Smart home appliances seamlessly integrate with other devices and platforms, allowing users to create interconnected and automated home environments. Thus, the home appliance segment captured 21.1% revenue share in the market 2022. Integration with smart hubs and home automation systems enables users to control multiple appliances with simple voice commands or automated routines, enhancing the overall experience.

The major strategies followed by the market participants is Partnership as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November 2022 Amazon.com, Inc. came into partnership with Samsung Electronics, a South Korean multinational major appliance and consumer electronics corporation. Through this partnership, Amazon.com, Inc. would provide smart things and Alexa users to leverage Matter's multi-admin feature, broadening communication and capabilities across various devices. Additionally, In October, 2022, Siemens AG came into partnership with, Qualcomm, an American multinational corporation. Through this partnership, Siemens AG would revolutionize building automation in the Americas by implementing a 5G private network (PN) based on the Snapdragon® X55 5G Modem-RF System.

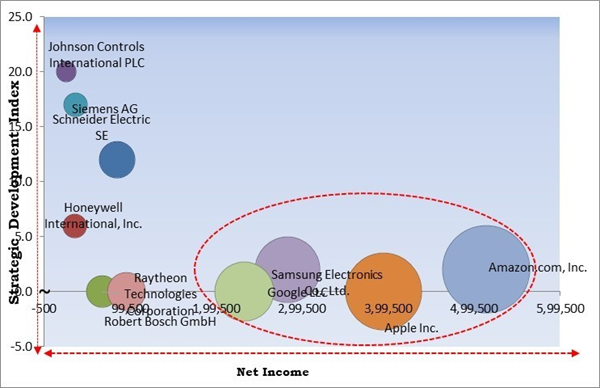

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Amazon.com, Inc., Apple Inc., and Samsung Electronics Co., Ltd. are the forerunners in the Smart Home Devices Market. Companies such as Raytheon Technologies Corporation, Siemens AG, and Schneider Electric SE are some of the key innovators in the Smart Home Devices Market. In August 2023, Siemens AG came into partnership with Sonepar, a wholesale company in Paris. Through this partnership, Siemens AG would enhance and modernize building materials to achieve greater efficiency and intelligence, by incorporating HVAC devices and building automation systems into its offerings.Market Growth Factors

Modern lifestyles are increasingly fast-paced and hectic, leaving consumers limited time for mundane tasks. Smart home devices promise to simplify daily routines and automate repetitive chores, allowing individuals to reclaim time for more meaningful activities. Smart home devices offer a high degree of customization and personalization.Additionally, according to the Office for National Statistics, 92% of adults in the UK were internet users in 2020, up from 91% in 2019. As internet connectivity expands and evolves, the market is poised for continued innovation and transformation, shaping the future of connected living environments. In conclusion, the increasing internet penetration is driving the market's growth.

Market Restraining Factors

Smart home devices often cost more upfront than traditional, non-connected alternatives. This is primarily due to the inclusion of advanced technology components, sensors, connectivity modules, and software features that enable smart functionality. For example, smart thermostats, security cameras, and lighting systems may cost more than their conventional counterparts due to the added features and capabilities. Thus, the high initial costs of devices are impeding the market's growth.By Type Analysis

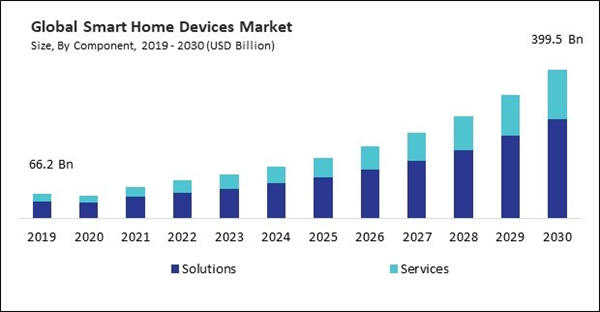

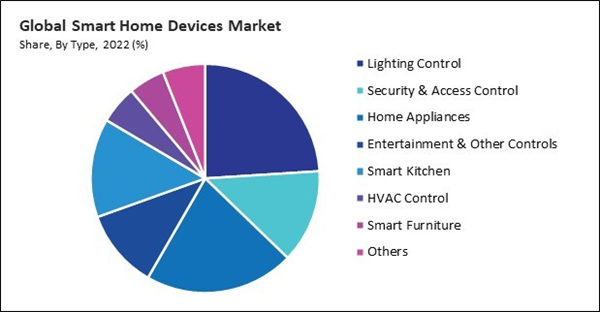

On the basis of type, the market is segmented into security & access control, HVAC control, entertainment & other controls, smart kitchen, lighting control, home appliances, smart furniture, and others. The lighting control segment recorded 23.9% revenue share in the market in 2022. The increasing affordability, convenience, energy efficiency, and integration capabilities of smart lighting solutions are driving their popularity among consumers looking to upgrade their homes with smart technology.By Component Analysis

Based on component, the market is bifurcated into solutions and services. The services segment attained 31.9% revenue share in the market in 2022. As the number and variety of it increase, consumers often encounter challenges in integrating and configuring these devices to work together seamlessly.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the Asia Pacific region generated 29.4% revenue share in the market. Many countries in the Asia Pacific region are experiencing rapid urbanization and population growth, leading to increased demand for housing and infrastructure solutions.- Feb-2024: Honeywell International, Inc. came into partnership with Analog Devices, an American multinational semiconductor company, and NXP Semiconductors, a Dutch semiconductor designer and manufacturer. Through this partnership, Honeywell International, Inc. would enhance digital connectivity and boost energy efficiency within buildings.

- Jan-2024: Schneider Electric SE introduced "Schneider Home" a home energy management solution. The Schneider Home Energy Management solution comprises a clean energy storage home battery, a high-power solar inverter, a smart electrical panel, an electric vehicle charger, and connected electric sockets and light switches. All these components are easily controlled through the user-friendly Schneider Home App.

- Sep-2023: Johnson Controls International PLC came into partnership with BT Group, a British multinational telecommunication holding company. Through this partnership, Johnson Controls International PLC would assist business clients in the UK and globally to leverage smart building technology for digital monitoring, analysis, and optimization of energy consumption in workplace environments.

- Aug-2023: Siemens AG came into partnership with Sonepar, a wholesale company in Paris. Through this partnership, Siemens AG would enhanc and modernize building materials to achieve greater efficiency and intelligence, by incorporating HVAC devices and building automation systems into its offerings.

- Jul-2023: Siemens AG came into partnership with PRODEA Investments, a real estate company. Through this partnership, Siemens AG would establish intelligent and sustainable buildings in Greece.

- Jul-2023: Honeywell International, Inc. took over SCADAfence, a computer and network security company. Through this acquisition, Honeywell International, Inc. would enhance its operational technology (OT) cybersecurity portfolio by strengthening its inclusive professional services, managed security services, and software solutions.

List of Key Companies Profiled

- Johnson Controls International PLC

- Schneider Electric SE

- Siemens AG

- Honeywell International, Inc.

- com, Inc.

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Robert Bosch GmbH

- Raytheon Technologies Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)

Market Report Segmentation

By Component- Solutions

- Services

- Lighting Control

- Security & Access Control

- Home Appliances

- Entertainment & Other Controls

- Smart Kitchen

- HVAC Control

- Smart Furniture

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Johnson Controls International PLC

- Schneider Electric SE

- Siemens AG

- Honeywell International, Inc.

- Amazon.com, Inc.

- Apple Inc.

- Google LLC (Alphabet Inc.)

- Robert Bosch GmbH

- Raytheon Technologies Corporation

- Samsung Electronics Co., Ltd. (Samsung Group)