NBR is used to manufacture various medical devices, including catheters, tubing, seals, and gaskets. Consequently, the medical segment captured $150.05 million revenue in the market in 2022. The utilization of NBR is consequently increased due to the expanding healthcare industry, developments in medical technology, and an aging population, all of which contribute to the demand for medical devices. Therefore, these aspects can pose lucrative growth prospects for the segment.

Nitrile butadiene rubber's robust and wear-resistant properties make it an ideal material for producing conveyor belts. The material's durability ensures reliable performance, making it suitable for conveying materials in construction and industrial settings. NBR's excellent sealing capabilities and resistance to oils and chemicals make it a preferred choice for manufacturing O-rings. Additionally, NBR can be produced from bio-based sources, contributing to its biodegradability and reduced environmental impact compared to synthetic rubber materials. This is consistent with the increasing focus on environmentally friendly practices and sustainability. NBR formulations can be tailored to meet regulatory and compliance standards. This adaptability ensures that products made from NBR align with stringent environmental regulations in different industries. Hence, owing to these factors, there will be increased growth in the market.

However, Fluctuations in the prices of crude oil, a primary raw material for butadiene production, directly impact the cost structure of NBR. As a derivative of petrochemicals, NBR manufacturers are susceptible to the volatile nature of oil industries. Acrylonitrile, a crucial component in the synthesis of NBR, is susceptible to price variations influenced by factors such as demand-supply dynamics, geopolitical events, and regulatory changes. NBR manufacturers may face challenges in negotiating stable and profitable pricing agreements with end-users, who themselves may be affected by the cost fluctuations. Pricing mechanisms and long-term contracts become indispensable to alleviate the effects of raw material price volatility. Hence, these aspects can hamper the growth of the market.

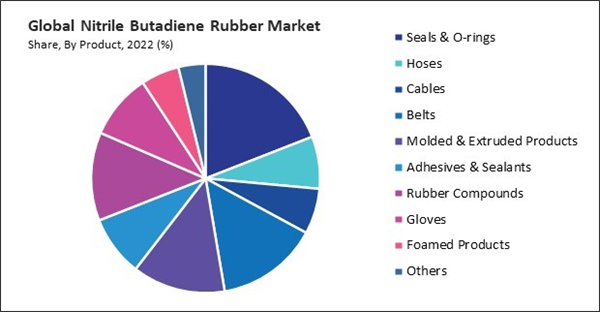

By Product Analysis

Based on product, the nitrile butadiene rubber market is segmented into hoses, belts, cables, molded & extruded products, seals & O-rings, rubber compounds, adhesives & sealants, gloves, foamed products, and others. In 2022, the molded and extruded products segment garnered a significant revenue share in the nitrile butadiene rubber market. NBR is also used in the oil and gas industry for seals and gaskets due to its resistance to oil and chemicals. Energy sector demand for NBR is susceptible to fluctuations in crude prices and exploration activities, among other variables. NBR is utilized in medical and industrial applications for gloves, gaskets, hoses, and other products. Changes in healthcare practices, industrial production, and safety standards can affect the demand for NBR in these sectors. Thus, these factors will boost the demand in the segment.By Application Analysis.

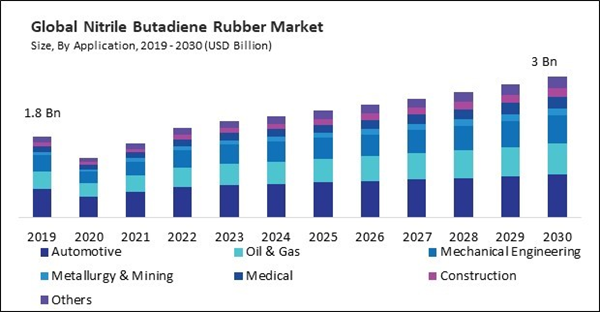

On the basis of application, the nitrile butadiene rubber market is divided into automotive, mechanical engineering, oil & gas, metallurgy & mining, construction, medical, and others. The automotive segment recorded the maximum revenue share in the market in 2022. With a growing emphasis on fuel efficiency and reducing vehicle weight, manufacturers increasingly focus on materials that can contribute to these goals. NBR, being lightweight and possessing excellent fuel resistance, can play a role in such applications. Thus, these factors can assist in the expansion of the segment.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific segment procured the highest revenue share in the market in 2022. The Asia Pacific region plays a crucial role in the market. NBR, is a synthetic rubber copolymer of acrylonitrile and butadiene. It is widely used in various industries due to its excellent oil and chemical resistance, making it suitable for applications in automotive, industrial, medical, and other sectors. Therefore, the segment will grow rapidly in the upcoming years.List of Key Companies Profiled

- PetroChina Company Limited (China National Petroleum Corporation)

- Synthos S.A.

- LG Chem Ltd. (LG Corporation)

- Versalis S.p.A (Eni S.p.A)

- Atlantic Gasket Corporation

- ARLANXEO (Saudi Arabian Oil Co.)

- NITRIFLEX

- AirBoss of America Corp.

- Precision Associates, Inc.

- NANTEX Industry Co., Ltd.

Market Report Segmentation

By Product (Volume, kilo Tonnes, USD Billion, 2019-2030)- Seals & O-rings

- Hoses

- Cables

- Belts

- Molded & Extruded Products

- Adhesives & Sealants

- Rubber Compounds

- Gloves

- Foamed Products

- Others

- Automotive

- Oil & Gas

- Mechanical Engineering

- Metallurgy & Mining

- Medical

- Construction

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- PetroChina Company Limited (China National Petroleum Corporation)

- Synthos S.A.

- LG Chem Ltd. (LG Corporation)

- Versalis S.p.A (Eni S.p.A)

- Atlantic Gasket Corporation

- ARLANXEO (Saudi Arabian Oil Co.)

- NITRIFLEX

- AirBoss of America Corp.

- Precision Associates, Inc.

- NANTEX Industry Co., Ltd.