The growing adoption of practice management systems in multi-specialty groups’ practices improves efficiency, enhances communication, and streamlines workflows. Major service providers are undergoing strategic development, contributing to the markets growth. For instance, in January 2024, Cardinal Health acquired Specialty Networks, a technology-enabled multi-specialty groups’ practice enhancement and purchasing organization, for USD 1.2 billion. This acquisition is anticipated to accelerate growth in its Specialty Business for Cardinal Health. It aims to bolster its portfolio with cutting-edge technologies, capabilities, and talent to better serve critical business & customer needs.

The COVID-19 pandemic has significantly impacted the market growth. Many physician groups have been impacted by a significant decrease in revenue due to the postponement and cancellation of elective procedures and non-urgent visits. This has been especially challenging for smaller and independent practices. The American Medical Association reports that spending on the Medicare Physician Fee Schedule (MPFS) dropped significantly to around 57% (USD 13.9 billion) in March and April 2020. However, the market growth has been positively impacted by the increasing adoption of telehealth and the shift towards value-based care in the U.S.

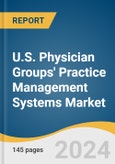

U.S. Physician Groups’ Practice Management Systems Market Report Highlights

- Based on practice type, the single-specialty segment dominated the market in 2023. This can be attributed to the growing patient preference to seamless integration between practice management systems and Electronic Health Records (EHRS) is crucial for efficient operations & continuity of patient care.

- Growing adoption of EHR systems by single and multispecialty groups, rising need to improve the efficiency of practices & reduce healthcare costs, and availability of several integrated practice management systems are expected to fuel segment growth over the forecast period.

- In January 2024, Henry Schein, Inc. announced the implementation of its full range of the company’s cloud-based platform, including Jarvis Analytics, Dentrix Ascend, TechCentral, and Detect AI, an AI-enabled X-ray analysis tool powered on the 42 North Dental platform. It aims to provide a scalable experience for patients and clinicians across over 100 practices.

- In December 2023, North Memorial Health announced the selection of the Oracle Fusion Cloud Applications Suite. The aim is to help improve operation efficiency, minimize cost, and enhance patient and employee experience.

Table of Contents

Companies Mentioned

- Henry Schein, Inc.

- Veradigm LLC (Allscripts Healthcare, LLC)

- AdvantEdge Healthcare Solutions

- Athenahealth, Inc.

- Cerner Corporation (Oracle)

- GE Healthcare

- McKesson Corporation

- EPIC Systems Corporation

- NXGN Management, LLC.

- eClinicalWorks

- CareCloud, Inc.

- Kareo, Inc.

- AdvancedMD, Inc.

- DrChrono, Inc. (EverCommerce)

- CollaborateMD Inc. (EverCommerce)

- OfficeAlly Inc.

- Accumedic Computer Systems, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 145 |

| Published | March 2024 |

| Forecast Period | 2023 - 2030 |

| Estimated Market Value ( USD | $ 2.11 Billion |

| Forecasted Market Value ( USD | $ 3.91 Billion |

| Compound Annual Growth Rate | 9.4% |

| Regions Covered | United States |

| No. of Companies Mentioned | 17 |