Rubber products manufactured using CO2 as a feedstock can exhibit comparable or improved performance characteristics compared to those made using traditional feedstocks. Therefore, the rubber segment captured $1,270.21 million revenue in the market in 2022. Also, the Russia market consumed 38.92 kilo tonnes in the market in 2022. The pursuit of sustainable products and the growing consciousness of consumers are motivating manufacturers to investigate alternative feedstocks, such as carbon dioxide.

CO2 injection has been proven to be one of the most efficient EOR methods. Injecting CO2 into an oil reservoir causes the oil to mix with the CO2, which lowers the oil’s viscosity and facilitates easier flow through the pores in the reservoir. Advances in EOR technology, including improved reservoir modeling, drilling techniques, and CO2 capture and injection methods, have made CO2-based EOR more feasible and cost-effective. Hence, the growing adoption of enhanced oil recovery (EOR) drives the market’s growth.

Additionally, one of the primary drivers of CO2 demand in the food and beverage industry is the increasing consumption of carbonated beverages such as soda, sparkling water, and beer. The increasing processed food industry is driving the growth demand for CO2. For example, according to the United States Department of Agriculture, with an average yearly growth rate of 4.3 percent and a projected GDP contribution to Mexico’s economy of $39.4 billion by 2020, the food processing industry is one of the most dynamic in the country.

However, Industrial activities include the production of cement, electricity, and chemicals, which are some of the main sources of CO2. The energy-intensive nature of these processes can result in high production costs, particularly if energy prices are volatile or renewable energy sources are not readily available. Hence, high CO2 production costs are hampering the market’s growth.

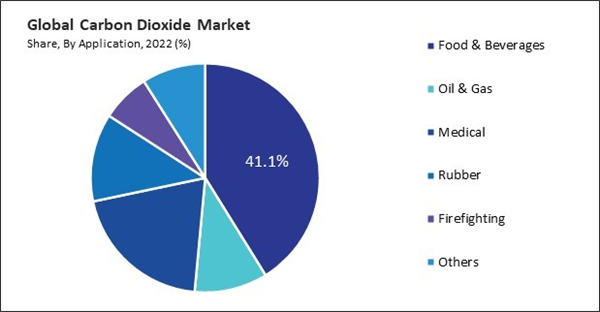

By Application Analysis

On the basis of application, the market is segmented into food & beverages, medical, oil & liquid, rubber, firefighting, and others. The food and beverages segment recorded the 41.15% revenue share in the market in 2022. In terms of volume, food and beverages segment registered 11,567.75 kilo tonnes in 2022. CO2 is used in cryogenic freezing and cooling applications to rapidly chill or freeze food products. In cryogenic freezing, liquid CO2 is sprayed or injected into food products, causing rapid cooling and freezing.By Form Analysis

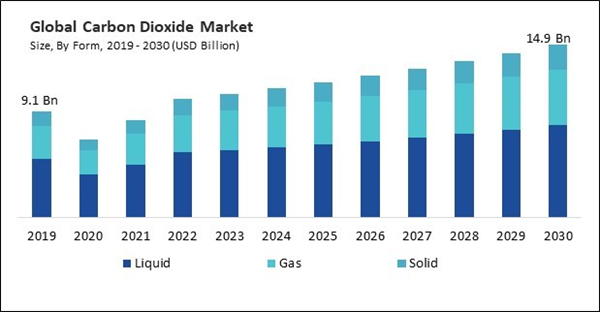

Based on form, the market is segmented into solid, liquid, and gas. In 2022, the gas segment garnered a 31.62% revenue share in the market. In terms of volume, gas segment would register 10,067.15 kilo tonnes by 2030. Gaseous CO2 is nonflammable, nontoxic, and noncorrosive, making it safe for various industrial and commercial applications. Due to its inert qualities, it can be used in food and beverage manufacturing plants, hospitals, and fire suppression systems where people’s safety is the top priority.By Source Analysis

By source, the market is divided into hydrogen, ethyl alcohol, ethylene oxide, substitute natural gas, and others. The ethyl alcohol segment attained the 36.44% revenue share in the market in 2022. In terms of volume, ethyl alcohol segment would consume 14,086.59 kilo tonnes by 2030. Ethyl alcohol, also known as ethanol, is widely available and accessible as a (CO2) production source. It is derived from renewable sources such as sugarcane, corn, and other biomass, making it a sustainable and abundant feedstock for CO2 generation.By Regional Analysis

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region witnessed a 32.93% revenue share in the market in 2022. In terms of volume, Asia Pacific segment would utilize 5,078.11 kilo tonnes by 2030. Rapid urbanization, economic growth, and industrialization in the Asia-Pacific region are driving up demand for CO2 across a range of industrial uses. CO2 is necessary for carbonation, chemical synthesis, metal production, and semiconductor creation in various industries, including electronics, metallurgy, food and beverage processing, and chemical manufacturing.Market Competition and Attributes

The market is characterized by intense competition driven by factors such as the demand for CO2 across various industries including food and beverage, healthcare, and agriculture, as well as the growing emphasis on reducing greenhouse gas emissions. Key players in the market vie for market share through strategies such as technological advancements, geographical expansion, and strategic partnerships, while regulatory frameworks and environmental concerns increasingly shape market dynamics, influencing pricing strategies and investment decisions.

Recent Strategies Deployed in the Market

- Feb-2024: Linde Engineering, a part of Linde PLC, has signed an agreement with Yara International ASA, a global fertilizer manufacturer, to build a world-scale CO2 liquefaction plant in Sluiskil, the Netherlands. This agreement will enhance Linde's geographical CO2 liquefaction portfolio.

- Dec-2023: Gulf Cryo announced its geographical expansion in Saudi Arabia’s western region by inaugurating a new carbon capture and utilization facility. The new facility will be capable of capturing 300 metric tons of CO2 daily from the MEG plant, leading to a significant reduction in carbon emissions.

- Apr-2023: Linde PLC signed an agreement with ExxonMobil, an American multinational oil and gas corporation, for the off-take of CO2 associated with Linde’s new clean hydrogen production in Beaumont, Texas. Under this agreement, Linde will decarbonize customer processes while safely and reliably supplying low-carbon hydrogen at scale.

- Oct-2022: SOL Group completed the geographical expansion of the liquid food CO2 production plant in Wanze (Belgium). This new plant will produce more than 65,000 metric tons of product per year to meet the growing demands of customers in Northern Europe and some neighboring foreign countries.

List of Key Companies Profiled

- SOL Group

- India Glycols Limited

- Gulf Cryo

- Linde plc

- Ellenbarrie Industrial Gases Limited

- Taiyo Nippon Sanso Corporation (Mitsubishi Chemical Holdings)

- Dubai Industrial Gas (Al Mana Group)

- Buzwair Industrial Gases Factories (Buzwair Group)

- Messer SE & Co. KGaA (Messer Industrie GmbH)

- Acail Gas (Acail Group)

Market Report Segmentation

By Application (Volume, kilo Tonnes, USD Billion, 2019-2030)- Food & Beverages

- Oil & Gas

- Medical

- Rubber

- Firefighting

- Others

- Liquid

- Gas

- Solid

- Ethyl Alcohol

- Hydrogen

- Ethylene Oxide

- Substitute Natural Gas

- Others

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Table of Contents

Companies Mentioned

- SOL Group

- India Glycols Limited

- Gulf Cryo

- Linde plc

- Ellenbarrie Industrial Gases Limited

- Taiyo Nippon Sanso Corporation (Mitsubishi Chemical Holdings)

- Dubai Industrial Gas (Al Mana Group)

- Buzwair Industrial Gases Factories (Buzwair Group)

- Messer SE & Co. KGaA (Messer Industrie GmbH)

- Acail Gas (Acail Group)