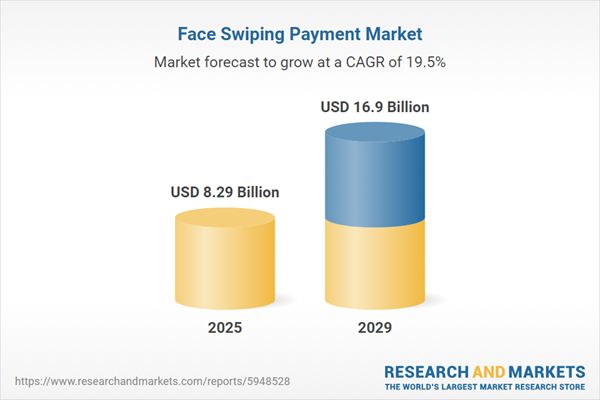

The face swiping payment market size has grown rapidly in recent years. It will grow from $6.93 billion in 2024 to $8.29 billion in 2025 at a compound annual growth rate (CAGR) of 19.6%. The growth in the historic period can be attributed to volatility in fuel prices, government incentives and regulations, environmental awareness, expansion of biofuel infrastructure, strategic alliances in the automotive industry.

The face swiping payment market size is expected to see rapid growth in the next few years. It will grow to $16.9 billion in 2029 at a compound annual growth rate (CAGR) of 19.5%. The growth in the forecast period can be attributed to stringent emission standards, consumer awareness and environmental consciousness, global expansion of biofuel infrastructure, incentives for sustainable transportation, collaboration in renewable energy initiatives. Major trends in the forecast period include integration of advanced engine technologies, focus on increasing fuel efficiency, development of hybrid flex fuel vehicles, education and awareness initiatives, incorporation of renewable fuel standards (rfs), focus on research and development for advanced biofuels.

The face-swiping payment market is anticipated to experience growth driven by the rising demand for contactless payments. Contactless payments involve wireless financial transactions, where customers make purchases by bringing a security token in close proximity to the vendor's terminal. Face-swiping payment technology facilitates contactless payments, offering speed and convenience as users can complete transactions without physical contact with cards or devices. In 2022, UK Finance reported that approximately 17 billion contactless payments were made using debit and credit cards, marking a 30% increase from 13.1 billion in 2021, highlighting the growing popularity of contactless payments.

The increasing digital transformation is contributing to the growth of the face-swiping payment market. Digital transformation, involving the use of digital technology to reshape processes, cultures, and consumer experiences, has led to the adoption of cashless transactions and contactless technologies. This transformation has spurred demand for secure and convenient payment methods. Face-swiping payment, utilizing advanced facial recognition technology, enables safe and contactless transactions, enhancing consumer experiences and simplifying payment procedures. A report from the European Investment Bank in May 2022 revealed that 46% of EU enterprises have taken initiatives to become more digital, compared to 58% of US firms. Additionally, the US has a higher percentage of firms using current digital technology (66% vs. 61% in the EU). Thus, the increasing digital transformation is a key driver for the face-swiping payment market.

Key players in the face-swiping payment market are actively engaged in developing innovative contactless payment systems with advanced technological solutions. One notable example is the 'Smile To Pay' system introduced by Mastercard in May 2022. This facial recognition technology allows users to make payments by utilizing facial biometrics, such as smiling or waving, to authorize transactions. Mastercard's initiative aims to enhance the overall payment experience by providing a secure and convenient payment alternative, reducing the need for physical interaction during transactions. This aligns with the broader trend of contactless and biometric-based payment solutions, addressing security concerns associated with face-swiping payments.

In August 2024, JPMorgan, a UK-based investment banking firm, acquired PopID for an undisclosed amount. This acquisition bolsters JPMorgan's entry into biometric payment solutions, especially through PopID's face-swiping payment technology. The move underscores the growing interest in secure and frictionless payment methods, with PopID recognized for its integration of facial recognition across various sectors, including retail and dining. By acquiring PopID, JPMorgan aims to leverage the rising demand for innovative payment technologies, thereby enhancing its digital payments portfolio. PopID is a US-based software company.

Major companies operating in the face swiping payment market report are Amazon.com Inc., Apple Inc., Alphabet Inc., Samsung Electronics Co. Ltd., Tencent Holdings Ltd., Visa Inc., NEC Corporation, WeChat Pay, Xiaomi Corporation, Alipay, PAX Global Technology Limited, UnionPay International Co. Ltd., CloudWalk Technology Co. Ltd., Facephi Biometria SA, Mastercard Inc., Zoloz Co. Ltd., Innovatrics, VisionLabs B.V., Smile Identity, FacePay Inc., FaceTec Inc., Telepower Communication Co. Ltd., PopID Inc., PayByFace B.V., SnapPay Inc.

Asia-Pacific was the largest region in the face swiping payment market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the face swiping payment market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the face-swiping payment market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The face-swiping payment market consists of revenues earned by entities by providing services such as secure payment infrastructure, biometric data protection, and integration with payment networks. The market value includes the value of related goods sold by the service provider or included within the service offering. The face-swiping payment market also includes sales of biometric payment devices, kiosk, point-of-sale (POS) systems, biometric payment cards, and biometric wearables. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Face-swiping payment is a payment mechanism employing biometric facial recognition technology, facilitating a swift transaction process for customers at retail stores, restaurants, and various businesses. This method provides a seamless and contactless payment experience.

The primary categories of face-swiping payment encompass payment equipment and payment systems. Payment equipment refers to devices such as card payment terminals, also known as credit card machines, chip and PIN machines, electronic point of sale (EPOS) systems, payment terminals, or point of sale (POS) systems. These devices incorporate various technologies such as facial recognition and image recognition, catering to different applications such as retail, restaurant, travel, and others.

The face-swiping payment market research report is one of a series of new reports that provides face-swiping payment market statistics, including face-swiping payment industry global market size, regional shares, competitors with a face-swiping payment market share, detailed face-swiping payment market segments, market trends and opportunities, and any further data you may need to thrive in the face-swiping payment industry. This face-swiping payment market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Face Swiping Payment Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on face swiping payment market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for face swiping payment? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The face swiping payment market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Payment Equipment; Payment System2) By Technology: Facial Recognition; Image Recognition

3) By Application: Retail; Restaurant; Travel; Other Applications

Subsegments:

1) By Payment Equipment: Facial Recognition Terminals; Smart Cameras; Biometric Sensors2) By Payment System: Cloud-Based Payment Systems; On-Premises Payment Systems

Key Companies Mentioned: Amazon.com Inc.; Apple Inc.; Alphabet Inc.; Samsung Electronics Co. Ltd.; Tencent Holdings Ltd.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Face Swiping Payment market report include:- Amazon.com Inc.

- Apple Inc.

- Alphabet Inc.

- Samsung Electronics Co. Ltd.

- Tencent Holdings Ltd.

- Visa Inc.

- NEC Corporation

- WeChat Pay

- Xiaomi Corporation

- Alipay

- PAX Global Technology Limited

- UnionPay International Co. Ltd.

- CloudWalk Technology Co. Ltd.

- Facephi Biometria SA

- Mastercard Inc.

- Zoloz Co. Ltd.

- Innovatrics

- VisionLabs B.V.

- Smile Identity

- FacePay Inc.

- FaceTec Inc.

- Telepower Communication Co. Ltd.

- PopID Inc.

- PayByFace B.V.

- SnapPay Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 8.29 Billion |

| Forecasted Market Value ( USD | $ 16.9 Billion |

| Compound Annual Growth Rate | 19.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |