Night vision devices are increasingly integrated into automotive systems to enhance driver visibility during nighttime driving. Thus, the navigation segment acquired $874.0 million in2022. These systems use infrared sensors and cameras to detect obstacles, pedestrians, and other vehicles, providing real-time images to the driver.

Night vision cameras and surveillance systems are increasingly used for home security purposes. Homeowners deploy these devices to monitor their properties at night, enhancing overall security and providing a deterrent against potential intruders. Therefore, the night vision devices market is expanding significantly due to the increasing applications in civilian sectors.

Additionally, military and special forces engaged in counterterrorism operations rely on night vision devices to conduct covert missions and raids at night. Thus, because of the global rise in terrorism and asymmetric threats, the night vision devices market is anticipated to increase significantly.

However, the high upfront costs of advanced night vision devices can restrict market accessibility for a broad range of potential users. Small businesses, individual consumers, and organizations with tight budgets may find it difficult to invest in these technologies, restricting the overall market growth. Thus, high initial costs can slow down the growth of the night vision devices market.

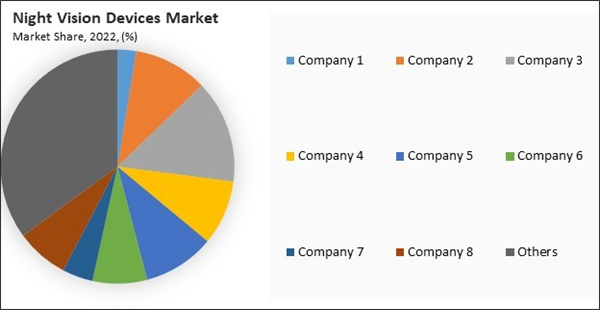

The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions, and Partnerships & Collaborations.

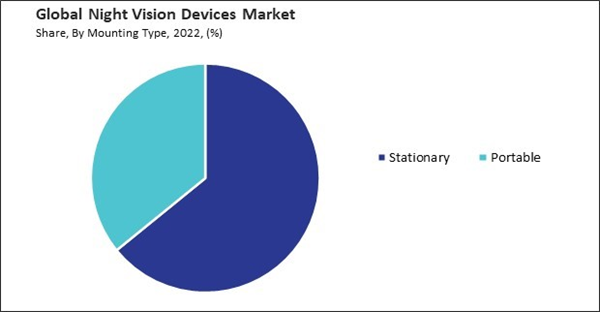

By Mounting Type Analysis

By mounting type, the night vision devices market is bifurcated into stationary and portable. The portable segment recorded a remarkable 36% share in the night vision devices market in 2022. Handheld options enable rescuers to quickly scan large areas and locate distressed individuals during nighttime missions.By Device Type Analysis

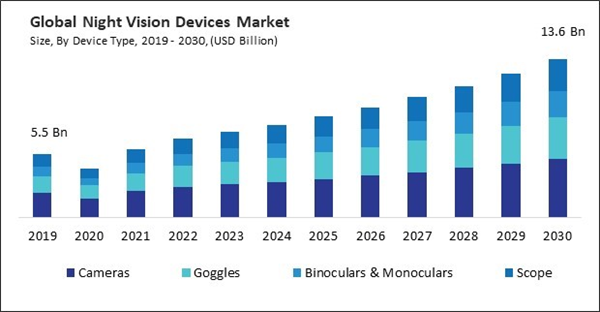

Based on device type, the market is classified into scopes, goggles, cameras, and binoculars & monoculars. In 2022, the cameras segment witnessed 39% revenue share in the market. Night vision cameras are popular among hunters for tracking games in low-light conditions.By Technology Analysis

By technology, the market is categorized into thermal imaging, imaging intensification, infrared illumination, and digital imaging. The imaging intensification segment covered a considerable 24% revenue share in the market in 2022. Image intensifiers are used in aviation for enhanced visibility during nighttime flights, contributing to pilot situational awareness and safety.By Application Analysis

On the basis of application, the market is divided into law enforcement, wildlife surveillance, commercial surveillance, navigation, and others. In 2022, the law enforcement segment acquired 45.3% share in market with maximum revenue share. This includes locating missing persons, responding to accidents, and conducting operations in challenging terrain.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the 37% revenue share. Night vision goggles and devices are integrated into aviation operations in North America, particularly for military and law enforcement aviation units.Recent Strategies Deployed in the Market

- Jan-2024: Teledyne FLIR LLC came into collaboration with Valeo, a global automotive supplier specializing in the design, production, and sale of components, integrated systems, and modules for the automotive industry. Through this collaboration, both companies would extend thermal imaging technology across transportation, enabling enhanced visibility for drivers and automated safety systems in challenging conditions like darkness, clutter, and adverse weather where conventional sensors falter.

- Oct-2023: Teledyne FLIR LLC introduced FLIR Quasar™ Premium Mini-Dome AI, an advanced surveillance solution featuring artificial intelligence, designed for compact deployment with superior monitoring capabilities. FLIR Quasar Premium Mini-Dome AI offers three models (5 MP, 4K Wide, 4K Narrow) with 12 analytics for detecting people, vehicles, objects, attributes, and events; the 4K Narrow option has AI detection ranges of 152m for vehicles, 71m for people, and 25m for faces.

- May-2023: ATN Corporation unveiled X-Sight 5, an advanced digital rifle scope featuring multiple functionalities including day and night vision capabilities, recording, and ballistic calculation. With the enhanced attributes of the Sight 5 Series encompass a high-performance sensor, delivering hunters an ultra-high-definition experience with an additional four million pixels, ensuring precise tones, vibrant colors, and a truly lifelike visual experience.

- May-2023: BAE Systems PLC signed a partnership with Unmanned Systems Technology (UST), a comprehensive platform covering the latest developments and innovations in unmanned and autonomous systems across various industries. Through this partnership, BAE Systems engineers would be able to directly enter a diverse array of pioneering and evolving technologies, aiming to enhance the capabilities of small unmanned systems platforms under development.

- Jan-2022: EOTECH, LLC. came into partnership with Theon Sensors, a company specializing in advanced sensor technologies for military and security applications. Under this partnership, EOTECH would be able to introduce customized products from Theon Sensors to the United States market, while also collaborating on the development of new product lines that incorporate our cutting-edge technology.

List of Key Companies Profiled

- Vista Outdoor, Inc.

- L3Harris Technologies, Inc.

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- BAE Systems PLC

- Thales Group S.A.

- RTX Corporation

- Elbit Systems Ltd.

- Leonardo SpA (Leonardo DRS, Inc.)

- ATN Corporation

- EOTECH, LLC.

Market Report Segmentation

By Mounting Type- Stationary

- Portable

- Cameras

- Goggles

- Binoculars & Monoculars

- Scope

- Thermal Imaging

- Image Intensification

- Infrared Illumination

- Digital Imaging

- Law Enforcement

- Commercial Surveillance

- Navigation

- Wildlife Surveillance

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Vista Outdoor, Inc.

- L3Harris Technologies, Inc.

- Teledyne FLIR LLC (Teledyne Technologies Incorporated)

- BAE Systems PLC

- Thales Group S.A.

- RTX Corporation

- Elbit Systems Ltd.

- Leonardo SpA (Leonardo DRS, Inc.)

- ATN Corporation

- EOTECH, LLC.