With higher disposable income, consumers may be more willing to spend on premium and higher-priced RTD tea and coffee products. Thus, the premium segment acquired $26,515.5 million in 2022. This can lead to a shift from basic or traditional beverages to more sophisticated, specialty, or artisanal offerings. Ready to drink beverages are inherently convenient, and consumers are willing to pay a premium for the time-saving and hassle-free nature of these products. As disposable income increases, consumers are more likely to opt for convenient solutions, boosting the demand for RTD options.

Introducing innovative flavors and formulations allows brands to differentiate themselves in a competitive market. Unique offerings help brands carve out a distinct identity and position themselves as leaders in the industry. Novel flavors and formulations generate excitement among consumers. This engagement can increase interest in the RTD tea and coffee category, encouraging consumers to explore and try new products. Additionally, urbanization often leads to hectic and fast-paced lifestyles. Consumers in urban areas may have limited time for meal preparation, making RTD beverages a convenient choice for those seeking a quick and portable refreshment option. Urban dwellers prefer on-the-go solutions, particularly those commuting to work or navigating busy city life. RTD tea and coffee products are packaged for portability, making them ideal for consumption during commutes or between appointments. Urban environments often offer a vibrant social scene with outdoor events, gatherings, and recreational activities. RTD tea and coffee products are convenient for individuals engaged in these activities, providing a refreshing and portable beverage option. In conclusion, urbanization and on-the-go culture are propelling the market's growth.

However, RTD tea and coffee products may be perceived as relatively more expensive than traditional homemade alternatives or other non-alcoholic beverages. This affordability concern can impact the purchasing decisions of price-conscious consumers. The market competes with various beverages, including carbonated soft drinks, fruit juices, and energy drinks. If RTD tea and coffee prices are significantly higher than these alternatives, consumers may opt for more cost-effective options. The demand for RTD tea and coffee products may exhibit elasticity, meaning that price changes can have a proportional impact on consumer demand. High price elasticity makes it challenging for companies to implement price increases without significantly reducing sales volume. Thus, sensitivity to pricing is impeding the growth of the market.

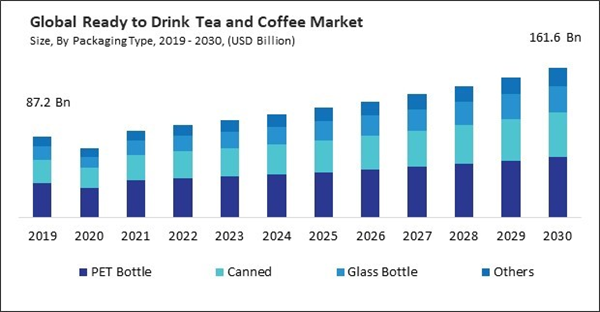

By Packaging Type Analysis

On the basis of packaging type, the market is segmented into canned, glass bottle, PET bottle, and others. In 2022, the canned segment attained a noteworthy revenue share in the market. Can offer excellent protection against external elements, such as light and air, helping preserve the freshness and flavor of RTD tea and coffee. The airtight seal of cans prevents oxidation, maintaining the quality of the beverage over an extended shelf life. The airtight seal of cans helps minimize exposure to oxygen and light, reducing the risk of flavor degradation and ensuring that the product remains fresh for an extended period.By Type Analysis

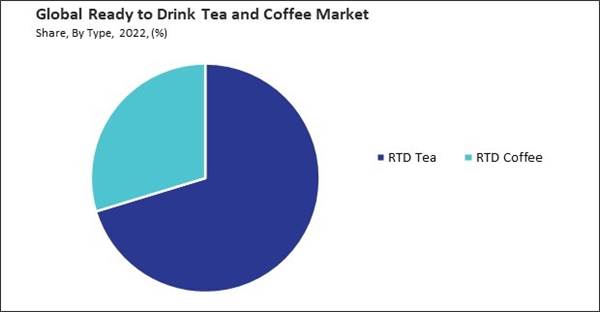

Based on type, the market is bifurcated into RTD tea and RTD coffee. In 2022, the RTD tea segment garnered the highest revenue share in the market. RTD tea offers diverse flavors and formulations, from traditional black and green teas to herbal infusions and innovative blends. This variety appeals to consumers looking for unique taste experiences and allows brands to cater to various flavor preferences. Incorporating functional ingredients, such as antioxidants, vitamins, and herbs, enhances the appeal of RTD tea.By Price Analysis

By price, the market is divided into premium and economy. The premium segment procured a considerable revenue share in the market. As consumers become more discerning and sophisticated in their tastes, a growing demand for high-quality and premium beverages is growing. The premium segment caters to consumers willing to pay a premium for exceptional taste, quality ingredients, and superior overall experience. Premium RTD tea and coffee brands emphasize using high-quality, carefully sourced ingredients. Craftsmanship in brewing and flavor formulation contributes to a distinct and sophisticated taste, setting premium offerings apart from mainstream products.By Distribution Channel Analysis

Based on distribution channel, the market is categorized into convenience stores, supermarkets/hypermarkets, food service, and others. In 2022, the supermarkets/hypermarkets segment registered the highest revenue share in the market. Supermarkets/hypermarkets are known for providing a one-stop shopping experience, offering consumers a wide array of products, including groceries and beverages. The convenience of finding RTD tea and coffee products alongside other daily essentials encourages consumers to make impromptu purchases, driving sales in these retail outlets. The ready availability of RTD tea and coffee in convenient packaging formats, such as bottles, cans, or tetra packs, aligns with the expectations of consumers shopping in supermarket/hypermarket.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region witnessed the maximum revenue share in the market. Tea has deep cultural roots in many Asian countries, and the tradition of tea consumption has been prevalent for centuries. As RTD tea offerings align with these cultural preferences, they resonate strongly with consumers in the Asia Pacific region. Additionally, the increasing popularity of coffee culture, influenced by global trends and the rise of coffee shops, has contributed to the growth of RTD coffee consumption.Recent Strategies Deployed in the Market

- Jan-2024: Asahi Group Holdings Ltd. signed an acquisition with Octopi Brewing, a contract beverage production and co-packing facility. Under this acquisition, Asahi would be able to strengthen its capabilities in North America and it would boost sales and distribution in the region.

- Oct-2023: Monster Beverage Corporation launched Java Monster Cold Brew, a line of energy drinks featuring cold brew coffee infused with energy-boosting ingredients. The Java Monster Cold Brew would be available in two Flavors: Latte and Sweet Black.

- Apr-2022: AriZona Beverages Company LLC launched African Rooibos Red Tea, a caffeine-free herbal tea derived from the Aspalathus linearis plant, known for its rich flavor and health benefits. AriZona's Rooibos Tea is naturally caffeine-free, sweetened with real sugar, and contains only 70 calories per serving.

- Feb-2022: PepsiCo, Inc. came into partnership with Starbucks, a multinational chain of coffeehouses and roastery reserves, known for its specialty coffee beverages and global presence. Through this partnership, both the companies would launch energy drinks under the brand name of Starbucks, expanding its ready-to-drink portfolio.

- Jul-2021: Nestle S.A. came into partnership with Starbucks Corporation, a multinational chain of coffeehouses and roastery reserves, known for its specialty coffee beverages and global presence. Through this partnership, Nestle would be able to expand its presence in the ready-to-drink coffee market and strengthen its worldwide coffee leadership, leveraging emerging growth prospects within a rapidly evolving segment.

- Dec-2019: PepsiCo, Inc. launched Pepsi Cafe, a fusion of rich coffee flavor intertwined with the invigorating taste of Pepsi cola. Pepsi Cafe would be available in two flavors: original and vanilla. Moreover, the coffee-infused cola beverage contains nearly double the caffeine content of regular Pepsi.

List of Key Companies Profiled

- Suntory Holdings Limited

- Nestle S.A.

- The Coca-Cola Company

- Unilever PLC

- Asahi Group Holdings Ltd.

- PepsiCo, Inc.

- Starbucks Coffee Company

- Monster Beverage Corporation

- Danone, S.A.

- AriZona Beverages Company LLC

Market Report Segmentation

By Packaging Type (Volume, Thousand Litres, USD Billion, 2019-2030)- PET Bottle

- Canned

- Glass Bottle

- Others

- RTD Tea

- RTD Coffee

- Economy

- Premium

- Supermarkets/Hypermarkets

- Convenience Stores

- Food Service

- Online

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Suntory Holdings Limited

- Nestle S.A.

- The Coca-Cola Company

- Unilever PLC

- Asahi Group Holdings Ltd.

- PepsiCo, Inc.

- Starbucks Coffee Company

- Monster Beverage Corporation

- Danone, S.A.

- AriZona Beverages Company LLC