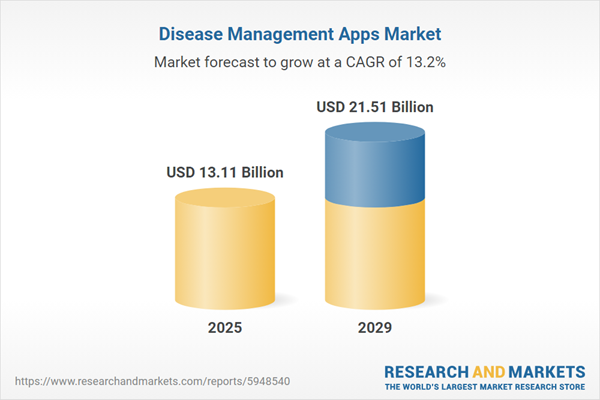

The disease management apps market size has grown rapidly in recent years. It will grow from $11.55 billion in 2024 to $13.11 billion in 2025 at a compound annual growth rate (CAGR) of 13.5%. The growth in the historic period can be attributed to infrastructure development boom, mining and quarrying activities, agricultural mechanization, government infrastructure investment, global economic growth.

The disease management apps market size is expected to see rapid growth in the next few years. It will grow to $21.51 billion in 2029 at a compound annual growth rate (CAGR) of 13.2%. The growth in the forecast period can be attributed to renewable energy projects, focus on sustainable construction practices, e-commerce infrastructure development, rise in disaster response and recovery efforts, global urban population growth. Major trends in the forecast period include enhancement of operator comfort and safety, application of advanced materials for durability, integration of intelligent machine control systems, focus on modular and versatile attachments, implementation of predictive maintenance technologies, adoption of remote control and teleoperation.

The anticipated rise in the prevalence of chronic disorders is expected to drive the growth of the disease management apps market in the future. Chronic conditions, characterized by long-lasting medical issues persisting for three months or more, are on the rise globally. Disease management apps play a crucial role in managing chronic diseases by providing tools for tracking symptoms, logging medication intake, monitoring vital signs, and identifying triggers. For example, in September 2022, the World Health Organization reported 41 million deaths annually, with 74% attributed to chronic diseases, including 17.9 million deaths from cardiovascular diseases, 9.3 million from cancer, 4.1 million from chronic respiratory diseases, and 2 million from diabetes. This surge in chronic conditions is a key factor propelling the growth of the disease management apps market.

The increasing adoption of smartphones is poised to boost the disease management apps market. Smartphones, with built-in computers and various functionalities, facilitate the use of disease management apps by allowing users to access real-time health information, monitor their conditions, receive medication reminders, and communicate with healthcare providers. In February 2023, there were 71.8 million mobile connections in the UK, marking a 3.8% increase over 2021. As the UK population is expected to reach 68.3 million by 2025, with approximately 65 million individuals owning smartphones, the growing prevalence of smartphones is a significant driver for the disease management apps market.

Major players in the disease management apps market are focusing on technological advancements, such as GenAI, to enhance profitability. GenAI, an artificial intelligence technology, automates clinical summary report generation and improves communication between patients and providers. In August 2023, Huma Therapeutics launched the GenAI artificial intelligence disease management platform technology using Google Cloud, aiming to enhance decision-making tools for diagnostic treatment and recommendations.

In February 2023, Amazon.com Inc. acquired the One Medical app from 1Life Healthcare, Inc. for approximately $3.9 billion. This strategic move allows Amazon.com Inc. to expand its services, offering various disease management features such as remote visits, 24/7 on-demand virtual care services, and on-demand video chats through the One Medical app. 1Life Healthcare, Inc. is a virtual care provider of the disease management app One Medical based in the United States.

Major companies operating in the disease management apps market report are Alphabet Inc., International Business Machines Corporation, Siemens Healthineers AG, Koninklijke Philips N.V., Garmin International Inc., DexCom Inc., Epic Systems Corporation, Teladoc Inc., Fitbit LLC, athenahealth Inc., Allscripts Healthcare Solutions Inc., Omada Health Inc., Calm.com Inc., Livongo Health Inc., American Well Corporation, MyFitnessPal Inc., Talkspace Inc., Noom Inc., Ada Health GmbH, Healthy.io.Ltd., Medisafe International LLC, Sleep Cycle AB, Buoy Health Inc., Azumio Inc., Propeller Health Inc., Welldoc Inc., Informed Data Systems Inc., Curable Inc.

North America was the largest region in the disease management apps market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the disease management apps market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the disease management apps market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The disease management apps market includes revenues earned by entities by provide disease management services such as medication management, health tracking, and e-prescribing software. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included. The disease management apps market consists of sales of wearable devices such as sensors, remote patient monitoring devices, and fitness trackers. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Disease management apps are software applications designed to assist individuals in monitoring, managing, and improving their health, particularly when dealing with chronic medical conditions or diseases. These apps incorporate various digital tools and wearables that enable healthcare professionals to remotely track patients' symptoms and activities and share information regarding medication adherence.

The main platform types for disease management apps include iOS, Android, and other platform types. iOS refers to a mobile operating system developed for Apple's mobile devices, including the iPhone, iPad, and iPod Touch. These apps are compatible with various devices such as smartphones, tablets, and wearables, and they are used for managing conditions such as obesity, cardiovascular issues, mental health, diabetes, and other medical indications.

The disease management apps market research report is one of a series of new reports that provides disease management apps market statistics, including the disease management apps industry global market size, regional shares, competitors with disease management apps market share, detailed disease management apps market segments, market trends and opportunities, and any further data you may need to thrive in the disease management apps industry. This disease management apps market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Disease Management Apps Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on disease management apps market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for disease management apps? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The disease management apps market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Platform Type: iOS; Android; Other Platform Types2) By Device: Smartphones; Tablets; Wearables

3) By Indication: Obesity; Cardiovascular Issues; Mental Health; Diabetes; Other Indications

Subsegments:

1) By IOS: IPhone Apps; iPad Apps2) By Android: Smartphone Apps; Tablet Apps

3) By Other Platform Types: Windows Mobile Apps; Web-Based Apps

Key Companies Mentioned: Alphabet Inc.; International Business Machines Corporation; Siemens Healthineers AG; Koninklijke Philips N.V. ; Garmin International Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Disease Management Apps market report include:- Alphabet Inc.

- International Business Machines Corporation

- Siemens Healthineers AG

- Koninklijke Philips N.V.

- Garmin International Inc.

- DexCom Inc.

- Epic Systems Corporation

- Teladoc Inc.

- Fitbit LLC

- athenahealth Inc.

- Allscripts Healthcare Solutions Inc.

- Omada Health Inc.

- Calm.com Inc.

- Livongo Health Inc.

- American Well Corporation

- MyFitnessPal Inc.

- Talkspace Inc.

- Noom Inc.

- Ada Health GmbH

- Healthy.io.Ltd.

- Medisafe International LLC

- Sleep Cycle AB

- Buoy Health Inc.

- Azumio Inc.

- Propeller Health Inc.

- Welldoc Inc.

- Informed Data Systems Inc.

- Curable Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 13.11 Billion |

| Forecasted Market Value ( USD | $ 21.51 Billion |

| Compound Annual Growth Rate | 13.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 29 |