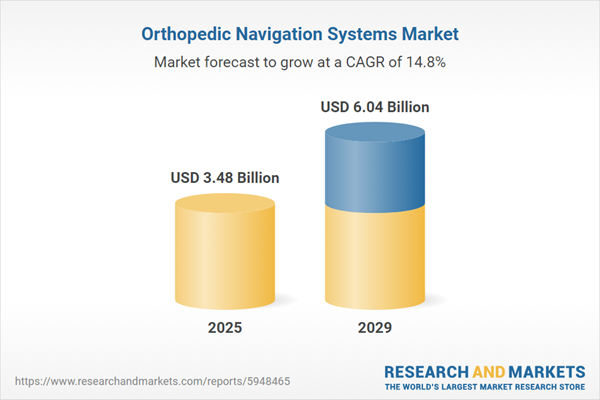

The orthopedic navigation systems market size has grown rapidly in recent years. It will grow from $3.03 billion in 2024 to $3.48 billion in 2025 at a compound annual growth rate (CAGR) of 14.8%. The growth in the historic period can be attributed to increasing aging population, rise in orthopedic disorders, growing patient preference for non-invasive treatments, surge in sports-related injuries, increased focus on outcomes and patient safety, collaboration between surgeons and technology developers.

The orthopedic navigation systems market size is expected to see rapid growth in the next few years. It will grow to $6.04 billion in 2029 at a compound annual growth rate (CAGR) of 14.8%. The growth in the forecast period can be attributed to continuous growth in aging population, expansion of orthopedic procedures, emphasis on value-based healthcare, focus on cost-effectiveness and efficiency, global collaboration in orthopedic research, patient-centric orthopedic care trends. Major trends in the forecast period include emergence of navigation systems for robotic-assisted total hip arthroplasty, utilization of machine learning algorithms, application of navigation systems in pediatric orthopedics, integration of navigation systems with patient electronic health records (ehr), shift towards subscription-based models.

The anticipated increase in cases of joint reconstruction is expected to drive the growth of the orthopedic navigation systems market in the future. Joint reconstruction involves a surgical approach where damaged or arthritic joint components are removed and replaced with artificial implants crafted from materials such as metal, plastic, or ceramics. Orthopedic navigation systems play a crucial role by providing guidance and evaluating various intraoperative factors during joint replacement or arthroplasty procedures. These systems find application in diverse joint reconstruction surgeries, including total knee arthroplasty, kinematic assessment, hip replacement surgery, and more. In November 2022, the American Joint Replacement Registry (AJRR) annual report published by the American Academy of Orthopedic Surgeons (AAOS) revealed a 14% overall cumulative procedural volume growth in hip and knee arthroplasty procedures in 2022 compared to the previous year. Additionally, the total number of total joint arthroplasty care procedures submitted by ambulatory surgical centers (ASCs) increased by 57% from 2021. Hence, the surge in joint reconstruction cases is a key driver of the orthopedic navigation systems market's growth.

The increasing prevalence of orthopedic disorders is expected to drive the growth of the orthopedic navigation systems market in the coming years. Orthopedic disorders encompass a range of conditions that affect the musculoskeletal system, such as arthritis, osteoarthritis, rheumatoid arthritis, bursitis, and various issues related to bones, joints, and soft tissues. Orthopedic navigation systems are crucial in providing real-time guidance and accurate navigation during surgeries, helping surgeons perform complex procedures with enhanced precision. For example, in June 2024, the Australian Institute of Health and Welfare (AIHW), a government agency based in Australia, reported that the mortality rate from chronic musculoskeletal conditions among women aged 85 and older increased from 1,047 deaths in 2021 to 1,141 deaths in 2022. Thus, the rising incidence of orthopedic disorders is driving the growth of the orthopedic navigation systems market.

Leading companies in the orthopedic navigation systems market are increasingly focusing on developing safer, faster, and more precise surgical technologies, such as visible light and machine-vision algorithms, to gain a competitive advantage. These technologies provide accurate, real-time imaging without the limitations associated with traditional navigation systems. For example, in August 2023, Orthofix, a U.S.-based medical device company, introduced its 7D FLASH Navigation Percutaneous Module 2.0, which was used in the first U.S. cases to enhance planning features for minimally invasive spine surgery. The 7D FLASH Navigation System supports navigated spinal fusion procedures for both open and minimally invasive techniques, emphasizing safety, speed, and efficiency. By utilizing visible light to quickly generate 3D images, the system’s proprietary camera and machine-vision technology overcome common navigation challenges while minimizing radiation exposure for both staff and patients during open procedures.

In July 2022, Enovis Corp., a U.S.-based orthopedic medical technology company, acquired Insight Medical Systems for an undisclosed amount. This acquisition aims to enhance orthopedic procedures, particularly for knee and hip surgeries, and allows Enovis to integrate augmented reality (AR) navigation technology into its portfolio, improving surgical precision and efficiency. Insight Medical Systems Inc., based in the U.S., is a medical device company that specializes in innovative wearable surgical navigation systems.

Major companies operating in the orthopedic navigation systems market report are Medtronic PLC, Johnson & Johnson MedTech, Siemens Healthineers, Stryker Corporation, GE Healthcare Technologies Inc., B. Braun Melsungen AG, Zimmer Biomet Holdings Inc., Smith & Nephew PLC, Karl Storz GmbH & Co. KG, NuVasive Inc., Globus Medical Inc., MicroPort Scientific Corporation, Brainlab Medication company, Amplitude Ortho SAS, Augmedics Inc., Stereotaxis Inc., Intellijoint Surgical Inc., OrthAlign Inc., Fiagon GmbH, Kinamed Inc., Orthokey Italia SRL, Ruthless Spine, Image Navigation Inc., Neocis Inc., Proprio Vision.

North America was the largest region in the orthopedic navigation systems market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the orthopedic navigation systems market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the orthopedic navigation systems market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

Orthopedic navigation systems market consists of revenue earned by entities by providing real-time during surgery and stereoscopic vision. The market value includes the value of related goods sold by the service provider or included within the service offering. Orthopedic navigation systems market also includes sales of surgical navigation systems, model-based navigation systems, and commercialized orthopedic navigation systems. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Orthopedic navigation systems represent an advanced technological platform utilized in orthopedic surgery to assist surgeons in achieving precise and accurate placement of implants, including joint replacements or screws. These systems find application in a variety of orthopedic procedures, such as musculoskeletal trauma, spine diseases, sports injuries, and degenerative diseases.

The primary types of technologies incorporated into orthopedic navigation systems include electromagnetic localizers, optical tracking, fluoroscopy, MRI (magnetic resonance imaging), and others. Electromagnetic localizers serve as an economical and adaptable technology employed in clinical settings, particularly for creating a free-hand three-dimensional ultrasound system. They are utilized in various orthopedic applications, including knee surgery, spine surgery, hip surgery, among others. These systems are deployed by different end users, including hospitals, ambulatory surgical centers, and other relevant healthcare facilities.

The orthopedic navigation systems market research report is one of a series of new reports that provides orthopedic navigation systems market statistics, including orthopedic navigation systems industry global market size, regional shares, competitors with a orthopedic navigation systems market share, detailed orthopedic navigation systems market segments, market trends and opportunities, and any further data you may need to thrive in the orthopedic navigation systems industry. This orthopedic navigation systems market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Orthopedic Navigation Systems Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on orthopedic navigation systems market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for orthopedic navigation systems? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The orthopedic navigation systems market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Technology: Electromagnetic Localizers; Optical Tracking; Fluoroscopy; MRI (Magnetic Resonance Imaging); Other Technologies2) By Application: Knee surgery; Spine surgery; Hip surgery; Other Applications

3) By End Users: Hospitals; Ambulatory Surgical Centers; Other End Users

Subsegments:

1) By Electromagnetic Localizers: Active Electromagnetic Localizers; Passive Electromagnetic Localizers; Hybrid Electromagnetic Localizers2) By Optical Tracking: Infrared Optical Tracking Systems; Marker-Based Optical Tracking Systems; Markerless Optical Tracking Systems

3) By Fluoroscopy: C-Arm Fluoroscopy Systems; 3D Fluoroscopy Systems; Mobile Fluoroscopy Units

4) By MRI (Magnetic Resonance Imaging): Intraoperative MRI Systems; MRI-Based Navigation Systems; MRI-Guided Robotic Systems

5) By Other Technologies: Ultrasound-Based Navigation Systems; Robot-Assisted Navigation Systems; Computer-Assisted Surgery Systems

Key Companies Mentioned: Medtronic Plc; Johnson & Johnson MedTech; Siemens Healthineers; Stryker Corporation; GE Healthcare Technologies Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Orthopedic Navigation Systems market report include:- Medtronic Plc

- Johnson & Johnson MedTech

- Siemens Healthineers

- Stryker Corporation

- GE Healthcare Technologies Inc.

- B. Braun Melsungen AG

- Zimmer Biomet Holdings Inc.

- Smith & Nephew PLC

- Karl Storz GmbH & Co. KG

- NuVasive Inc.

- Globus Medical Inc.

- MicroPort Scientific Corporation

- Brainlab Medication company

- Amplitude Ortho SAS

- Augmedics Inc.

- Stereotaxis Inc.

- Intellijoint Surgical Inc.

- OrthAlign Inc.

- Fiagon GmbH

- Kinamed Inc.

- Orthokey Italia SRL

- Ruthless Spine

- Image Navigation Inc.

- Neocis Inc.

- Proprio Vision

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 3.48 Billion |

| Forecasted Market Value ( USD | $ 6.04 Billion |

| Compound Annual Growth Rate | 14.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |