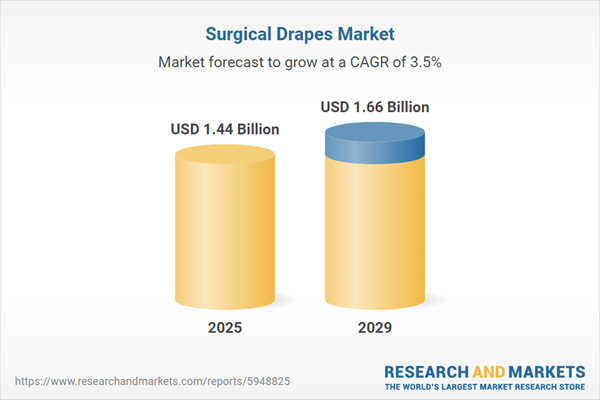

The surgical drapes market size has grown steadily in recent years. It will grow from $1.39 billion in 2024 to $1.44 billion in 2025 at a compound annual growth rate (CAGR) of 3.8%. The growth in the historic period can be attributed to increasing surgical procedures, stringent infection control regulations, growing awareness of infection prevention, increasing healthcare expenditure, rising demand for single-use products, collaboration with healthcare institutions.

The surgical drapes market size is expected to see steady growth in the next few years. It will grow to $1.66 billion in 2029 at a compound annual growth rate (CAGR) of 3.5%. The growth in the forecast period can be attributed to growing surgical volume, environmental sustainability concerns, expansion of ambulatory surgical centers, global health preparedness, strategic alliances for market penetration, regulatory support for infection control products. Major trends in the forecast period include advancements in adhesive technologies, rise in disposable and single-use drapes, development of drapes with fluid management capabilities, incorporation of fenestration and aperture designs, usage of biodegradable and biocompatible materials, focus on ergonomic design and user-friendly features, integration of barrier films and laminates.

The growth of the surgical drapes market is anticipated to be propelled by the rising number of surgical procedures in the future. Surgical procedures, involving medical treatments that necessitate incisions and are typically conducted in operating rooms with anesthesia or pain management, benefit from the use of surgical drapes. These drapes provide essential features such as barrier protection, fluid management, visibility, durability, and patient comfort during surgeries. For example, in September 2023, the Organization for Economic Co-operation and Development reported an 8.4% increase in cataract surgical procedures in the Czech Republic, totaling 142,670 procedures in 2022 compared to 131,612 in 2021. Additionally, in April 2022, The Aesthetic Society noted a remarkable 54% increase in surgical procedures, with 365,000 breast augmentations performed in 2021. Consequently, the surge in surgical procedures is a driving force for the growth of the surgical drapes market.

The expansion of the surgical drapes market is also expected to be fueled by the growing number of ambulatory surgical centers. These medical facilities provide same-day surgical care, including preventive and diagnostic procedures, without requiring patients to stay overnight. Ambulatory surgical centers utilize surgical drapes to maintain a sterile and controlled environment during outpatient procedures, enhance infection prevention measures, and facilitate efficient surgical practices. As of August 2022, Surgical Information Systems LLC reported that the ambulatory surgery center (ASC) industry experienced robust growth, exceeding 6,000 centers with a 2.5% annual increase in 2022. Hence, the increasing prevalence of ambulatory surgical centers contributes to the growth of the surgical drapes market.

Key players in the surgical drape market are concentrating on the development of innovative products using advanced technology, such as BeneHold CHG adhesive technology, to offer reliable services to customers. This technology incorporates chlorhexidine gluconate (CHG), an antibacterial chemical, into a thin acrylic adhesive film that prevents edge lift, maintaining a sterile surgical site. In March 2022, Cardinal Health, a US-based healthcare company, introduced the first surgical incise drape utilizing antiseptic CHG, employing Avery Dennison's patented BeneHold CHG adhesive technology to reduce the risk of surgical site contamination.

In April 2023, Cardinal Health collaborated with MedStar Health, a US-based healthcare company, to launch Stray Away, an innovative hair management drape. This collaboration aimed to simplify surgical procedure preparation and enhance patient comfort by minimizing hair obstruction in the operative area, ultimately saving time for the surgical team. MedStar Health offers a comprehensive range of healthcare services, including primary care, specialty care, urgent care, and surgical procedures.

Major companies operating in the surgical drapes market report are Cardinal Health Inc., Thermo Fisher Scientific Inc., 3M Company, Medline Industries LP, Ecolab Inc., STERIS Corporation, Ahlstrom-Munksjo Oyj, PAUL HARTMANN AG, Molnlycke Health Care AB, Standard Textile Co., Alan SA, TIDI Products LLC, AdvaCare Pharma LLP, Crosstex International Inc., Kimal PLC, Rocialle Healthcare Ltd., Welmed Inc., Dynarex Corporation, Hefei C&P Nonwoven Products Co. Ltd., Foothills Industries, Medica Europe BV, Priontex SA, GPC Medical Ltd., Surgeine Healthcare (India) Pvt. Ltd., Barrier Technologies LLC, Bellcross Industries Private Limited, Meditech (India), Sunrise Enterprises Pvt. Ltd., Customed Inc., Wuhan Dymex Healthcare Co. Ltd.

Asia-Pacific was the largest region in the surgical drapes market in 2024. The regions covered in the surgical drapes market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the surgical drapes market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The surgical drapes market consists of sales of incise drapes, impervious drapes, and split drapes. Values in this market are ‘factory gate’ values, that is, the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors, and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

Surgical drapes are specially designed sterile sheets made of non-woven or woven fabric materials that are resistant to fluids and bacteria. They play a crucial role in maintaining a sterile environment and preventing contamination during surgical and medical procedures. These drapes find applications in hospitals and other healthcare settings for infection control, patient safety, and the preservation of a sterile surgical environment.

The main types of surgical drapes include disposable and reusable. Reusable drapes can be cleaned and sterilized for multiple uses, reducing waste and requiring careful cleaning and sterilization processes to ensure their functionality over time. Surgical drapes are categorized based on the level of risk, including minimal (AAMI level 1), low (AAMI level 2), moderate (AAMI level 3), and high (AAMI level 4). These drapes are utilized by various end-users, including clinics, hospitals, ambulatory surgical centers, and others in the healthcare industry.

The surgical drapes market research report is one of a series of new reports that provides surgical drapes market statistics, including surgical drapes industry global market size, regional shares, competitors with a surgical drapes market share, detailed surgical drapes market segments, market trends, and opportunities, and any further data you may need to thrive in the surgical drapes industry. This surgical drapes market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenario of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Surgical Drapes Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on surgical drapes market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for surgical drapes? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The surgical drapes market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Type: Disposable; Reusable2) By Risk Type: Minimal (AAMI Level 1); Low (AAMI Level 2); Moderate (AAMI Level 3); High (AAMI Level 4)

3) By End User: Clinics; Hospitals; Ambulatory Surgical Centers; Other End Users

Subsegments:

1) By Disposable: Single-Use Surgical Drapes; Sterile Disposable Drapes2) By Reusable: Washable Surgical Drapes; Sterilizable Reusable Drapes

Key Companies Mentioned: Cardinal Health Inc.; Thermo Fisher Scientific Inc.; 3M Company; Medline Industries LP; Ecolab Inc.

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Surgical Drapes market report include:- Cardinal Health Inc.

- Thermo Fisher Scientific Inc.

- 3M Company

- Medline Industries LP

- Ecolab Inc.

- STERIS Corporation

- Ahlstrom-Munksjo Oyj

- PAUL HARTMANN AG

- Molnlycke Health Care AB

- Standard Textile Co.

- Alan SA

- TIDI Products LLC

- AdvaCare Pharma LLP

- Crosstex International Inc.

- Kimal PLC

- Rocialle Healthcare Ltd.

- Welmed Inc.

- Dynarex Corporation

- Hefei C&P Nonwoven Products Co. Ltd.

- Foothills Industries

- Medica Europe BV

- Priontex SA

- GPC Medical Ltd.

- Surgeine Healthcare (India) Pvt. Ltd.

- Barrier Technologies LLC

- Bellcross Industries Private Limited

- Meditech (India)

- Sunrise Enterprises Pvt. Ltd.

- Customed Inc.

- Wuhan Dymex Healthcare Co. Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 1.44 Billion |

| Forecasted Market Value ( USD | $ 1.66 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |