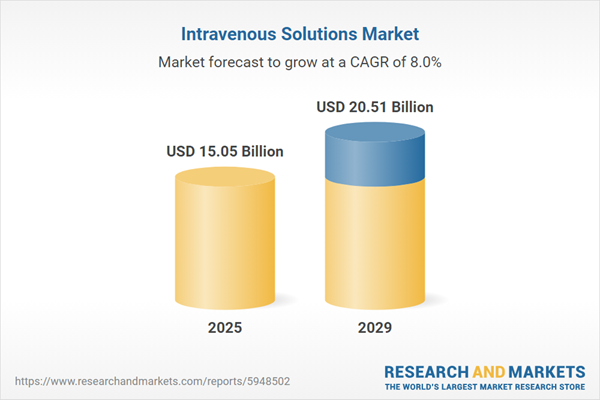

The intravenous solutions market size has grown strongly in recent years. It will grow from $14 billion in 2024 to $15.05 billion in 2025 at a compound annual growth rate (CAGR) of 7.5%. The growth in the historic period can be attributed to rise in surgical procedures, growing prevalence of chronic diseases, expansion of home healthcare, stringent regulations ensuring product safety, increased focus on patient hydration, global emergency preparedness initiatives.

The intravenous solutions market size is expected to see strong growth in the next few years. It will grow to $20.51 billion in 2029 at a compound annual growth rate (CAGR) of 8%. The growth in the forecast period can be attributed to population growth and aging, increasing surgical interventions, rising incidence of infectious diseases, telemedicine and remote patient monitoring, focus on preventive healthcare, global health security investments, patient-centric care trends. Major trends in the forecast period include increased demand for parenteral nutrition solutions, rise in adoption of pre-mixed iv solutions, expansion of home infusion therapies, introduction of electrolyte-balanced solutions, introduction of novel drug additives and adjuncts, integration of smart iv systems for monitoring.

The rising prevalence of cancer is projected to drive the growth of the intravenous solutions market in the coming years. Cancer encompasses a range of diseases characterized by uncontrolled cell proliferation, with the capability to invade nearby tissues and metastasize to other areas of the body. Intravenous solutions are frequently utilized in cancer treatment to administer chemotherapy medications and maintain patient hydration throughout therapy. For example, in February 2024, the World Health Organization (WHO), a Switzerland-based intergovernmental organization, forecasted that by 2050, there would be over 35 million new cancer cases, marking a 77% increase from the estimated 20 million cases reported in 2022. Consequently, the increasing incidence of cancer is propelling the growth of the intravenous solutions market.

The increasing number of surgical procedures is also expected to contribute to the expansion of the intravenous solutions market. Surgical procedures, employed to treat various diseases and disorders through incisions or invasive approaches, rely on intravenous solutions for essential support, including hydration, electrolyte balance, medication administration, and emergency interventions. As an illustration, data from the International Society of Aesthetic Plastic Surgery in September 2023 revealed that in 2022, plastic surgeons worldwide conducted approximately 14.9 million surgical and 18.8 million non-surgical procedures, indicating an 11.2% increase in total procedures. Therefore, the growing number of surgical procedures is driving the growth of the intravenous solutions market.

Key companies in the intravenous solutions market are strategically focusing on the development of innovative syringes, such as pre-filled and ready-to-administer syringes, to gain a competitive advantage. Pre-filled and ready-to-administer syringes come preloaded with medication, designed for immediate use without the need for manual filling or preparation. For instance, in August 2023, GENIXUS Corp., a US-based healthcare company, introduced KinetiX Rocuronium Bromide Injection in 5 mL and 10 mL ready-to-administer (RTA) syringes. These syringes are made of transparent, durable polymer material, eliminating risks associated with glass syringes. They are pre-filled and ready for administration, saving time and reducing medication errors. The product possesses features such as RFID-enabled technology with KitCheck, intuitive labeling, and a color-coded plunger rod for rapid identification.

In August 2022, CSL Limited, an Australia-based specialty biotechnology company, acquired Vifor Pharma AG for an undisclosed amount. This strategic acquisition enables CSL Limited to diversify its portfolio, expand its product offerings, increase revenue, and access new markets. Vifor Pharma AG, based in Switzerland, is a pharmaceutical manufacturing company providing intravenous (IV) solutions for the treatment of iron deficiency, nephrology, and rare diseases.

Major companies operating in the intravenous solutions market report are Pfizer Inc., Abbott Laboratories, Eli Lilly and Company, Fresenius SE & Co. KGaA, Becton, Dickinson and Company, Baxter International Inc., Otsuka Pharmaceutical Co. Ltd., CSL Limited, B. Braun Melsungen AG, Grifols S.A., Terumo Corporation, Nipro Corporation, Sichuan Kelun Pharmaceutical Co. Ltd., Cipla Limited, Hikma Pharmaceuticals PLC, ICU Medical Inc., Gland Pharma Limited, Cisen Pharmaceutical Co. Ltd., Amsino International Inc., JW Life Science Co. Ltd., Eurolife Healthcare Pvt. Ltd., Huaren Pharmaceutical Co. Ltd., Troikaa Pharmaceuticals Ltd., Claris Lifesciences Limited, Amanta Healthcare Ltd., Axa Parenterals Ltd., Wockhardt Ltd., Liqvor pharmaceuticals cjsc, Soxa Formulations & Research Pvt.Ltd., Aculife Healthcare Pvt. Ltd.

North America was the largest region in the intravenous solutions market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the intravenous solutions market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the intravenous solutions market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The intravenous solutions market consists of sales of dextrose 5% in water (D5W), 0.45% sodium chloride (half normal saline), dextrose 5% in normal saline (D5NS), 0.2% sodium chloride (hypotonic saline), and dextrose 10% in water (D10W). Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Intravenous solutions are sterile liquids administered directly into a patient's bloodstream, primarily for purposes of hydration, medication delivery, or nutrient supplementation. These solutions play a crucial role in intravenous therapy, serving to restore or maintain normal fluid volume and electrolyte balance in situations where oral administration is not feasible.

The main types of products within the category of intravenous solutions include total parenteral nutrition (TPN) and peripheral parenteral nutrition. Total parenteral nutrition is a method employed to provide essential nutrients and fluids directly into the bloodstream for individuals unable to eat or absorb nutrients through the digestive system. Various nutrients, including carbohydrates, vitamins and minerals, single-dose amino acids, parenteral lipid emulsion, among others, are utilized in applications such as basic intravenous (IV) solution, nutritional intravenous (IV) solution, blood intravenous (IV) solution, drug intravenous (IV) solution, and irrigation intravenous (IV) solution. End users of these intravenous solutions include hospitals, clinics, ambulatory surgery centers, and home care settings.

The intravenous solutions market research report is one of a series of new reports that provides intravenous solutions market statistics, including intravenous solutions industry global market size, regional shares, competitors with an intravenous solutions market share, detailed intravenous solutions market segments, market trends and opportunities, and any further data you may need to thrive in the intravenous solutions industry. This intravenous solutions market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Intravenous Solutions Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on intravenous solutions market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for intravenous solutions? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The intravenous solutions market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Total Parenteral Nutrition; Peripheral Parenteral Nutrition2) By Nutrients: Carbohydrates; Vitamins And Minerals; Single Dose Amino Acids; Parenteral Lipid Emulsion; Other Nutrients

3) By Application: Basic Intravenous (IV) Solution; Nutritional Intravenous (IV) Solution; Blood Intravenous (IV) Solution; Drug Intravenous (IV) Solution; Irrigation Intravenous (IV) Solution

4) By End User: Hospitals; Clinics; Ambulatory Surgery Centers; Home Care Settings

Subsegments:

1) By Total Parenteral Nutrition (TPN): Carbohydrate Solutions; Amino Acid Solutions; Lipid Solutions; Electrolyte Solutions; Multivitamin Solutions2) By Peripheral Parenteral Nutrition (PPN): Carbohydrate Solutions; Amino Acid Solutions; Lipid Solutions; Electrolyte Solutions

Key Companies Mentioned: Pfizer Inc.; Abbott Laboratories; Eli Lilly and Company; Fresenius SE & Co. KGaA; Becton, Dickinson and Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Intravenous Solutions market report include:- Pfizer Inc.

- Abbott Laboratories

- Eli Lilly and Company

- Fresenius SE & Co. KGaA

- Becton, Dickinson and Company

- Baxter International Inc.

- Otsuka Pharmaceutical Co. Ltd.

- CSL Limited

- B. Braun Melsungen AG

- Grifols S.A.

- Terumo Corporation

- Nipro Corporation

- Sichuan Kelun Pharmaceutical Co. Ltd.

- Cipla Limited

- Hikma Pharmaceuticals PLC

- ICU Medical Inc.

- Gland Pharma Limited

- Cisen Pharmaceutical Co. Ltd.

- Amsino International Inc.

- JW Life Science Co. Ltd.

- Eurolife Healthcare Pvt. Ltd.

- Huaren Pharmaceutical Co. Ltd.

- Troikaa Pharmaceuticals Ltd.

- Claris Lifesciences Limited

- Amanta Healthcare Ltd.

- Axa Parenterals Ltd.

- Wockhardt Ltd.

- Liqvor pharmaceuticals cjsc

- Soxa Formulations & Research Pvt.Ltd.

- Aculife Healthcare Pvt. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.05 Billion |

| Forecasted Market Value ( USD | $ 20.51 Billion |

| Compound Annual Growth Rate | 8.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |