

17.2. Major Recent Developments

18. Company Profiles

18.1. Roche

18.2. Amgen

18.3. Novartis

18.4. Pfizer

18.5. Johnson & Johnson

18.6. Eli Lilly and Company

18.7. AbbVie

18.8. Biogen

18.9. AstraZeneca

18.10. Sanofi

18.11. Merck & Co.

18.12. Genentech (a member of the Roche Group)

18.13. Celgene (acquired by Bristol Myers Squibb)

18.14. Teva Pharmaceuticals

18.15. Samsung Bioepis