AI algorithms analyze sensor data from machinery to predict equipment failures before they occur. Therefore, the manufacturing segment captured $1,613.6 million revenue in the market in 2022. This enables proactive maintenance, reducing downtime and preventing costly breakdowns. AI-powered computer vision systems can inspect and analyze products for defects on the production line. This ensures high-quality manufacturing and minimizes the chances of faulty products reaching the market. AI algorithms analyze historical sales data, market trends, and other relevant factors to forecast demand more accurately. This allows manufacturers to adjust production levels, minimize overstock, and effectively meet customer demand.

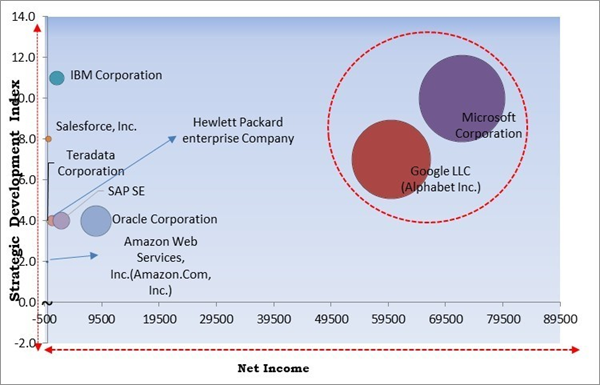

The major strategies followed by the market participants are Partnerships, Collaborations & Agreements as the key developmental strategy to keep pace with the changing demands of end users. For instance, In August, 2023, Salesforce, Inc. signed a collaboration with IBM Corporation. Through this collaboration, both companies would assist clients in transforming customer, partner, and employee experiences while ensuring the security of their data. Additionally, In March, 2023, Amazon Web Services, Inc., a subsidiary of Amazon.com, Inc. company, joined hands with NVIDIA Corporation. The new product offers 20 exaFLOPS of compute performance that aids training and building deep learning models.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Microsoft Corporation and Google LLC (Alphabet Inc.) are the forerunners in the market. In October, 2023, Microsoft Corporation joined hands with Domino’s Pizza, Inc., an American multinational pizza restaurant chain. Under this collaboration, the companies enhanced the Azure OpenAI and Microsoft Cloud Services to improve customer experiences through a personalized and simplified ordering process. Additionally, the collaboration assisted the store managers in saving time on several tasks, like inventory management and staff scheduling. Companies such as Oracle Corporation, SAP SE, Teradata Corporation are some of the key innovators in the market.Market Growth Factors

Cloud computing platforms offer scalable and flexible infrastructure, allowing associations to scale up or down based on their data management needs. This scalability aligns well with the dynamic requirements of AI applications, especially those involving large datasets and complex computations. Cloud-based solutions provide a cost-effective alternative to traditional on-premises infrastructure. Organizations can leverage cloud services pay-as-you-go, avoiding upfront capital investments and reducing operational costs. Moreover, cloud providers offer various AI services, such as machine learning APIs and pre-trained models. Organizations can integrate these services into their AI data management workflows, enhancing functionality and reducing the need for in-house model development. Thus, the rising adoption of cloud computing provides a foundation for the growth of the market.Personalization is crucial in marketing strategies. AI data management allows businesses to analyze customer data, preferences, and behavior to create targeted and personalized marketing campaigns. This includes personalized emails, advertisements, and content recommendations. In the e-commerce and retail sectors, personalization is key to enhancing the online shopping experience. This enables businesses to analyze customer purchase history, browsing patterns, and preferences to offer personalized product recommendations and promotions. This is used to personalize content across various platforms. As companies strive to satisfy the expectations of individual consumers and users, the market continues to rise.

Market Restraining Factors

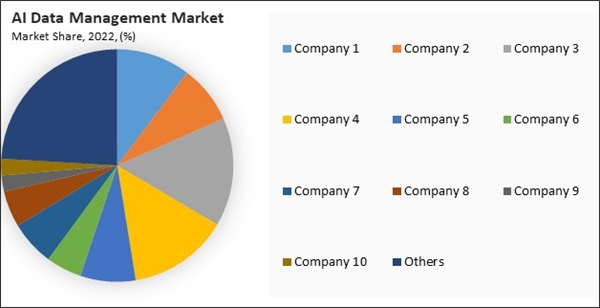

Implementing AI data management often requires significant investments in infrastructure, including powerful computing resources, storage systems, and networking capabilities. Organizations may find setting up or upgrading their infrastructure to support AI applications is expensive. The costs of acquiring AI technologies, software licenses, and proprietary algorithms can be substantial. Organizations may need to pay licensing fees for advanced AI tools, which can contribute to the overall high cost of implementation. Tailoring these solutions to meet organizational needs and integrating them with existing systems can contribute to higher costs. Customization and integration efforts often require specialized expertise and resources. As a result, the above aspects will cause the market growth to decline.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Partnerships, Collaborations & Agreements.

By Deployment Mode Analysis

Based on deployment mode, the market is divided into cloud and on-premise. The on-premise segment garnered a significant revenue share in the market in 2022. On-premise deployment provides organizations with direct control over their data and infrastructure. This level of control is particularly crucial for businesses dealing with sensitive or regulated data that must be kept on-premises for compliance reasons. On-premise solutions allow organizations to customize and tailor these systems according to their specific needs. This is particularly helpful for businesses with unique data processing requirements or specialized workflows. On-premise deployment often results in lower latency as data does not need to travel over the internet to external servers.By Offering Analysis

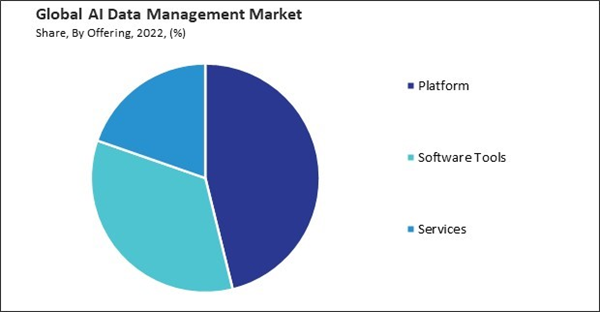

On the basis of offering, the market is segmented into platform, software tools, and services. In 2022, the platform segment dominated the market with the maximum revenue share. Platform-type solutions provide a centralized and integrated environment for managing diverse aspects of AI data management. This includes data integration, quality management, analytics, and other functionalities. Platforms are designed to scale horizontally to handle growing data volumes and evolving business requirements. They often support flexible deployment options, including on-premises, cloud, or hybrid architectures. AI-driven platforms automate routine data management tasks such as cleansing, validation, and integration. Automation reduces manual effort, minimizes errors, and enhances overall operational efficiency.By Technology Analysis

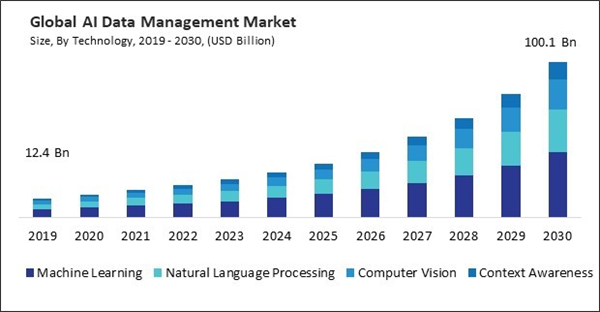

On the basis of technology, the market is classified into machine learning, natural language processing, computer vision, and context awareness. In 2022, the context awareness segment witnessed a considerable revenue share in the market. Context-aware AI systems can analyze user behavior, preferences, and historical interactions with data to understand the context in which they are accessing or manipulating information. These systems equipped with context awareness can dynamically adjust data processing methods based on the specific context of the data. For example, data cleansing algorithms can be adapted based on the quality and source of incoming data. Context awareness allows for the dynamic adjustment of data access policies based on the current context. For instance, they tighten security measures in sensitive contexts or relax restrictions in less critical situations.By Application Analysis

Based on application, the market is categorised into data augmentation & exploratory data analysis, data anonymization & customization, imputation predictive modeling, data validation & noise reduction, process automation, and others. The data augmentation and exploratory data analysis segment acquired a substantial revenue share in the market in 2022. These tools facilitate data enrichment by adding new data points or features to existing datasets. This augmentation process can significantly improve the performance of machine learning models trained on the enriched data, enhancing their predictive capabilities and robustness. Moreover, these tools excel in integrating data from various sources and formats, simplifying the analysis of diverse datasets in EDA applications. This integration capability is essential for deriving comprehensive insights and making informed decisions based on a holistic view of the data.By Data Type Analysis

By data type, the market is fragmented into audio data, speech & voice data, image data, text data, and video data. The speech & voice data segment recorded a remarkable revenue share in the market in 2022. This is extensively used in speech distinction systems to convert spoken language into text. This technology is applied in virtual assistants, transcription services, voice-activated devices, and more. AI-driven voice search technology uses natural language processing to understand and respond to spoken queries. Organizations can optimize content for voice search to improve visibility in search engine results. This is employed in speech analytics solutions to analyze and derive insights from customer service calls. This includes sentiment analysis, identification of trends, and monitoring agent performance.By Vertical Analysis

By vertical, the market is segmented into BFSI, retail & eCommerce, government & public sector, healthcare & life sciences, manufacturing, energy & utilities, media & entertainment, IT & telecom, and others. The retail & e-commerce segment procured a remarkable revenue share in the market in 2022. AI analyzes customer data to deliver personalized product recommendations, including purchase history, browsing behavior, and preferences. This enhances the shopping experience, increases customer satisfaction, and encourages repeat business. AI analyzes transaction data and user behavior to detect and prevent fraud, such as unauthorized transactions or account takeovers. This improves security and builds trust among consumers. AI enables visual search capabilities, allowing customers to search for products using images. Image recognition technology can also tag products and automate catalog management.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region registered the highest revenue share in the market. The market in North America is a global powerhouse characterized by the innovation and technological ability of the US and Canada. The United States, with Silicon Valley as a prominent hub, has been a breeding ground for AI startups and tech giants pioneering cutting-edge solutions in data management. The market in North America thrives on a culture of innovation, strong R&D initiatives, and a business landscape that readily embraces AI-driven data management to enhance operations, decision-making, and overall efficiency across diverse industries.Recent Strategies Deployed in the Market

- Sep-2023: Salesforce, Inc. expanded its strategic partnership with Google LLC, an American multinational technology company focusing on artificial intelligence, to integrate Salesforce, the leading AI CRM, and Google Workspace, the widely used productivity tool. The collaboration introduced bidirectional integrations, enabling customers to merge context from Salesforce and Google Workspace, including Google Calendar, Docs, Meet, Gmail, and more, to enhance generative AI experiences across platforms.

- Mar-2023: Google LLC formed a partnership with Replit, Inc., an online integrated development environment. Through this partnership, the developers of Replit got to access Google Cloud infrastructure, services, and foundation models through Ghostwriter, while the collaborative code editing platform of Replit was accessed by Google Cloud and Workplace developers. Additionally, the collaboration advanced the creation of generative AI applications and created an open ecosystem for generative AI.

- May-2023: IBM Corporation introduced "IBM Watsonx". This will empower businesses to expand and expedite the influence of state-of-the-art AI by utilizing trustworthy data. Additionally, IBM would enhance the development of a GPU-as-a-service infrastructure, designed to cater to AI-intensive workloads. This initiative aims to assist clients in the implementation of AI.

- Dec-2023: Salesforce, Inc. took over Spiff, a company offering innovative Incentive Compensation Management (ICM) software and a robust processing engine to enable scalable automation of commission management. Through this acquisition, Spiff organization would be integrated into Sales Cloud, collaborating to elevate Salesforce's Sales Performance Management solutions, delivering customers a reliable platform for heightened visibility, enhanced sales effectiveness, and accelerated growth.

- May-2023: IBM Corporation completed the acquisition of Polar Security Inc., a leading provider of cloud data protection solutions. Through this acquisition, the DSPM technology of Polar Security was combined with the Guardium data security product portfolio of IBM. Additionally, the acquisition provided the security teams with a data security platform that covers all data types across all storage locations.

List of Key Companies Profiled

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services, Inc.(Amazon.Com, Inc.)

- Google LLC (Alphabet Inc.)

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Hewlett Packard enterprise Company

- Snowflake Inc.

- Teradata Corporation

Market Report Segmentation

By Deployment Mode- Cloud

- On-premise

- Platform

- Software Tools

- Services

- Machine Learning

- Natural Language Processing

- Computer Vision

- Context Awareness

- Process Automation

- Data Validation & Noise Reduction

- Data Anonymization & Customization

- Data Augmentation & Exploratory Data Analysis

- Imputation Predictive Modeling & Others

- Image Data

- Video Data

- Text Data

- Speech & Voice Data

- Audio Data

- BFSI

- Government & Public Sector

- Energy & Utilities

- IT & Telecom

- Media & Entertainment

- Manufacturing

- Retail & eCommerce

- Healthcare & Lifesciences

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services, Inc.(Amazon.Com, Inc.)

- Google LLC (Alphabet Inc.)

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- Hewlett Packard enterprise Company

- Snowflake Inc.

- Teradata Corporation