Online channels such as e-commerce websites and social media platforms allow major companies to reach a broad consumer base. It offers consumers distinct cut vegetable choices in terms of product range, packaging, and brands from different regions. Online channels provide customers with varied options, thereby catering to different consumer preferences. Online sales allow companies to streamline the distribution of products and adjust inventory levels based on product demand data. This further allows key manufacturers to understand region-wise consumer preferences and optimize product offerings.

The pandemic further accelerated the growth of e-commerce, leading to a pertinent need for building warehouses across Saudi Arabia. The emergence of e-commerce has transformed how people shop and purchase food products. The growing penetration of the internet and smartphones, quick access to emerging technologies, rising purchasing power, and convenience provided by online retail shopping platforms are among the key factors bolstering e-commerce. Online retail channel bridges the gap between product manufacturers and consumers through direct delivery from their inventories to the global audience through express delivery options. Hence, the emergence of online sales channels would offer potential business opportunities to the cut vegetable manufacturers in the coming years.

The emphasis on organic cut vegetables also aligns with a desire for transparency in the food supply chain. Consumers are seeking information about the origins of their food, and the organic label assures that the produce has met specific standards of cultivation. This demand for transparency reflects a growing consciousness about the impact of food choices on personal well-being, environmental sustainability, and the local economy. According to Business Start Up Saudi Arabia, the number of organic farms increased by 28% in 2021, due to the country’s US$ 200 million strategy for innovation plan. The plan aims to increase the capacity of organic farming by 300% in the coming years. The country also introduced a traceability mechanism to offer product transparency to consumers. Thus, growing preferences for organic cut vegetables are expected to create a potential business in the cut vegetables market during the forecast period.

Based on end user, the Saudi Arabia cut vegetables market is segmented into food processing, foodservice, and food retail. The food retail segment holds significant market share in 2022. The lifestyle of consumers has evolved due to hectic work schedules and rising dependency on convenience food, ready-to-use ingredients and ready-to-eat food. Convenience food ingredients allow household consumers to save time and effort associated with meal preparation, cooking, consumption, and post-meal activities. Due to hectic work schedules, consumers prefer to be efficient with their time and avoid tedious tasks. Some consumers are willing to pay a premium for specialty cuts and organic pre-cut vegetables, contributing to the overall growth of the market segment.

Almunajem Foods Co, Uhrenholt AS, Afdan Co, Grimmway Enterprises Inc, Ovochi, The Egyptian Saudi Food Industries Co, Del Monte Foods (UAE) FZE, Sunbulah Food & Fine Pastries Manufacturing Co Ltd, BRF SA, and Mondial Foods BV are among the key players operating in the Saudi Arabia cut vegetables market.

The overall Saudi Arabia cut vegetables market size has been derived using primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs; business development managers; market intelligence managers; national sales managers; and external consultants, including valuation experts, research analysts, and key opinion leaders, specializing in the Saudi Arabia cut vegetables market.

Reasons to Buy

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Saudi Arabia cut vegetables market, thereby allowing players to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

Table of Contents

Companies Mentioned

- Almunajem Foods Co

- Uhrenholt AS

- Afdan Co

- Grimmway Enterprises Inc

- Ovochi

- The Egyptian Saudi Food Industries Co

- Del Monte Foods (U.A.E.) FZE

- Sunbulah Food & Fine Pastries Manufacturing Co Ltd

- BRF SA

- Mondial Foods BV

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | February 2024 |

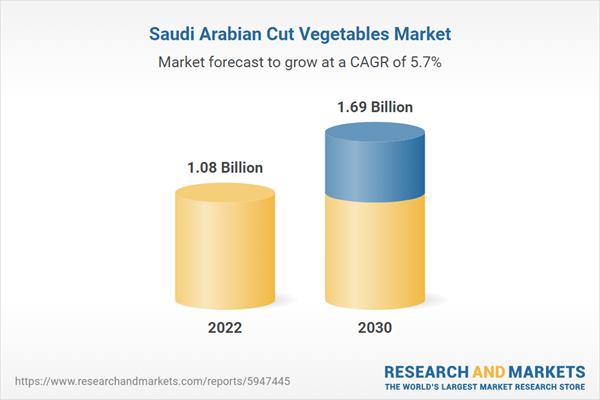

| Forecast Period | 2022 - 2030 |

| Estimated Market Value in 2022 | 1.08 Billion |

| Forecasted Market Value by 2030 | 1.69 Billion |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |