Governments and industries in the Asia Pacific region have been working towards sustainable practices, including increased PET recycling. Consequently, the Asia Pacific segment captured $11,603.5 million revenue in the market in 2022. Also, the China market consumed 2,424.16 kilo tonnes of volume in 2022. Environmental concerns and regulations have led to a greater emphasis on recycling in market. This trend can impact the overall market dynamics. Thus, the segment will expand rapidly in the upcoming years.

The beverage sector, spanning water, soft drinks, juices, and alcoholic beverages, stands as a dominant consumer of PET packaging. As beverages are often distributed on a large scale, the reduced weight of PET containers compared to alternative materials lowers shipping costs and environmental impact, making it an economically viable choice. Therefore, owing to these factors, the market will grow rapidly in the upcoming years.

Additionally, the global trends of urbanization and evolving consumer lifestyles are pivotal drivers in the packaging industry, emphasizing the demand for convenient and portable solutions. As per Statistics Canada, in 2021, nearly three in four Canadians (73.7%) lived in one of Canada's large urban centers, up from 73.2% five years earlier. Urbanization often corresponds with a faster-paced lifestyle, where consumers seek convenient and time-efficient solutions.

However, the demand for is intricately tied to the prices of its key raw materials, namely purified terephthalic acid (PTA) and monoethylene glycol (MEG). PET, derived from these feedstocks, is vulnerable to price fluctuations, posing a substantial challenge for manufacturers. The challenge extends beyond the production phase, affecting pricing strategies, supply chain management, and, ultimately, the ability of market players to maintain healthy profit margins.

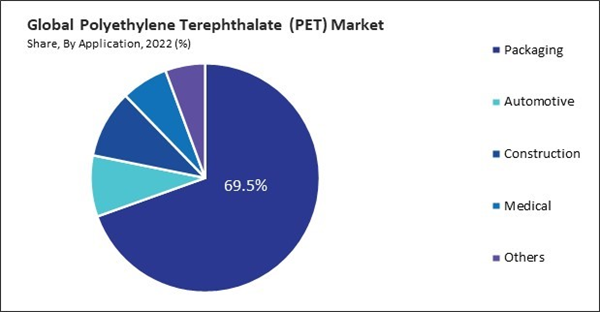

By Application Analysis

On the basis of application, the market is divided into packaging, automotive, construction, medical, and others. The packaging segment recorded the 69.53% revenue share in the market in 2022. In terms of volume, packaging segment would register 20,219.4 kilo tonnes by 2030. The rise in consumer demand for convenience and on-the-go products has led to an increased consumption of packaged goods.By Type Analysis

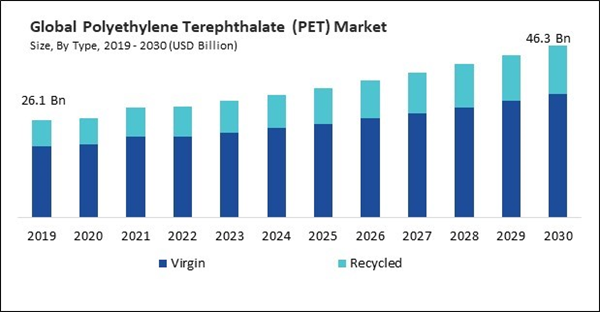

Based on type, the market is segmented into virgin and recycled. In 2022, the recycled segment garnered a 27.0% revenue share in the market. In terms of volume, recycled segment registered 5,330.0 kilo tonnes in 2022. Governments, industries, and organizations worldwide are promoting circular economy models. Utilizing recycled materials supports closing the loop, reducing the need for new raw materials, and minimizing waste.By Regional Analysis

By region, the market is segmented into North America, Europe, Asia Pacific, and LAMEA. The North America segment procured a 25.21% revenue share in the market in 2022. In terms of volume, North America segment utilized 4,928.0 kilo tonnes in 2022. PET is widely used to produce bottles, containers, and other packaging materials. The demand for PET in North America may be influenced by the growth in the food and beverage, personal care, and pharmaceutical industries, which are major consumers of PET packaging.List of Key Companies Profiled

- Lanxess AG

- LOTTE Chemical Corporation (LOTTE Corp.)

- DuPont de Nemours, Inc.

- LyondellBasell Industries Holdings B.V.

- BASF SE

- Indorama Ventures Public Company Limited (Indorama Resources Ltd.)

- RTP Company, Inc.

- SABIC (Saudi Arabian Oil Company)

- Nan Ya Plastics Corp. (NPC)

- Koninklijke DSM N.V.

Market Report Segmentation

By Type (Volume, kilo Tonnes, USD Billion, 2019-2030)- Virgin

- Recycled

- Packaging

- Automotive

- Construction

- Medical

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Lanxess AG

- LOTTE Chemical Corporation (LOTTE Corp.)

- DuPont de Nemours, Inc.

- LyondellBasell Industries Holdings B.V.

- BASF SE

- Indorama Ventures Public Company Limited (Indorama Resources Ltd.)

- RTP Company, Inc.

- SABIC (Saudi Arabian Oil Company)

- Nan Ya Plastics Corp. (NPC)

- Koninklijke DSM N.V.