Biotechnology is the fastest growing segment, North America is the largest regional market

Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The global protein extracts market is profoundly influenced by increasing protein demand due to population growth, pressuring existing food systems. Meeting the nutritional needs of a growing populace necessitates efficient protein production from diverse sources, including novel alternatives. According to the Food and Agriculture Organization, in June 2024, global animal protein production is expected to reach 371 million tons by next year. Concurrently, a significant shift in consumer preferences towards plant-based and health-conscious options strongly influences market evolution.Consumers increasingly prioritize ethical sourcing, environmental sustainability, and personal health, fostering demand for plant-derived and microbial proteins. This trend is exemplified: according to the Plant Based Foods Association, in May 2024, e-commerce sales of plant-based foods reached $394 million in 2023, demonstrating a 16.4% annual growth rate over three years. These converging factors create a dual demand for both increased protein volume and qualitatively different, more sustainable protein types.

Key Market Challenges

The complex regulatory landscape governing novel protein sources significantly impedes market growth. Companies face lengthy and resource-intensive approval processes before new ingredients can reach consumers. For instance, according to a study published in npj Science of Food, analyzing European Food Safety Authority novel food applications between 2018 and 2024, the average duration from submission to publication was approximately 2.56 years. This extended timeline for market authorization creates substantial uncertainty, deters investment, and delays innovation from effectively contributing to market expansion.Key Market Trends

The global protein extracts market is significantly shaped by evolving production methodologies and resource optimization strategies. Precision fermentation advancements are emerging as a pivotal trend, revolutionizing the production of novel proteins by utilizing microbial hosts to create specific, functional protein ingredients. This approach enables the tailored creation of high-quality proteins with precise sensory and functional attributes that can replicate animal-derived components or introduce entirely new functionalities. According to The Good Food Institute, its company database identified 165 companies focused primarily on fermentation for alternative proteins in 2024. This technological shift is further underscored by strategic industry collaborations, such as the partnership announced in November 2023 between Novozymes and Arla Foods Ingredients to develop advanced protein ingredients using precision fermentation.Key Market Players Profiled:

- Unilever PLC

- Taiwan Chlorella Manufacturing Company

- XIAMEN HYFINE GELATIN CO.,LTD.

- BlueBioTech International GmbH

- Euglena Co. ltd

- Corbion NV

- KnipBio Inc.

- Earthrise Nutritionals, LLC

Report Scope:

In this report, the Global Protein Extracts From Single Cell Protein And Other Conventional Sources Market has been segmented into the following categories:By Source:

- Plant Protein Extract Sources

- Microbial Sources - Single Cell Proteins

- Microbial Sources - Direct Use

By Application:

- Biotechnology

- Animal Feed

- Agriculture &Fertilizers

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Protein Extracts From Single Cell Protein And Other Conventional Sources Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The companies profiled in this Protein Extracts From Single Cell Protein and Other Conventional Sources market report include:- Unilever PLC

- Taiwan Chlorella Manufacturing Company

- XIAMEN HYFINE GELATIN CO.,LTD.

- BlueBioTech International GmbH

- Euglena Co. ltd

- Corbion NV

- KnipBio Inc.

- Earthrise Nutritionals, LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | November 2025 |

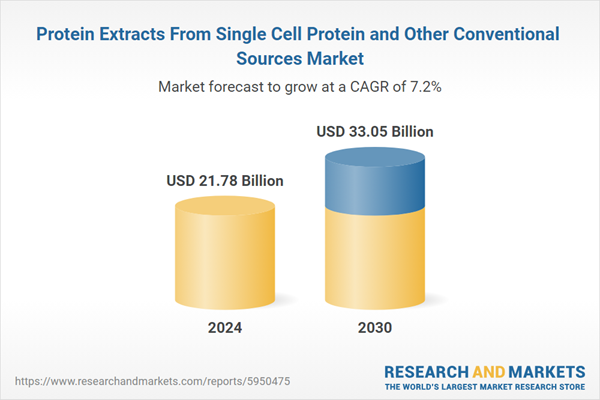

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 21.78 Billion |

| Forecasted Market Value ( USD | $ 33.05 Billion |

| Compound Annual Growth Rate | 7.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |