Telecommunication networks provide the backbone for communication within industrial automation systems. Consequently, the electronics & telecommunication segment captured $1,656.6 million revenue in the market in 2022. The expansion of telecommunication infrastructure supports real-time data transfer and control but also introduces security challenges that require cybersecurity measures to safeguard against potential vulnerabilities and attacks. Adopting 5G technology in telecommunications offers high-speed and low-latency connectivity, enabling faster and more efficient communication in industrial automation.

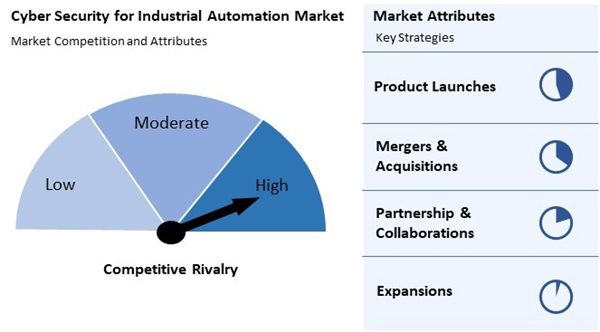

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. For instance, In June, 2023, Schneider Electric SE launched EcoStruxureTM Automation Expert V23.0 for the Canadian market. With this cyber-secure solution, people can monitor and manage different aspects of industrial operations and work more efficiently. Additionally, In April, 2023, Cisco Systems Inc. unveiled the XDR solution, a unified, AI-driven, cross-domain security platform to help organizations better protect the integrity of their entire IT ecosystem.

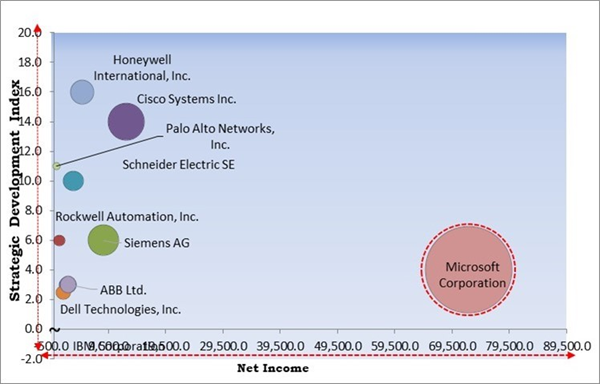

Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the Cardinal Matrix; Microsoft Corporation is the forerunner in the Market. Companies such as Cisco Systems Inc., Siemens AG and Honeywell International, Inc. are some of the key innovators in Market. For Instance, In October, 2023, Siemens AG launched SINEC Security Inspector, an all-in-one security testing suite for industrial networks. This new product provides a novel, improved testing approach to the shopfloor, allowing clients to inspect their whole IT/OT ecosystem, including all individual components.Market Growth Factors

Cyber threats have evolved with advanced techniques, including sophisticated malware, ransomware, and zero-day exploits. Securing critical systems from cyber-attacks is paramount to ensuring essential services' continuous and safe operation. Denial-of-Service (DoS) attacks aim to disrupt industrial operations by overwhelming systems with traffic. Cybersecurity solutions are necessary to prevent and mitigate the impact of such disruptive attacks on industrial automation. Thus, because of the increasing number of cyber threats, the market is anticipated to increase significantly.Additionally, AI-based solutions employ behavioral analytics to monitor and analyze behavior patterns within industrial networks. AI-driven behavioral biometrics enhance user authentication by analyzing patterns in user behavior. This strengthens access controls, ensuring only authorized personnel can access critical industrial systems. According to International Trade Administration, the AI industry is expanding globally. AI funding increased to $66.8 billion globally in 2021, and a record 65 AI companies were valued at $1 billion or more, up 442% from the previous year.

Market Restraining Factors

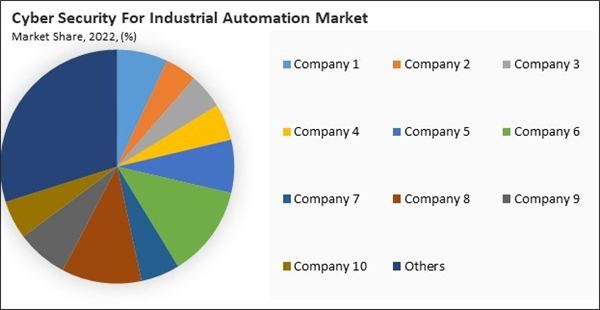

Industrial networks often use proprietary communication protocols. Developing cybersecurity solutions that can effectively secure these protocols across various systems can be complex, potentially hindering the development of standardized security measures. Continuous monitoring of industrial networks for cybersecurity threats is essential. However, the intricacies of these networks may make real-time monitoring and detection of anomalies more challenging, slowing down incident response efforts. Thus, rising complexity of industrial networks can slow down the growth of the market.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches.

By Technologies Analysis

By technologies, the market is segmented into programmable logic controllers, computer numerical control (CNC) systems, industrial sensors, and others. In 2022, the programmable logic controllers segment registered 36.79% revenue share in the market. Programmable logic controllers (PLCs) are widely used to control and automate manufacturing processes in automotive, pharmaceutical, and food processing industries.By Type Analysis

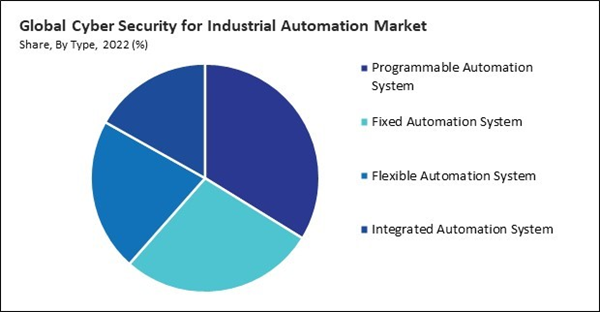

On the basis of type, the market is divided into flexible automation system, integrated automation system, fixed automation system, and programmable automation system. The flexible automation system segment garnered a 21.61% revenue share in the market in 2022. Flexible automation systems enable dynamic changes to manufacturing configurations based on production requirements.By Security Type Analysis

By security type, the market is categorized into enterprise security, SCADA security, network security, device security, and physical security. In 2022, the SCADA security segment held 27.4% revenue share in the market. SCADA security helps minimize downtime by preventing disruptions caused by cyber threats. By safeguarding against unauthorized access, data manipulation, or denial-of-service attacks, organizations can maintain continuous and reliable operation of industrial processes.By End Use Analysis

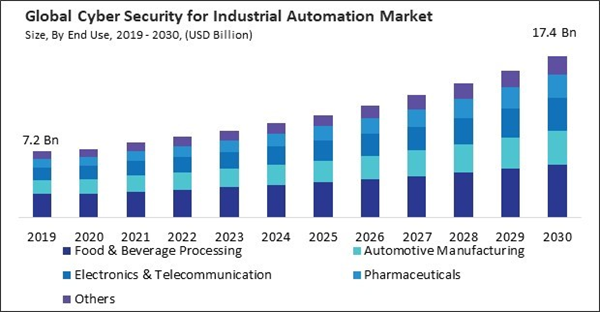

Based on end use, the market is classified into automotive manufacturing, electronics & telecommunication, food & beverage processing, pharmaceuticals, and others. The automotive manufacturing segment acquired a 21.27% revenue share in the market in 2022. The automotive industry heavily relies on automated production lines, robotic systems, and industrial control systems to enhance efficiency and precision. As automation increases, the attack surface for potential cyber threats expands, necessitating cybersecurity measures to protect these critical systems.By Regional Analysis

Region-wise, the market is analysed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region acquired a 29.45% revenue share in the market. North America relies heavily on critical infrastructure systems, including energy grids, water treatment facilities, and transportation networks. North America has witnessed a high adoption of advanced manufacturing technologies, including robotics, IoT devices, and industrial control systems.Market Competition and Attributes

The market competition in cybersecurity for industrial automation is fierce, with a myriad of cybersecurity firms, industrial automation companies, and technology providers vying to develop robust solutions tailored to safeguard critical infrastructure from cyber threats. As industries increasingly adopt automation and interconnected systems, the demand for effective cybersecurity measures intensifies, driving innovation and investment in threat detection, prevention, and incident response capabilities. Furthermore, regulatory requirements and growing awareness of cyber risks propel competition, prompting companies to differentiate themselves through advanced technologies, strategic partnerships, and comprehensive cybersecurity services.

Recent Strategies Deployed in the Market

- Feb-2024: Palo Alto Networks, Inc. launched the Cortex platform for endpoint security to help customers accelerate platformization and improve their endpoint protection. The new product will offer qualified customers a higher standard of endpoint protection without disruption.

- Dec-2023: Palo Alto Networks, Inc. acquired Dig Security, an innovative provider of data security posture management (DSPM). Through this acquisition, the company will provide customers with the critical data security capabilities and context they need to improve their overall cloud security posture.

- Dec-2023: Honeywell International, Inc. acquired Carrier Global Corporation, an American multinational company, to enhance and strengthen its building automation capabilities. This acquisition will enable Honeywell to become a leading provider of security solutions by providing its customers advanced security and safety systems.

- Dec-2023: Cisco Systems Inc. announced that it had acquired Isovalent, a privately held enterprise software company headquartered in California, to extend security and networking innovation. Through this acquisition, Cisco intended to isolate security controls from multi-cloud architecture to enable superior defense against new threats across any cloud, application, or workload.

- Nov-2023: Rockwell Automation, Inc. acquired Verve Industrial Protection, an asset inventory system and vulnerability management solution, to help with cybersecurity vulnerabilities. This acquisition will expand Rockwell’s cybersecurity offerings and help build the resilience and security of customers’ operations.

List of Key Companies Profiled

- Cisco Systems Inc.

- Schneider Electric SE

- Dell Technologies, Inc.

- Rockwell Automation, Inc.

- Honeywell International, Inc.

- IBM Corporation

- ABB Ltd.

- Microsoft Corporation

- Siemens AG

- Palo Alto Networks, Inc.

Market Report Segmentation

By Type- Programmable Automation System

- Fixed Automation System

- Flexible Automation System

- Integrated Automation System

- SCADA Security

- Enterprise Security

- Network Security

- Device Security

- Physical Security

- Food & Beverage Processing

- Automotive Manufacturing

- Electronics & Telecommunication

- Pharmaceuticals

- Others

- Programmable Logic Controllers

- Computer Numerical Control (CNC) Systems

- Industrial Sensors

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- Cisco Systems Inc.

- Schneider Electric SE

- Dell Technologies, Inc.

- Rockwell Automation, Inc.

- Honeywell International, Inc.

- IBM Corporation

- ABB Ltd.

- Microsoft Corporation

- Siemens AG

- Palo Alto Networks, Inc.