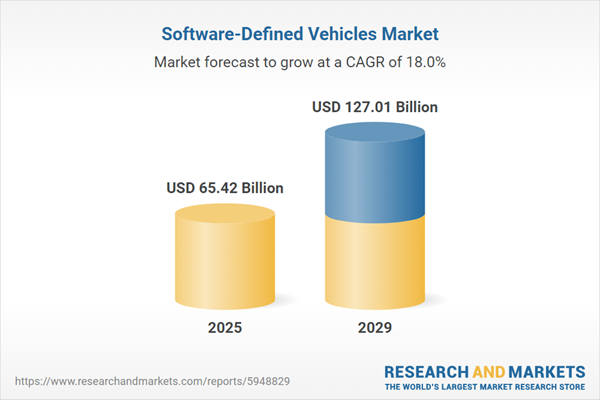

The software-defined vehicles market size has grown rapidly in recent years. It will grow from $55.16 billion in 2024 to $65.42 billion in 2025 at a compound annual growth rate (CAGR) of 18.6%. The growth in the historic period can be attributed to advancements in embedded systems, rising consumer demand for connected vehicles, integration of over-the-air (ota) updates, shift toward electric and hybrid vehicles, regulatory emphasis on vehicle safety.

The software-defined vehicles market size is expected to see rapid growth in the next few years. It will grow to $127.01 billion in 2029 at a compound annual growth rate (CAGR) of 18%. The growth in the forecast period can be attributed to 5g connectivity implementation, rise of mobility-as-a-service (maas), integration of augmented reality (ar) in vehicles, demand for personalized and context-aware services, regulatory push for emission reductio. Major trends in the forecast period include continued collaboration for ecosystem development, increasing emphasis on cybersecurity, evolution of autonomous driving technologies, shift towards software-defined architectures, focus on user experience (ux).

The surge in demand for electrified and autonomous vehicles is anticipated to drive the expansion of the software-defined vehicle market in the future. An electric vehicle (EV) is a car propelled by multiple electric motors, drawing power from various sources, including a battery or an external energy collection system. A self-driving vehicle, also known as an autonomous or unsupervised car, can operate autonomously. The software-defined vehicle is poised to centralize the electric and electrical architecture of automobiles, facilitating seamless integration of innovative features throughout their lifecycle. In March 2023, the International Energy Agency reported exponential growth in the electric car market, with sales surpassing 10 million in 2022, constituting 14% of all new car sales, up from approximately 9% in 2021. Additionally, G2.com Inc. revealed in January 2022 that the global self-driving car industry was growing at a 16% annual rate, with over 1,400 self-driving vehicles undergoing testing. Consequently, the increasing demand for electrified and self-driving automobiles is propelling the software-defined vehicle market.

The growing demand for commercial vehicles is expected to drive the expansion of the software-defined vehicle market. Commercial vehicles are motor vehicles primarily used for transporting goods, services, or passengers for business purposes, such as trucks, vans, and buses. The increasing demand for these vehicles is driven by factors like the rise of e-commerce, urbanization, and favorable government policies. Software-defined vehicles incorporate advanced telematics and data analytics that allow companies to monitor vehicle performance, track locations, and optimize routes in real time, leading to improved efficiency and reduced operational costs. For example, in February 2024, S&P Global Mobility, a US-based financial analytics company, reported that over 1.6 million commercial vehicles were registered in 2023, reflecting an increase compared to 2022. As a result, the growing demand for commercial vehicles is fueling the growth of the software-defined vehicle market.

Leading companies in the software-defined vehicle sector are directing their efforts towards advanced technological products such as the DRIVE Thor to better cater to the needs of their existing consumers. DRIVE Thor is a forward-looking system-on-a-chip (SoC) designed for self-driving cars, aiming to consolidate all intelligent vehicle operations on a single artificial intelligence computer. For instance, in September 2022, NVIDIA Corporation, a US-based technological firm renowned for its graphics processing units, introduced DRIVE Thor. This modern central system, with a performance rating of up to 2,000 teraflops, integrates intelligent functions such as automated driving, parking, driver and person monitoring, digital tool cluster, in-vehicle infotainment (IVI), and rear-seat entertainment into a unified architecture. The advanced AI capabilities of DRIVE Thor draw inspiration from the NVIDIA Hopper Multi-Instance GPU architecture, along with the NVIDIA Grace CPU and NVIDIA Ada Lovelace GPU. DRIVE Thor's MIG support for visuals and computation facilitates the execution of IVI and sophisticated driver-assistance technologies with domain solitude, allowing concurrent time-critical activities to proceed uninterrupted.

In December 2022, Aptiv PLC, an Irish-based company specializing in creating safer, greener, and more interconnected transportation solutions for the future, completed the acquisition of Wind River Systems Inc. for approximately $3.5 billion. This strategic move enables Aptiv PLC to empower clients to leverage the full potential of the software-defined car throughout its entire lifecycle by integrating the Wind River Studios cloud-native software framework into Aptiv's industry-leading Smart Car Architecture. The initial version of this comprehensive end-to-end solution was showcased at CES 2023 in January. Wind River Systems Inc., a US-based company, provides applications for critical intelligent systems and solutions for software-defined vehicles.

Major companies operating in the software-defined vehicles market report are Volkswagen AG, Toyota Motor Corporation, Stellantis N.V., Mercedes-Benz Group AG, Ford Motor Company, General Motors Company, Bayerische Motoren Werke AG, Honda Motor Co. Ltd., Hyundai Motor Group, Robert Bosch GmbH, Tesla Inc., Kia Corporation, Renault Group, Volvo Group, Qualcomm Incorporated, Continental AG, Tata Motors Ltd., Suzuki Motor Corporation, Nvidia Corporation, ZF Friedrichshafen AG, BYD Co. Ltd., Valeo S.A., Aptiv PLC, Harman International Industries, BlackBerry Limited, Jaguar Land Rover Automotive PLC, Marelli Holdings Co. Ltd., Green Hills Software Inc., Airbiquity Inc., Sonatus Inc.

North America was the largest region in the software-defined vehicles market in 2024. The regions covered in the software-defined vehicles market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa. The countries covered in the software-defined vehicle market report are Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, USA, Canada, Italy, Spain.

The software-defined vehicle market includes revenues earned by entities by providing services such as driver assistance, real-time information, diagnostics, and telematics. The market value includes the value of related goods sold by the service provider or included within the service offering. Only goods and services traded between entities or sold to end consumers are included. The software-defined vehicle market consists of sales of operating systems, bootloaders, device drivers, hypervisors, and middleware. Values in this market are ‘factory gate’ values, that is the value of goods sold by the manufacturers or creators of the goods, whether to other entities (including downstream manufacturers, wholesalers, distributors and retailers) or directly to end customers. The value of goods in this market includes related services sold by the creators of the goods.

A software-defined vehicle refers to an automobile whose characteristics and operations are primarily enabled by software, marking a shift from a predominantly hardware-based product to a software-centric electronic device on wheels. This transformation is integral to the development of future intelligent, networked, and environmentally friendly vehicles.

The main propulsions for software-defined vehicles include ICE vehicles and electric vehicles. An ICE vehicle, or internal combustion engine vehicle, is powered by a conventional internal combustion engine. Various types of vehicles fall under this category, such as passenger cars and commercial vehicles. These vehicles can have different levels of autonomy, classified as level 1 through level 5, and encompass a range of applications, including Advanced Driver Assistance Systems (ADAS) and safety features, connected vehicle services, autonomous driving, body control and comfort systems, and powertrain systems.

The software-defined vehicles market research report is one of a series of new reports that provides software-defined vehicles market statistics, including software-defined vehicles industry global market size, regional shares, competitors with software-defined vehicles market share, detailed software-defined vehicles market segments, market trends, and opportunities, and any further data you may need to thrive in the software-defined vehicles industry. This software-defined vehicles market research report delivers a complete perspective of everything you need, with an in-depth analysis of the current and future scenarios of the industry.

The market value is defined as the revenues that enterprises gain from the sale of goods and/or services within the specified market and geography through sales, grants, or donations in terms of the currency (in USD unless otherwise specified).

The revenues for a specified geography are consumption values that are revenues generated by organizations in the specified geography within the market, irrespective of where they are produced. It does not include revenues from resales along the supply chain, either further along the supply chain or as part of other products.

This product will be delivered within 3-5 business days.

Table of Contents

Executive Summary

Software-Defined Vehicles Global Market Report 2025 provides strategists, marketers and senior management with the critical information they need to assess the market.This report focuses on software-defined vehicles market which is experiencing strong growth. The report gives a guide to the trends which will be shaping the market over the next ten years and beyond.

Reasons to Purchase:

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Assess the impact of key macro factors such as conflict, pandemic and recovery, inflation and interest rate environment and the 2nd Trump presidency.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market shares.

- Benchmark performance against key competitors.

- Suitable for supporting your internal and external presentations with reliable high quality data and analysis

- Report will be updated with the latest data and delivered to you along with an Excel data sheet for easy data extraction and analysis.

- All data from the report will also be delivered in an excel dashboard format.

Description

Where is the largest and fastest growing market for software-defined vehicles? How does the market relate to the overall economy, demography and other similar markets? What forces will shape the market going forward? The software-defined vehicles market global report answers all these questions and many more.The report covers market characteristics, size and growth, segmentation, regional and country breakdowns, competitive landscape, market shares, trends and strategies for this market. It traces the market’s historic and forecast market growth by geography.

- The market characteristics section of the report defines and explains the market.

- The market size section gives the market size ($b) covering both the historic growth of the market, and forecasting its development.

- The forecasts are made after considering the major factors currently impacting the market. These include:

- The forecasts are made after considering the major factors currently impacting the market. These include the Russia-Ukraine war, rising inflation, higher interest rates, and the legacy of the COVID-19 pandemic.

- Market segmentations break down the market into sub markets.

- The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by geography and compares their historic and forecast growth. It covers the growth trajectory of COVID-19 for all regions, key developed countries and major emerging markets.

- The competitive landscape chapter gives a description of the competitive nature of the market, market shares, and a description of the leading companies. Key financial deals which have shaped the market in recent years are identified.

- The trends and strategies section analyses the shape of the market as it emerges from the crisis and suggests how companies can grow as the market recovers.

Scope

Markets Covered:

1) By Propulsion: ICE Vehicles; Electric Vehicles2) By Vehicle Type: Passenger Car; Commercial Vehicles

3) By Level Of Autonomy: Level 1; Level 2; Level 3; Level 4; Level 5

4) By Application: ADAS And Safety; Connected Vehicles Services; Autonomous Driving; Body Control And Comfort System; Powertrain System

Subsegments:

1) By ICE Vehicles (Internal Combustion Engine): Gasoline-Powered Vehicles; Diesel-Powered Vehicles2) By Electric Vehicles: Battery Electric Vehicles (BEVs); Hybrid Electric Vehicles (HEVs); Plug-In Hybrid Electric Vehicles (PHEVs)

Key Companies Mentioned: Volkswagen AG; Toyota Motor Corporation; Stellantis N.V.; Mercedes-Benz Group AG; Ford Motor Company

Countries: Australia; Brazil; China; France; Germany; India; Indonesia; Japan; Russia; South Korea; UK; USA; Canada; Italy; Spain

Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

Time Series: Five years historic and ten years forecast.

Data: Ratios of market size and growth to related markets, GDP proportions, expenditure per capita.

Data Segmentation: Country and regional historic and forecast data, market share of competitors, market segments.

Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Delivery Format: PDF, Word and Excel Data Dashboard.

Companies Mentioned

Some of the major companies featured in this Software-Defined Vehicles market report include:- Volkswagen AG

- Toyota Motor Corporation

- Stellantis N.V.

- Mercedes-Benz Group AG

- Ford Motor Company

- General Motors Company

- Bayerische Motoren Werke AG

- Honda Motor Co. Ltd.

- Hyundai Motor Group

- Robert Bosch GmbH

- Tesla Inc.

- Kia Corporation

- Renault Group

- Volvo Group

- Qualcomm Incorporated

- Continental AG

- Tata Motors Ltd.

- Suzuki Motor Corporation

- Nvidia Corporation

- ZF Friedrichshafen AG

- BYD Co. Ltd.

- Valeo S.A.

- Aptiv Plc

- Harman International Industries

- BlackBerry Limited

- Jaguar Land Rover Automotive PLC

- Marelli Holdings Co. Ltd.

- Green Hills Software Inc.

- Airbiquity Inc.

- Sonatus Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 200 |

| Published | March 2025 |

| Forecast Period | 2025 - 2029 |

| Estimated Market Value ( USD | $ 65.42 Billion |

| Forecasted Market Value ( USD | $ 127.01 Billion |

| Compound Annual Growth Rate | 18.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 31 |