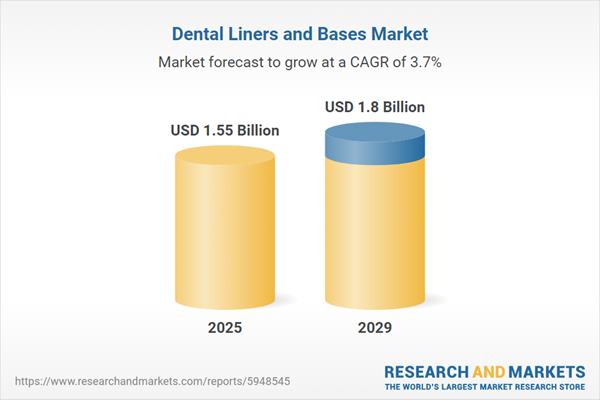

The dental liners and bases market size has grown strongly in recent years. It will grow from $1.48 billion in 2024 to $1.55 billion in 2025 at a compound annual growth rate (CAGR) of 5.2%. The growth in the historic period can be attributed to advancements in cosmetic dentistry, increasing aesthetic awareness, celebrity influences, rising disposable income, social media impact.

The dental liners and bases market size is expected to see steady growth in the next few years. It will grow to $1.8 billion in 2029 at a compound annual growth rate (CAGR) of 3.7%. The growth in the forecast period can be attributed to aging population demands, economic growth in emerging markets, integration of 3d printing in dentistry, focus on minimally invasive cosmetic dentistry, telemedicine and virtual consultations. Major trends in the forecast period include customization and digital smile design, technological advancements in veneer materials, technological innovations in dentistry, surge in demand for non-invasive cosmetic dentistry, rising popularity of minimal-prep and no-prep veneers.

The anticipated rise in the prevalence of dental caries is expected to drive the growth of the dental liners and bases market. Dental caries, commonly known as tooth decay or cavities, is a persistent infectious condition caused by bacteria in the mouth breaking down sugars, producing acid that demineralizes the tooth enamel. Dental liners and bases play a crucial role in restorative dentistry by providing a protective barrier and support for tooth structures. This helps prevent postoperative sensitivity, promotes tissue health, and enhances the overall success and longevity of dental restorations. According to the World Health Organization (WHO), approximately 514 million children worldwide and 2 billion adults are estimated to suffer from primary and permanent tooth caries, respectively, in 2022. With 7% tooth loss in adults above 20 and 23% in those above 60 due to dental caries, the rise in its prevalence is expected to propel the dental liners and bases market.

The increasing incidences of periodontic diseases are expected to further boost the dental liners and bases market. Periodontic diseases, inflammatory conditions affecting the supporting structures of the teeth, use dental liners and bases as a protective barrier to shield the pulp from irritants and bacteria. According to a global oral health status report by the WHO, around 19% of the global adult population, representing more than one billion cases worldwide annually, was estimated to suffer from severe periodontal diseases in 2023. The increasing incidences of periodontic diseases are expected to drive the growth of the dental liners and bases market.

Major companies are focusing on developing innovative solutions, such as high-impact denture bases. This involves utilizing ceramic-infused 3D printing resin for fabricating the gum-colored section of dentures. For instance, in May 2023, SprintRay Inc., a 3D printer manufacturing company based in the United States, introduced ceramic-infused 3D printing resins designed specifically for high-performance dentures. The resulting high-impact denture bases created with this biocompatible 3D printing material exhibit improved mechanical characteristics, including enhanced impact resistance. Compared to traditional denture base materials, these products aim to provide greater durability and resistance to breakage.

In April 2022, DenMat Holdings LLC, a dental products company based in the United States, made an undisclosed acquisition of Den-Shur Denture Caps from Prismatrix Decal Inc. This strategic acquisition is expected to diversify the range of dental products offered to end users, expanding DenMat's existing product portfolio. The acquisition not only broadens the availability of products for dental practices but also strengthens DenMat's network. Den-Shur Denture Caps is a U.S.-based manufacturer specializing in removable appliance storage containers for dental liners and bases.

Major companies operating in the dental liners and bases market report are 3M Company, Danaher Corporation, Henry Schein Inc., Kuraray Noritake Dental Inc., Dentsply Sirona Inc., Ivoclar Vivadent AG, Ultradent Products Inc., Kulzer GmbH, COLTENE Holding AG, VITA Zahnfabrik H. Rauter GmbH & Co. KG, Bisco Inc., Pentron Clinical Technologies LLC, VOCO GmbH, GC Corporation, Safco Dental Supply Co., Pulpdent Corporation, Parkell Inc., DMG Chemisch-Pharmazeutische Fabrik GmbH, Cetylite Inc., PrevestDenPro Limited, SHOFU Dental GmbH, Cosmedent Inc., Temrex Corp., Amtouch Dental Supply, ICPA Health Products Ltd.

North America was the largest region in the dental liners and bases market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the dental liners and bases market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dental liners and bases market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The dental liners and bases market consists of sales of calcium liners, polymer-based liners, ceramic fillings, and temporary cement. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Dental liners and bases are intermediate restorative materials positioned between the restoration and the dentin to protect the pulp. Dentists use these materials to shield the pulp from thermal and mechanical irritation, thereby enhancing the durability of dental restorations such as fillings and crowns.

The main types of dental liners and bases include zinc oxide eugenol, glass ionomers, resin-modified glass ionomers, calcium hydroxide, and composites. Zinc oxide eugenol involves a combination of zinc oxide and eugenol derived from clove oil, creating a dental substance. These materials are distributed through direct and indirect channels and are available for both adults and pediatrics. They find applications in various healthcare settings, including hospitals, dental clinics, research and academic institutes, and home care settings.

The dental liners and bases market research report is one of a series of new reports that provides dental liners and bases market statistics, including dental liners and bases industry global market size, regional shares, competitors with dental liners and bases market share, detailed dental liners and bases market segments, market trends, and opportunities, and any further data you may need to thrive in the dental liners and bases industry. This dental liners and bases market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Dental Liners and Bases Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental liners and bases market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental liners and bases? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental liners and bases market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Zinc Oxide Eugenol; Glass Ionomer; Resin-Modified Glass Ionomers; Calcium Hydroxide; Composites2) By Distribution Channel: Direct; Indirect

3) By Application: Hospitals; Dental Clinics; Research And Academic Institutes; Home Care Settings

4) By End-User: Adults; Pediatrics

Subsegments:

1) By Zinc Oxide Eugenol: Temporary Liners; Permanent Liners2) By Glass Ionomer: Conventional Glass Ionomer; Resin-Modified Glass Ionomer

3) By Resin-Modified Glass Ionomers: Light-Cured Resin-Modified Glass Ionomer; Self-Cured Resin-Modified Glass Ionomer

4) By Calcium Hydroxide: Liner Formulations; Base Formulations

5) By Composites: Light-Cured Composites; Chemically Cured Composites

Key Companies Mentioned: 3M Company; Danaher Corporation; Henry Schein Inc.; Kuraray Noritake Dental Inc.; Dentsply Sirona Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Dental Liners and Bases market report include:- 3M Company

- Danaher Corporation

- Henry Schein Inc.

- Kuraray Noritake Dental Inc.

- Dentsply Sirona Inc.

- Ivoclar Vivadent AG

- Ultradent Products Inc.

- Kulzer GmbH

- COLTENE Holding AG

- VITA Zahnfabrik H. Rauter GmbH & Co. KG

- Bisco Inc.

- Pentron Clinical Technologies LLC

- VOCO GmbH

- GC Corporation

- Safco Dental Supply Co.

- Pulpdent Corporation

- Parkell Inc.

- DMG Chemisch-Pharmazeutische Fabrik GmbH

- Cetylite Inc.

- PrevestDenPro Limited

- SHOFU Dental GmbH

- Cosmedent Inc.

- Temrex Corp.

- Amtouch Dental Supply

- ICPA Health Products Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.55 Billion |

| Forecasted Market Value ( USD | $ 1.8 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 26 |