Off-the-Road Tire Market Trends:

Growth in construction and mining industries

The robust growth in the construction and mining industries stands as a primary driver of the global off-the-road tire market. In the construction sector, the demand for off-the-road tires is propelled by heavy-duty construction equipment such as excavators, bulldozers, and loaders, which rely on these specialized tires for optimal performance in rugged terrains. Similarly, the mining industry heavily depends on off-the-road tires for large haul trucks and earthmoving equipment essential for mining operations. The continuous expansion of infrastructure projects, urbanization, and mining activities, particularly in developing regions, fuels the demand for off-the-road tires.Expansion in the agricultural sector

The agricultural sector's expansion serves as another significant driver for the global off-the-road tire market. With the mechanization and modernization of agriculture, the demand for specialized agricultural off-the-road tires has surged. The tires are vital for tractors, combines, and other agricultural machinery used in planting, harvesting, and fieldwork. As farms seek to improve efficiency and productivity, there is a growing need for off-the-road tires designed to provide traction and stability in various soil conditions. Furthermore, the adoption of precision farming techniques, which rely on heavy agricultural equipment, further underscores the importance of high-quality off-the-road tires in modern agriculture.Infrastructure development projects worldwide

Infrastructure development projects on a global scale significantly contribute to the growth of the off-the-road tire market. Governments and private enterprises invest heavily in infrastructure development, including the construction of roads, bridges, airports, and industrial facilities. These projects require a wide range of heavy machinery and vehicles equipped with off-the-road tires to operate in diverse and often challenging environments. The demand for off-the-road tires is further amplified by urbanization trends, as expanding cities necessitate improved transportation networks.Environmental concerns and sustainable practices

Environmental concerns and the adoption of sustainable practices have led to the development of eco-friendly off-the-road tire options, which represent a pivotal driver in the market. As the global community becomes increasingly aware of environmental issues, there is a growing emphasis on reducing the carbon footprint and conserving natural resources. In response, tire manufacturers have innovated to produce off-the-road tires with eco-friendly materials and designs that minimize environmental impact. These tires are designed to offer durability while also being energy-efficient and promoting fuel savings. Furthermore, governments and regulatory bodies have introduced stringent environmental regulations that encourage industries to adopt greener practices.Off-the-Road Tire Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the vehicle type, tire type, end-use, distribution channel, and rim size.Breakup by Vehicle Type:

- Mining Vehicles

- Construction & Industrial Vehicles

- Agricultural Vehicles

- Others

Agricultural vehicles accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes mining vehicles, construction & industrial vehicles, agricultural vehicles, and others. According to the report, agricultural vehicles represented the largest segment.In the agricultural vehicles segment, the key factor driving the segment is the mechanization and modernization of agriculture. Farms are increasingly adopting advanced machinery and equipment to enhance productivity and efficiency in food production. As traditional farming methods make way for mechanized processes, agricultural vehicles such as tractors and combines play a pivotal role.

The mining vehicles segment is driven by the increasing demand for minerals and metals globally. The expanding construction and infrastructure development projects have escalated the need for minerals and metals, prompting the mining industry to operate at full capacity. To meet this demand, mining vehicles require robust off-the-road tires that can withstand the rugged terrains of mining sites, ensuring the continuous extraction and transportation of essential resources.

The construction and industrial vehicles segment is propelled by the surge in construction activities across the globe. Urbanization, population growth, and the need for modern infrastructure have led to a steady increase in construction projects, ranging from buildings to transportation networks. Construction and industrial vehicles, including excavators, loaders, and cranes, rely heavily on off-the-road tires for their operations.

Moreover, the others segment encompasses a wide range of applications, including aviation ground support equipment, military and defense vehicles, forestry machinery, and recreational vehicles. The growth of the aviation industry drives the demand for specialized ground support equipment, which requires off-the-road tires designed for airport environments.

Breakup by Tire Type:

- Radial Tire

- Bias Tire

Bias tire holds the largest share in the industry

The report has provided a detailed breakup and analysis of the market based on the tire type. This includes radial tire and bias tire. According to the report, bias tire accounted for the largest market share.The bias tire segment is driven by the increasing demand from industries and applications that require robust and durable tires capable of withstanding heavy loads and challenging terrains. These tires find extensive use in the agricultural sector, where they are essential for tractors and farming equipment. The bias tire's cross-ply construction offers excellent load-bearing capacity, making it ideal for farm machinery that operates on uneven and muddy fields. Furthermore, the construction and mining industries rely on bias tires for their heavy-duty vehicles and earthmoving equipment. The ability of bias tires to provide stability and traction in harsh conditions makes them indispensable in these sectors.

Additionally, the radial tire segment is driven by the increasing emphasis on fuel efficiency, safety, and comfort in various industries. Radial tires have gained prominence in the automotive sector, where they are the preferred choice for passenger cars and commercial vehicles. Moreover, the radial tire's design offers enhanced grip, stability, and control, contributing to safer driving experiences. This segment also benefits from the growing adoption of radial tires in the trucking and logistics industry, as fuel efficiency plays a significant role in reducing operational costs. Additionally, the radial tire segment caters to the demands of the aviation industry, where aircraft tires require exceptional performance and durability.

Breakup by End-Use:

- OEM

- Replacement

OEM represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes OEM and replacement. According to the report, OEM accounted for the largest market share.The OEM segment is driven by the increasing demand for heavy machinery in various industries, including construction, mining, and agriculture. As these sectors experience growth and modernization, there is a parallel rise in the need for new heavy equipment that comes equipped with off-the-road tires as original equipment. OEMs strive to provide cutting-edge machinery that offers high performance, efficiency, and durability, and off-the-road tires are an integral part of this equation. Additionally, technological advancements play a significant role in the OEM segment, with manufacturers incorporating innovative tire designs and materials into their equipment to enhance overall performance and safety.

On the other hand, the replacement segment is influenced by factors such as wear and tear of existing off-the-road tires, maintenance requirements, and market dynamics. As off-the-road tires are subjected to harsh operating conditions in industries like mining and construction, they have a limited lifespan and need periodic replacement. The replacement market benefits from the continuous use of off-the-road tires across various industries, creating a steady demand for replacements. Moreover, the replacement segment is responsive to technological advancements and tire innovations, as end-users seek to upgrade their equipment with more advanced and efficient tire options.

Breakup by Distribution Channel:

- Online

- Offline

Offline dominates the market

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline. According to the report, offline represented the largest segment.The offline retail segment is driven by factors rooted in physical experiences and in-store shopping. This segment continues to thrive due to the enduring appeal of brick-and-mortar stores, where consumers can physically touch and try products before making a purchase. The offline segment places importance on location, as retailers strategically choose prime real estate to attract foot traffic. Additionally, in-store experiences, including customer service, visual merchandising, and interactive displays, play a pivotal role in driving sales. Social interaction and the sensory experience of shopping in physical stores remain key drivers in this segment.

The online retail segment is driven by the increasing prevalence of e-commerce platforms and the growing preference for online shopping among consumers. E-commerce has revolutionized the way consumers shop, offering convenience, a wide product selection, and the ability to shop from the comfort of one's home. The segment's growth is further fueled by advancements in technology, such as mobile shopping apps, secure payment gateways, and personalized shopping experiences through data analytics. Additionally, the COVID-19 pandemic accelerated the shift to online shopping, as consumers sought contactless and safe shopping alternatives.

Breakup by Rim Size:

- Below 29 inches

- 29-45 inches

- Above 45 inches

The below 29 inches segment is driven by the increasing demand for smaller off-the-road tires in applications, such as compact construction equipment, utility vehicles, and agricultural machinery. These tires are favored for their agility and versatility in navigating tight spaces and delivering high traction in various terrains. Furthermore, the segment benefits from technological advancements in tire manufacturing, which enable the production of smaller tires with enhanced performance characteristics.

In contrast, the 29-45 inches segment is primarily driven by the robust growth in the construction and mining industries, where medium-sized off-the-road tires find extensive use. These tires are essential for a wide range of heavy machinery, including loaders, articulated dump trucks, and graders. The demand for 29-45 inches off-the-road tires is closely tied to infrastructure development projects, urbanization, and the expansion of mining operations.

The above 45 inches segment represents the largest off-the-road tires and is driven by the monumental scale of mining and large construction projects. The demand for these massive tires arises from the requirement of colossal vehicles, such as haul trucks and earthmovers, used in open-pit mining and major infrastructure developments. The segment's growth is closely linked to the expansion of mining activities in resource-rich regions and the need for high-load-bearing tires capable of enduring extreme conditions.

Breakup by Region:

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- Saudi Arabia

- UAE

- South Africa

- Others

Asia Pacific leads the market, accounting for the largest off-the-road tire market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa (Saudi Arabia, UAE, South Africa and other). According to the report, Asia Pacific accounted for the largest market share.The Asia Pacific off-the-road tire market experiences robust growth due to the extensive construction and mining activities in countries like China, India, and Australia. These nations have large-scale infrastructure development projects and mining operations that heavily rely on off-the-road tires. The vast agricultural practices in India also drive the demand for agricultural off-the-road tires. Moreover, Asia-Pacific's increasing focus on sustainable and energy-efficient tire solutions, coupled with its expanding industrialization, accelerates the market growth.

The North America off-the-road tire market is driven by the increasing construction activities in the United States and Canada, which demand heavy-duty off-the-road tires for various construction equipment. Furthermore, the mining industry's expansion in this region necessitates off-the-road tires for haul trucks and excavators. The agricultural sector's modernization, particularly in the Midwest, fuels the demand for specialized agricultural off-the-road tires. Additionally, the region's focus on sustainability and environmental consciousness has led to the development of eco-friendly off-the-road tire options.

In Europe, the off-the-road tire market is primarily driven by infrastructure development projects, especially in Eastern European countries, where road construction and urbanization are on the rise. The agriculture sector in Western Europe, particularly in countries like France and Germany, contributes significantly to the demand for specialized agricultural off-the-road tires. Moreover, Europe's strict environmental regulations have accelerated the shift towards eco-friendly off-the-road tires, aligning with the region's sustainability goals.

In Latin America, the off-the-road tire market is propelled by the growth of mining activities in countries like Brazil and Chile. The construction sector in Latin America, driven by urbanization and infrastructure development, also contributes to the demand for off-the-road tires.

The Middle East and Africa off-the-road tire market benefits from infrastructure development projects, particularly in the Gulf Cooperation Council (GCC) countries. The mining industry in Africa, including regions like South Africa and Ghana, drives the demand for off-the-road tires.

Leading Key Players in the Off-the-Road Tire Industry:

The key players in the global off-the-road tire market are actively pursuing strategies to maintain and expand their market presence. The companies are investing heavily in research and development (R&D) to innovate and create technologically advanced off-the-road tire solutions that offer superior performance, durability, and sustainability. They are also focused on enhancing their production capabilities to meet the growing demand for off-the-road tires worldwide, particularly in regions with booming construction, mining, and agricultural sectors. Additionally, strategic partnerships, mergers, and acquisitions are common tactics employed by these key players to strengthen their market position and broaden their product portfolios. Furthermore, they are actively engaging in sustainable practices and eco-friendly tire manufacturing to align with global environmental regulations and cater to the increasing demand for greener solutions in the off-the-road tire market.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Apollo Tyres

- Balkrishna Industries Limited

- Bridgestone Corporation

- Cheng Shin Rubber Ind. Co. Ltd.

- China National Tire & Rubber Co. Ltd. (China National Chemical Corporation Limited)

- Continental AG

- Double Coin Holdings (Shanghai Huayi Group Corporation Limited)

- JK Tyre & Industries Ltd.

- Michelin

- Pirelli & C. S.p.A.

- The Goodyear Tire & Rubber Company

- Titan International Inc.

- Trelleborg Ab

- Yokohama Rubber Co. Ltd.

Key Questions Answered in This Report

1. How big is the global off-the-road tire market?2. What is the expected growth rate of the global off-the-road tire market during 2025-2033?

3. What are the key factors driving the global off-the-road tire market?

4. What has been the impact of COVID-19 on the global off-the-road tire market?

5. What is the breakup of the global off-the-road tire market based on the vehicle type?

6. What is the breakup of the global off-the-road tire market based on the tire type?

7. What is the breakup of the global off-the-road tire market based on the end-use?

8. What is the breakup of the global off-the-road tire market based on the distribution channel?

9. What are the key regions in the global off-the-road tire market?

10. Who are the key players/companies in the global off-the-road tire market?

Table of Contents

Companies Mentioned

- Apollo Tyres

- Balkrishna Industries Limited

- Bridgestone Corporation

- Cheng Shin Rubber Ind. Co. Ltd.

- China National Tire & Rubber Co. Ltd. (China National Chemical Corporation Limited)

- Continental AG

- Double Coin Holdings (Shanghai Huayi Group Corporation Limited)

- JK Tyre & Industries Ltd.

- Michelin

- Pirelli & C. S.p.A.

- The Goodyear Tire & Rubber Company

- Titan International Inc.

- Trelleborg Ab

- Yokohama Rubber Co. Ltd.

Table Information

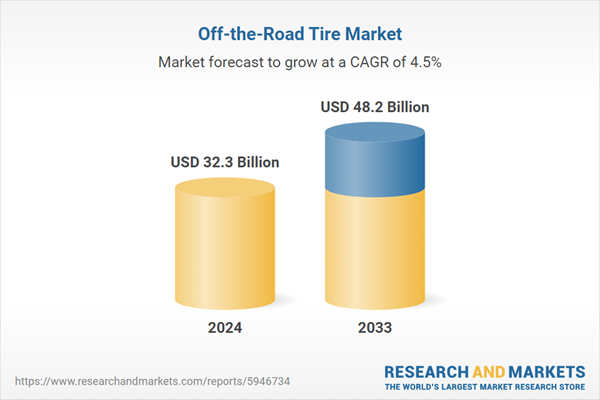

| Report Attribute | Details |

|---|---|

| No. of Pages | 148 |

| Published | August 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 32.3 Billion |

| Forecasted Market Value ( USD | $ 48.2 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |