Rising initiatives by regulatory authorities is predicted to propel the market growth during the forecast period. Chromatography software is the term for professional computer applications developed for data processing and interpretation using chromatographic methods. Using a stationary phase and a mobile phase as well as other physical and chemical characteristics, chromatography is a laboratory method that may be used to separate and analyze mixtures of chemicals. For instance, in January 2022, According to Waters Corporation, Waters Empower Chromatography Data Software (CDS) and NuGenesis Laboratory Management Software (LMS) have been bought by the Office of Regulatory Affairs (ORA) of the U.S. Food and Drug Administration. This marks an extension of the FDA's use of Waters' software, which now aids its medical products testing operations in all five of its field science laboratories.

By type, integrated was the highest revenue-grossing segment in the global chromatography software market in 2023 owing to the rise in the need for workflow integration to support efficient coordination and communication that yields precise results rapidly, as well as an increase in the introduction of cutting-edge technologies. For instance, in August 2022, During the International Mass Spectrometry Conference (IMSC 2022), Bruker Corporation introduced several innovations, including the nanoElute 2 nano-LC, MetaboScape, and TASQ 2023 software designed for fluxomics. Also, they presented developments in PaSERs intelligent acquisition, which are intended to enhance studies of protein-protein interactions (PPIs) and applications related to metaproteomics. Additionally, standalone is predicted to grow at the fastest CAGR during the forecast period owing to its enhanced in-depth reporting capabilities, the standalone attributes of the chromatography software enable the generation of highly detailed and focused data and reports. As a result, the program has been used more frequently.

By deployment model, web and cloud-based was the highest revenue-grossing segment in the global chromatography software market in 2023 owing to the increased flexibility, rapid accessibility, simplified data backup, and reduced handling costs, along with real-time tracking and storage of data, offer advantages. Moreover, the provision of huge storage space for vast amounts of data, coupled with remote access from any location and device, is contributing to the growing adoption. The ongoing introduction of new platforms is further fueling this trend. For instance, in August 2023, DataApex is pleased to declare the launch of Clarity 9.0, featuring numerous new functions and improvements. Additionally, on-premise is predicted to grow at the fastest CAGR during the forecast period as it provides features such as seamless data retrieval, robust data security & privacy measures, and straightforward data access. Furthermore, the software offers customization options, hassle-free installation, and full control over its operations and functionality.

By application, pharmaceutical industry was the highest revenue-grossing segment in the global chromatography software market in 2023 owing to the rising demand for pharmaceutical products, a rise in the introduction of novel solutions, and increased use of the purified chemicals by the pharmaceutical sector for manufacturing large quantities of highly pure materials and analyze them for trace impurities. For instance, in October 2023, Resolvex Prep, a tabletop automation system for mid-range chromatography sample preparation, was introduced by Tecan. This instrument is set to improve the effectiveness, precision, and dependability of chromatography sample preparation, impacting fields such as analytical chemistry, proteomics, and biomedical research applications. Additionally, environmental testing segment is predicted to grow at the fastest CAGR during the forecast period owing to the increase in the use of chromatographic methods to determine environmental conditions and irregularities. The analysis of contaminants in water and the presence of volatile organic compounds in the atmosphere by chromatography aids in environmental monitoring, which raises the need for chromatography software even more.

North America region is anticipated for the highest revenue share during the forecast period owing to the increasing use of technology in laboratory testing, regulations that encourage its use to produce reliable results, rising levels of digital literacy, the development of cutting-edge infrastructure, the presence of major industry players, and the frequent introduction of new products. For instance, in June 2023, Agilent Technologies introduced two novel liquid chromatography mass spectrometry systems (LC/MS), namely the Agilent 6495D LC/TQ and the Agilent Revident LC/Q-TOF. In conjunction with the advanced capabilities of the Revident LC/Q-TOF, Agilent is also revealing the Agilent MassHunter Explorer Profiling software and the Agilent ChemVista library manager software. Additionally, Asia Pacific region is predicted to grow at fastest CAGR during the forecast period owing to the increased use of chromatography technology in a variety of settings, such as drug, forensic, environmental, and food testing, positive government initiatives regarding automation of laboratory processes, rising awareness, growing adoption of technology in laboratories and an increase in market player collaborations. For instance, in June 2023, Waters Corporation and Sartorius have entered into a collaboration to develop integrated analytical solutions for downstream biomanufacturing, building upon their initial joint agreement focused on upstream bioprocessing analytics. The integration of software and hardware between the Waters PATROL UltraPerformance Liquid Chromatography (UPLC) Process Analysis System and the Sartorius Resolute BioSMB multi-column chromatography platform will provide bioprocess engineers with extensive analytical data for both downstream batch and continuous manufacturing. This integration aims to enhance yields, minimize waste, and reduce biomanufacturing costs.

Report Scope:

- Base Year: 2023

- Forecast Period: 2024-2034

Study Coverage

- Market Forecast by Type, Material, Product, and End-user

- Market Forecast for 5 Regions and 17+ Countries

- North America (U.S. and Canada)

- Europe (Germany, France, UK, Spain, Italy, Russia, Rest of Europe)

- Asia Pacific (China, Japan, India, Australia, South Korea, Rest of APAC)

- Latin America (Brazil, Mexico, Argentina, Rest of LATAM)

- MEA (South Africa, GCC, Rest of MEA)

- Exhaustive Company Profiles of Top 10+ Major Market Players

- 20% Free Customization Available to Meet Your Exact Requirement.

Segmentation: Chromatography Software Market Report 2023 - 2034

Chromatography Software Market Analysis & Forecast by Type 2023 - 2034 (Revenue USD Bn)

- Integrated

- Standalone

Chromatography Software Market Analysis & Forecast by Deployment Model 2023 - 2034 (Revenue USD Bn)

- Web & Cloud-Based

- On-premise

Chromatography Software Market Analysis & Forecast by Application 2023 - 2034 (Revenue USD Bn)

- Pharmaceutical Industry

- Environmental Testing

- Food Industry

- Forensic Testing

Chromatography Software Market Analysis & Forecast by Region 2023 - 2034 (Revenue USD Bn)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Rest of LATAM

- Middle East & Africa

- South Africa

- GCC

- Rest of MEA

Table of Contents

Companies Mentioned

- Bruker Corporation

- Waters Corporation

- Restek Corporation

- Gilson Inc.

- Shimadzu Corporation

- Cytiva

- Scion Instruments

- DataApex

- KNAUER

- Agilent Technologies Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2024 |

| Forecast Period | 2023 - 2034 |

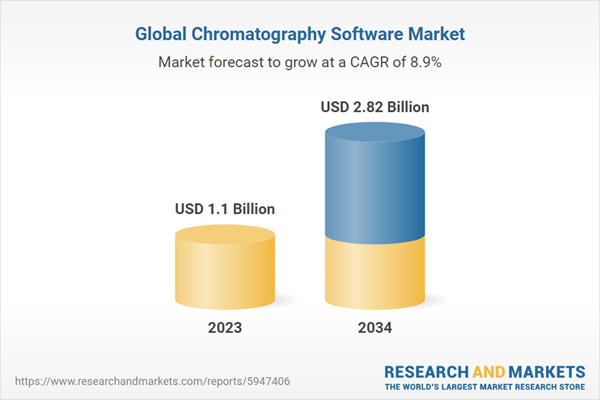

| Estimated Market Value ( USD | $ 1.1 Billion |

| Forecasted Market Value ( USD | $ 2.82 Billion |

| Compound Annual Growth Rate | 8.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |