Military aviation MRO refers to the maintenance, repair, and overhaul of military aircraft and related systems. MRO services are essential for ensuring the safety, reliability, and readiness of military aircraft, and extending their operational lifespan. Military aviation MRO involves a wide range of activities, including inspection, testing, repair, replacement, and overhaul of various aircraft components and systems such as engines, avionics, landing gear, and airframes. These services are provided by both government agencies and private companies, with many specialized MRO providers focusing solely on military aircraft. The primary goal of military aviation MRO is to ensure that military aircraft are optimal to carry out their missions safely and effectively. MRO providers use advanced technologies, specialized tools, and highly trained personnel to carry out these services, which require strict adherence to safety and quality standards. In recent years, military aviation MRO has gained traction due to the increasing need to maintain the operational readiness of military aircraft fleets, which requires regular maintenance and repairs.

Military Aviation MRO Market Trends:

One of the primary factors driving the market is the need for operational readiness. Military aircraft are critical assets that must always be maintained in a state of readiness. This requires regular maintenance, repairs, and upgrades to ensure they are safe, reliable, and capable of carrying out their missions effectively. Additionally, several military aircraft fleets worldwide are aging and require extensive maintenance and repairs to remain operational. The cost of replacing these fleets can be prohibitively expensive, making MRO services a cost-effective alternative. Other than this, militaries outsource MRO services to specialized providers to reduce costs and increase efficiency. Outsourcing allows militaries to focus on their core missions while relying on expert providers for MRO services. Besides this, the growth in air travel has led to an increase in demand for military aircraft, which in turn, has escalated the demand for MRO services. In line with this, the increase in geopolitical tensions around the world has led to a rise in military spending, which is creating a positive market outlook for military aircraft and MRO services. As a result, militaries are investing in their aircraft fleets to maintain their military readiness in the face of potential threats. Furthermore, the development of new materials, components, and systems has resulted in more efficient and effective MRO processes. Moreover, advancements in predictive maintenance, additive manufacturing, and data analytics help reduce maintenance costs and improve aircraft availability, accelerating the adoption of military aviation MRO services.Key Market Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on MRO type and aircraft type.MRO Type Insights:

- Engine MRO

- Components and Modifications MRO

- Airframe MRO

- Field Maintenance

Aircraft Type Insights:

- Fixed-Wing Aircraft

- Rotorcraft

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the global military aviation MRO market. Detailed profiles of all major companies have been provided. Some of the companies covered include Airbus SE, Ametek Inc., AMMROC (Abu Dhabi Developmental Holding Company PJSC), BAE Systems Plc, Elbit Systems Ltd., General Atomics AeroTec Systems GmbH, Lockheed Martin Corporation, MTU Aero Engines (Daimler-Benz AG), Rolls-Royce Holding Plc, Safran SA, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.Key Questions Answered in This Report:

- How has the global military aviation MRO market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global military aviation MRO market?

- What is the impact of each driver, restraint, and opportunity on the global military aviation MRO market?

- What are the key regional markets?

- Which countries represent the most attractive military aviation MRO market?

- What is the breakup of the market based on the MRO type?

- Which is the most attractive MRO type in the military aviation MRO market?

- What is the breakup of the market based on the aircraft type?

- Which is the most attractive aircraft type in the military aviation MRO market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global military aviation MRO market?

Table of Contents

Companies Mentioned

- Airbus SE

- Ametek Inc.

- AMMROC (Abu Dhabi Developmental Holding Company PJSC)

- BAE Systems Plc

- Elbit Systems Ltd.

- General Atomics AeroTec Systems GmbH

- Lockheed Martin Corporation

- MTU Aero Engines (Daimler-Benz AG)

- Rolls-Royce Holding Plc

- Safran SA

Table Information

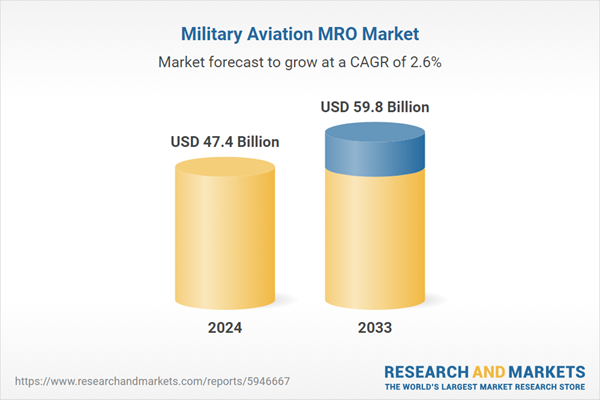

| Report Attribute | Details |

|---|---|

| No. of Pages | 141 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 47.4 Billion |

| Forecasted Market Value ( USD | $ 59.8 Billion |

| Compound Annual Growth Rate | 2.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |