Blast Valves Market Analysis:

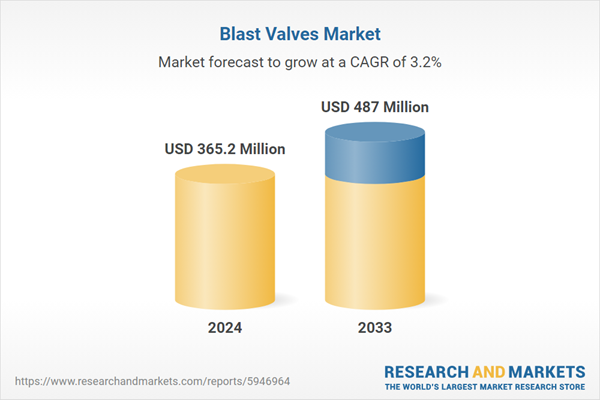

Market Growth and Size: The global blast valves market is experiencing steady growth, with a projected increase in market size over the coming years. Moreover, the market size is expanding due to the rising concerns about security and the need for blast-resistant structures in vulnerable areas, such as critical infrastructure and military installations.Major Market Drivers: Rapid urbanization and infrastructure development, growth in the renewable energy sector, stringent safety regulations and standards imposed by governments and regulatory bodies, increasing concerns in healthcare facilities, escalating product demand from oil and gas pipelines, and the need for blast mitigation in chemical plants are some of the key market drivers.

Technological Advancements: Continuous technological advancements in materials and design are enhancing the effectiveness of blast valves. Innovations include composite materials, real-time monitoring systems, and adaptive valve designs, making blast valves more efficient and reliable.

Industry Applications: Blast valves find applications across various industries, including defense, energy, manufacturing, transportation, healthcare, residential construction, and telecommunications, underscoring their versatility and wide-ranging utility.

Key Market Trends: Key market trends include integration of the product with the Internet of Things (IoT) and smart building systems, focus on lightweight and portable blast valves, availability of customized solutions for specific industry needs, growing popularity of blast-resistant glass, and increased collaboration between manufacturers and research institutions.

Geographical Trends: North America leads in the blast valves market due to stringent safety regulations, particularly in the defense and energy sectors. Europe also exhibits significant growth, driven by infrastructure development and increasing safety awareness. Asia-Pacific is an emerging market, with rapid industrialization and urbanization contributing to its growth potential.

Competitive Landscape: The market is characterized by the presence of both established players and emerging companies, driving innovation and quality in blast valve manufacturing.

Challenges and Opportunities: Challenges include the high initial cost of blast valves, the need for continuous technological upgrades, and varying industry-specific requirements. Opportunities lie in expanding applications, sustainability initiatives, and addressing emerging security threats, presenting a dynamic landscape for the blast valves market.

Blast Valves Market Trends:

Increasing concerns for safety and security

The global blast valves market is significantly influenced by the increasing concerns for safety and security across various industries. In recent years, there has been a growing recognition of the potential risks associated with explosive events, whether accidental or intentional. This has further compelled organizations to prioritize blast protection measures, leading to a surge in demand for blast valves. Industries such as defense, energy, and manufacturing have been particularly proactive in adopting blast-resistant solutions to safeguard their personnel and critical assets.Stringent government regulations and safety standards

Stringent government regulations and safety standards play a pivotal role in shaping the global blast valves market. Governments across the globe have enacted regulations that mandate the incorporation of blast-resistant solutions in various infrastructure projects. The regulations are aimed at minimizing the potential impact of explosive events on public safety and infrastructure integrity. As a result, industries involved in critical infrastructure, such as transportation and government facilities, are compelled to invest in blast protection systems, driving the market growth.Rising terrorism threats

The rise in terrorism threats globally has had a significant impact on the demand for blast valves. With the increasing frequency of terrorist attacks, there is a growing need for protective measures in place to mitigate the destructive effects of explosive incidents. Critical infrastructure facilities, in particular, have become prime targets for such threats. As a response to this heightened risk, organizations and government agencies are increasingly investing in blast-resistant solutions, including blast valves, to enhance security and safeguard human lives.Rapid technological advancements

Technological advancements in blast valve design and materials are driving innovation and adoption in the market. Manufacturers are continuously developing and refining blast-resistant solutions to improve their effectiveness and reliability. Advanced materials, such as composite materials and high-strength alloys, are being incorporated into blast valve construction, enhancing their resistance to explosive forces. Furthermore, innovative engineering designs are optimizing the performance of blast valves, making them more attractive to potential buyers.Blast Valves Industry Segmentation:

The publisher provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2025-2033. Our report has categorized the market based on the type and application.Breakup by Type:

- Galvanized Valve

- Stainless Steel Valve

Stainless steel valve holds the largest share in the industry

The report has provided a detailed breakup and analysis of the market based on the type. This includes galvanized valve and stainless steel valve. According to the report, stainless steel valve accounted for the largest market share.The stainless steel valve segment is driven by its exceptional resistance to corrosion, high-temperature applications, and versatility in various industries. Stainless steel valves are known for their durability and reliability in demanding environments, such as petrochemical, food processing, pharmaceuticals, and oil and gas. The pharmaceutical industry relies on stainless steel valves to maintain product purity and integrity. Moreover, the oil and gas sector utilize stainless steel valves in critical applications where resistance to harsh chemicals and extreme temperatures is paramount. The food and beverage (F&B) industry also benefits from stainless steel valves due to their hygienic properties and resistance to food-related substances.

The galvanized valve segment is driven by the increasing demand for corrosion-resistant valves in various industries, such as plumbing, water treatment, and chemical processing. They are specifically designed to withstand harsh environmental conditions, making them ideal for applications where corrosion poses a significant threat. Additionally, the construction and infrastructure sectors rely on galvanized valves for plumbing systems, as they offer long-term durability and reduced maintenance costs. Furthermore, the growth in water and wastewater treatment facilities worldwide contributes to the demand for galvanized valves, as they ensure the integrity of pipelines and water distribution systems.

Breakup by Application:

- Civil

- Military

Civil represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes civil and military. According to the report, civil accounted for the largest market share.The civil segment is driven by the increasing emphasis on safety and security across various industries. As urbanization and infrastructure development continue to expand, so does the need for blast-resistant solutions in critical infrastructure facilities. Industries such as energy, healthcare, telecommunications, and residential construction are increasingly adopting blast valves to protect their assets and ensure the safety of personnel. Moreover, the rising awareness of the potential risks associated with explosive events, whether accidental or intentional, is compelling organizations to invest in blast protection measures. Additionally, stringent government regulations and safety standards, which mandate the incorporation of blast-resistant solutions in infrastructure projects, play a pivotal role in propelling the civil segment.

On the other hand, the military segment is primarily driven by the evolving nature of modern warfare and national security priorities. Increasing defense budgets and the need to protect military personnel and assets from explosive threats have led to a growing demand for advanced blast-resistant technologies. The military segment benefits from technological advancements, with a focus on designing blast-resistant structures, vehicles, and equipment. Furthermore, research and development (R&D) efforts in the military segment are aimed at enhancing the survivability of military installations and vehicles in the face of explosive threats.

Breakup by Region:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

North America leads the market, accounting for the largest blast valves market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, North America accounted for the largest market share.The North America blast valves market is driven by the increasing emphasis on safety and security across various industries, including defense, energy, and manufacturing. Stringent government regulations and safety standards mandating the incorporation of blast-resistant solutions have propelled the demand for blast valves in critical infrastructure projects. In line with this, the growing threat of terrorism has further heightened the need for protective measures, boosting market growth. Moreover, the expansion of data centers, transportation facilities, and government buildings has created opportunities for blast valve adoption.

In Europe, the blast valves market is experiencing growth due to increasing safety concerns and infrastructure development. The region places a strong emphasis on safety regulations, driving the demand for blast-resistant solutions in various sectors. Infrastructure projects, such as transportation hubs and government buildings, require blast protection systems, further boosting market growth. Europe also witnesses technological advancements, particularly in materials and design, which enhance the efficiency of blast valves.

The Asia-Pacific blast valves market is driven by rapid industrialization, urbanization, and the need for safety measures. With infrastructure development projects on the rise, there is a growing demand for blast-resistant solutions in the region. The Asia-Pacific region also faces security challenges, contributing to the adoption of blast valves in critical infrastructure protection.

In Latin America, the blast valves market is influenced by increasing concerns for safety, especially in critical infrastructure projects. The region's energy sector and industrial growth contribute to the demand for blast valves, particularly in oil and gas applications.

The Middle East and Africa blast valves market is characterized by the need for blast mitigation in various industries, including oil and gas, defense, and infrastructure. With a focus on protecting critical assets and personnel, the region has witnessed an increased adoption of blast-resistant solutions. Additionally, government initiatives and investments in infrastructure projects further contribute to market growth.

Leading Key Players in the Blast Valves Industry:

Key players in the blast valves market are actively engaged in various strategic initiatives to maintain their competitive edge and cater to the evolving needs of the industry. They are investing in advanced materials, such as high-strength alloys and composite materials, to enhance the resilience and performance of their valves. Additionally, manufacturers are working on smart and connected blast valve solutions, incorporating Internet of Things (IoT) technology to provide real-time monitoring and rapid response capabilities. Moreover, some major players are expanding their market presence through mergers, acquisitions, and partnerships. Simultaneously, companies are emphasizing sustainability by adopting eco-friendly materials and manufacturing processes, aligning with global environmental concerns and regulations. Furthermore, they are providing customized blast-resistant solutions tailored to specific industry requirements, offering flexibility and efficiency to their clients.The market research report has provided a comprehensive analysis of the competitive landscape. Detailed profiles of all major companies have also been provided.

Some of the key players in the market include:

- Andair AG

- Beth-El Zikhron Yaaqov Industries Ltd.

- Disaster Bunker

- European EMC Products

- FUCARE

- Halton Group

- SagiCofim spa

- Temet

Key Questions Answered in This Report

- How big is the global blast valves market?

- What is the expected growth rate of the global blast valves market during 2025-2033?

- What are the key factors driving the global blast valves market?

- What has been the impact of COVID-19 on the global blast valves market?

- What is the breakup of the global blast valves market based on the type?

- What is the breakup of the global blast valves market based on the application?

- What are the key regions in the global blast valves market?

- Who are the key players/companies in the global blast valves market?

Table of Contents

Companies Mentioned

- Andair AG

- Beth-El Zikhron Yaaqov Industries Ltd.

- Disaster Bunker

- European EMC Products

- FUCARE

- Halton Group

- SagiCofim spa

- Temet

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 144 |

| Published | March 2025 |

| Forecast Period | 2024 - 2033 |

| Estimated Market Value ( USD | $ 365.2 Million |

| Forecasted Market Value ( USD | $ 487 Million |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |