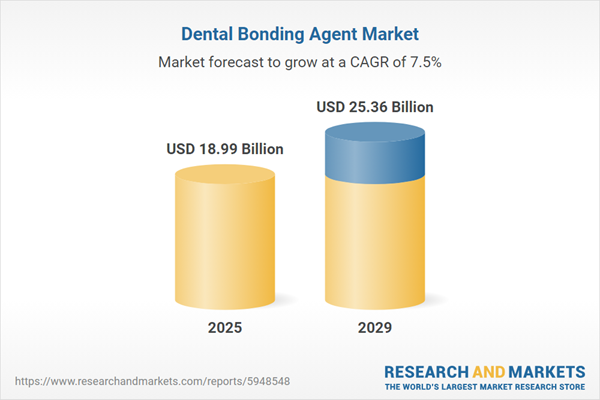

The dental bonding agent market size has grown strongly in recent years. It will grow from $17.45 billion in 2024 to $18.99 billion in 2025 at a compound annual growth rate (CAGR) of 8.8%. The growth in the historic period can be attributed to rise in dental implant procedures, growing aging population, prevalence of dental disorders, expanding applications in oral surgeries, patient preference for non-invasive treatments, collaboration in dental research.

The dental bonding agent market size is expected to see strong growth in the next few years. It will grow to $25.36 billion in 2029 at a compound annual growth rate (CAGR) of 7.5%. The growth in the forecast period can be attributed to increasing cosmetic dentistry procedures, global emphasis on oral health, expansion of dental tourism, customization for patient-specific needs, education and training programs. Major trends in the forecast period include rise in minimally invasive grafting techniques, development of growth factor-augmented grafts, expanding applications in periodontal and implant dentistry, customization for patient-specific treatments, integration of 3d printing technology, research on bioactive and osteoconductive materials.

The rising prevalence of dental disorders is anticipated to drive the growth of the dental bonding agent market in the coming years. Dental disorders, also known as oral disorders or oral diseases, encompass a variety of conditions that impact the teeth, gums, mouth, and related structures. Dental bonding agents are utilized to treat patients with dental disorders, such as cavities, by filling voids and reconstructing fractured teeth. For example, in March 2023, the World Health Organization (WHO), an intergovernmental organization based in Switzerland, reported that in 2022, approximately 3.5 billion people worldwide suffered from oral diseases. Among these, caries affected about 2 billion adults and 514 million children. Consequently, the increasing prevalence of dental disorders is fueling the growth of the dental bonding agent market.

The increasing expenditures on dental care are projected to drive the growth of the dental bonding agent market in the future. Dental care expenditures refer to the financial resources allocated for oral health services, treatments, and related expenses. These expenditures facilitate the use of advanced dental bonding agents by providing funding for research, development, and access to innovative technologies, ultimately improving overall dental treatment outcomes. For instance, in December 2023, the Canadian Dental Care Plan (CDCP), a government-funded dental insurance program in Canada, outlined the Canadian government's commitment to enhancing public health by allocating $13 billion over five years, along with $4.4 billion annually, to support the CDCP. As a result, the increasing dental care expenditures are expected to boost the growth of the dental bonding agent market.

Companies in the dental bonding agent market are intensifying their focus on introducing next-generation dental bonding agents to gain a competitive edge. Next-generation dental bonding agents are adhesives used in dentistry to bond restorative materials to teeth, designed to enhance bonding effectiveness and simplify the bonding process. For example, in February 2022, Parkell Inc., a US-based company manufacturing dental tools and bonding materials, launched Brush&Bond MAX, a next-generation bonding agent. This product prioritizes optimal results on enamel and dentin surfaces, simplifying the bonding process with its single-bottle system. It creates robust adhesion and high bond strength, allowing clinicians to confidently provide restorations without post-operative sensitivity complications. The streamlined touch application method replaces the scrubbing step required by many other bonding agents, some of which require up to 20 or 30 seconds of scrubbing.

In August 2024, Benco Dental, a U.S.-based distributor of dental products and equipment, acquired M&S Dental Supply and A-Dent Dental Equipment for an undisclosed amount. This acquisition is intended to expand Benco Dental's product and service offerings while reinforcing its position in the dental supply market. Both M&S Dental Supply and A-Dent Dental Equipment are U.S.-based companies specializing in dental supplies.

Major companies operating in the dental bonding agent market report are 3M Corporation, Danaher Corporation, Sirona Dental Systems Inc., Heraeus Kulzer GmbH, Ivoclar Vivadent AG, Kerr Corporation, Ultradent Products Inc., Kulzer GmbH, KaVo Kerr, Kuraray America Inc., COLTENE Group, Septodont Holdings, FGM Produtos Odontológicos, SDI Limited, GC America, Zhermack SpA, VOCO America Inc., Premier Dental Products Co, BISCO Inc., Pulpdent Corporation, Parkell Inc., DMG America LLC, Pentron Clinical Technologies LLC, Shofu Dental Inc., Cosmedent Inc., DMP Dental Industry Srl, Tokuyama Dental America.

North America was the largest region in the dental bonding agent market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the dental bonding agent market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the dental bonding agent market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The dental bonding agent market consists of sales of adhesive, dual-cured etchant, and primer. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

A dental bonding agent is a type of material used in dentistry to facilitate the attachment or bonding of dental restorative materials. It serves as an adhesive for joining two materials in various dental procedures, including root canals.

The primary product types within dental bonding agents include self-etch and total-etch. Self-etch adhesives incorporate formulations containing acidic monomers that perform the dual function of etching and priming the tooth surface. These bonding agents utilize various technologies, such as light-cured and dual-cured. End-users of these products include hospitals, dental clinics, ambulatory surgical centers, and others.

The dental bonding agent market research report is one of a series of new reports that provides dental bonding agent market statistics, including dental bonding agent industry global market size, regional shares, competitors with a dental bonding agent market share, detailed dental bonding agent market segments, market trends and opportunities, and any further data you may need to thrive in the dental bonding agent industry. This dental bonding agent market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Dental Bonding Agent Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on dental bonding agent market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for dental bonding agent? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The dental bonding agent market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Product: Self-etch; Total-etch2) By Technology: Light-cured; Dual-cured

3) By End Users: Hospitals; Dental Clinics; Ambulatory Surgical Centers; Other End Users

Subsegments:

1) By Self-Etch: One-Step Self-Etch; Two-Step Self-Etch2) By Total-Etch: Two-Step Total-Etch; Three-Step Total-Etch

Key Companies Mentioned: 3M Corporation; Danaher Corporation; Sirona Dental Systems Inc.; Heraeus Kulzer GmbH; Ivoclar Vivadent AG

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Dental Bonding Agent market report include:- 3M Corporation

- Danaher Corporation

- Sirona Dental Systems Inc.

- Heraeus Kulzer GmbH

- Ivoclar Vivadent AG

- Kerr Corporation

- Ultradent Products Inc.

- Kulzer GmbH

- KaVo Kerr

- Kuraray America Inc.

- COLTENE Group

- Septodont Holdings

- FGM Produtos Odontológicos

- SDI Limited

- GC America

- Zhermack SpA

- VOCO America Inc.

- Premier Dental Products Co

- BISCO Inc.

- Pulpdent Corporation

- Parkell Inc.

- DMG America LLC

- Pentron Clinical Technologies LLC

- Shofu Dental Inc

- Cosmedent Inc.

- DMP Dental Industry Srl

- Tokuyama Dental America

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 18.99 Billion |

| Forecasted Market Value ( USD | $ 25.36 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 28 |