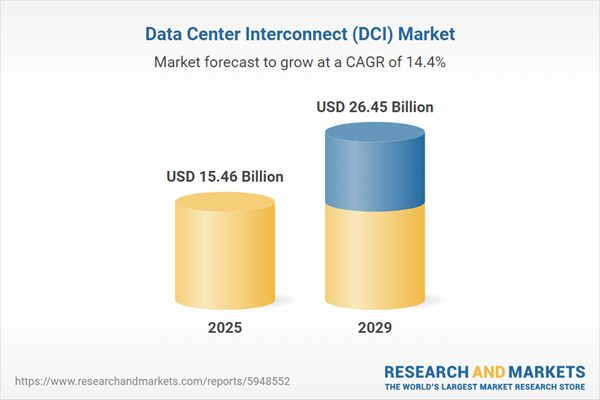

The data center interconnect (DCI) market size has grown rapidly in recent years. It will grow from $13.47 billion in 2024 to $15.46 billion in 2025 at a compound annual growth rate (CAGR) of 14.8%. The growth in the historic period can be attributed to rise of big data, document management needs, automation in business processes, regulatory compliance requirements, growing e-commerce activities.

The data center interconnect (DCI) market size is expected to see rapid growth in the next few years. It will grow to $26.45 billion in 2029 at a compound annual growth rate (CAGR) of 14.4%. The growth in the forecast period can be attributed to AI and machine learning integration, real-time data extraction, unstructured data handling, cross-platform compatibility, customization for industry-specific needs. Major trends in the forecast period include increased digitization, advancements in OCR technology, enhanced automation with ai and machine learning, cloud-based solutions, natural language processing (NLP) integration.

The upward trend in the number of data centers is anticipated to drive the growth of the Data Center Interconnect (DCI) market in the future. A data center serves as a dedicated facility designed to house IT infrastructure, support application deployment, and store data. DCI technology facilitates the connection of multiple data centers, enabling the pooling and sharing of resources. In January 2022, the Campfil Group reported that the United States had 2,751 data centers in 2022. Additionally, there were 484 data centers in Germany, 458 in the UK, 447 in China, and 324 in Canada. Consequently, the increasing prevalence of data centers is a key driver for the Data Center Interconnect (DCI) market.

The expansion of digitization is expected to fuel the growth of the Data Center Interconnect (DCI) market. Digitization involves converting analog information into digital format, using discrete numerical values to represent data, media, or objects. DCI plays a crucial role in ensuring seamless and secure communication between geographically dispersed data centers, facilitating efficient data exchange, scalability, and enhanced performance for interconnected digital infrastructure. According to Augusta Free Press, global digital transformation spending reached $1.85 trillion in December 2022, marking a 16% increase from the previous year. Moreover, StockApps projects a 57% increase in global digital transformation spending by 2026. Thus, the ongoing digitization efforts are a significant factor driving the growth of the Data Center Interconnect (DCI) market.

Major companies in the data center interconnect (DCI) market are focusing on developing advanced technologies, such as Global Data Center Interconnect (GDCI), to manage complexity and enhance their global presence. GDCI refers to the technology that connects two or more data centers to share resources and facilitate the transit of critical assets over short, medium, or long distances using high-speed packet-optical connectivity. For example, in July 2022, Juniper Networks Inc., a U.S.-based leader in AI-driven and secure networking solutions, introduced new innovations to support its Cloud Metro strategy, targeting service providers looking for metro transformation and sustainable business growth. The Cloud Metro solution incorporates AI-driven automation and advanced security features to improve data flow across regional and global networks while also promoting energy efficiency. Through these innovations, Juniper’s Cloud Metro enables service providers to optimize operations, ensure scalability, and manage increasing network complexity, all while aligning with sustainability objectives.

In March 2022, CyrusOne Inc., a leading global provider of data center solutions based in the U.S., was acquired by funds managed by KKR, a prominent investment firm headquartered in the U.S., along with Global Infrastructure Partners (GIP), a private equity company also based in the U.S. This strategic acquisition is designed to strengthen CyrusOne's market position and capitalize on its strong history of delivering cutting-edge data center solutions globally. The transaction is anticipated to significantly enhance the global colocation market as CyrusOne continues to expand its innovative services and infrastructure.

Major companies operating in the data center interconnect (dci) market report are Nippon Telegraph and Telephone Corporation, Huawei Technologies Co. Ltd., Cisco Systems Inc., Fujitsu Limited, Nokia Corporation, ZTE Corporation, Equinix Inc., Juniper Networks Inc., Digital Realty Trust Inc., Arista Networks Inc., Ciena Corporation, Microsemi Corporation, Infinera Corporation, Extreme Networks Inc., Colt Technology Services Group Limited, ADVA Optical Networking SE, Cyxtera Technologies, Reichle and DeMassari AG, CoreSite Realty Corporation, Flexential Corp., Ekinops SA, Megaport Limited, Interxion Holding NV, Cologix Inc., Evoque Data Center Solutions LLC, Innovium Inc., Pluribus Networks, XKL LLC, Fiber Mountain Inc., Ranovus Inc.

North America was the largest region in the data center interconnect (DCI) market in 2024. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the data center interconnect (dci) market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the data center interconnect (DCI) market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The data center interconnect (DCI) market includes revenues earned by entities by providing services such as professional services and managed services. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included. The data center interconnect (DCI) market consists of sales of products such as packet-switching networking and optical DCI. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Data center interconnect (DCI) pertains to a technology that establishes connections among multiple data centers spanning varying distances, ranging from short to long distances, utilizing high-speed packet-optical connectivity. DCI links offer enhanced encryption to ensure secure information sharing, enable companies to enforce quality of service (QoS) for optimal performance, and facilitate the distribution of workloads across different connection types.

The primary categories of data center interconnect (DCI) encompass products, software, and services. DCI products, including packet-switching networking, are instrumental in transferring small data segments across diverse networks. These products find applications in various areas such as disaster recovery and business continuity, shared data and resources, data (storage) mobility, among others. End users, including communication service providers, internet content providers, governments, and others, utilize these products for their specific needs.

The data center interconnect (dci) market research report is one of a series of new reports that provides data center interconnect (dci) market statistics, including data center interconnect (dci) industry global market size, regional shares, competitors with data center interconnect (dci) market share, detailed data center interconnect (dci) market segments, market trends, and opportunities, and any further data you may need to thrive in the data center interconnect (dci) industry. This data center interconnect (dci) market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD, unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Data Center Interconnect (DCI) Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on data center interconnect (dci) market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for data center interconnect (dci)? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The data center interconnect (dci) market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Products; Software; Services2) By Application: Disaster Recovery And Business Continuity; Shared Data And Resources; Data (Storage) Mobility; Other Applications

3) By End-User: Communications Service Providers (CSPs); Internet Content Providers And Carrier-Neutral Providers (ICPs/CNPs); Government Or Research And Education (Government/R&E); Other End Users

Subsegments:

1) By Products: Optical Packet Platforms; Routers And Switches; Communication Platforms2) By Software: Network Management Software; SDN (Software-Defined Networking); Virtualization Software

3) By Services: Consulting And Integration Services; Maintenance And Support Services; Managed Services

Key Companies Mentioned: Nippon Telegraph and Telephone Corporation; Huawei Technologies Co. Ltd.; Cisco Systems Inc.; Fujitsu Limited; Nokia Corporation

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Data Center Interconnect (DCI) market report include:- Nippon Telegraph and Telephone Corporation

- Huawei Technologies Co. Ltd.

- Cisco Systems Inc.

- Fujitsu Limited

- Nokia Corporation

- ZTE Corporation

- Equinix Inc.

- Juniper Networks Inc.

- Digital Realty Trust Inc.

- Arista Networks Inc.

- Ciena Corporation

- Microsemi Corporation

- Infinera Corporation

- Extreme Networks Inc.

- Colt Technology Services Group Limited

- ADVA Optical Networking SE

- Cyxtera Technologies

- Reichle and DeMassari AG

- CoreSite Realty Corporation

- Flexential Corp.

- Ekinops SA

- Megaport Limited

- Interxion Holding NV

- Cologix Inc.

- Evoque Data Center Solutions LLC

- Innovium Inc.

- Pluribus Networks

- XKL LLC

- Fiber Mountain Inc.

- Ranovus Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 15.46 Billion |

| Forecasted Market Value ( USD | $ 26.45 Billion |

| Compound Annual Growth Rate | 14.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |

![Data Center Interconnect Market by Type [Products (Packet Switching Network, Optical DCI), Software, Services (Professional, Managed)], Application (Real-time Disaster Recovery & Business Continuity, Workload & Data Mobility) - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/11916/11916963_60px_jpg/data_center_interconnect_market.jpg)