As health-conscious consumers increasingly seek convenient and nutritious protein options, the demand for frozen tuna continues to rise, driven by its high protein content, omega-3 fatty acids, and long shelf life. This diversity in tuna types ensures that the frozen fish market can effectively meet the varied needs and preferences of consumers, further solidifying tuna's position as a staple in the global seafood industry. Therefore, the Brazil market consume 10.6 kilo tonnes tuna by 2030.

The Brazil market dominated the LAMEA Frozen Fish Market, by Country in 2022, and would continue to be a dominant market till 2030; thereby, achieving a market value of $1,035.9 Million by 2030, growing at a CAGR of 7.5 % during the forecast period. The Argentina market is expected to witness a CAGR of 9.4% during (2023 - 2030). Additionally, The UAE market is expected to witness a CAGR of 8.2% during (2023 - 2030).

With the ability to preserve fish at peak freshness through advanced freezing technologies, the market has witnessed a surge in trade. Countries can export and import a wide range of frozen fish products, leading to greater market accessibility and diversity in seafood offerings for consumers. factor has contributed to the growing preference for frozen fish, particularly among health-conscious consumers who prioritize the food's safety and integrity.

The adoption of frozen fish has also been fueled by the diversification of product offerings within the market. Manufacturers and retailers are continually innovating, introducing a wide array of ready-to-cook products, processed seafood items, and premium frozen seafood options. This diversification caters to consumers' evolving tastes and preferences, expanding the market's appeal and driving adoption across different demographic segments.

As per the International Trade Administration, the United Arab Emirates leads the Gulf Cooperation Council in eCommerce sales, which surged by 53% in 2020 to a record $3.9 billion, or 10% of overall retail sales. The Dubai Chamber of Commerce and Industry signifies that eCommerce will develop $8 billion in sales by 2025 as the UAE region has nearly 100% internet and mobile phone penetration .Thus, due to these aspects, the frozen fish market will expand across the LAMEA region in upcoming years.

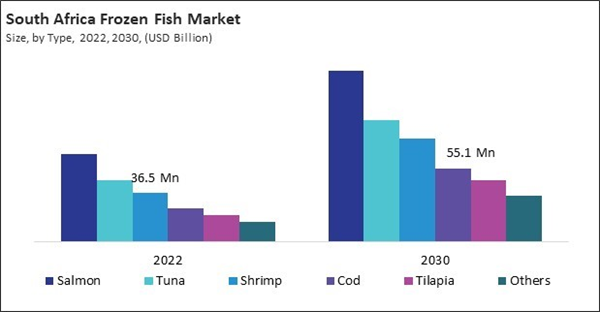

Based on Distribution Channel, the market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Online Retail, and Specialty Stores. Based on Type, the market is segmented into Salmon, Tuna, Shrimp, Cod, Tilapia, and Others. Based on countries, the market is segmented into Brazil, Argentina, UAE, Saudi Arabia, South Africa, Nigeria, and Rest of LAMEA.

List of Key Companies Profiled

- Dongwon Enterprises Co. Ltd.

- Mowi ASA

- Zoneco Group Co., Ltd.

- F.C.F. Fishery Co., Ltd.

- Nippon Suisan Kaisha, Ltd.

- Chicken of the sea International (Thai Union Group PLC)

- Nueva Pescanova, S.L (Abanca Corporación Bancaria, S.A.)

- Tassal Group Limited

- High Liner Foods

- SalMar ASA (Kvera AS)

Market Report Segmentation

By Distribution Channel (Volume, Kilo Tonnes, USD Billion, 2019-2030)- Supermarkets & Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Stores

- Salmon

- Tuna

- Shrimp

- Cod

- Tilapia

- Others

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Dongwon Enterprises Co. Ltd.

- Mowi ASA

- Zoneco Group Co., Ltd.

- F.C.F. Fishery Co., Ltd.

- Nippon Suisan Kaisha, Ltd.

- Chicken of the sea International (Thai Union Group PLC)

- Nueva Pescanova, S.L (Abanca Corporación Bancaria, S.A.)

- Tassal Group Limited

- High Liner Foods

- SalMar ASA (Kvera AS)