The widespread adoption of mobile devices, including smartphones and tablets, is a characteristic feature of North America. Consequently, the North America segment captured $2935.2 million revenue in the market in 2022. The region is home to numerous tech companies, startups, and research institutions that actively contribute to developing and advancing solutions. Thus, these aspects will boost the demand in the segment.

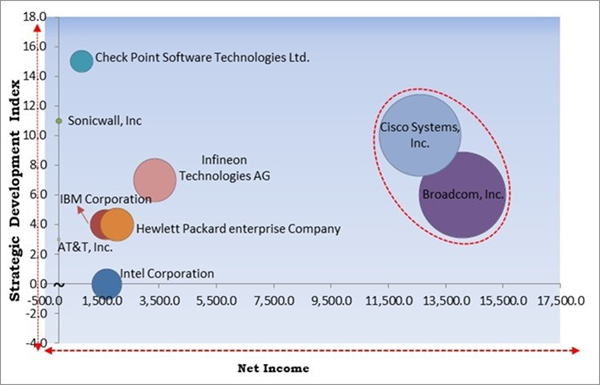

The major strategies followed by the market participants are Mergers & Acquisition as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2021, Cisco Systems, Inc. announced the acquisition of Kenna Security, Inc. Cisco believes this integration will revolutionize the collaboration between security and IT teams, leading to a reduction in the attack surface and quicker detection and response times. Additionally, In April, 2020, Infineon Technologies AG acquired Cypress Semiconductor Corporation. This addition strengthens Infineon's focus on structural growth drivers and expands its range of applications, accelerating profitable growth.

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Cisco Systems, Inc. and Broadcom, Inc. are the forerunners in the Market. For Instance, In November, 2019, Broadcom Inc. has finalized its acquisition of Symantec Corporation's Enterprise Security business. This division will now operate as the Symantec Enterprise division within Broadcom, with Art Gilliland appointed as SVP and General Manager.Market Growth Factors

BYOD environments often feature a diverse ecosystem of devices, including various makes, models, and operating systems. This diversity increases the complexity of managing and securing numerous devices accessing corporate networks and data. The solutions provide endpoint protection, including antivirus, anti-malware, and threat detection capabilities, to safeguard devices against malicious attacks. Thus, these aspects will boost the demand for mobile security in the coming years.Additionally, Mobile malware includes various types of malicious software specifically designed to target smartphones and tablets. The solutions employ advanced malware detection algorithms, behavioral analysis, and signature-based detection to identify and neutralize malicious code before it can compromise the device or steal sensitive information. Owing to these aspects, the market will witness increased demand in the upcoming years.

Market Restraining Factors

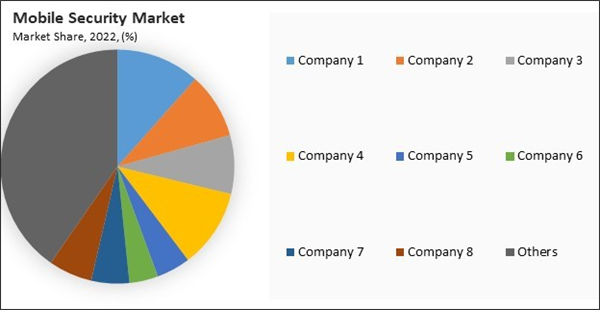

The delicate balance between robust security measures and a seamless user experience is a perennial challenge in developing these solutions. However, frequent and intrusive update prompts can disrupt user activities and lead to frustration. Developers need to find ways to encourage prompt updates without causing inconvenience. Thus, these aspects can reduce the demand for mobile security in the upcoming years.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Acquisitions.

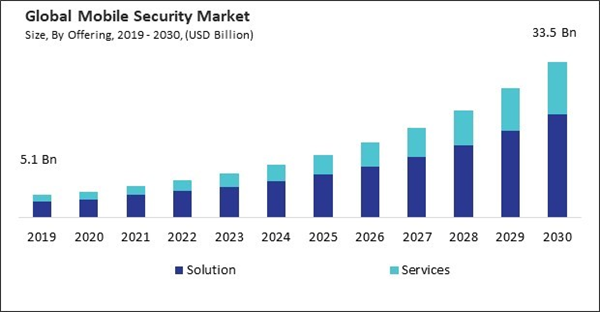

By Offering Analysis

Based on offering, the market is segmented into solution and services. The solution segment held 70.13% revenue share in the market in 2022. With the increasing use of mobile applications, securing them has become crucial. Mobile Application Security solutions include app scanning, code analysis, and behavioral monitoring to identify and mitigate vulnerabilities and malicious activities.By Solution Analysis

The solution segment is further segmented into network security, data security & encryption, web security, identity & access management, endpoint security, application security, and others. The network security segment held the 27.86% revenue share in the market in 2022. Mobile VPNs establish secure and encrypted connections for mobile devices over public networks, ensuring the confidentiality and integrity of data transmitted between the device and the corporate network.By Services Analysis

The services segment is bifurcated into professional services and managed services. The professional services recorded the 67.48% revenue share in the market in 2022. Professionals conduct a thorough assessment of an organization's mobile security risks, identifying vulnerabilities and providing recommendations for mitigation. Consultants assist in designing a robust architecture tailored to the organization's needs, ensuring a holistic and effective security framework.By Operating System Analysis

Based on operating system, the market is divided into Android, iOS, and others. In 2022, the iOS segment witnessed a 36.14% revenue share in the market. Many enterprises adopt iOS devices for their employees due to the perceived security advantages Apple's ecosystem offers. iOS devices are often preferred in corporate environments where stringent security measures are essential. Apple is known for providing regular and timely software updates for iOS devices.By Deployment Analysis

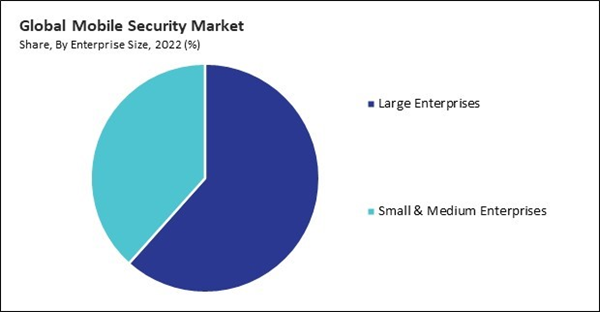

Based on deployment, the market is segmented into on-premise and cloud. The on-premise segment held the 56.5% revenue share in the market in 2022. With on-premise deployment, organizations have complete control over their data. This can be particularly important for businesses that handle sensitive information and have regulatory or compliance requirements that necessitate strict control over data storage and processing.By Enterprise Size Analysis

By enterprise size, the market is bifurcated into large enterprises and small & medium enterprises. The small and medium enterprises segment 38.38% the maximum revenue share in the market in 2022. The solutions for SMEs need to be cost-effective and aligned with budget constraints. These businesses may not have the financial resources for extensive security investments, so solutions that provide a balance between affordability and effectiveness are crucial.By Vertical Analysis

Based on vertical, the market is divided into BFSI, retail, government & defense, IT & telecom, healthcare & lifesciences, manufacturing, energy & utilities, and others. In 2022, the BFSI segment witnessed a 20.39% revenue share in the market. Financial institutions, especially banks, have undergone a significant digital transformation, with a growing emphasis on mobile banking services.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific segment acquired a 27.61% revenue share in the market. The Asia Pacific region has experienced rapid and widespread adoption of smartphones. Countries like China, India, South Korea, and Japan have become significant contributors to the global smartphone industry.Recent Strategies Deployed in the Market

- Feb-2024: AT&T, Inc. unveiled a security product to thwart potential threats before they reach customers' networks, without extra hardware. The AT&T Dynamic Defence platform is embedded in the network and can be activated online "within minutes," targeting SMEs using its internet services. Initially launched in ten US markets, AT&T plans wider deployment, offering three subscription options.

- Jan-2024: Sonicwall, Inc acquired Banyan Security, enhancing its SSE offerings with zero trust security, catering to Fortune 100 firms and small businesses transitioning to SSE solutions like ZTNA. Together, they'll provide SASE solutions for partners, adapting to customers' evolving cloud journeys.

- Nov-2023: Sonicwall, Inc has acquired Solutions Granted, Inc (SGI), a Managed Security Service Provider (MSSP), to bolster its partner commitment and service range. This includes U.S.-based SOCaaS, MDR, and specialized MSP and MSSP services. This enhances SonicWall's cybersecurity offerings for MSPs, empowering them with cost-effective threat defense solutions and a comprehensive portfolio for managing security across customer environments with automated detection and response services.

- Oct-2023: Cisco Systems, Inc. acquired Working Group Two (WG2), a Norwegian company known for its cloud-native mobile services platform, fully API consumable and highly programmable. WG2's platform, built for simplicity, innovation, and efficiency, aligns with Cisco's Mobility Services Platform, aiming to simplify mobile network architecture and deliver innovative mobile services. This acquisition will enhance Cisco's service edge deployment and API-first strategy for application development partners, enterprise customers, and service provider partners.

- Sep-2023: Symantec Corporation, a division of Broadcom Inc., teamed up with Google Cloud to integrate generative AI (gen AI) into its security platform, enhancing detection and remediation of cyber-attacks. This collaboration aims to provide innovative solutions, simplifying processes for increased customer productivity.

List of Key Companies Profiled

- Broadcom, Inc. (Symantec Corporation)

- Check Point Software Technologies Ltd.

- Intel Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Hewlett Packard enterprise Company

- FireEye, Inc.

- Infineon Technologies AG

- Sonicwall, Inc

- AT&T, Inc.

Market Report Segmentation

By Offering- Solution

- Network Security

- Data Security & Encryption

- Web Security

- Identity & Access Management

- Endpoint Security

- Application Security

- Others

- Services

- Professional Services

- Managed Services

- Android

- iOS

- Others

- On-premise

- Cloud

- Large Enterprises

- Small & Medium Enterprises

- IT & Telecom

- Government & Defense

- Energy & Utilities

- Healthcare & Lifesciences

- Manufacturing

- Retail

- BFSI

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Broadcom, Inc. (Symantec Corporation)

- Check Point Software Technologies Ltd.

- Intel Corporation

- IBM Corporation

- Cisco Systems, Inc.

- Hewlett Packard enterprise Company

- FireEye, Inc.

- Infineon Technologies AG

- Sonicwall, Inc

- AT&T, Inc.