Liquid Crystal on Silicon (LCoS) HUD is the fastest growing segment, North America is the largest market globally

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing adoption of Advanced Driver-Assistance Systems (ADAS) critically drives the global head-up display market by establishing a need for intuitive platforms to present vital safety and navigational data. As vehicles integrate features like lane keeping assistance and automatic emergency braking, HUDs become essential for minimizing driver distraction by projecting warnings directly into the driver's line of sight.According to the Partnership for Analytics Research in Traffic Safety (PARTS), a collaboration between automobile manufacturers and the U. S. Department of Transportation's National Highway Traffic Administration (NHTSA), in its October 2024 report, by the 2023 model year, 10 out of 14 advanced driver-assistance system features had surpassed 50% market penetration in U. S. passenger vehicles.

Key Market Challenges

The inherent complexity and elevated costs associated with integrating advanced Head-Up Display systems into diverse vehicle platforms present a significant impediment to market expansion. The requirement for substantial hardware components, meticulous calibration, and seamless synchronization with various vehicle sensors and software necessitates considerable investment from automotive manufacturers. This financial burden directly impacts the rate of adoption, particularly within more budget-conscious vehicle segments where the added cost of HUD integration can render vehicles less competitive.Key Market Trends

This trend highlights the expansion of Head-Up Display technology into the mid-segment vehicle market, moving beyond its traditional presence in premium models. This shift is fueled by improvements in manufacturing efficiency and component cost reductions, making these advanced display systems more economically viable for a wider consumer base. As manufacturers integrate HUDs into more accessible vehicle categories, they enhance safety and convenience for a larger segment of drivers. According to Continental AG, in its March 2024 earnings call, the User Experience business area secured approximately €1.1 billion in new business for multi-display solutions, including a significant award for a next-generation head-up display unit. This commercial momentum indicates increasing market readiness and demand for HUDs across a broader range of vehicle offerings.Key Market Players Profiled:

- BAE Systems, Inc

- Continental AG

- DENSO Corporation

- Elbit Systems Ltd

- Honeywell International Inc

- Nippon Seiki Co., Ltd

- Visteon Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Saab AB

Report Scope:

In this report, the Global Head Up Display Market has been segmented into the following categories:By Technology:

- Cathode Ray Tube (CRT) HUD

- Liquid Crystal on Silicon (LCoS) HUD

- Digital Light Processing (DLP) HUD

- Microelectromechanical Systems (MEMS) HUD

By Component:

- Combiner Glass

- Projector Unit

- Display Panel

- VideoGenerator

- Others

By End-user:

- Original Equipment Manufacturers (OEMs)

- Aftermarket

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Head Up Display Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BAE Systems, Inc

- Continental AG

- DENSO Corporation

- Elbit Systems Ltd

- Honeywell International Inc

- Nippon Seiki Co., Ltd

- Visteon Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Saab AB

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2025 |

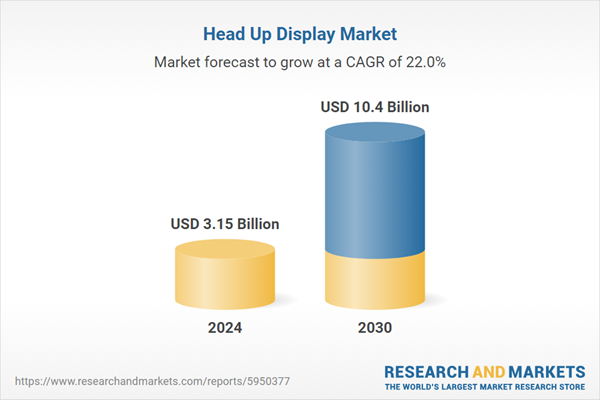

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.15 Billion |

| Forecasted Market Value ( USD | $ 10.4 Billion |

| Compound Annual Growth Rate | 22.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |