In the market, packaging represents one of the primary and most significant applications. PET's versatility, transparency, lightweight nature, and excellent barrier properties make it an ideal material for various packaging formats, including bottles, containers, trays, films, and pouches. PET packaging is widely used across diverse industries such as food and beverage, pharmaceuticals, personal care, and household products due to its ability to preserve product freshness, extend shelf life, and enhance visual appeal on retail shelves. Therefore, the Japan Market consumed 963.53 Kilo Tonnes in packaging in 2022.

The China market dominated the Asia Pacific Polyethylene Terephthalate (PET) Market by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $4,947.7 Million by 2030. The Japan market is registering a CAGR of 5.4% during (2023 - 2030). Additionally, The India market would showcase a CAGR of 6.7% during (2023 - 2030).

PET is widely used in packaging construction materials such as adhesives, sealants, paints, and coatings. It is also used in the production of construction components and materials. The construction sector's expansion significantly impacts the demand for various materials, including plastics like PET. As per the India Brand Equity Foundation, in conjunction with the initiative 'Make in India' and the production-linked incentives (PLI) scheme.

Additionally, the government has implemented the National Infrastructure Pipeline (NIP) to stimulate the expansion of the infrastructure sector. These initiatives have rendered the "Smart Cities Mission" and "Housing for All" programs more effective. Likewise, as per the data from the Statistics Canada, investment in building construction rose 1.7% to $19.8 billion in November 2023. The residential sector grew 2.2% to $13.7 billion, while non-residential sector investment increased 0.4% to $6.0 billion.

Demand for PET is highly correlated with the expansion of the packaging industry in India, given that this polymer provides adaptable and dependable packaging solutions for a vast array of industries. As consumer preferences evolve and industries continue to expand, the demand for PET in the packaging sector will likely remain robust. As per Invest India, the Indian packaging industry is expected to reach $ 204.81 Bn by 2025, registering a growth rate of 26.7% during the period of 2020-2025. Therefore, the expansion of the packaging and construction industries in Asia Pacific is anticipated to drive the regional PET market.

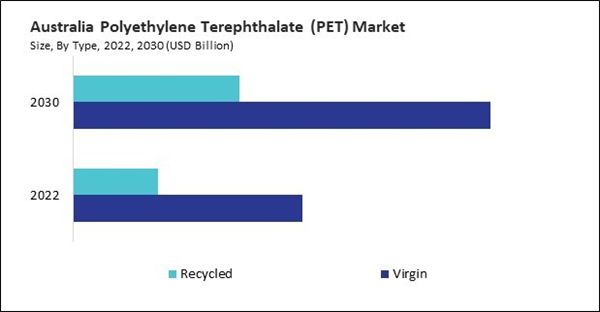

Based on Type, the market is segmented into Virgin and Recycled. Based on Application, the market is segmented into Packaging, Automotive, Construction, Medical, and Others. Based on countries, the market is segmented into China, Japan, India, South Korea, Australia, Malaysia, and Rest of Asia Pacific.

List of Key Companies Profiled

- Lanxess AG

- LOTTE Chemical Corporation (LOTTE Corp.)

- DuPont de Nemours, Inc.

- LyondellBasell Industries Holdings B.V.

- BASF SE

- Indorama Ventures Public Company Limited (Indorama Resources Ltd.)

- RTP Company, Inc.

- SABIC (Saudi Arabian Oil Company)

- Nan Ya Plastics Corp. (NPC)

- Koninklijke DSM N.V.

Market Report Segmentation

By Type (Volume, kilo Tonnes, USD Billion, 2019-2030)- Virgin

- Recycled

- Packaging

- Automotive

- Construction

- Medical

- Others

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

Table of Contents

Companies Mentioned

- Lanxess AG

- LOTTE Chemical Corporation (LOTTE Corp.)

- DuPont de Nemours, Inc.

- LyondellBasell Industries Holdings B.V.

- BASF SE

- Indorama Ventures Public Company Limited (Indorama Resources Ltd.)

- RTP Company, Inc.

- SABIC (Saudi Arabian Oil Company)

- Nan Ya Plastics Corp. (NPC)

- Koninklijke DSM N.V.