Active ingredients in acne-fighting serums, such as salicylic acid, penetrate the pores to remove excess oil, dead skin cells, and debris. Consequently, the acne fighting serums segment would generate approximately 12.37 % share of the market by 2030. This lessens the possibility of future breakouts and helps stop the development of new blemishes. Diverse varieties of acne, such as inflammatory lesions, blackheads, and whiteheads, can be effectively treated with acne-fighting serums.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In September 2023, Galderma S.A has introduced a fresh skincare collection within its dermatologist-recommended skincare series, named Cetaphil Healthy Renew. This lineup features a Face Serum, Eye Gel Serum, Day Cream SPF 30, and Night Cream. In March 2022, Unilever Plc has unveiled a new addition to its Simple facial skincare collection with the introduction of a trio of beauty serums. The Simple Booster Serum range consists of three powerful formulations. The first serum contains 3% Hyaluronic Acid + B5, which is aimed at locking in moisture for hydrated skin. The second serum contains 10% Vitamins C+E+F, offering benefits such as enhancing skin radiance, shielding against environmental stressors, and providing moisture while fortifying the skin barrier. The third and final serum, 10% Vitamin B3 Niacinamide, is specifically formulated to regulate sebum production, thereby preventing acne and reinforcing the skin barrier for improved skin health.

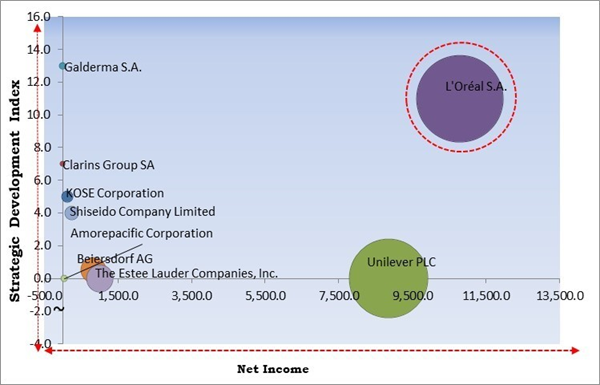

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; L'Oréal S.A. are the forerunners in the Market. In July, 2023, L'Oréal S.A. has introduced a fresh facial care line named Revita lift Clinical, featuring Vitamin C as its primary ingredient. This new series comprises two key products: a serum enriched with 12% pure vitamin C and a facial lotion combining vitamin C with SPF50 for shielding against sun-related damage. These products are designed to address common skin concerns such as wrinkles, enlarged pores, and uneven skin tone. They work to minimize pores, refine skin texture, and shield against environmental aggressors, thereby promoting smoother and healthier-looking skin. And Companies such as Unilever PLC, The Estee Lauder Companies, Inc., Beiersdorf AG are some of the key innovators in Market.

Market Growth Factors

Subscribers benefit from the convenience of receiving facial serums directly at their doorstep. This eliminates the need for regular visits to physical stores and allows consumers to access premium or specialized products without the hassle of searching for them in traditional retail outlets. Thus, because of the subscription services and sampling programs, the market is anticipated to increase significantly.Social media platforms encourage user-generated content, where consumers share their experiences with facial serums. Positive reviews, testimonials, and before-and-after photos enhance brand credibility and influence potential customers. Hence, rising digital and social media marketing has been a pivotal factor in driving the growth of the market.

Market Restraining Factors

Rapid adjustments in the supply chain, such as sourcing alternative raw materials or changing manufacturing locations, can pose challenges to maintaining consistent quality control. This may impact the efficacy and safety of facial serums, leading to potential recalls and reputational damage. Thus, supply chain disruptions can slow down the growth of the market.By Price Point Analysis

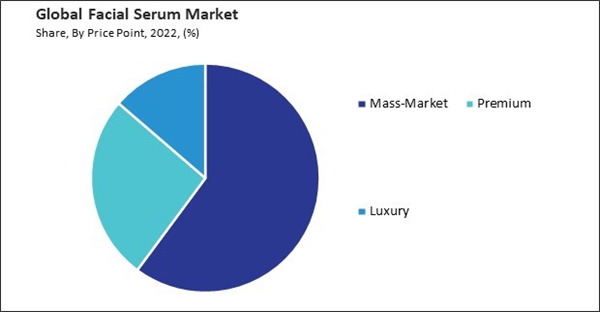

By price point, the market is fragmented into mass-market, premium, and luxury. The premium segment recorded a 26.17 % revenue share in the market in 2022. Premium facial serums are presented in luxurious and aesthetically pleasing packaging. Brands in the premium segment are transparent about the scientific research behind their products, providing consumers with confidence in the performance and results of the serums.By Form Analysis

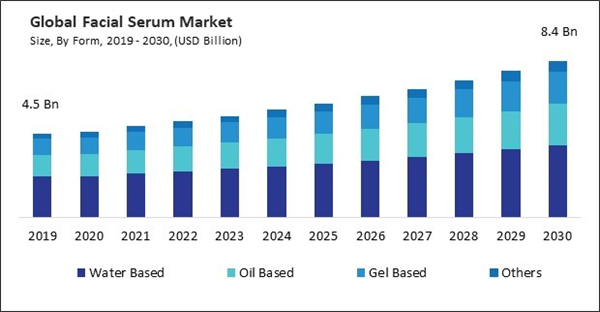

Based on form, the market is classified into oil based, gel based, water based, and others. In 2022, the water-based segment witnessed the 48.08 % revenue share in the market. Water-based serums are versatile and suitable for all skin types, including oily and sensitive skin. Consumers appreciate the efficiency of these serums, as they can be seamlessly incorporated into daily skincare routines without causing delays or leaving a sticky residue on the skin.By Distributional Channel Analysis

On the basis of distribution channel, the market is divided into supermarkets & hypermarkets, drugstores & pharmacies, specialty beauty stores, online retailers, and others. The specialty beauty stores segment garnered a 20.64 % revenue share in the market in 2022. Specialty beauty stores provide an immersive shopping experience, allowing visitors to explore and interact with products. These initiatives help educate consumers about the benefits of facial serums, the proper use of specific ingredients, and how to incorporate serums into a comprehensive skincare routine.By Serum Type

By serum type, the market is categorized into anti-aging serums, skin brightening serums, acne fighting serums, hydrating & exfoliating face serums, and others. In 2022, the anti-aging serums segment held the 32.35 % revenue share in the market. Anti-aging serums are designed to diminish the appearance of fine lines and wrinkles. A more youthful complexion results from the synergistic effects of retinol, peptides, and hyaluronic acid, which stimulate collagen production, enhance skin elasticity, and diminish the appearance of wrinkles. These ingredients help reduce hyperpigmentation, dark spots, and discoloration associated with aging, resulting in a more radiant complexion.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region acquired a 30.26 % revenue share in the market. North American consumers are increasingly leaning towards clean and natural beauty products. Consumers in North America prefer the convenience of online shopping, allowing them to explore and purchase products from the comfort of their homes.Recent Strategies Deployed in the Market

- Sep-2023: Galderma S.A has introduced a fresh skincare collection within its dermatologist-recommended skincare series, named Cetaphil Healthy Renew. This lineup features a Face Serum, Eye Gel Serum, Day Cream SPF 30, and Night Cream. All products in the Cetaphil Healthy Renew line are enriched with Vitamins B3 and B5, aiming to moisturize, calm, and reinforce the skin's moisture barrier. Additionally, the formula incorporates botanical extracts from Rice Lees and Edelweiss to address dullness and uneven skin tone.

- Jul-2023: L'Oréal S.A. has introduced a fresh facial care line named Revitalift Clinical, featuring Vitamin C as its primary ingredient. This new series comprises two key products: a serum enriched with 12% pure vitamin C and a facial lotion combining vitamin C with SPF50 for shielding against sun-related damage. These products are designed to address common skin concerns such as wrinkles, enlarged pores, and uneven skin tone. They work to minimize pores, refine skin texture, and shield against environmental aggressors, thereby promoting smoother and healthier-looking skin.

- Dec-2022: The Estee Lauder Companies Inc. has acquired Tom Ford International LLC, a prestigious fashion label renowned for its beauty and fashion accessories. With this acquisition, Estee Lauder intends to enhance its competitive position against L’Oréal by incorporating another sought-after, luxury brand into its portfolio. This move underscores Estee Lauder's commitment to evolving its offerings to remain pertinent to consumers' preferences.

- Nov-2022: L'Oréal S.A has formed a joint Venture with Hotel Shilla and Anchor Equity Partners to introduce a new beauty brand called Shihyo. Inspired by the Asian concept of 24 seasons, this brand features products formulated with ShiHyo24, a signature ingredient comprising a patented blend of 24 herbal ingredients, along with fermented rice water and ginseng water. The luxury beauty line includes skincare essentials like facial cleansers, essences, and creams, as well as scalp and hair care products.

- Oct-2022: Amorepacific Corporation has extended its collaboration with istyle, Inc., a Japanese company renowned for managing the cosmetics portal website @cosme. As part of this extended partnership, Amorepacific has introduced its brand, Innisfree, to the @cosme store. The brand's debut will take place at @cosmeTOKYO, featuring a curated selection of products, including Innisfree's popular Green Tea Seed Serum.

List of Key Companies Profiled

- L'Oréal S.A.

- Galderma S.A.

- Amorepacific Group Inc.

- KOSÉ Corporation

- Clarins Inc.

- Unilever plc

- Shiseido Company Limited

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Revlon Inc.

Market Report Segmentation

By Price Point (Volume, Thousand Units (1 OZ), USD Billion, 2019-2030)- Mass-Market

- Premium

- Luxury

- Water Based

- Oil Based

- Gel Based

- Others

- Supermarkets & Hypermarkets

- Specialty Beauty Stores

- Online Retailers

- Drugstores & Pharmacies

- Others

- Anti-Aging Serums

- Skin Brightening Serums

- Acne Fighting Serums

- Hydrating & Exfoliating Face Serums

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- L'Oréal S.A.

- Galderma S.A.

- Amorepacific Group Inc.

- KOSÉ Corporation

- Clarins Inc.

- Unilever plc

- Shiseido Company Limited

- Beiersdorf AG

- Estée Lauder Companies Inc.

- Revlon Inc.