Speak directly to the analyst to clarify any post sales queries you may have.

MARKET TRENDS & DRIVERS

Emerging Demand from Automotive Industry Aftersales

Decorative films improve a vehicle's aesthetic appeal, safeguard the exterior, and give the occupants privacy. The trend of personalizing automobiles is driving the need for decorative films. Moreover, rising demand for Sport Utility Vehicles (SUVs) and high-end vehicles with personalized interiors drives revenue growth of the decorative films and foils market.Furthermore, the premium materials used to create these films also defend against scuffs, Ultraviolet (UV) radiation, and other environmental elements. There is an increasing need for such protection due to rising worries about vehicle upkeep. Revenue growth of the market is expected to be driven by consumers' growing demand for premium films that offer durable protection.

Rising Consumer Preference for Aesthetics and Personalization

Psycho-graphical and demographical indicators of the population have changed drastically over the past few years. The rising disposable income enables the population to purchase electronic devices, increasing the usage of decorative films as they protect the phone's screen from scratches, scuffs, and minor impacts. Moreover, patterned screen protectors allow users to personalize the appearance of their phones, and UV-cured screen protectors offer a solid and durable bond with the screen, ensuring both protection and high transparency among others across the electronic segment.Growing Adoption Among Homeowners

Homeownership is progressively gaining momentum in various economies worldwide. Due to rising income levels and increasing standards of living, the demand for single residential ownership is growing. For instance, in the EU, more than 70% of the total residents are single-ownership residents. Moreover, with the rising demand for single residents, there is an increasing demand for home renovation activities, leading to a higher demand for home interior materials, thereby raising the demand for decorative films and foils in the market.SEGMENTATION INSIGHTS

INSIGHTS BY CATEGORY

The global decorative films and foils market by category is segmented into adhesive and non-adhesive. In 2023, the adhesive segment dominated the international market. The growth of this segment is ascribed to its rising adoption by the interior design and architecture sector. These adhesive decorative films and foils are typically formulated to provide strong bonding with easy application and are removable without damaging the underlying surface. Furthermore, these films and foils are designed with adhesive backing, allowing them to be easily applied to various surfaces, such as walls, furniture, and glass, to achieve a decorative or functional purpose.Segmentation by Category Type

- Adhesive

- Non-adhesive

INSIGHTS BY MATERIAL

In 2023, the PVC material segment held the most significant share of the global decorative films and foils market and is growing at a CAGR of 4.01% during the forecast period. The rising utilization of PVC decorative films and foils is due to their durability, which makes this kind of decorative film and foil resistant to wear and easily survive in different environmental conditions. PVC decorative films are cost-effective compared with other materials, making them an affordable choice for individuals and industries for budget-friendly solutions to enhance the appearance of surfaces such as furniture, walls, and architectural elements, among others.Segmentation by Material Type

- PVC

- PET

- PP

- Others

INSIGHTS BY PRODUCT

The frosted product segment held the most prominent share of the global decorative films and foils market 2023. The increasing demand for frosted decorative films and foils is attributed to several factors, including aesthetic preferences and utilization in commercial spaces, healthcare, hospitality, and automotive industries. Further, these films are often utilized to maintain privacy in residential and commercial settings as they can obscure the outside view, making frosted films and foil an ideal choice for windows and glass partitions.Further, the architectural segment holds a significant share of the decorative films and foils market; the increasing utilization for better energy efficiency in heating and cooling purposes in residential and commercial applications drives the segmental market growth. The rising industrialization and urbanization in developing countries such as China and India are boosting the demand for architectural decorative films and foils in the market.

Segmentation by Product Type

- Frosted

- Architectural

- Vinyl

- Others

INSIGHTS BY TECHNOLOGY

By technology, the global decorative films and foils market is segmented into metalized, ceramic, dyed, and other categories. In 2023, the metalized segment dominated the global market owing to the growing adoption of UV-ray protective films and foils. These metalized films and foils can reflect significant solar heat, contributing to building energy efficiency by reducing heat absorption through windows.The metalized layer imparts distinct visual and functional characteristics to the films and foils, contributing to their versatility and appeal. Further, the ceramic segment is growing at a high CAGR rate during the forecast period, as it is primarily used in the car interior for UV protection and heat rejection as it can block nearly 99% of harmful UV rays and rejects a significant amount of solar heat, making the car interior cooler, and protects from sun damage.

Segmentation by Technology

- Metalized

- Ceramic

- Dyed

- Others

INSIGHTS BY USAGE TYPE

The global decorative films and foils market by usage type is segmented into indoor and outdoor. In 2023, the indoor usage type segment dominated the market, owing to increasing usage in the residential segment, as they offer a cost-effective way to introduce decorative elements without the need for expensive renovations.Segmentation by Usage Type

- Indoor

- Outdoor

INSIGHTS BY END-USER

The global decorative films and foils market by end-user is segmented into commercial, residential, automotive, marine, and others. In 2023, the commercial end-user segment is dominating the market. The growth is attributed to the rising application of decorative films and foils in commercial buildings, which often prioritize modern aesthetics, energy efficiency, and large expanses of glass to create a visual aesthetic of the buildings. Along with the rapid shift toward urbanization, significantly rising infrastructure, and an increasing number of corporate offices, hotels, and restaurants, demand for decorative films and foils increased dramatically from the commercial sector.Segmentation by End-user

- Commercial

- Residential

- Automotive

- Marine

- Others

INSIGHTS BY DISTRIBUTION CHANNEL

The offline distribution channel dominated the global decorative films and foils market share in 2023. Popularity in areas that lack connectivity and high consumer trust is associated with experiencing the quality of products driving the growth of this segment. Furthermore, the online channel holds a relatively lower market share but is expected to witness the highest segmental CAGR during the forecast period.The proliferation of e-commerce and a rise in the awareness of the benefits of online purchases, such as heavy discounts, occasional offers, and convenience, drive the growth of the online segment. Furthermore, high penetration rates are expected for online multichannel platforms, and vendors are expected to grow their online presence through their e-commerce platforms and collaborations with other e-commerce firms during the forecast period.

Segmentation by Distribution Channel

- Offline

- Online

GEOGRAPHICAL ANALYSIS

North America dominates the global decorative films and foils market, accounting for a revenue share of over 35% in 2023. The region is anticipated to maintain its position during the forecast period, with revenue mostly generated from the U.S., its largest economy. North America is home to numerous large industries, including the automobile, construction, aerospace, electronics, and packaging. The growth in the region is ascribed to raising living standards and ongoing initiatives aimed at enhancing residential and non-residential building structures. Also, the region’s increasing construction and automotive industry supports the demand for decorative films and foils.Segmentation by Geography

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Russia

- Italy

- Spain

- Netherlands

- Belgium

- APAC

- China

- Japan

- India

- Australia

- South Korea

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

VENDOR LANDSCAPE

The global decorative films and foils market is fragmented with global and local vendors. The present scenario leads vendors to alter and improve their unique value propositions to achieve a strong market presence. Differentiated global and regional vendors characterize the market. As international players increase their market footprint, regional vendors will likely increase difficulty competing with these global players. The rivalry is solely based on durability, technology, services, price, and customization.Key vendors in the global decorative films and foils market are Eastman, 3M Company, and LINTEC Corporation. Furthermore, the growth of vendors in the market also depends on market conditions, technological innovations, and industry development. For instance, 3M’s new 3M™ FASARA™ Glass Finishes are decorative glass and window films in over 100+ unique designs, patterns, and textures.

Key Company Profiles

- Eastman

- 3M Company

- LINTEC Corporation

Other Prominent Vendors

- LG Hausys

- Madico

- RENOLIT

- Klockner Pentaplast

- OMNOVA Solutions

- Grafix Plastics

- Dumore Corporation

- Avery Dennison Corporation

- Peiyu Plastic Corporation

- ORAFOL Group

- Sun Process Converting, Inc.

- RASIK PRODUCTS PVT. LTD.

- Yodean Decor

- Decorative Films, LLC

- America Standard Window Films

- Armolan Window Films

- Toray Plastics

- Saint-Gobain Performance Plastics Corporation

KEY QUESTIONS ANSWERED

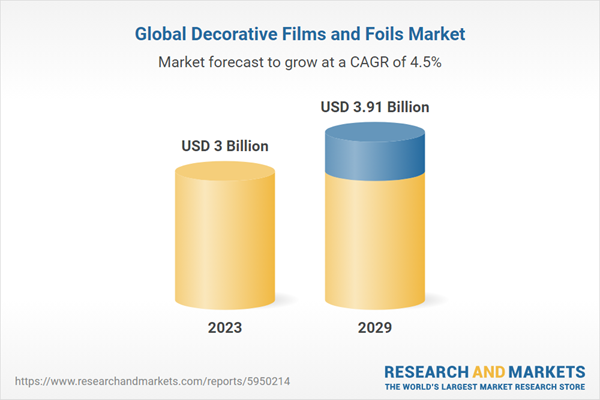

1. How big is the decorative films and foils market?2. What is the growth rate of the global decorative films and foils market?

3. Which region dominates the global decorative films and foils market share?

4. What are the significant trends in the decorative films and foils industry?

5. Who are the key players in the global decorative films and foils market?

Table of Contents

Companies Mentioned

- Eastman

- 3M Company

- LINTEC Corporation

- LG Hausys

- Madico

- RENOLIT

- Klockner Pentaplast

- OMNOVA Solutions

- Grafix Plastics

- Dumore Corporation

- Avery Dennison Corporation

- Peiyu Plastic Corporation

- ORAFOL Group

- Sun Process Converting, Inc.

- RASIK PRODUCTS PVT. LTD.

- Yodean Decor

- Decorative Films, LLC

- America Standard Window Films

- Armolan Window Films

- Toray Plastics

- Saint-Gobain Performance Plastics Corporation

Methodology

Our research comprises a mix of primary and secondary research. The secondary research sources that are typically referred to include, but are not limited to, company websites, annual reports, financial reports, company pipeline charts, broker reports, investor presentations and SEC filings, journals and conferences, internal proprietary databases, news articles, press releases, and webcasts specific to the companies operating in any given market.

Primary research involves email interactions with the industry participants across major geographies. The participants who typically take part in such a process include, but are not limited to, CEOs, VPs, business development managers, market intelligence managers, and national sales managers. We primarily rely on internal research work and internal databases that we have populated over the years. We cross-verify our secondary research findings with the primary respondents participating in the study.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 310 |

| Published | April 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 3.91 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 21 |