The IT & telecom segment heavily relies on various IT services to support their operations, ranging from network management to customer support systems. Therefore, the IT & telecom segment acquired $1,777.0 million in 2022. The growing complexity of IT environments in this sector increases the demand for ITSM solutions that can effectively manage and optimize these services. ITSM tools contribute to improved customer experience by ensuring prompt issue resolution, reducing service downtime, and providing efficient customer support. Positive customer experiences increase customer loyalty and retention, critical factors for success in the competitive IT & telecom segment.

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In January 2024, Zendesk, Inc. acquired Klaus. Through this acquisition, Zendesk AI and Klaus’ functionalities would assist businesses in managing increased complexity and volume, ensuring that both digital and human agents provide personalized and empathetic service. Additionally, In December 2023, IBM Corporation acquired StreamSets that would enhance WatsonX with data ingestion, while webMethods would offer additional integration and API tools for hybrid multi-cloud environments.

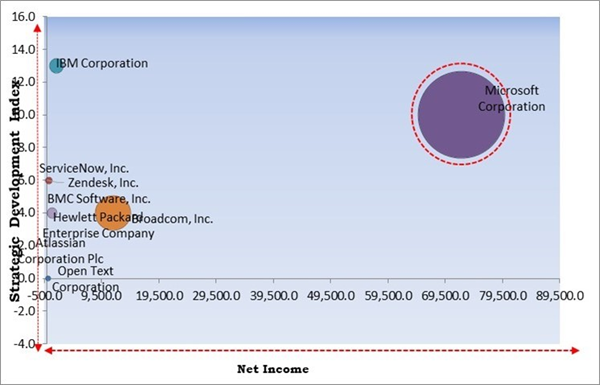

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Microsoft Corporation is the forerunner in the IT Service Management (ITSM) Market. In 2021, August, Microsoft Corporation took over RiskIQ, a cybersecurity company offering digital threat management solutions and threat intelligence for organizations worldwide. Through this acquisition, Microsoft would be able to enhance the cybersecurity posture for digital transformation initiatives and hybrid work environments. Companies such as IBM Corporation, Broadcom, Inc., Hewlett Packard Enterprise Company, are some of the key innovators in IT Service Management (ITSM) Market.Market Growth Factors

A customer-centric approach ensures that IT services meet or exceed customer expectations, leading to higher satisfaction. Satisfied customers are likelier to advocate for ITSM solutions, contributing to word-of-mouth referrals and market expansion. Customer-centricity drives organizations to prioritize service quality in ITSM processes. High-quality IT services attract the attention of other organizations seeking similar improvements, thereby expanding the market for ITSM solutions. Focusing on customer satisfaction builds a positive reputation and strengthens the brand image of ITSM solution providers. Organizations seeking ITSM solutions value effective communication and support, leading to increased market opportunities for providers with a customer-centric focus.Cloud-based services offer scalable and flexible infrastructure that can adapt to changing business requirements. ITSM solutions compatible with cloud environments enable organizations to scale their IT services efficiently, driving the demand for such solutions. Cloud services facilitate remote accessibility to IT resources from anywhere, promoting a distributed workforce. Cloud-based services enable rapid deployment of applications and seamless updates. Cloud-compatible ITSM solutions allow organizations to quickly deploy and update their ITSM infrastructure, contributing to increased market adoption. Hence, growing adoption of cloud-based services has been a pivotal factor in driving the growth of the market.

Market Restraining Factors

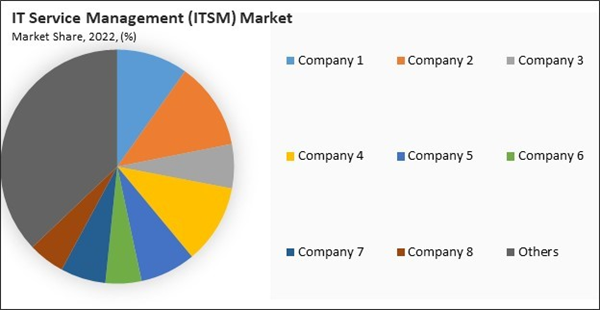

Data breaches can lead to unauthorized access and exposure of sensitive information. Organizations utilizing ITSM solutions may face reputational damage and legal consequences if a data breach occurs, impacting the trust of customers and stakeholders. Data security incidents erode customer trust and confidence. Data breaches and improper handling of sensitive information can potentially erode consumer trust, adversely impacting an organization's reputation and customer relationships. As ITSM solutions become attractive targets for cybercriminals, organizations face the challenge of continuously evolving cybersecurity measures to safeguard against sophisticated threats. Cloud-based ITSM solutions raise concerns about data residency and security in the cloud. Organizations may hesitate to adopt cloud based ITSM solutions due to uncertainties about the security of data stored in the cloud and potential breaches during data transit. The demand for ITSM solutions built with privacy in mind may limit the adoption of solutions lacking robust privacy features, impacting market dynamics.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

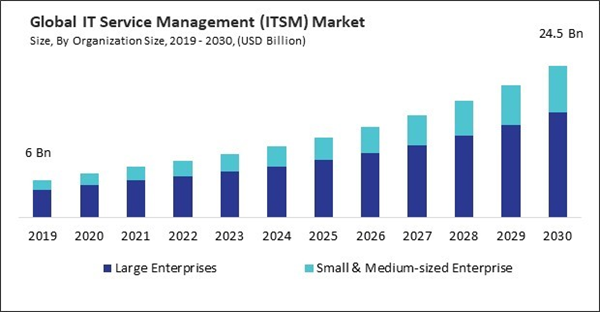

By Organization Size Analysis

On the basis of organization size, the market is bifurcated into small & medium-sized enterprise and large enterprises. The small & medium-sized enterprise segment covered a considerable revenue share in the market in 2022. Small & medium-sized enterprise often operate with limited resources, making operational efficiency a top priority. ITSM solutions streamline processes, automate routine tasks, and enhance overall efficiency in managing IT services. As small & medium-sized enterprise grow, their IT needs evolve. Scalable ITSM solutions allow small & medium-sized enterprise to expand their IT infrastructure and services without facing major disruptions, supporting business growth. Small & medium-sized enterprise focus on providing excellent customer experiences. ITSM solutions contribute to improved service delivery, faster issue resolution, and enhanced communication, resulting in higher customer satisfaction.By Deployment Type Analysis

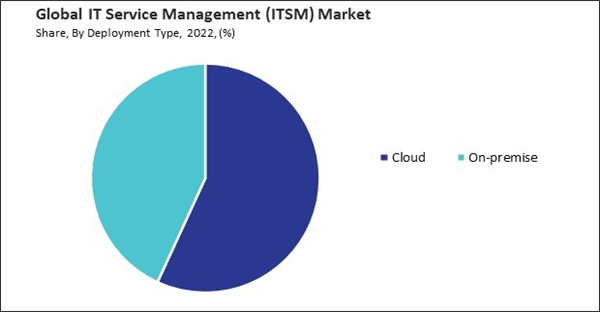

Based on deployment type, the market is classified into cloud and on-premise. In 2022, the cloud segment registered the maximum revenue share in the market. Cloud-based solutions enable rapid deployment compared to traditional on-premises alternatives. Organizations can quickly implement ITSM solutions, accelerating time-to-value and responsiveness to business needs. Cloud-based ITSM solutions facilitate collaboration among teams and stakeholders. Improved collaboration ensures that ITSM processes are transparent, well-coordinated, and aligned with organizational goals.By Offering Analysis

By offering, the market is categorized into solution and services. The services segment covered a considerable revenue share in the market in 2022. ITSM services focus on optimizing service delivery processes, leading to improved service quality. Enhanced service quality results in higher customer satisfaction, increased user productivity, and a positive impact on the overall business. ITSM services facilitate efficient identification and resolution of IT incidents. Quick incident resolution minimizes service disruptions, ensuring business continuity and reducing the impact on end-users. A positive user experience fosters collaboration, encourages user adoption, and improves employee satisfaction.By Solution Analysis

Under solution type, the market is segmented into service portfolio management, configuration & change management, service desk software, operations & performance management, and dashboarding, reporting & analytics. In 2022, the operations & performance management segment witnessed the largest revenue share in the market. Operations & performance management tools help optimize IT processes, reducing downtime and improving overall efficiency. Streamlining operations ensures that IT services are delivered promptly and consistently, enhancing customer satisfaction. Operations & performance management tools generate valuable data and insights that can be used for informed decision-making. Data-driven decision-making contributes to strategic planning, helping organizations align their IT services with business goals.By Vertical Analysis

By vertical, the market is divided into BFSI, IT & telecom, government & public sector, energy & utilities, manufacturing, retail & consumer goods, media & entertainment, healthcare & lifesciences, and others. In 2022, the BFSI segment held the highest revenue share in the market. BFSI organizations handle sensitive financial data and are subject to strict regulatory requirements. ITSM solutions help ensure data security, enforce compliance, and manage audits to meet industry regulations such as GDPR, PCI DSS, and SOX. BFSI organizations prioritize customer service excellence. ITSM solutions enhance service delivery, streamline customer support processes, and contribute to a positive customer experience through efficient incident resolution. The BFSI segment emphasizes strong IT governance. ITSM frameworks, such as ITIL (Information Technology Infrastructure Library), provide a structured approach to IT governance, ensuring alignment with business objectives.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. North American businesses heavily rely on technology to drive their operations, making ITSM essential for managing and optimizing IT services. Cybersecurity has gained more attention in North America because of the growing sophistication and frequency of cyberattacks. Cloud-based services are rising in North America due to their scalability, flexibility, and accessibility.Recent Strategies Deployed in the Market

- Jan-2024: Zendesk, Inc. acquired Klaus, a platform offering quality assurance and performance monitoring for customer support teams through its innovative review and feedback system. Through this acquisition, Zendesk AI and Klaus’ functionalities would assist businesses in managing increased complexity and volume, ensuring that both digital and human agents provide personalized and empathetic service.

- Nov-2023: Broadcom Inc. completed the acquisition of VMware, Inc., an American cloud computing and virtualization technology company. Through this acquisition, the Broadcom Software portfolio was combined with the VMware platform to provide critical infrastructure solutions to customers.

- Nov-2023: ServiceNow, Inc. signed a partnership with DXC Technology, a global IT services company providing solutions and consulting for digital transformation, cloud migration, and cybersecurity. Under this partnership, DXC would provide Enterprise Applications Value Optimization services, expanding its coverage from Global Business Services (GBS) to Global Infrastructure Services (GIS), offering comprehensive support for customers throughout its digital transformation journeys.

- Aug-2023: IBM Corporation took over Apptio Inc., a US-based software development company. Through this acquisition, IBM Corporation would enhance its business portfolio with a comprehensive technology management platform, enabling it to optimize and automate decisions throughout its IT environments.

- May-2023: IBM Corporation introduced IBM Hybrid Cloud Mesh; A SaaS solution tailored to empower enterprises in managing their hybrid multi-cloud infrastructure effectively. The IBM Hybrid Cloud Mesh streamlines application connectivity across public and private clouds, aiding modern enterprises in managing hybrid multi-cloud environments effectively.

- Mar-2023: Hewlett Packard Enterprise Company took over OpsRamp, a comprehensive digital operations management platform for hybrid IT environments, facilitating efficient monitoring, incident management, and automation. Through this acquisition, HPE would provide their customers with an integrated edge-to-cloud platform to efficiently manage and innovate their multi-vendor and multi-cloud IT environments.

List of Key Companies Profiled

- Microsoft Corporation

- IBM Corporation

- Open Text Corporation

- ServiceNow, Inc.

- BMC Software, Inc. (KKR & Co., Inc.)

- Broadcom, Inc.

- Hewlett Packard enterprise Company

- Atlassian Corporation PLC

- Zendesk, Inc.

- Ivanti, Inc. (Clearlake Capital Group, L.P.)

Market Report Segmentation

By Organization Size- Large Enterprises

- Small & Medium-sized Enterprise

- Cloud

- On-premise

- Solution

- Operations & Performance Management

- Configuration & Change Management

- Service Portfolio Management

- Service Desk Software

- Dashboarding, Reporting & Analytics

- Services

- BFSI

- Government & Public Sector

- Energy & Utilities

- IT & Telecom

- Media & Entertainment

- Manufacturing

- Retail & Consumer Goods

- Healthcare & Lifesciences

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Microsoft Corporation

- IBM Corporation

- Open Text Corporation

- ServiceNow, Inc.

- BMC Software, Inc. (KKR & Co., Inc.)

- Broadcom, Inc.

- Hewlett Packard enterprise Company

- Atlassian Corporation PLC

- Zendesk, Inc.

- Ivanti, Inc. (Clearlake Capital Group, L.P.)