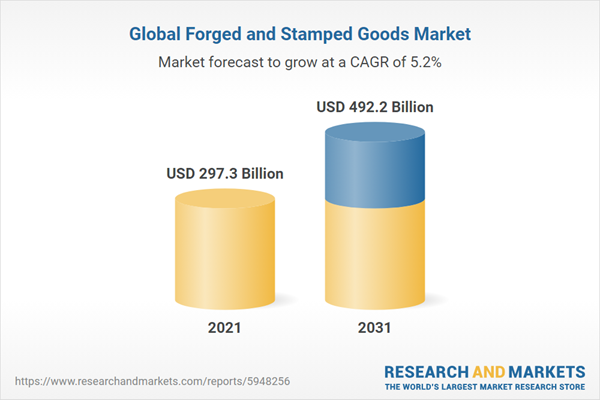

The global forged and stamped goods market reached a value of nearly $297.32 billion in 2023, having grown at a compound annual growth rate (CAGR) of 3.44% since 2018. The market is expected to grow from $297.32 billion in 2023 to $384.83 billion in 2028 at a rate of 5.30%. The market is then expected to grow at a CAGR of 5.04% from 2028 and reach $492.19 billion in 2033.

Growth in the historic period resulted from the emerging market growth, rapid growth in the automotive industry, increase in industrialization, rise in government support and expansion of the steel sector. Factors that negatively affected growth in the historic period were global supply chain disruptions and high costs of gas manufacturing.

Going forward, the rapid urbanization, increasing metal consumption by the aerospace sector and investment in infrastructure will drive the growth. Factor that could hinder the growth of the forged and stamped goods market in the future include skills shortages in the mining sector, presence of substitutes and stringent government regulations.

The forged and stamped goods market is segmented by type into iron and steel forging (or forged iron and steel goods), nonferrous forging (or forged nonferrous metal goods), custom roll forming (or rolled metal goods), powder metallurgy part manufacturing (or molded metal parts) and metal crown, closure and other metal stamping (or stamped metal goods). The metal crown, closure and other metal stamping market was the largest segment of the forged and stamped goods market segmented by type, accounting for 38.3% or $113.94 billion of the total in 2023. Going forward, the nonferrous forged goods segment is expected to be the fastest growing segment in the forged and stamped goods market segmented by type, at a CAGR of 6.92% during 2023-2028.

The forged and stamped goods market is segmented by end user industry into automotive, construction, food and beverage packaging, machinery, metal products and others end user industries. The automotive market was the largest segment of the forged and stamped goods market segmented by type of expenditure, accounting for 34.1% or $101.38 billion of the total in 2023. Going forward, the other end user industries segment is expected to be the fastest growing segment in the forged and stamped goods market segmented by type of expenditure, at a CAGR of 5.57% during 2023-2028.

Asia Pacific was the largest region in the forged and stamped goods market, accounting for 43.3% or $128.7 billion of the total in 2023. It was followed by Western Europe, North America and then the other regions. Going forward, the fastest-growing regions in the forged and stamped goods market will be Middle East and South America where growth will be at CAGRs of 16.8% and 11.5% respectively. These will be followed by Western Europe and Eastern Europe where the markets are expected to grow at CAGRs of 6.3% and 4.5% respectively.

The global forged and stamped goods market is fragmented, with a large number of small players operating in the market. The top ten competitors in the market made up to 6.75% of the total market in 2022. The market fragmentation can be attributed to the presence of large number of players in different geographies. Prominent players are acquiring the products and entering into partnerships with the other companies to consolidate their market positions across the globe, while others are distributing products. ArcelorMittal S.A. was the largest competitor with a 2.28% share of the market, followed by Berkshire Hathaway Inc. with 1.32%, Kobe Steel, Ltd. with 0.60%, American Axle & Manufacturing, Inc. with 0.60%, Bharat Forge Limited with 0.53%, ThyssenKrupp AG with 0.52%, Aichi Steel Corporation with 0.31%, Illinois Tool Works Inc. with 0.26%, ATI Inc with 0.16% and CITIC Heavy Industries Co.,Ltd. with 0.16%.

The top opportunities in the forged and stamped goods market segmented by type will arise in the metal crown, closure, and other metal stamped goods segment, which will gain $35.2 billion of global annual sales by 2028. The top opportunities in the forged and stamped goods market segmented by end user industry will arise in the automotive segment, which will gain $29.1 billion of global annual sales by 2028. The forged and stamped goods market size will gain the most in Turkey at $13.2 billion.

Market-trend-based strategies for the forged and stamped goods market include new technology development to provide comparable or even superior products, strategically investing, to expand and build new metal stamping facilities and expand their product portfolio, mergers and acquisitions to improve their financial strength, using robotics and automation to improve plant efficiency and productivity, focus on partnerships and collaborations.

Player-adopted strategies in the forged and stamped goods market include focuses on strengthening business operations through strategic investments, focuses on enhancing its business operations through strategic acquisitions.

To take advantage of the opportunities, the analyst recommends the forged and stamped goods companies to focus on technological advancements for enhanced product capabilities, focus on production facility expansion initiatives, focus on leveraging robotics and automation for enhanced efficiency, focus on innovating through R&D for metal stamping solutions, focus on nonferrous forged goods for accelerated growth, expand in emerging markets, continue to focus on developed markets, focus on strategic collaborations for market expansion, focus on diversifying distribution channels, provide competitively priced offerings, focus on strategic pricing for market competitiveness, participate in trade shows and events, continue to use B2B promotions, prioritize digital engagement for enhanced brand visibility, focus on growing opportunities in other end user industries and diversify offerings to cater to growing automotive demands.

Table of Contents

Executive Summary

Forged and Stamped Goods Global Market Opportunities and Strategies to 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global forged and stamped goods market as it emerges from the COVID-19 shut down.Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 50 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description:

Where is the largest and fastest-growing market for forged and stamped goods? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The forged and stamped goods market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider forged and stamped goods market; and compares it with other markets.

The report covers the following chapters:

Introduction and Market Characteristics

Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by type and by end user industry in the market.Product Analysis

The product analysis section of the report describes the leading products in the forged and stamped goods market, along with key features and differentiators for those products.Supply Chain

The supply chain section of the report defines and explains the key players in the forged and stamped goods industry supply chain.Customer Information

The chapter covers recent customer trends/preferences in the global forged and stamped goods market.Key Trends

Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.Macro-Economic Scenario

The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the forged and stamped goods market.Global Market Size and Growth

Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.Regional and Country Analysis

Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.Market Segmentation

Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by type and by end user industry in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.Regional Market Size and Growth

Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.Competitive Landscape

Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.Key Mergers and Acquisitions

Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.Market Opportunities and Strategies

Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.Conclusions and Recommendations

This section includes recommendations for forged and stamped goods providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.Market Background

: Metal Products Market - This chapter describes the metal products market of which the forged and stamped goods market is a segment. This chapter includes the global metal products market characteristics and (2018-23, 2028F) values and regional analyses for the metal products market.Appendix

This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.Scope

Markets Covered:

1) by Type: Iron and Steel Forging (Or Forged Iron and Steel Goods); Nonferrous Forging (Or Forged Nonferrous Metal Goods); Custom Roll Forming (Or Rolled Metal Goods); Powder Metallurgy Part Manufacturing (Or Molded Metal Parts); Metal Crown, Closure and Other Metal Stamping (Or Stamped Metal Goods)2) by End User Industry: Automotive; Construction; Food and Beverage Packaging; Machinery; Metal Products; Other End User Industries.

Key Companies Mentioned: ArcelorMittal S.A; Berkshire Hathaway Inc.; Kobe Steel, Ltd; American Axle & Manufacturing, Inc; Bharat Forge Limited

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Brazil; France; Germany; UK; Russia; Czech Republic; Poland; Romania; Ukraine;Austria; Belgium; Denmark; Finland; Ireland; Italy; Netherlands; Norway; Portugal; Spain; Sweden; Switzerland; Egypt; Nigeria; South Africa; Iran; Israel; Saudi Arabia; Turkey; UAE; Argentina; Chile; Colombia; Peru; Canada; Mexico; Vietnam; Thailand; Singapore; Philippines; New Zealand; Malaysia; Hong Kong

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; forged and stamped goods indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- ArcelorMittal S.A

- Berkshire Hathaway Inc.

- Kobe Steel, Ltd

- American Axle & Manufacturing, Inc.

- Bharat Forge Limited

- ThyssenKrupp AG

- Aichi Steel Corporation

- Illinois Tool Works Inc.

- ATI Inc

- CITIC Heavy Industries Co.,Ltd.

- Forge Bros Engineering

- Bharat Forge Ltd

- Fine Sinter Co., Ltd.

- ALS Australia

- BHP Group Limited

- Tata Bluescope Steel Limited

- Ramakrishna Forgings Limited (RKFL)

- Mahindra CIE Automotive Limited (MCIE)

- Ahmednagar Forgings & Steel Industries Limited (AFSIL)

- Shanghai Baosteel Group Corporation (SBG)

- Jiangxi Daye Group Co., Ltd.

- Shandong Yulong Forging Co., Ltd.

- Hebei Chengde Precision Forging Co., Ltd.

- Zhejiang Yongan Forging Co., Ltd.

- Acro Metal Stamping

- Manor Tool & Manufacturing Company

- Klesk Metal Stamping Co

- Clow Stamping Company

- Goshen Stamping Company

- AAPICO Hitech Public Company Limited

- Mospressare

- Lada-Press

- Largo

- Electromash

- Novolipetsk Steel (NLMK)

- Magnitogorsk Iron and Steel Works (MMK)

- Severstal

- Zavod Met Alloform

- All Metals & Forge Group, LLC

- Ken Forging, Inc

- Milwaukee Forge

- D&H Industries Inc

- Kenmode Inc

- Tempco Manufacturing Company Inc

- Precision Castparts

- Arcelor Mittal AG

- Ternium Argentina S.A.

- Gestamp Automoción, S.A.

- Associated Spring Do Brasil Ltda

- Aperam

- Gerdau

- Sinobras

- Alico Industries Company Limited

- Urbanstudio

- Amajed Industries

- Arabian International Company Aic Steel

- Qatar Steel

- Qatar Blue Steel Factory WLL

- Ezz Steel

- Kandil Steel Company

- Omega Egypt

- Smith’s Manufacturing (Pty) Ltd

- Mahle Behr South Africa

- Feltex Fehrer

- Tuyauto Gestamp Morocco SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 346 |

| Published | March 2024 |

| Forecast Period | 2021 - 2031 |

| Estimated Market Value ( USD | $ 297.3 Billion |

| Forecasted Market Value ( USD | $ 492.2 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 65 |