Syrups is the fastest growing segment, Asia-Pacific is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The increasing demand for convenience foods is a key driver of the global fillings and toppings market. Busy modern lifestyles continue to boost the need for quick, ready-to-eat, and ready-to-cook options, where fillings and toppings play a crucial role in delivering flavor, texture, and appeal with minimal preparation. These ingredients elevate products such as frozen meals, instant desserts, and on-the-go bakery items. According to The Soft Copy, in March 2023, sales of ready-to-eat products rose from 50% in 2022 to 70% in 2023, reflecting the growing reliance on convenience options.Rising demand for premium and indulgent products further drives the market as consumers seek elevated food experiences featuring unique flavors and high-quality ingredients. This trend supports innovation in artisanal pastries, gourmet chocolates, and specialty dairy products. Nestlé’s three-month 2023 sales report, as referenced by NACS in April 2023, showed double-digit growth in confectionery driven by strong brands such as KitKat. Additionally, ingredient sector performance reinforces market growth; according to The DairyNews in July 2024, Fonterra’s ingredients business accounted for 80% of its milk solids sold in FY23, generating USD 17.4 billion in revenue, demonstrating extensive global demand for high-value food ingredients.

Key Market Challenges

A major challenge to the global fillings and toppings market is the persistent volatility of raw material prices. Costs of essential ingredients such as sugar, dairy, and cocoa fluctuate frequently, complicating financial planning and affecting overall profitability. These shifts force manufacturers to absorb higher costs or pass them on to consumers, potentially reducing demand. According to Global Dairy Trade (GDT), the GDT Price Index increased by 3.7% on February 4, 2025 after falling nearly 3% in December 2024, demonstrating the rapid and unpredictable nature of price movements. Such instability can hinder investment in new product development and broader market expansion, slowing long-term growth within the sector.Key Market Trends

The rise of plant-based and vegan fillings is a leading trend in the market, driven by health considerations, sustainability values, and growing interest in animal-free products. This shift encourages innovation to replicate traditional textures and flavors in plant-based formats. According to the Good Food Institute (GFI) Europe, retail sales of plant-based foods across six major European markets grew by 5.5% in 2023, reaching €5.4 billion. Manufacturers continue to expand offerings in this area - for example, Kerry Group launched Plenti, a line of whole-muscle textured plant proteins, in October 2024 to support cleaner-label and environmentally friendly solutions.Clean label and natural ingredient preferences also significantly influence the market, as consumers increasingly seek simplified ingredient lists and transparency. According to FMI - The Food Industry Association, 57% of grocery shoppers in October 2023 believed private-label brands were as healthy as manufacturer brands, underscoring growing trust in transparent labeling. To meet these expectations, companies such as Ingredion have introduced solutions like NOVATION® Indulge 2940 starch, launched in February 2024, a non-GMO functional native corn starch designed to enhance texture in dairy and alternative dairy products. These trends collectively drive reformulation efforts and foster demand for natural colors, flavors, and plant-derived stabilizers.

Key Market Players Profiled:

- Cargill Inc.

- Archer Daniels Midland Company

- AAK AB

- Barry Callebaut

- Tate & Lyle PLC

- Highlander Partners, L.P.

- Zentis GmbH & Co. Kg

- Associated British Foods PLC

- Agrana Beteiligungs-Ag

- Ashland Global Holdings Inc.

Report Scope:

In this report, the Global Fillings & Toppings Market has been segmented into the following categories:By Type:

- Creams

- Syrups

- Pastes & Variegates

- Fruits & Nuts

- Others

By Functionality:

- Glazing

- Viscosity

- Stabilizing

- Others

By Flavour:

- Chocolate

- Fruit

- Nut

- Caramel

- Vanilla

- Others

By Raw Materials:

- Sweeteners

- Cocoa

- Fruits

- Others

By Form:

- Solid

- Liquid

- Gel

- Foam

By Application:

- Confectionery Products

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Fillings & Toppings Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Fillings & Toppings market report include:- Cargill Inc.

- Archer Daniels Midland Company

- AAK AB

- Barry Callebaut

- Tate & Lyle PLC

- Highlander Partners, L.P.

- Zentis GmbH & Co. Kg

- Associated British Foods PLC

- Agrana Beteiligungs-Ag

- Ashland Global Holdings Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | November 2025 |

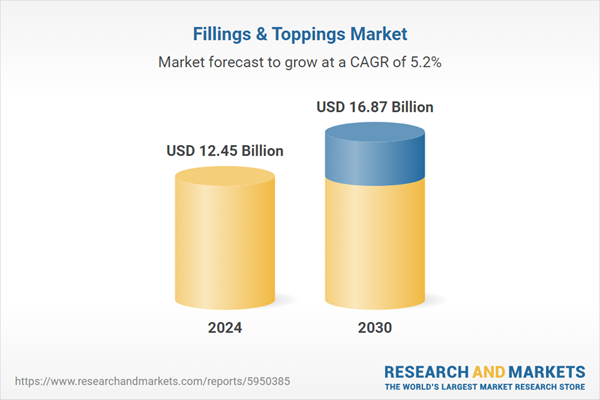

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.45 Billion |

| Forecasted Market Value ( USD | $ 16.87 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |