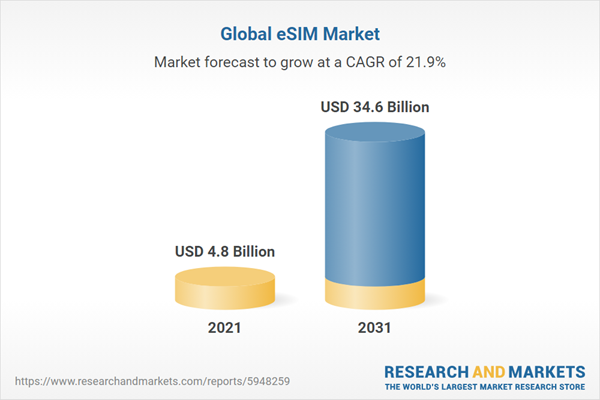

The global eSIM market reached a value of nearly $4.78 billion in 2023, having grown at a compound annual growth rate (CAGR) of 29.8% since 2018. The market is expected to grow from $4.78 billion in 2023 to $14.83 billion in 2028 at a rate of 25.4%. The market is then expected to grow at a CAGR of 18.5% from 2028 and reach $34.62 billion in 2033.

Growth in the historic period resulted from the increasing demand for connected cars, increasing demand for consumer electronics and emerging markets growth. Factors that negatively affected growth in the historic period were lack of technological awareness.

Going forward, growth in number of IoT devices, increased adoption of eSIM-connected devices, increasing penetration of smartphones and increasing internet penetration will drive the growth. Factor that could hinder the growth of the eSIM market in the future include intensifying security threats.

The eSIM market is segmented by solution into hardware and connectivity services. The connectivity services market was the largest segment of the eSIM market segmented by solution, accounting for 88.6% or $4.24 billion of the total in 2023. Going forward, the connectivity services segment is expected to be the fastest growing segment in the eSIM market segmented by solution, at a CAGR of 25.7% during 2023-2028.

The eSIM market is segmented by application into connected car, smartphone and tablet, wearable device and others applications. The connected car market was the largest segment of the eSIM market segmented by application, accounting for 39.2% or $1.87 billion of the total in 2023. Going forward, the smartphone and tablet segment is expected to be the fastest growing segment in the eSIM market segmented by application, at a CAGR of 28.8% during 2023-2028.

The eSIM market is segmented by vertical into automotive, consumer electronics, energy and utilities, manufacturing, retail and other verticals. The automotive market was the largest segment of the eSIM market segmented by vertical, accounting for 39.6% or $1.89 billion of the total in 2023. Going forward, the consumer electronics segment is expected to be the fastest growing segment in the eSIM market segmented by vertical, at a CAGR of 27.9% during 2023-2028.

North America was the largest region in the eSIM market, accounting for 36.9% or $1.76 billion of the total in 2023. It was followed by Asia Pacific, Western Europe and then the other regions. Going forward, the fastest-growing regions in the eSIM market will be Asia Pacific and North America where growth will be at CAGRs of 28.9% and 25.2% respectively. These will be followed by Western Europe and South America where the markets are expected to grow at CAGRs of 24.6% and 24.1% respectively.

The global eSIM market is highly concentrated, with a large number of players operating in the market. The top ten competitors in the market made up to 64.4% of the total market in 2022. The market concentration can be attributed to the presence of large number of players in different geographies. Prominent players are acquiring the products and entering into partnerships with the other companies to consolidate their market positions across the globe, while others are distributing products. STMicroelectronics N.V. was the largest competitor with a 11.8% share of the market, followed by Idemia with 9.8%, ARM Limited with 9.3%, Thales Group with 8.1%, Infineon Technologies AG with 6.1%, Deutsche Telekom AG (T-Mobile) with 5.7%, Vodafone Group with 5.3%, Giesecke+Devrient Mobile Security GmbH with 3.8%, Tata Communications with 3% and Eastcompeace with 1.4%.

The top opportunities in the eSIM market segmented by solution will arise in the connectivity services segment, which will gain $9.04 billion of global annual sales by 2028. The top opportunities in the eSIM market segmented by application will arise in the smartphone and tablet segment, which will gain $4.1 billion of global annual sales by 2028. The top opportunities in the eSIM market segmented by vertical will arise in the automotive segment, which will gain $4.06 billion of global annual sales by 2028. the eSIM market size will gain the most in the USA at $3.11 billion.

Market-trend-based strategies for the eSIM market include innovative eSIM launches to offer global connectivity, adoption of AI in eSIM to enhance user experience, technological advances in eSIMs to offer improved connectivity for IoT devices, 5G eSIM cloud platforms to improve security and efficiency of eSIM services, new product launches for seamless user experience and strategic partnerships and collaborations among market players to drive innovation in the market.

Player-adopted strategies in the eSIM market include strengthening business operations through introducing new products, strengthening operational capabilities through strategic partnerships and enhancing its business operations through investments.

To take advantage of the opportunities, the analyst recommends the eSIM companies to embrace global connectivity revolution with innovative eSIM solutions, focus on AI integration for personalized eSIM experiences, focus on seamless IoT connectivity solutions, focus on continuous product innovation, expand in emerging markets, continue to focus on developed markets, focus on strategic partnerships for market growth, provide competitively priced offerings, focus on strategic pricing, participate in trade shows and events, continue to use B2B promotions, focus on strategic promotion, focus on customer-centric approaches to enhance eSIM adoption and focus on connected car and smartphone/tablet segments.

Table of Contents

Executive Summary

eSIM Global Market Opportunities and Strategies to 2033 provides the strategists; marketers and senior management with the critical information they need to assess the global eSIM market as it emerges from the COVID-19 shut down.Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 12 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies based on local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Description:

Where is the largest and fastest-growing market for eSIM? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The eSIM market global report answers all these questions and many more.The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market’s history and forecasts market growth by geography. It places the market within the context of the wider eSIM market; and compares it with other markets.

The report covers the following chapters:

Introduction and Market Characteristics

Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by solution, by application and by vertical.Key Trends

Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.Macro-Economic Scenario

The report provides an analysis of the impact of the COVID-19 pandemic, impact of the Russia-Ukraine war and impact of rising inflation on global and regional markets, providing strategic insights for businesses in the eSIM market.Global Market Size and Growth

Global historic (2018-2023) and forecast (2023-2028, 2033F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.Regional and Country Analysis

Historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison by region and country.Market Segmentation

Contains the market values (2018-2023) (2023-2028, 2033F) and analysis for each segment by solution, by application and by vertical in the market. Historic (2018-2023) and forecast (2023-2028) and (2028-2033) market values and growth and market share comparison by region market.Regional Market Size and Growth

Regional market size (2023), historic (2018-2023) and forecast (2023-2028, 2033F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.Competitive Landscape

Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.Key Mergers and Acquisitions

Information on recent mergers and acquisitions in the market covered in the report. This section gives key financial details of mergers and acquisitions, which have shaped the market in recent years.Market Opportunities and Strategies

Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.Conclusions and Recommendations

This section includes recommendations for eSIM providers in terms of product/service offerings geographic expansion, marketing strategies and target groups.Appendix

This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.Scope

Markets Covered:

1) by Solution: Hardware; Connectivity Services2) by Application: Connected Car; Smartphone and Tablet; Wearable Device; Other Applications.

3) by Vertical: Automotive; Consumer Electronics; Energy and Utilities; Manufacturing; Retail; Other Verticals.

Key Companies Mentioned: STMicroelectronics N.V.; Idemia; ARM Limited; Thales Group; Infineon Technologies AG

Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Brazil; France; Germany; UK; Russia

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; eSIM indicators comparison.

Data Segmentation: Country and regional historic and forecast data; market share of competitors; market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Companies Mentioned

- STMicroelectronics N.V.

- Idemia

- ARM Limited

- Thales Group

- Infineon Technologies AG

- Deutsche Telekom AG (T-Mobile)

- Vodafone Group

- Giesecke+Devrient Mobile Security GmbH

- Tata Communications

- Eastcompeace

- Bharti Airtel

- Reliance Jio Infocomm

- Vodafone Idea

- Airtel

- BSNL

- MTNL

- Holafly

- Airalo

- SimOptions

- EE

- O2

- Telekom AG

- Lyca Mobile

- Sky

- Giffgaff

- Holafly

- Bouygues My European eSIM

- MTS eSIM

- Manet

- AloSIM

- Nomad

- T-Mobile Polska S.A

- CETIN a.s

- Nordic Telecom s.r.o

- US Mobile

- T-Mobile US Inc

- Verizon

- Sierra Wireless

- KORE Wireless Group

- TIM Brasil

- Airalo

- Claro Brasil

- Simply

- eSimplified

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 259 |

| Published | March 2024 |

| Forecast Period | 2021 - 2031 |

| Estimated Market Value ( USD | $ 4.8 Billion |

| Forecasted Market Value ( USD | $ 34.6 Billion |

| Compound Annual Growth Rate | 21.9% |

| Regions Covered | Global |

| No. of Companies Mentioned | 44 |