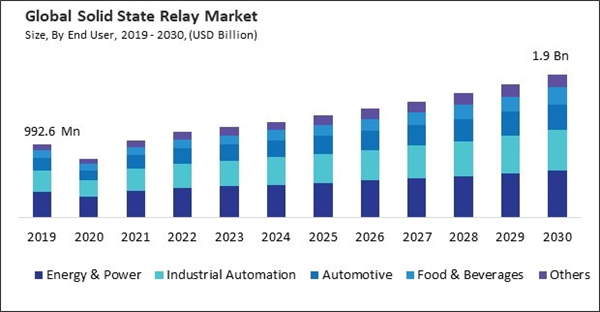

SSRs play a crucial role in smart manufacturing systems by providing reliable and precise control of electrical loads in automated machinery, robotics, conveyor systems, and production lines. Consequently, the Industrial Automation segment would generate approximately 27.86 % share of the market by 2030. Also, France would utilize 839.12 thousand units of PCB mount by 2030. As smart manufacturing adoption grows, the demand for SSRs to support automation and internet of things (IoT) integration increases.

SSRs offer much faster switching speeds compared to electromechanical relays. They can switch on and off in microseconds, making them ideal for applications requiring rapid response times and precise control of electrical loads. This feature is crucial in manufacturing, automation, and telecommunications industries, where high-speed switching is essential for efficiency and performance. Therefore, the above advantages of SSRs over electromechanical relays drive the market’s growth.

Additionally, Consumer electronics devices, such as smartphones, tablets, laptops, and wearable gadgets, require compact and lightweight components to meet the demand for smaller, more portable designs. SSRs, with their solid-state construction and compact form factor, are well-suited for integration into these miniaturized electronic devices. Hence, the growing demand for SSRs in consumer electronics drives the market’s growth.

However, SSRs typically have a higher initial cost compared to electromechanical relays. This higher upfront cost includes the price of the SSR device itself and associated installation and integration expenses. For businesses and industries operating on tight budgets or seeking cost-effective solutions, the higher initial investment required for SSRs may be a barrier to adoption. Thus, the high initial investment cost is hampering the market’s growth.

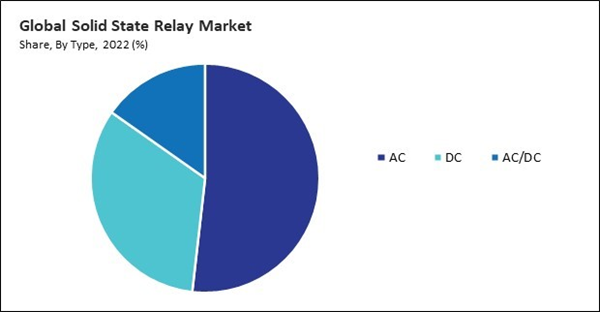

By Type Analysis

On the basis of type, the market is segmented into AC, DC, and AC/DC. The AC segment recorded the 51.79 % revenue share in the market in 2022. In terms of volume, the AC/DC relays segment sold 2,185.1 thousand units in 2022. AC SSRs are versatile and can be used in various industries. They are commonly employed in heating, ventilation, air conditioning (HVAC) systems, industrial automation, lighting control, motor control, and power distribution applications. They can handle a wide range of AC voltages and frequencies, allowing them to be used in different regions with varying electrical standards.By End User Analysis

Based on end user, the market is divided into energy & power, industrial automation, automotive, food & beverages, and others. In 2022, the food & beverages segment held a 10.43 % revenue share in the market. SSRs offer a hygienic and safe solution for controlling electrical loads in food and beverage processing equipment. As per the National Investment Promotion & Facilitation Agency, by 2025, the food processing sector in India is estimated to reach $535 Bn and grow at a rate of 15.2%.By Mounting Type Analysis

By mounting type, the market is divided into panel mount, PCB mount, DIN rail mount, and others. In 2022, the PCB mount segment registered a 42.79 % revenue share in the market. PCB (printed circuit board) mount SSRs are compact and can be directly mounted onto the circuit board, saving space compared to traditional through-hole components. This cost-effectiveness makes them attractive for manufacturers looking to reduce production costs without compromising performance.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region generated a 27.82 % revenue share in market. North America is witnessing significant growth in renewable energy sources such as solar, wind, and hydroelectric power. SSRs are used in smart grid systems to facilitate grid automation, demand response, and energy management, contributing to their rising demand in the region.Recent Strategies Deployed in the Market

- May-2023: Omron Corporation launched the G2RV-ST, an industrial 6mm electromechanical relay. The G2RV-ST relay includes a short bar that is easily cut and offers a tangible sense of secure connection. Furthermore, this product presents machine manufacturers and panel builders with the perfect solution for compact panels and equipment, ensuring the durability and reliability essential for industrial applications.

- Sep-2022: Panasonic Holdings Corporation expanded its PhotoMOS relay series by unveiling the AQV258H5 HE series PhotoMOS relays, MOSFET-enabled Solid State Relays. The series includes 5kV I/O isolation and enhanced clearance and creepage distance on the output side, along with compact 1-Form-A DIP5 packaging. Moreover, AQV258H5 relays are characterized by low control current and leakage current, and they generate no switching noise.

- Jul-2022: Littelfuse, Inc. completed the acquisition of C&K Components, Inc., a designer and manufacturer of high-performance electromechanical switches and interconnect solutions. Through this acquisition, Littelfuse aims to broaden its technologies and capabilities, enhancing its ability to provide a comprehensive range of solutions to a diverse customer base across various vertical end markets. Furthermore, the synergies between the businesses of C&K and Littelfuse will allow for an expansion of Littelfuse's presence in the market.

- Apr-2022: Sensata Technologies Holding PLC acquired Dynapower Company LLC, a provider of energy storage and power conversion solutions, from private equity firm Pfingsten Partners, L.L.C. Through this acquisition, Dynapower will introduce energy storage and power conversion solutions into Sensata's portfolio. Moreover, Dynapower will empower Sensata Technologies to provide meticulously engineered, mission-critical power conversion solutions to rapidly expanding markets such as renewable energy storage, electric vehicle charging, industrial sectors, and defense applications.

- Nov-2021: Littelfuse, Inc. acquired Carling Technologies, Inc., a manufacturer of circuit breakers, switches, power distribution units, digital switching systems, and electronic controls. Through this acquisition, Littelfuse will enhance its technologies and capabilities, achieving critical scale. Furthermore, the inclusion of Carling's business will significantly increase the size of Littelfuse's commercial vehicle segment, and the synergy between customers, distribution channels, and products will expedite Littelfuse's growth in key markets.

List of Key Companies Profiled

- Vishay Intertechnology, Inc.

- Panasonic Holdings Corporation

- Omron Corporation

- Infineon Technologies AG

- TE Connectivity Ltd.

- Fujitsu Limited

- Sharp Corporation

- Sensata Technologies Holdings PLC

- Littelfuse, Inc.

- Carlo Gavazzi Automation S.p.A. (Carlo Gavazzi Holding AG)

Market Report Segmentation

By Type (Volume, Thousand Units, USD Billion, 2019-2030)- AC

- DC

- AC/DC

- Energy & Power

- Industrial Automation

- Automotive

- Food & Beverages

- Others

- PCB Mount

- Panel Mount

- DIN Rail Mount

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Vishay Intertechnology, Inc.

- Panasonic Holdings Corporation

- Omron Corporation

- Infineon Technologies AG

- TE Connectivity Ltd.

- Fujitsu Limited

- Sharp Corporation

- Sensata Technologies Holdings PLC

- Littelfuse, Inc.

- Carlo Gavazzi Automation S.p.A. (Carlo Gavazzi Holding AG)